United Kingdom Anticoagulants Market Size, Share, By Application (Atrial Fibrillation, Infarction, Deep Vein Thrombosis (DVT), Pulmonary Embolism, and Other), By Drug Category (Vitamin K Antagonist, Direct Thrombin Inhibitors, Novel Oral Anticoagulants (NOACs), Eliquis, Xarelto, Savaysa & lixiana, Pradaxa, Heparin, and Others), By Route of Administration (Oral Anticogulants, Injectable Anticogulants), United Kingdom Anticoagulants Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Anticoagulants Market Insights Forecasts to 2035

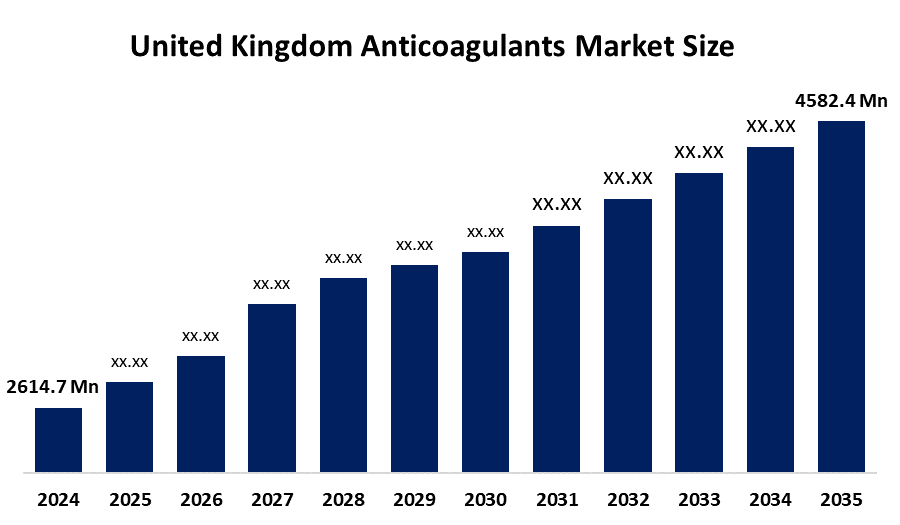

- United Kingdom Anticoagulants Market Size 2024: USD 2614.7 Million

- United Kingdom Anticoagulants Market Size 2035: USD 4582.4 Million

- United Kingdom Anticoagulants Market CAGR 2024: 5.23%

- United Kingdom Anticoagulants Market Segments: Application, Drug Category, and Route of Administration

Get more details on this report -

The United Kingdom anticoagulants market includes medications that prevent and treat blood clot-related disorders by inhibiting the formation of blood clots and the increasing blood flow. The major indications for the medications include atrial fibrillation, deep vein thrombosis, pulmonary embolism, stroke prevention, and the treatment of cardiovascular diseases. The market is now growing due to the rise in the incidence of cardiovascular diseases, the rising geriatric population, rising number of surgical procedures, and the rising awareness of the prevention of thrombosis. In addition, the development of direct oral anticoagulants, the availability of better diagnostic facilities, and the strong focus on reducing hospitalization rates are also contributing to the growth of the market.

The United Kingdom anticoagulants market receives advantages from healthcare policies which the Medicines and Healthcare Products Regulatory Agency (MHRA) regulates while NHS reimbursement systems and NICE guidelines provide access to crucial anticoagulant medications. The government healthcare initiatives establish programs which help prevent cardiovascular diseases and treat thrombosis.

Major pharmaceutical companies are investing in next-generation direct oral anticoagulants (DOACs) because they develop extended-release formulations and patient-friendly dosing regimens which will improve treatment adherence and safety. Digital health monitoring systems and telemedicine together with clinical decision-support systems have created a new path which brings better treatment accuracy and improved patient health results. The development of hospital services together with cardiovascular treatment centers and outpatient facilities throughout the UK creates new ways which advanced anticoagulant treatments will be adopted and used more widely.

Market dynamics of the United Kingdom surgical robot market

The United Kingdom anticoagulants market is driven by the increasing number of cardiovascular disease patients, the growing numbers of atrial fibrillation, thromboembolic disorder cases and the expanding elderly population which needs continuous blood clot prevention treatments. The market receives support from government programs which include MHRA regulatory supervision, NHS reimbursement systems and NICE treatment protocols that enable safe and effective anticoagulant administration. The UK healthcare system receives benefits from market expansion because direct oral anticoagulants (DOACs) become more widely used and diagnostic technologies improve and patient monitoring systems develop. Digital health solutions now reach better performance because of specialized healthcare professional training which leads to safer research results and higher treatment success rates.

The United Kingdom anticoagulants market is restrained by the high cost of advanced anticoagulant therapies which includes direct oral anticoagulants and the requirement for ongoing patient observation in particular treatment methods. The development process faces additional difficulties because of two major factors which include the potential for bleeding accidents and the need to follow strict regulatory standards and clinical governance requirements that increase both development expenses and compliance expenses.

The future of the UK anticoagulants market shows positive prospects because hospital network expansion, specialized cardiovascular treatment centers and outpatient care services will create new growth opportunities. The direct oral anticoagulant adoption increase together with digital health monitoring and personalized medicine progress has improved treatment outcomes. The market will experience continuous growth because atrial fibrillation management and stroke prevention and venous thromboembolism treatment and post-surgical clot prevention have developed new applications.

United Kingdom Anticoagulants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2614.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.23% |

| 2035 Value Projection: | USD 4582.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Application, By Drug Category |

| Companies covered:: | B. Braun, Carl Zeiss, Baxter, Becton Dickinson (BD), Danaher, KLS Martin, Scanlan International, Mercian Surgical, Belle Healthcare., and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom anticoagulants market share is classified into application, drug category, and route of administration.

By Application

The United Kingdom anticoagulants market is divided by application into atrial fibrillation, infarction, deep vein thrombosis (DVT), pulmonary embolism, and other. Among these, the atrial fibrillation segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is because the atrial fibrillation is the most common sustained cardiac arrhythmia and its prevalence increases with age.

By Drug Category

The United Kingdom anticoagulants market is divided by drug category into vitamin k antagonist, direct thrombin inhibitors, novel oral anticoagulants (noacs), eliquis, xarelto, savaysa & lixiana, pradaxa, heparin, and others. Among these, the novel oral anticoagulants segment dominated the share in 2024 and is anticipated to grow at a strong CAGR during the forecast period. It is because it requires regular INR blood tests and strict dietary monitoring, NOACs are administered in fixed doses, offering high convenience.

By Route of Administration

The United Kingdom anticoagulants market is divided by route of administration into oral anticogulants, injectable anticogulants. Among these, the oral anticogulants segment dominated the share in 2024 and is anticipated to grow at a notable CAGR during the forecast period. It is driven by Direct Oral Anticoagulants (DOACs), has surpassed traditional therapies in market share due to patient convenience, safety, and reduced monitoring requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom anticoagulants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Microsurgical Market

- B. Braun

- Carl Zeiss

- Baxter

- Becton Dickinson (BD)

- Danaher

- KLS Martin

- Scanlan International

- Mercian Surgical

- Belle Healthcare.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom anticoagulants market based on the below-mentioned segments:

United Kingdom Anticoagulants Market, By Application

- Atrial Fibrillation

- Infarction

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism

- Other.

United Kingdom Anticoagulants Market, By Drug Category

- Vitamin K Antagonist

- Direct Thrombin Inhibitors

- Novel Oral Anticoagulants (NOACs)

- Eliquis

- Xarelto

- Savaysa & lixiana

- Pradaxa

- Heparin

- Others.

United Kingdom Anticoagulants Market, By Route of Administration

- Oral Anticogulants

- Injectable Anticogulants.

Frequently Asked Questions (FAQ)

-

Q: What is the United Kingdom anticoagulants market size?A: United Kingdom anticoagulants market is expected to grow from USD 2614.7 million in 2024 to USD 4582.4 million by 2035, growing at a CAGR of 5.23% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing number of cardiovascular disease patients, the growing numbers of atrial fibrillation, thromboembolic disorder cases and the expanding elderly population which needs continuous blood clot prevention treatments.

-

Q: What factors restrain the United Kingdom anticoagulants market?A: Constraints include the high cost of advanced anticoagulant therapies which includes direct oral anticoagulants and the requirement for ongoing patient observation in particular treatment methods.

-

Q: How is the market segmented by application?A: The market is segmented into atrial fibrillation, infarction, deep vein thrombosis (DVT), pulmonary embolism, and other.

-

Q: Who are the key players in the United Kingdom anticoagulants market?A: Key companies include B. Braun, Carl Zeiss, Baxter, Becton Dickinson (BD), Danaher, Olympus, KLS Martin, Scanlan International, Mercian Surgical, Belle Healthcare.

Need help to buy this report?