Global Unit-Linked Insurance Market Size, Share, and COVID-19 Impact Analysis, By Mode (Online and Offline), By Distribution Channel (Direct from Insurers, Insurance Brokers and Agencies, Banks, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Banking & FinancialGlobal Unit-Linked Insurance Market Insights Forecasts to 2035

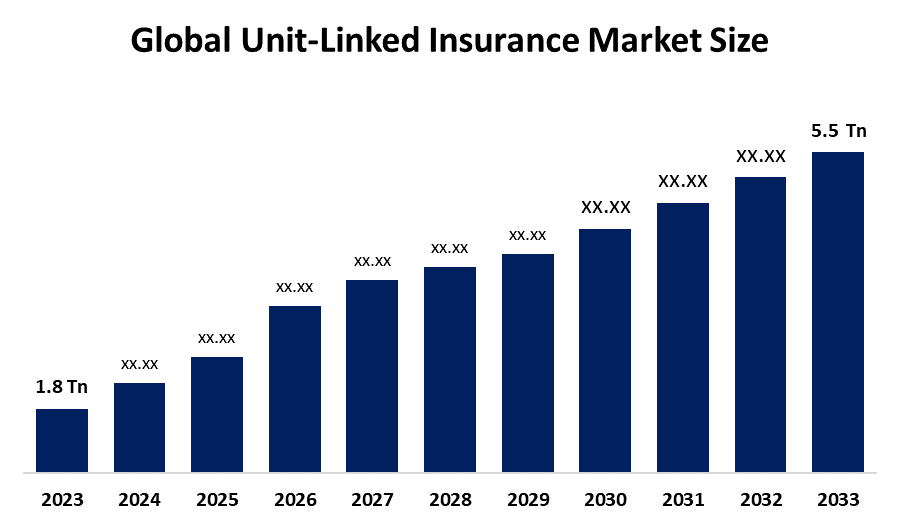

- The Global Unit-Linked Insurance Market Size Was Estimated at USD 1.8 Trillion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.69% from 2025 to 2035

- The Worldwide Unit-Linked Insurance Market Size is Expected to Reach USD 5.5 Trillion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Unit-Linked Insurance market size was worth around USD 1.8 Trillion in 2024 and is predicted to grow to around USD 5.5 Trillion by 2035 with a compound annual growth rate (CAGR) of 10.69% from 2025 and 2035. The market for unit-linked insurance has a number of opportunities to grow, driven by growing consumer demand for dual benefit products that combine investment opportunities and life insurance, rising disposable incomes and financial literacy, a move toward highly customizable and market linked products, and digital distribution that makes these products more widely available.

Market Overview

A unit-linked insurance plan is a type of hybrid financial product offered by insurance firms. It involves the policyholder paying a portion of the premium for life insurance and the remaining amount being invested in market linked funds. The growing demand for products that combine protection and investment potential, rising awareness of life insurance benefits, and the emergence of digital distribution channels that streamline management and buying are the main reasons propelling the unit linked insurance market. Adoption is further aided by changing consumer preferences for goal based financial planning and personalization. The growing consumer awareness of the benefits of both investment and protection is driving the unit-linked insurance industry. As digital adoption increases, policy management becomes easier, increasing the appeal and accessibility of ULIPs. In order to meet a variety of financial objectives, insurers utilize technology to customize their solutions. Demand is further fueled by growing discretionary incomes and an emphasis on building long term wealth. Together, these elements foster consistent market expansion by encouraging more consumers to select unit linked plans. For example, Bandhan Life Insurance introduced ULIP Plus, a new unit linked insurance plan, in May 2025. It offers market-linked investment returns in addition to high life coverage of up to 50 times the yearly premium. This plan offers versatile investment alternatives across debt and equity funds, combining long term wealth building with robust financial safety.

The Insurance Regulatory and Development Authority of India in India launched the Bima Trinity initiative to increase insurance access and inclusion. It is made up of three components, Bima Sugam, Bima Vistaar, and Bima Vahak.

Report Coverage

This research report categorizes the unit-linked insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the unit-linked insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the unit-linked insurance market.

Unit-Linked Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.8 Trillion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 10.69% |

| 024 – 2035 Value Projection: | USD 5.5 Trillion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Mode, By Distribution Channel |

| Companies covered:: | Life Insurance Corporation of India, HDFC Life Insurance, ICICI Prudential Life Insurance, SBI Life Insurance, Max Life Insurance, Aviva plc, Allianz SE, Prudential plc, AIA Group Limited, MetLife, Inc., AXA SA, Zurich Insurance Group, Nippon Life Insurance Company, Sun Life Financial Inc., Manulife Financial Corporation, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The unit-linked insurance market is driven by the growing consumer knowledge of the advantages of financial planning. More individuals are aware that these products provide both investment and life insurance coverage. Policyholders can acquire, manage, and track their assets more easily and conveniently due to the growing adaptability of digital platforms. Due to its accessibility, the clientele is growing to include professionals and young adults who are keen to secure safety while making investments in their future. Insurers use technology to provide individualized policies that are suited to each customer's financial objectives. The demand for customizable insurance plans that mix security and financial potential has increased with this digital integration, which also draws in new clients.

Restraining Factors

The unit-linked insurance market is restricted by factors like the market risks that policyholders are exposed to through the investment component of ULIPs. Fund valuations and returns can be adversely affected by market volatility or economic downturns.

Market Segmentation

The unit-linked insurance market share is classified into mode and distribution channel.

- The online segment dominated the market in 2024, accounting for approximately 35% and is projected to grow at a substantial CAGR during the forecast period.

Based on the mode, the unit-linked insurance market is divided into online and offline. Among these, the online segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by the growing consumer use of digital channels, and the ease with which customers may compare various ULIP plans are some of the factors that have contributed to this increase. More consumers are using internet services to buy insurance goods as a result of the COVID-19 pandemic's acceleration of digital transformation.

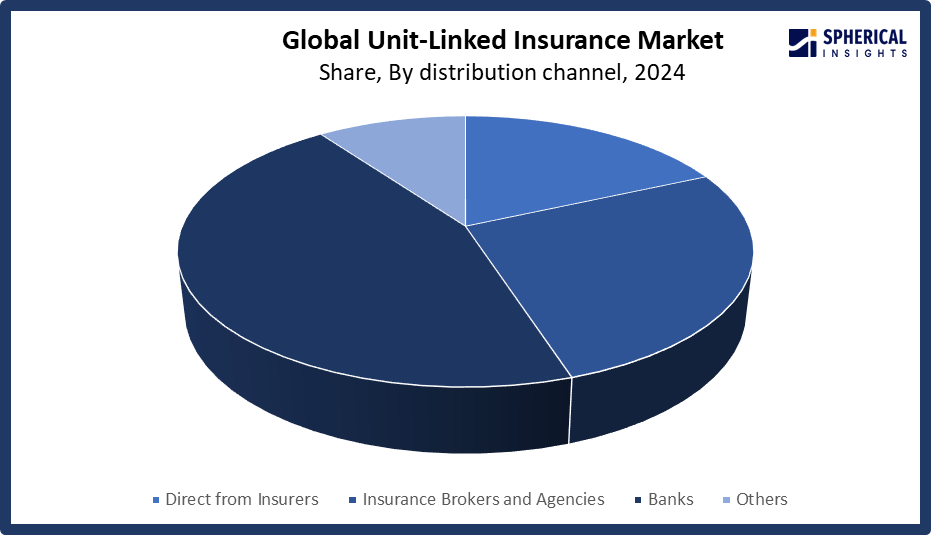

- The banks segment accounted for the largest share in 2024, accounting for approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the unit-linked insurance market is divided into direct from insurers, insurance brokers and agencies, banks, and others. Among these, the banks segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to the wide reach and long standing trust that banks have built with their clientele. Unit-linked insurance plans can be successfully marketed and sold by banks by utilizing their current clientele, strong distribution networks, and well established financial consulting services.

Get more details on this report -

Regional Segment Analysis of the Unit-Linked Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 40% of the Unit-Linked Insurance market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 40% of the unit-linked insurance market over the predicted timeframe. In the North America market, the market is rising due to the region's well established insurance infrastructure, strong distribution networks including banks and brokers, high consumer knowledge of investment linked life insurance, and widespread internet access that makes market penetration easier.

The United States' robust and established insurance industry, strong customer preference for investment linked life insurance products, and sophisticated distribution methods, such as bancassurance and digital platforms, are all major factors in the market's supremacy.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 25% in the unit-linked insurance market during the forecast period. The Asia Pacific area has a thriving market for unit-linked insurance due to a high number of individuals who lack insurance, increased disposable incomes, and the rapid digitization of insurance distribution through online and mobile platforms. Adoption is also fueled by growing awareness of retirement products and wealth creation.

China's large population, rising middle class income, and rising demand for investment linked insurance products support its position in the unit linked insurance market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the unit-linked insurance market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Life Insurance Corporation of India

- HDFC Life Insurance

- ICICI Prudential Life Insurance

- SBI Life Insurance

- Max Life Insurance

- Aviva plc

- Allianz SE

- Prudential plc

- AIA Group Limited

- MetLife, Inc.

- AXA SA

- Zurich Insurance Group

- Nippon Life Insurance Company

- Sun Life Financial Inc.

- Manulife Financial Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Bajaj Life Insurance announced a notable update on ULIP investment tax rules. The company highlighted the impact of recent circulars by the Central Board of Direct Taxes, which introduced new caps on capital gains assessment for ULIPs with premiums exceeding Rs 2.5 lakh annually. This change is aimed at curbing the misuse of tax benefits by high net worth individuals.

- In September 2024, AU Small Finance Bank partnered with Kotak Life Insurance to offer a comprehensive suite of life insurance and financial security solutions. This collaboration extends Kotak Life's previous relationship with Fincare Small Finance Bank, which has now merged with AU SFB. Through this partnership, AU SFBA's customers, including those from former Fincare branches, can access Kotak Life's range of products such as term insurance, retirement plans, savings, and select investment plans. The initiative aims to enhance financial planning options and reach underserved segments of the population with tailored insurance solutions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the unit-linked insurance market based on the below-mentioned segments:

Global Unit-Linked Insurance Market, By Mode

- Online

- Offline

Global Unit-Linked Insurance Market, By Distribution Channel

- Direct from Insurers

- Insurance Brokers and Agencies

- Banks

- Others

Global Unit-Linked Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the unit-linked insurance market over the forecast period?The global unit-linked insurance market is projected to expand at a CAGR of 10.69% during the forecast period.

-

2. What is the market size of the unit-linked insurance market?The global unit-linked insurance market size is expected to grow from USD 1.8 Trillion in 2024 to USD 5.5 Trillion by 2035, at a CAGR of 10.69% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the unit-linked insurance market?North America is anticipated to hold the largest share of the unit-linked insurance market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global unit-linked insurance market?Life Insurance Corporation of India, HDFC Life Insurance, ICICI Prudential Life Insurance, SBI Life Insurance, Max Life Insurance, Aviva plc, Allianz SE, Prudential plc, AIA Group Limited, MetLife, Inc., AXA SA, Zurich Insurance Group, Nippon Life Insurance Company, Sun Life Financial Inc., Manulife Financial Corporation, and Others.

-

5. What factors are driving the growth of the unit-linked insurance market?The unit-linked insurance market growth is driven as more individuals are looking for products that provide both safety and investment returns as a result of growing financial literacy and rising disposable incomes. Advances in technology, such as mobile based purchasing and digital distribution platforms, have expanded reach and made access easier, particularly for younger audiences.

-

6. What are market trends in the unit-linked insurance market?The unit-linked insurance market trends include digital & tech‑driven distribution, ESG & thematic investment options, rise of market linked growth preference, expansion into emerging markets & segments, and regulatory transparency and product innovation.

-

7. What are the main challenges restricting wider adoption of the unit-linked insurance market?The unit-linked insurance market trends include the low financial literacy and complexity of many products that many consumers face. However, because these insurance policies are susceptible to market fluctuations, risk averse clients avoid them, and returns are unpredictable.

Need help to buy this report?