United Kingdom Ambulatory Services Market Size, Share By Type (Primary Care Offices, Outpatient Departments, Emergency Departments, Surgical Specialty, and Medical Specialty), By Technology (Telemedicine, Mobile Health Applications, and Wearable Health Devices), United Kingdom Ambulatory Services Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Ambulatory Services Market Insights Forecasts to 2035

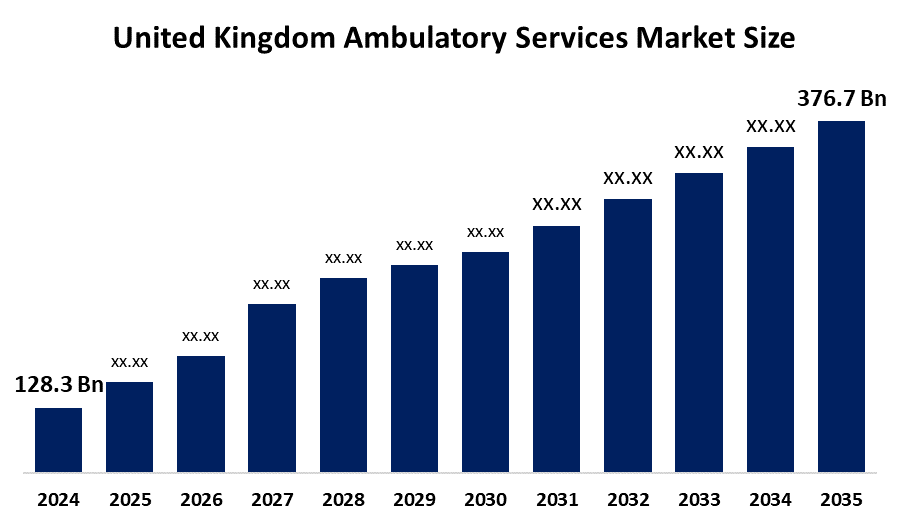

- United Kingdom Ambulatory Services Market Size 2024: USD 128.3 Bn

- United Kingdom Ambulatory Services Market Size 2035: USD 376.7 Bn

- United Kingdom Ambulatory Services Market CAGR 2024: 10.29%

- United Kingdom Ambulatory Services Market Segments: Type and Technology

Get more details on this report -

The United Kingdom Ambulatory Services Market Size is a quickly burgeoning market in the healthcare industry. The market includes ambulatory healthcare services, ambulatory emergency healthcare services, and same-day ambulatory surgery. These are further supplemented by ambulatory diagnostic services. Additionally, ambulatory healthcare delivery is also delivered on a community scale. Notably, this market in the United Kingdom is fuelled by factors such as population growth due to an aging population. Moreover, it is driven by NHS pressures due to waiting lists. In particular, it is fuelled by growth in the private sector. Additionally, it is fuelled by various supportive policies from the United Kingdom government. Further, it is fuelled by delivery partnership models due to NHS-independent sectors.

Primary care improvement is a key focus in the United Kingdom ambulatory services market, supported by government initiatives to enhance access in deprived areas through more urgent same-day appointments, expanded community diagnostic centres, and delivery of minor procedures, helping shift care away from hospitals and reduce pressure on emergency and inpatient services.

The United Kingdom Ambulatory Services Market Size has enormous growth potential, which comes with an increase in the prevalence of chronic illnesses, an elderly population, waiting lists in the NHS, and the growing requirement for same-day and outpatient facilities. Technology uptake, including digital triage, virtual consultations, scheduling with the use of artificial intelligence, and diagnostic technology, presents opportunities for high-volume ambulatory facilities and community facilities. The main areas with immense growth prospects include ambulatory emergency care, day surgery, and community diagnostic centre, which are fuelled by government initiatives for care at home, public partnerships, and optimal utilization of hospitals, despite the challenges posed by staff shortages and budgetary constraints.

Market Dynamics of the United Kingdom Ambulatory Services Market

The United Kingdom Ambulatory Services Market Size is evolving as the UK Government support through health policy initiatives, with funding for the NHS–Private Partnership model to provide healthcare to a growing elderly population, rapidly increasing rates of Chronic Disease and the shift from waiting lists in the hospital to community-based service delivery, including telehealth, digital health technologies that are beginning to transform how the services are delivered in both the Independent sector and NHS. Increasing investments in community diagnostic centres, ambulatory emergency care units, and virtual care platforms will facilitate increasing demand further by expanding the capacity of traditional hospitals to treat large patient populations quickly and conveniently through Government Funding through the NHS-Private Partnership or other emerging models of care supported by the increased use of AI-assisted scheduling, remote monitoring of patients and the use of data-driven care paths, placing the UK as an evolved and sophisticated ambulatory care market.

The United Kingdom Ambulatory Services Market Size faces restraints such as workforce shortages, funding constraints, capacity limitations, and operational pressure from rising demand. Regulatory complexity, data integration challenges, and uneven regional access also affect service delivery, while inflation, staffing costs, and dependency on NHS commissioning impact profitability, despite strong long-term demand for outpatient and same-day care services.

The future of United Kingdom Ambulatory Services Market Size is optimistic as a result of increasing digital innovation, supportive government health care reform, and increased demand for outpatient/same-day appointments. AI based triage, virtual consultations, advanced diagnostics and digitally integrated care pathways are providing new avenues for growth. In addition, the development of community diagnostic centres, ambulatory care/urgent care centres and high volume surgical centres are helping improve healthcare delivery within the UK. In addition, the increased pressure being exerted on healthcare from an aging population, an increase in chronic disease, and a backlog of elective surgeries all create additional momentum for developing ambulatory and community based service models.

United Kingdom Ambulatory Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 128.3 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 10.29% |

| 2035 Value Projection: | USD 376.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Type, By Technology |

| Companies covered:: | Guy’s and St Thomas’ NHS Foundation Trust Chelsea and Westminster Hospital NHS Foundation Trust Nottingham University Hospitals NHS Trust Brighton and Sussex University Hospitals NHS Trust Spire Healthcare Group plc Circle Health Group Care UK Limited Nuffield Health Ramsay Health Care UK Aspen Healthcare BMI Healthcare HCA Healthcare UK Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Kingdom ambulatory services market share is classified into type and technology.

By Type

The United Kingdom Ambulatory Services Market Size is divided by type into primary care offices, outpatient departments, emergency departments, surgical specialty, and medical specialty. Among these, the primary care offices systems segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is due to being the initial patient contact point, offering cost-effective, accessible care for chronic conditions and routine needs.

By Technology

The United Kingdom Ambulatory Services Market Size is divided by technology into telemedicine, mobile health applications, and wearable health devices. Among these, the telemedicine segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is driven by widespread adoption of telehealth services, especially post-pandemic, and the robust integration of these technologies within the National Health Service (NHS) infrastructure.

Competitive Analysis

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom ambulatory services market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Kingdom Ambulatory Services Market

- Guy’s and St Thomas’ NHS Foundation Trust

- Chelsea and Westminster Hospital NHS Foundation Trust

- Nottingham University Hospitals NHS Trust

- Brighton and Sussex University Hospitals NHS Trust

- Spire Healthcare Group plc

- Circle Health Group

- Care UK Limited

- Nuffield Health

- Ramsay Health Care UK

- Aspen Healthcare

- BMI Healthcare

- HCA Healthcare UK

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom ambulatory services market based on the below-mentioned segments:

United Kingdom Ambulatory Services Market, By Type

- Primary Care Offices

- Outpatient Departments

- Emergency Departments

- Surgical Specialty

- Medical Specialty

United Kingdom Ambulatory Services Market, By Technology

- Telemedicine

- Mobile Health Applications

- Wearable Health Devices

Frequently Asked Questions (FAQ)

-

What is the United Kingdom ambulatory services market size?United Kingdom ambulatory services Market is expected to grow from USD 128.3 billion in 2024 to USD 376.7 billion by 2035, growing at a CAGR of 10.29% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by health policy initiatives, with funding for the NHS–Private Partnership model to provide healthcare to a growing elderly population, rapidly increasing rates of Chronic Disease.

-

What factors restrain the United Kingdom ambulatory services market?Constraints include the workforce shortages, funding constraints, capacity limitations, and operational pressure from rising demand.

-

How is the market segmented by type?The market is segmented into primary care offices, outpatient departments, emergency departments, surgical specialty, and medical specialty.

-

Who are the key players in the United Kingdom ambulatory services market?Key companies include Guy’s and St Thomas’ NHS Foundation Trust, Chelsea and Westminster Hospital NHS Foundation Trust, Nottingham University Hospitals NHS Trust, Brighton and Sussex University Hospitals NHS Trust, Spire Healthcare Group plc, Circle Health Group, Care UK Limited, Nuffield Health, Ramsay Health Care UK, Aspen Healthcare, BMI Healthcare, HCA Healthcare UK, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?