United Kingdom Ayurveda Market Size, Share By Form (Herbal, Mineral, and Herbomineral), By Application (Medical/Therapy, Personal Care), By Indication (GI Tract, Infectious Diseases, Skin/Hair, Respiratory System, Nervous System, Cardiovascular System, Reproductive System, and Others), United Kingdom Ayurveda Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Ayurveda Market Insights Forecasts to 2035

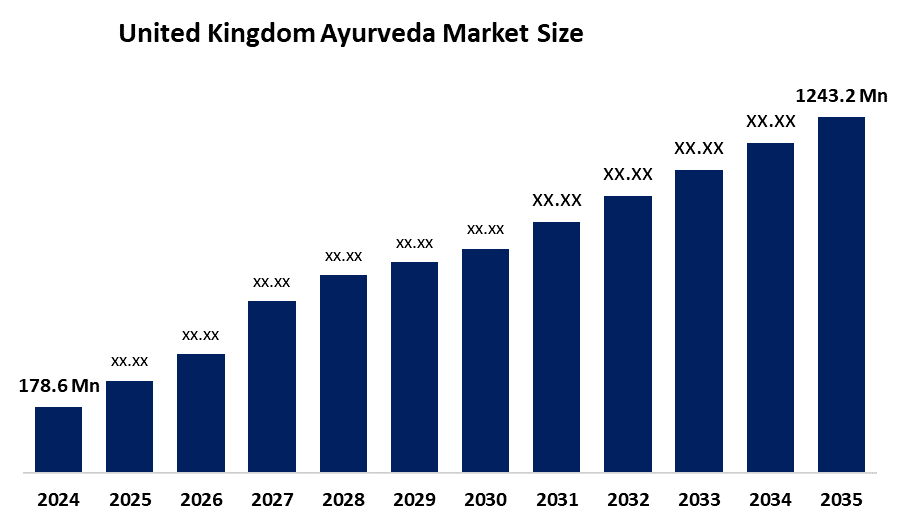

- United Kingdom Ayurveda Market Size 2024: USD 178.6 Mn

- United Kingdom Ayurveda Market Size 2035: USD 1243.2 Mn

- United Kingdom Ayurveda Market CAGR (2024–2035): 19.29%

- United Kingdom Ayurveda Market Segments: Form, Application, and Indication

Get more details on this report -

Market Overview

Ayurveda is a rapidly growing market in the United Kingdom, encompassing a wide range of wellness products, personalized therapeutic solutions, and skincare offerings. The Ayurveda market is responding to the increasing demand for ethically sourced, high-quality, and natural products. All products must comply with the guidelines set by the UK Medicines and Healthcare Products Regulatory Agency (MHRA) and local trading standards.

An increasing number of domestic and international brands are entering the UK Ayurveda market, leading to intensified competition among suppliers. The presence of multiple clinics offering Ayurvedic services highlights strong product development, growing clinical evidence supporting the therapeutic benefits of herbal formulations, and a robust regulatory framework. This framework provides consumers with confidence regarding safety, consistency, and standardized Ayurvedic practices.

Market Growth Outlook

The UK Ayurveda market is expected to experience rapid growth driven by rising wellness awareness, increasing demand for natural and herbal products, and wider acceptance of personalized Ayurvedic therapies. Stress management, lifestyle-related disorders, immunity enhancement, and skincare applications are key growth areas within the wellness sector.

The market is shifting toward high-value products supported by evidence-based research and ethical sourcing. Traditional herbal products, integrative wellness programs, research into herbal efficacy, and online consultation services are expanding market reach and improving consumer experience. Government initiatives supporting health, wellness, and sustainability further encourage market growth. However, companies continue to face challenges related to regulatory compliance and competitive pressure.

Market Dynamics

The United Kingdom Ayurveda market is influenced by the increasing popularity of natural wellness solutions, government recognition of complementary and alternative medicine, and growing investment in Ayurvedic research and development. These factors have significantly contributed to market expansion.

Improved wellness infrastructure, access to trained Ayurvedic practitioners, and availability of high-quality herbal raw materials have supported the development of premium health and wellness products. Future growth will be driven by greater consumer awareness of health benefits and partnerships between wellness clinics, research institutions, and Ayurvedic product manufacturers. These developments have enabled the UK to evolve from a niche herbal market into a leading hub for Ayurvedic wellness services.

Market Restraints

Despite strong growth potential, the United Kingdom Ayurveda market faces several challenges, including fragmented regulatory frameworks, quality and safety compliance issues, limited standardization of herbal ingredients, intellectual property concerns, shortages of skilled practitioners, and reliance on imported raw materials. These factors create pressure on domestic innovation, product development, and profitability.

Future Prospects

The future outlook for the UK Ayurveda market remains highly optimistic. Growth is supported by a rising population of wellness-conscious consumers, favorable government initiatives, and increasing interest in natural and personalized healthcare solutions.

Advancements in herbal research, formulation standardization, immune-support therapies, and artificial intelligence-based personalized wellness recommendations are creating significant opportunities. Improved regulatory clarity, integration with digital health platforms, quality-controlled manufacturing, evidence-based clinical studies, and enhanced practitioner training are expected to drive innovation, improve service delivery, and increase operational efficiency across the market.

United Kingdom Ayurveda Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 178.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 19.29% |

| 2035 Value Projection: | USD 1243.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | The Ayurvedic Clinic, Croydon, Ayurveda Clinic and Wellness Centre LTD, Ayu Ayurveda & Wellness Clinic, Jivita Ayurveda, Prana Wellness Ayurvedic Clinic., and Others Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom Ayurveda market is segmented by form, application, and indication.

By Form

The market is categorized into herbal, mineral, and herbomineral products. The herbal segment dominated the market in 2024 and is expected to grow at a strong CAGR during the forecast period. This growth is attributed to the wide availability of user-friendly products such as tablets, capsules, and teas, which are easily accessible through online platforms and specialized health stores across the UK.

By Application

Based on application, the market is divided into medical or therapy-based applications and personal care. The personal care segment held the largest market share in 2024 and is projected to grow at a significant CAGR. This trend is driven by increased consumer focus on self-care and holistic well-being, with Ayurveda being adopted not only for treatment but also for daily hygiene, beauty, and preventive health.

By Indication

The market is segmented by indication into gastrointestinal disorders, infectious diseases, skin and hair conditions, respiratory system disorders, nervous system disorders, cardiovascular system disorders, reproductive system disorders, and others. The skin and hair segment dominated the market in 2024 and is expected to grow at a strong CAGR due to rising consumer preference for plant-based, natural, and organic alternatives over synthetic products.

Competitive Analysis:

The report provides a detailed analysis of key companies operating in the United Kingdom Ayurveda market, including comparisons based on product offerings, business overview, geographic presence, strategic initiatives, segment market share, and SWOT analysis. It also covers recent developments such as product launches, innovations, joint ventures, partnerships, mergers and acquisitions, and strategic alliances, offering a comprehensive view of market competition.

Top Key Companies in the United Kingdom Ayurveda Market

- The Ayurvedic Clinic

- Croydon Ayurveda Centre

- Ayurveda Clinic and Wellness Centre Ltd

- Ayu Ayurveda and Wellness Clinic

- Jivita Ayurveda

- Prana Wellness Ayurvedic Clinic

- Others

Recent Developments

In January 2025, Kama Ayurveda launched a 750 square foot flagship store in Notting Hill, London. The store offers 32 product SKUs along with personalized consultations from Ayurvedic doctors, strengthening the brand’s retail presence and enhancing the overall Ayurveda market experience in the UK.

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers

Market Scope

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. The market is segmented as follows:

United Kingdom Ayurveda Market by Form

- Herbal

- Mineral

- Herbomineral

United Kingdom Ayurveda Market by Application

- Medical or Therapy

- Personal Care

United Kingdom Ayurveda Market by Indication

- Gastrointestinal Tract

- Infectious Diseases

- Skin and Hair

- Respiratory System

- Nervous System

- Cardiovascular System

- Reproductive System

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom ayurveda market size?A: United Kingdom ayurveda market is expected to grow from USD 178.6 million in 2024 to USD 1243.2 million by 2035, growing at a CAGR of 19.29% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by increasing popularity of natural wellness products among consumers in the UK, as well as the recognition by the UK government for complementary and alternative medicine and financial backing.

-

Q: What factors restrain the United Kingdom ayurveda market?A: Constraints include the fragmented regulations, quality and safety compliance challenges, limited standardization of herbal ingredients, intellectual property concerns, practitioner talent gaps, and reliance on imported raw herbs.

-

Q: How is the market segmented by form?A: The market is segmented into herbal, mineral, and herbomineral.

-

Q: Who are the key players in the United Kingdom ayurveda market?A: Key companies include The Ayurvedic Clinic, Croydon, Ayurveda Clinic and Wellness Centre LTD, Ayu Ayurveda & Wellness Clinic, Jivita Ayurveda, Prana Wellness Ayurvedic Clinic., and Others

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?