United Kingdom ATM Market Size, Share, By Type (Conventional Bank ATMs, White Label ATMs, and Others), By Solutions (Deployment, Onsite ATM, Offsite ATM, Worksite ATM, Mobile ATM, and Managed Services), United Kingdom ATM Market Insights, Industry Trend, Forecasts to 2035.

Industry: Electronics, ICT & MediaUnited Kingdom ATM Market Insights Forecasts to 2035

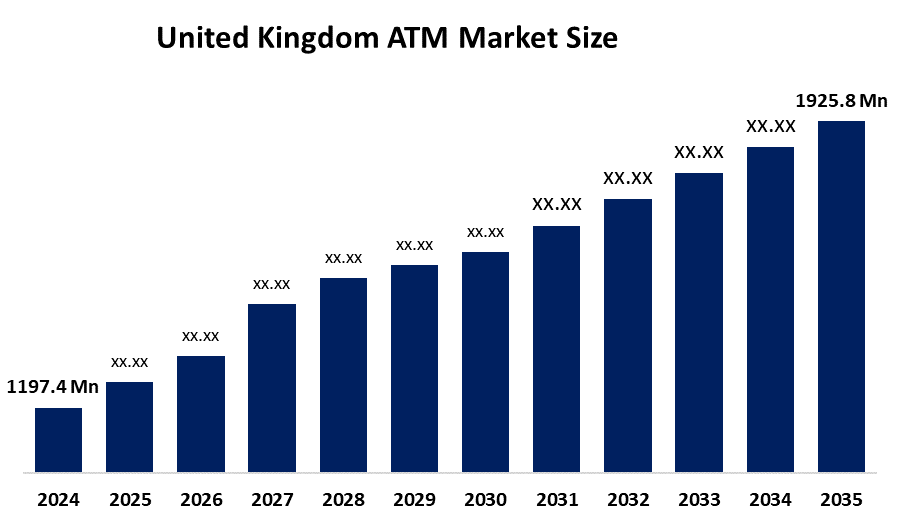

- United Kingdom ATM Market Size 2024: USD 1197.4 Million

- United Kingdom ATM Market Size 2035: USD 1925.8 Million

- United Kingdom ATM Market CAGR 2024: 4.41%

- United Kingdom ATM Market Segments: Type and Solution

Get more details on this report -

The UK ATM industry represents a growing sector of the financial industry with continued demand for easy access to cash available due to the constant support of financial inclusion drive as well as ongoing innovations in self-service financial instruments. Over the years, the industry has shifted from simple cash machine providers towards more efficient ATMs with deposit facilities, bill payments, as well as contactless withdrawal solutions with an enhanced banking network facilitated by independent ATM deployers. This industry continues to thrive with the ongoing demand for access to financial services by both the larger community as well as the support of shared banking facilities alongside digital integration. This is coupled with the ever-enhancing dynamic system innovation with efficient operations under the UK financial authorities.

The Financial Services and Markets Act 2023 granted the Financial Conduct Authority new powers to ensure reasonable provision of cash withdrawal and deposit services across the UK. The legislation supports ATM network availability, strengthens cash access infrastructure, and helps sustain consumer reliance on physical banking services.

The UK ATM industry presents good opportunities for long-term growth and stability, with cash transactions remaining strong through continuing reliance among certain consumer groups, the demand for accessible banking services, and the expansion of self-service financial technologies. The growth in multifunctional ATMs, which enable cash deposits, contactless cash withdrawals, and bill payment, is enhancing consumer convenience. The impact of shared banking networks, programs of financial inclusion, and cash access initiatives supported by governments is supporting consumer access to ATMs. Innovations related to ATM technology, such as software and security solutions, are supporting the industry through the reduction of operation problems and enhancing service efficiency. The UK already has well-developed banking infrastructure, and ATMs operated independently with the support of financial technology companies suggest good long-term opportunities.

Market Dynamics of the United Kingdom ATM Market

The UK ATM market is driven by a well-established banking and financial services infrastructure, along with growing demand for easy access to cash and increasing investments in advanced self-service banking technologies. Powerful collaborations between banks, independent ATM deployers, payment network providers, and fintech companies are transforming this market away from traditional cash-dispensing services to more advanced and multi-functional financial service platforms. This, in turn, is creating a greater need for financial inclusion along with shared banking hubs and community cash access points, thus driving business growth, especially within less privileged and rural areas. Additionally, improvement in contactless withdrawals, biometric authentication, remote monitoring systems, and integrated digital banking services enhance operational efficiency and improve customer experience. Expanding managed service models, improved ATM software platforms, and strategic partnerships with payment service providers further establish the UK ATM market to be leading in the country's wider financial services ecosystem.

The UK ATM market faces restraints including the high operational and maintenance costs associated with machine installation, cash handling, security upgrades, and compliance with financial regulations. Additionally, the rapid shift toward digital and contactless payment methods, mobile banking adoption, and declining cash usage are placing pressure on transaction volumes and profitability for ATM operators.

The future for the UK ATM Market appears to be encouraging and stable, but at the same time, moderation is required because of the need for access to cash infrastructure, especially for SMEs, rural communities, and cash-dependent consumers. In addition, technological advancements for ATMs are improving accessibility, security, and overall operation, for example, contactless withdrawal capabilities, biometric verification, live monitoring, and versatility for services. At the same time, the introduction of shared banking hubs, being financially inclusive, is building the overall cash infrastructure between banking institutions, independent ATMs operators, and fintech operators. As increased integration and connectivity continue with safe self-service banking alternatives, ATMs will remain an essential feature for the overall evolution of Financial Services within the UK.

United Kingdom ATM Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1197.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.41% |

| 2035 Value Projection: | USD 1925.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Solutions |

| Companies covered:: | Cardtronics, NoteMachine, LINK Scheme, Diebold Nixdorf, NCR Atleos, Hitachi Channel Solutions,, Triton Systems., and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom ATM market share is classified into type and solution.

By Type

The United Kingdom ATM market is divided by type into conventional bank ATM, white label ATM, and others. Among these, the conventional bank ATM segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the consumers prefer bank-operated ATMs for their high security, reliability, and integration with core banking systems, which reduces risks like card trapping or skimming.

By Solution

The United Kingdom ATM market is divided by solution into deployment, onsite ATM, offsite ATM, worksite ATM, mobile ATM, and managed services. Among these, the managed services segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by the need for financial institutions to reduce operational costs, enhance efficiency, and manage complex, aging infrastructure.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom ATM market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom ATM Market

- Cardtronics

- NoteMachine

- LINK Scheme

- Diebold Nixdorf

- NCR Atleos

- Hitachi Channel Solutions,

- Triton Systems.

Recent Development in United Kingdom ATM Market

In June 2024, Cash Access UK, LINK, and NCR Atleos launched multi-bank “super-ATMs” in Atherstone, Swanage, and Heathfield, enabling customers to deposit and withdraw cash across banks, strengthening ATM infrastructure and addressing gaps from closures.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom ATM market based on the below-mentioned segments:

United Kingdom ATM Market, By Type

- Conventional Bank ATM

- White Label ATM

- Others

United Kingdom ATM Market, By Solutions

- Deployment

- Onsite ATM

- Offsite ATM

- Worksite ATM

- Mobile ATM

- Managed Services

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom ATM market size?A: United Kingdom ATM market is expected to grow from USD 1197.4 million in 2024 to USD 1925.8 million by 2035, growing at a CAGR of 4.41% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by well-established banking and financial services infrastructure, along with growing demand for easy access to cash and increasing investments in advanced self-service banking technologies.

-

Q: What factors restrain the United Kingdom ATM market?A: Constraints include the high operational and maintenance costs associated with machine installation, cash handling, security upgrades, and compliance with financial regulations.

-

Q: How is the market segmented by genre?A: The market is segmented into conventional bank ATM, white label ATM, and others

-

Q: Who are the key players in the United Kingdom ATM market?A: Key companies include Cardtronics, NoteMachine, LINK Scheme, Diebold Nixdorf, NCR Atleos, Hitachi Channel Solutions, and Triton Systems.

Need help to buy this report?