United Arab Emirates Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid, and Gas), By End Use (Agriculture & fertilizer, Chemical Manufacturing, Food & Beverages, Wastewater Management, and Others), and United Arab Emirates Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Arab Emirates Ammonia Market Insights Forecasts to 2035

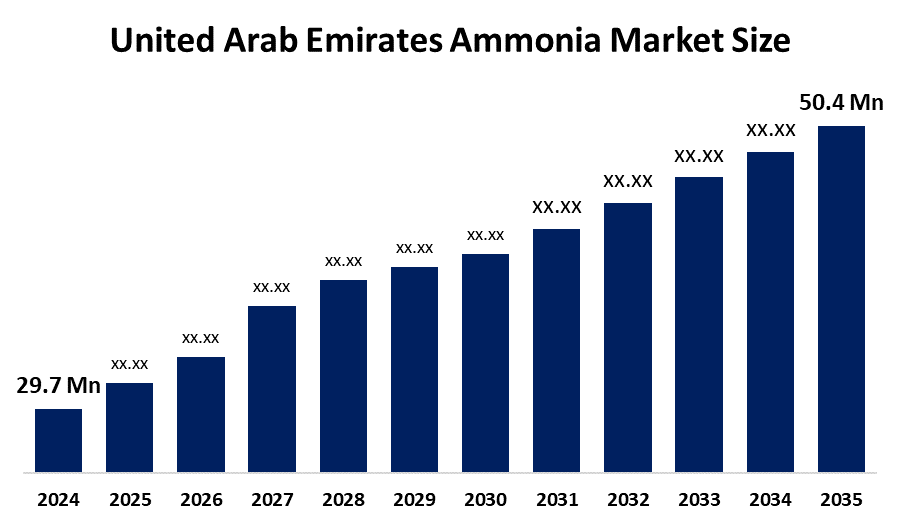

- The United Arab Emirates Ammonia Market Size Was Estimated at USD 29.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.93% from 2025 to 2035

- The United Arab Emirates Ammonia Market Size is Expected to Reach USD 50.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Arab Emirates Ammonia Market Size Is Anticipated To Reach USD 50.4 Million By 2035, Growing At A CAGR Of 4.93% From 2025 to 2035. The ammonia market in United Arab Emirates is driven by rising fertilizer demand, growing petrochemical industries, robust natural gas supply, food security programs, industrial refrigeration use, and government assistance for downstream chemical manufacture.

Market Overview

The United Arab Emirates Ammonia Market Size comprises all activities involved in producing, distributing, and consuming ammonia derived from natural gas sources. Ammonia serves as a vital component for producing fertilizers, which help agricultural production and efforts to maintain food security. The UAE economy sees increased demand for industrial solutions as both industrial growth and sustainable development projects expand their use across sectors.

The UAE is developing a 1 mtpa low-carbon ammonia plant at TA'ZIZ in Al Ruwais through its In-Country Value (ICV) program and strategic partnerships, which will create local employment opportunities and boost export capacity. The UAE National Hydrogen Strategy 2050 establishes incentives for clean hydrogen and ammonia development, which will transform the UAE into a regional hub for clean fuels.

The UAE's TA'ZIZ low-carbon ammonia facility awarded its construction contract in May 2024, targeting 1 Mtpa output by 2027, with clean ammonia production by 2030. Mitsui and partners began building their project in June 2024 using CO2 capture technology. Future opportunities include expanding low-carbon exports and hydrogen value chains as clean fuel demand grows.

Report Coverage

This research report categorizes the market for the United Arab Emirates Ammonia Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Arab Emirates ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Arab Emirates ammonia market.

United Arab Emirates Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.93% |

| 2035 Value Projection: | USD 50.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Fertiglobe Abu Dhabi National Oil Company TA’ZIZ Industrial Chemicals Zone Ruwais Fertilizer Industries Brothers Gas Bottling & Distribution Co LLC Sharjah Oxygen Company Servochem LLC Dubi Chem Marine International Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Ammonia Market Size in United Arab Emirates is driven by the increasing fertilizer needs for food security and expanding petrochemical and industrial uses, and government efforts to develop clean energy. The market growth receives support from three factors, which include investments in low-carbon and blue ammonia, the existence of inexpensive natural gas, and the country's strategic position for exporting and its initiatives through the UAE Hydrogen Leadership Roadmap. The rising worldwide needs for ammonia to function as a hydrogen carrier and marine fuel system have increased the pace of capacity growth.

Restraining Factors

The ammonia Market in United Arab Emirates is mostly constrained by the high initial investment requirements for new facilities, together with unpredictable global ammonia price movements, strict environmental protection laws, carbon emission reduction mandates, and increasing competition from low-cost manufacturers.

Market Segmentation

The United Arab Emirates ammonia market share is classified into type and end use.

- The liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Arab Emirates Ammonia Market Size is segmented by type into liquid, and gas. Among these, the liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Liquid ammonia shipping is supported by the UAE's robust port infrastructure, and steady demand is driven by its extensive use in industrial, refrigeration, and fertilizer applications. Liquid ammonia's superior handling efficiency and cost benefits over gaseous ammonia further contribute to its market dominance and expansion.

- The agriculture & fertilizer segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The United Arab Emirates Ammonia Market Size is segmented by end use into agriculture & fertilizer, chemical manufacturing, food & beverages, wastewater management, and others. Among these, the agriculture & fertilizer segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Ammonia's widespread use in nitrogen-based fertilizers, growing domestic food security programs, and robust export demand are the main drivers of this dominance. This segment's dominant market position and promising development prospects are further reinforced by government support for sustainable agriculture and the UAE's well-established infrastructure for fertilizer manufacturing and distribution.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United arab Emirates Ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fertiglobe

- Abu Dhabi National Oil Company

- TA’ZIZ Industrial Chemicals Zone

- Ruwais Fertilizer Industries

- Brothers Gas Bottling & Distribution Co LLC

- Sharjah Oxygen Company

- Servochem LLC

- Dubi Chem Marine International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In October 2024, ADNOC completes the acquisition of a majority stake in Fertiglobe, which enables its global low-carbon ammonia operations to expand while its future project capacity doubles.

- In May 2024, TA'ZIZ awarded a construction contract to build a 1 million-ton-per-year low-carbon ammonia plant, which will begin construction in Q3 2024 and reach operational status in 2027.

- In May 2024, ADNOC conducted its initial certified bulk low-carbon ammonia shipment, which originates from the UAE and travels to Japan, while Fertiglobe produced the ammonia through carbon capture and storage technology for use in clean power applications internationally.

Market Segment

This study forecasts revenue at the United Arab Emirates, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Arab Emirates ammonia market based on the below-mentioned segments:

United Arab Emirates Ammonia Market, By Type

- Liquid

- Gas

United Arab Emirates Ammonia Market, By End Use

- Agriculture & fertilizer

- Chemical Manufacturing

- Food & Beverages

- Wastewater Management

- Others

Frequently Asked Questions (FAQ)

-

What is the United Arab Emirates ammonia market size?United Arab Emirates ammonia market size is expected to grow from USD 29.7 million in 2024 to USD 50.4 million by 2035, growing at a CAGR of 4.93% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing fertilizer needs for food security and expanding petrochemical and industrial uses, and government efforts to develop clean energy.

-

What factors restrain the United Arab Emirates ammonia market?Constraints include the high initial investment requirements for new facilities, and together with unpredictable global ammonia price movements.

-

How is the market segmented by type?The market is segmented into liquid, and gas.

-

Who are the key players in the United Arab Emirates ammonia market?Key companies include Fertiglobe, Abu Dhabi National Oil Company, TA’ZIZ Industrial Chemicals Zone, Ruwais Fertilizer Industries, Brothers Gas Bottling & Distribution Co LLC, Sharjah Oxygen Company, Servochem LLC, Dubi Chem Marine International, and Others.

Need help to buy this report?