United Arab Emirates Methanol Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Natural Gas, Oil, and Coal), By Application (Formaldehyde, Acetic Acid, MTBE, DME, Fuel Blending, MTO, Biodiesel, and Others), and United Arab Emirates Methanol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Arab Emirates Methanol Market Insights Forecasts to 2035

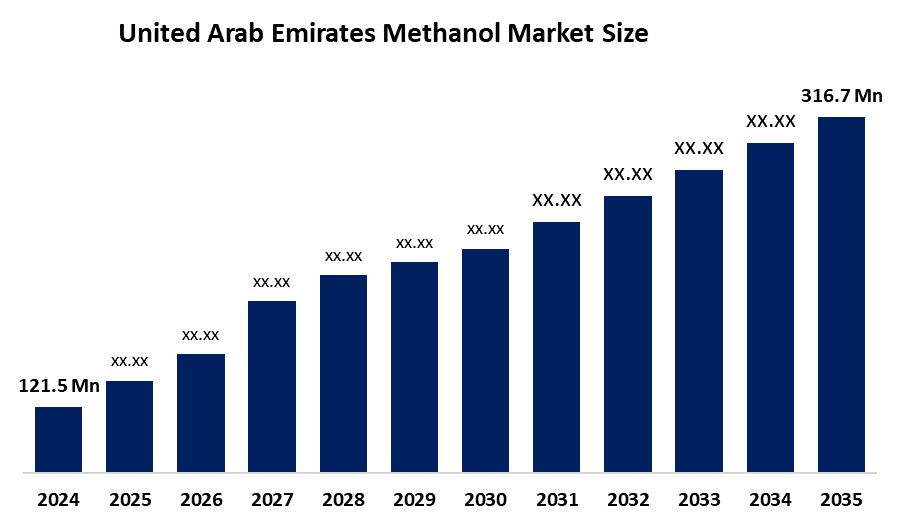

- The United Arab Emirates Methanol Market Size Was Estimated at USD 121.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.1% from 2025 to 2035

- The United Arab Emirates Methanol Market Size is Expected to Reach USD 316.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Arab Emirates methanol market size is anticipated to reach USD 316.7 million by 2035, growing at a CAGR of 9.1% from 2025 to 2035. The methanol market in United Arab Emirates is driven by growing petrochemical capacity, plentiful natural gas supplies, growing demand for methanol-to-olefins, acceptance of clean fuels, industrial diversification programs, and significant investments in downstream chemical manufacture.

Market Overview

The United Arab Emirates methanol market refers to the production, distribution, and consumption of methanol, which is a vital petrochemical that comes from natural gas. The United Arab Emirates uses methanol as a primary feedstock to create formaldehyde, acetic acid, and olefins, while also using it for fuel blending and power generation, biodiesel production, and solvents and antifreeze applications, which serve multiple industrial and energy purposes throughout the country.

The UAE government supports methanol market development through state-funded projects, which include the $1.7 billion TA'ZIZ methanol facility. The government establishes strategic partnerships, which include Proman, to support national diversification efforts and clean energy objectives through their shared projects, which develop green methanol and supporting infrastructure. The government uses its comprehensive policies to boost economic competitiveness while drawing foreign investment to establish the UAE as a major chemical manufacturing center.

TA'ZIZ awarded Samsung E&A an EPC contract worth $1.7 billion to construct the first large-scale methanol plant in the UAE, which will produce 1.8 Mtpa of methanol through its clean electricity operations and expects completion by 2028. The partnership between AD Ports Group, Masdar, Advario, and CMA CGM develops e-methanol bunkering and export facilities, which create new low-carbon fuel infrastructure. The future offers new possibilities through green hydrogen-to-methanol production, sustainable marine fuels, and the development of international export supply networks.

Report Coverage

This research report categorizes the market for the United Arab Emirates methanol market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Arab Emirates methanol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Arab Emirates methanol market.

United Arab Emirates Methanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 121.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.1% |

| 2035 Value Projection: | USD 316.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | TA’ZIZ, Abu Dhabi National Oil Company (ADNOC), ADNOC Distribution, Borouge, Petrochem Middle East FZE, Altek International, AIMS, Trice Chemicals Industrial LLC, Valero Commodities LLC, Liwa Chemicals, Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The methanol market in United Arab Emirates is driven by the natural gas resources that exist in abundance, and the petrochemical downstream sectors continue to develop, and government programs support industrial development. The market expansion throughout the country results from increasing methanol demand in chemical, fuel, and energy uses, together with funding for large production facilities, clean fuel projects, and rising export opportunities.

Restraining Factors

The methanol market in United Arab Emirates is mostly constrained by the industry's demands for substantial financial investments, and companies face unpredictable natural gas and methanol price movements, and they must comply with environmental regulations, and they encounter competition from established international producers who affect their project financials and their ability to earn profits over time.

Market Segmentation

The United Arab Emirates methanol market share is classified into feedstock and application.

- The natural gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Arab Emirates methanol market is segmented by feedstock into natural gas, oil, and coal. Among these, the natural gas segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The UAE's large and inexpensive natural gas deposits, well-established gas infrastructure, and reduced carbon intensity when compared to methanol derived from coal or oil are the reasons for this dominance. Gas-based feedstock is also favored by government-backed initiatives and petrochemical integration, which will promote increased production efficiency, cost competitiveness, and continuous capacity growth during the forecast period.

- The formaldehyde segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United Arab Emirates methanol market is segmented by application into formaldehyde, acetic acid, MTBE, DME, fuel blending, MTO, biodiesel, and others. Among these, the formaldehyde segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Formaldehyde-based goods are widely employed in the building, automotive, furniture, and resin production industries, which are the main drivers of this domination. The UAE's high methanol use in formaldehyde synthesis is sustained by rapid infrastructural development, an increase in wood panels and insulation materials, and consistent industrial expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Arab Emirates methanol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TA’ZIZ

- Abu Dhabi National Oil Company (ADNOC)

- ADNOC Distribution

- Borouge

- Petrochem Middle East FZE

- Altek International

- AIMS

- Trice Chemicals Industrial LLC

- Valero Commodities LLC

- Liwa Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In June 2025, to advance sustainable fuels infrastructure, AD Ports Group, Masdar, Advario, and CMA CGM Group sign an agreement to investigate the construction of an e-methanol bunkering and export plant at Khalifa Port and KEZAD.

- In February 2025, TA'ZIZ gives Samsung E&A a $1.7 billion EPC contract to construct the first large-scale methanol plant (1.8 Mtpa) in the United Arab Emirates at Al Ruwais Industrial City; completion is anticipated by 2028 and will be powered by sustainable energy.

Market Segment

This study forecasts revenue at the United Arab Emirates, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Arab Emirates methanol market based on the below-mentioned segments:

United Arab Emirates Methanol Market, By Feedstock

- Natural Gas

- Oil

- Coal

United Arab Emirates Methanol Market, By Application

- Formaldehyde

- Acetic Acid

- MTBE

- DME

- Fuel Blending

- MTO

- Biodiesel

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the United Arab Emirates methanol market size?A: United Arab Emirates methanol market size is expected to grow from USD 121.5 million in 2024 to USD 316.7 million by 2035, growing at a CAGR of 9.1% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the natural gas resources that exist in abundance, and the petrochemical downstream sectors continue to develop, with government programs supporting industrial development.

-

Q: What factors restrain the United Arab Emirates methanol market?A: Constraints include the industry's demands for substantial financial investments, and companies face unpredictable natural gas and methanol price movements.

-

Q: How is the market segmented by application?A: The market is segmented into formaldehyde, acetic acid, MTBE, DME, fuel blending, MTO, biodiesel, and others.

-

Q: Who are the key players in the United Arab Emirates methanol market?A: Key companies include TA’ZIZ, Abu Dhabi National Oil Company (ADNOC), ADNOC Distribution, Borouge, Petrochem Middle East FZE, Altek International, AIMS, Trice Chemicals Industrial LLC, Valero Commodities LLC, Liwa Chemicals, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?