United Kingdom Battery Market Size, Share, By Type (Lithium-ion Battery, Lead-acid Battery, Nickel-cadmium Battery, Nickel-metal Hydride Battery, and Others), By State (Primary and Secondary), By Application (Electric Mobility, Energy Storage, Consumer Electronics, and Others), United Kingdom Battery Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited Kingdom Battery Market Insights Forecasts to 2035

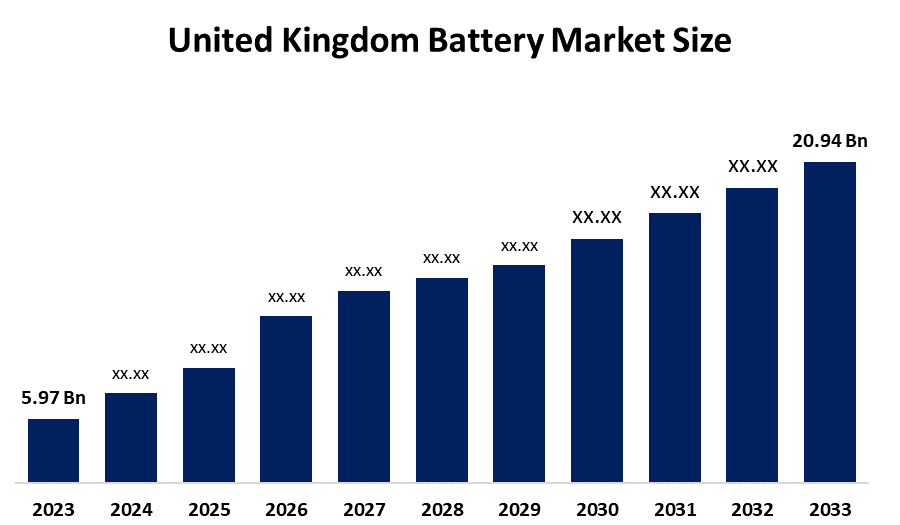

- United Kingdom Battery Market Size 2024: USD 5.97 Bn

- United Kingdom Battery Market Size 2035: USD 20.94 Bn

- United Kingdom Battery Market CAGR 2024: 12.08%

- United Kingdom Battery Market Segments: Type, State, and Application

Get more details on this report -

The UKs battery market is experiencing rapid expansion as it relates to integrating renewable energy, electric vehicles, and infrastructure for grid storage within the country. The primary battery types being manufactured include lithium-ion, solid-state, and advanced modular types of batteries. As the sector transitions from producing traditional batteries, to producing more efficient materials, faster recharging options, and greater capacities for energy storage, this sector continues to grow. Demand for clean energy continues to increase; therefore, governments are implementing their respective net-zero initiatives and enforcing stricter rules regarding the standards of safety and performance of all products. In addition, due to the transition towards electrification of transportation, electronic, and sustainable development policy for climate change, the UK Battery Market offers a dynamic environment that integrates both technological advancement with extensive applications, due to an overall encouraging regulatory and economic environment, therefore, allowing for greater innovation.

The future of the United Kingdom battery market looks very promising, complemented by government-backed net-zero targets, EV adoption incentives, and renewable energy deployment. Each expansion of electric vehicles, grid scale storage, and next generation battery technologies creates new growth opportunities. Advances in high performance materials, modular manufacturing, digital design, and data driven battery management systems further enhance product performance, safety, regulatory compliance, and lifecycle efficiency, strengthening the UKs battery ecosystem around mobility, energy storage, and clean energy infrastructure

United Kingdom Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.97 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 12.08% |

| 2035 Value Projection: | USD 20.94 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type,By State |

| Companies covered:: | Johnson Matthey Battery Systems,Nyobolt,Aceleron,Nexeon,Tesla,BYD,LG Energy Solution,Samsung SDI,SK Innovation / SK Battery,GS Yuasa Corporation And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom battery market share is classified into type, state, and application.

By Type

The United Kingdom battery market is divided by type into lithium-ion battery, lead-acid battery, nickel–cadmium battery, nickel-metal hydride battery, and others. Among these, the lithium-ion battery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by the surging demand from electric vehicles (EVs), consumer electronics, and grid storage, thanks to their high energy density, long life, and declining costs.

By State

The United Kingdom battery market is divided by state into primary and secondary. Among these, the secondary segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because of the ability to recharge secondary batteries makes them more cost-effective over an extended period and environmentally friendly compared to primary batteries, which are disposed of after a single use.

By Application

The United Kingdom battery market is divided by application into electric mobility, energy storage, consumer electronics, and others. Among these, the electric mobility segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by strong government mandates, increasing EV adoption for cleaner transport, and investments in charging infrastructure, leading to rapid growth and significant market share, with Lithium-ion batteries being the core technology.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom battery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Battery Market

- Johnson Matthey Battery Systems

- Nyobolt

- Aceleron

- Nexeon

- Tesla

- BYD

- LG Energy Solution

- Samsung SDI

- SK Innovation / SK Battery

- GS Yuasa Corporation

- Others

Recent Developments in United Kingdom Battery Market

In January,construction began on Coalburn 2, part of Alcemis large scale battery storage projects in Scotland adding 500MW capacity and strengthening the UKs renewable grid integration and energy storage capabilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Sphrical Insights has segmented the United Kingdom battery market based on the below-mentioned segments:

United Kingdom Battery Market, By Type

- Lithium-ion Battery

- Lead-acid Battery

- Nickel–cadmium Battery

- Nickel-metal Hydride Battery

- Others.

United Kingdom Battery Market, By State

- Primary

- Secondary.

United Kingdom Battery Market, By Application

- Electric Mobility

- Energy Storage

- Consumer Electronics

- Others.

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom battery market size?A: United Kingdom battery market is expected to grow from USD 5.97 billion in 2024 to USD 20.94 billion by 2035, growing at a CAGR of 12.08% during the forecast period 2025-2035

-

Q: What are the key growth drivers of the market?A: Market growth is driven by large-scale storage solutions for energy produced from renewable sources, which will further increase demand for EVs and grid modernization.

-

Q: What factors restrain the United Kingdom battery market?A: Constraints include the strict regulatory standards, high compliance costs, and price sensitivity in electric vehicle and energy storage sectors, which can pressure profit margins.

-

Q: How is the market segmented by type?A: The market is segmented into lithium-ion battery, lead-acid battery, nickel–cadmium battery, nickel-metal hydride battery, and others.

-

Q: Who are the key players in the United Kingdom battery market?A: Key companies include Johnson Matthey Battery Systems, Nyobolt, Aceleron, Nexeon, Tesla, BYD, LG Energy Solution (LG Chem), Samsung SDI, SK Innovation / SK Battery, GS Yuasa Corporation, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?