United Arab Emirates Co-working Space Market Size, Share, By Type (Conventional Coworking, Corporate Coworking, Specialized Coworking), By Offering (Hot Desks, Dedicated Desks, Private Offices), By Application (IT & ITES, BFSI, Consulting), By Mode (Independent, Chain/Franchise), By End Use (Freelancers & Remote Workers, Startups & SMEs, Large Enterprises), United Arab Emirates Co-working Space Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited Arab Emirates Co-Working Space Market Insights Forecasts to 2035

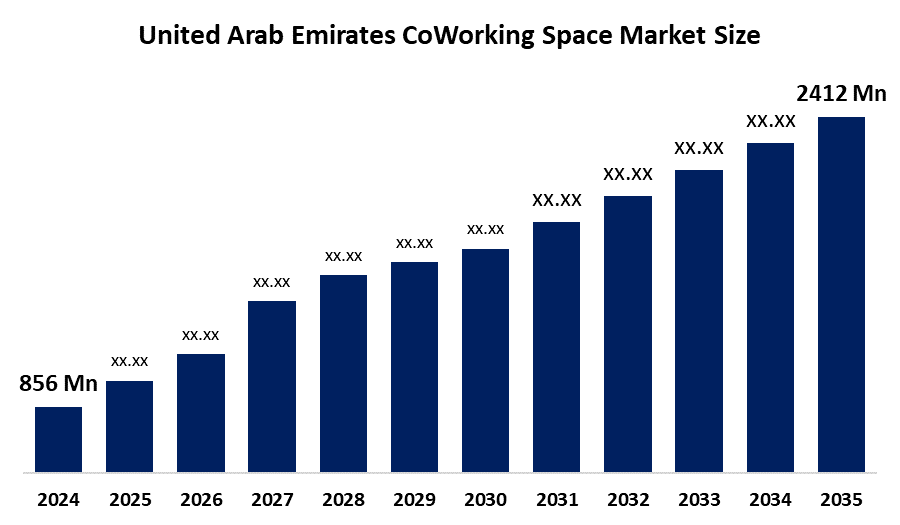

- United Arab Emirates Co-Working Space Market Size 2024: USD 856 Mn

- United Arab Emirates Co-Working Space Market Size 2035: USD 2412 Mn

- United Arab Emirates Co-Working Space Market CAGR 2024: 9.88%

- United Arab Emirates Co-Working Space Market Segments: Type, Offering, Application, Mode, and End Use.

Get more details on this report -

The United Arab Emirates co working space market refers to an industry that offers flexible workspace solutions like shared open space, private offices, and virtual offices, among others. These are offered for the purposes of servicing freelancers, startups, SMEs, large scale businesses, and different industries in general, as they offer cost effective spaces for collaboration, networking, and operations. These spaces are employed in the provision of hybrid work spaces, enhancing innovation within technology, financial based companies, consulting businesses, and catering to the needs of remote workers and diversification of the economy as an entrepreneurial catalyst. This market is growing as technology is improving in the areas of smart offices, hybrid membership, and wellness spaces, among others.

Presently, initiatives by the government, such as the Dubai Future Foundation, Abu Dhabi Investment Office ADIO, free zones like Dubai Internet City and ADGM, and programs like the Golden Visa, are great sources of support for these sectors, and in line with major developments in the field, the UAE has moved forward with a regulatory framework for flexible licensing and foreign ownership, ensuring quicker market entry for international operators. Future developments are bound by increasing demand for hybrid workspaces, advancements in digital infrastructure, and access to investments in the real estate and startup sectors, among others.

Market Dynamics of the United Arab Emirates Co-Working Space Market:

The driving factors of this market include the need for flexible workspaces, a hybrid work style, and cost savings with high commercial property costs. Government support received by the UAE, such as the need for diversification through Operation 300bn, free zones, and innovation centers, is a driving force for the market. The advancement of various technologies, including IoT-based smart buildings, innovation spaces with AI, and installing high-end infrastructure such as internet connectivity and health facilities, is rapidly growing the market for co-working spaces within the tech, financial, and professional sectors.

The market challenges include premium rentals charged in prime locations, tightly regulated markets with respect to licensing and visas, high operational costs, as well as restricted secondary market presence. Technical challenges, high occupancy, as well as the need for cybersecurity, also pose as challenges.

The outlook for the co working space business in the UAE is positive, and this includes areas like working from home, startup accelerators, company satellite offices, special industries like tech and creative, and filling gaps in the unpenetrated emirates. This can be attributed to various things, including the growth of SMEs and freelancers, funding from venture capital, and favorable regulations, among others.

United Arab Emirates Co-Working Space Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 856 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.88% |

| 2035 Value Projection: | USD 2412 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 91 |

| Segments covered: | ByType,By Offering |

| Companies covered:: | WeWork,Regus,Spaces,AstroLabs,Letswork,Servcorp And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The United Arab Emirates co-working space market share is classified into type, offering, application, mode, and end use.

By Type:

The United Arab Emirates co-working space market is divided by type into conventional coworking, corporate coworking, and specialized coworking. Among these, the corporate coworking segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Corporate coworking leads the way mainly because of its appeal to established enterprises seeking agile lease arrangements, premium amenities, and cost-effective alternatives to traditional offices, strong collaborations with free zones, and regulatory support for hybrid models in the UAE. Thus, it is naturally the choice for large-scale and commercial uses.

By Offering:

The market is divided by offering into hot desks, dedicated desks, and private offices. Among these, the private offices segment dominated in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Private offices give the most benefits because they offer secure, customizable spaces outside shared environments, thus drastically reducing distractions and enhancing privacy. Consequently, business confidentiality is improved and, on top of that, private offices are thus the preferred choice for SMEs and enterprises in high-demand areas like Dubai and Abu Dhabi.

By Application:

The market is divided by application into IT ITES, BFSI, and consulting. Among these, IT & ITES dominated in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The main factors driving this include demand for tech driven workspaces for startups and digital nomads, innovation hubs in free zones, and the number of tech firms utilizing co working for scalable operations at a much faster pace.

By Mode:

The market is divided by mode into independent and chain/franchise. Among these, the chain/franchise segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. By partnering with chains, operators can tap into global expertise, gain access to standardized infrastructure, accelerate expansion, etc. Hence, operators in the UAE are able to reduce the time-to-market for their flexible workspace offerings.

By End Use:

The market is divided by end use into freelancers & remote workers, startups & SMEs, and large enterprises. Among these, startups & SMEs dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The reason these have come out on top is that their increasing investments in flexible offices, in startup ecosystems, accelerators, and in commercial applications, have all fueled the need for affordable co-working solutions in the UAE.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations companies involved within the United Arab Emirates co-working space market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in United Arab Emirates Co-Working Space Market:

- WeWork

- Regus

- Spaces

- AstroLabs

- Letswork

- Servcorp

- Nook

- The Co Dubai

- Impact Hub

- One Business Centre

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the UAE, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Arab Emirates co-working space market based on the below-mentioned segments:

United Arab Emirates Co-Working Space Market, ByType

- Conventional Coworking

- Corporate

- Specialized Coworking

United Arab Emirates Co-Working Space Market, By Offering

- Hot Desks

- Dedicated Desks

- Private Offices

United Arab Emirates Co-Working Space Market, By Application

- IT & ITES

- BFSI

- Consulting

United Arab Emirates Co-Working Space Market, By Mode

- Independent

- Chain/Franchise

United Arab Emirates Co-Working Space Market, By End Use

- Freelancers & Remote Workers

- Startups & SMEs

- Large Enterprises

Frequently Asked Questions (FAQ)

-

1. What is the size of the United Arab Emirates co-working space market in 2024?The United Arab Emirates co-working space market was valued at USD 856 million in 2024 and is projected to reach USD 2,412 million by 2035, growing at a CAGR of 9.88% during 2025–2035.

-

2. What is driving the growth of the UAE co-working space market?The UAE co-working space market is driven by the rise of hybrid work models, increasing startup formation, high commercial real estate costs, government diversification initiatives such as Operation 300bn, growth of free zones, expansion of digital infrastructure, and demand for flexible, cost-efficient office solutions.

-

3. Which type segment dominates the UAE co-working space market?The corporate coworking segment dominates the UAE co-working space market. Large enterprises prefer corporate coworking due to flexible lease structures, premium facilities, regulatory support in free zones, and the ability to scale operations without long-term real estate commitments.

-

4. Which offering is most popular in the UAE co-working space market?Private offices lead the market by offering. Businesses prefer private offices because they provide confidentiality, reduced distractions, customizable layouts, and enhanced security—especially in major business hubs such as Dubai and Abu Dhabi.

-

5. Which application segment holds the largest share in the UAE co-working market?The IT & ITES segment holds the largest share. The UAE’s strong technology ecosystem, digital startups, innovation hubs, and demand from tech-driven enterprises significantly boost the use of co-working spaces.

-

6. How is the UAE government supporting the co-working space market?Government support includes initiatives by the Dubai Future Foundation, Abu Dhabi Investment Office (ADIO), flexible licensing regulations, free zone incentives, foreign ownership reforms, and Golden Visa programs. These policies encourage entrepreneurship and attract international businesses.

-

7. What are the key challenges in the UAE co-working space market?Key challenges include high rental costs in prime locations, licensing and visa regulations, operational expenses, cybersecurity concerns, and limited presence in secondary emirates compared to Dubai and Abu Dhabi.

-

8. Who are the major players in the UAE co-working space market?Major companies operating in the UAE co-working space market include WeWork, Regus, Spaces, AstroLabs, Letswork, Servcorp, Nook, The Co-Dubai, Impact Hub, and One Business Centre.

-

9. What are the main end users of co-working spaces in the UAE?The primary end users are startups & SMEs, followed by freelancers & remote workers and large enterprises. The rapid growth of startups and SME ecosystems significantly contributes to market expansion.

-

10. What are the future opportunities in the UAE co-working space market?Future opportunities include expansion into underserved emirates, development of specialized coworking hubs (tech, creative, fintech), growth in satellite offices for multinational corporations, digital integration through IoT smart buildings, and increasing demand from remote and hybrid workers.

Need help to buy this report?