Global Unified Communication as a Service (UCaaS) Market Size, By Offering (Telephony, Unified Messaging, Collaboration Platforms, Conferencing, Others), By Delivery Model (Managed Services, Hosted/Cloud Services), By End-users (BFSI, IT & Telecommunications, IT-enabled Services (ITeS), Education, Retail & Consumer Goods, Government & Defense, Healthcare, Others), By Geographic Scope and Forecast, 2022 – 2032

Industry: Information & TechnologyGlobal Unified Communication as a Service (UCaaS) Market Size Insights Forecasts to 2032

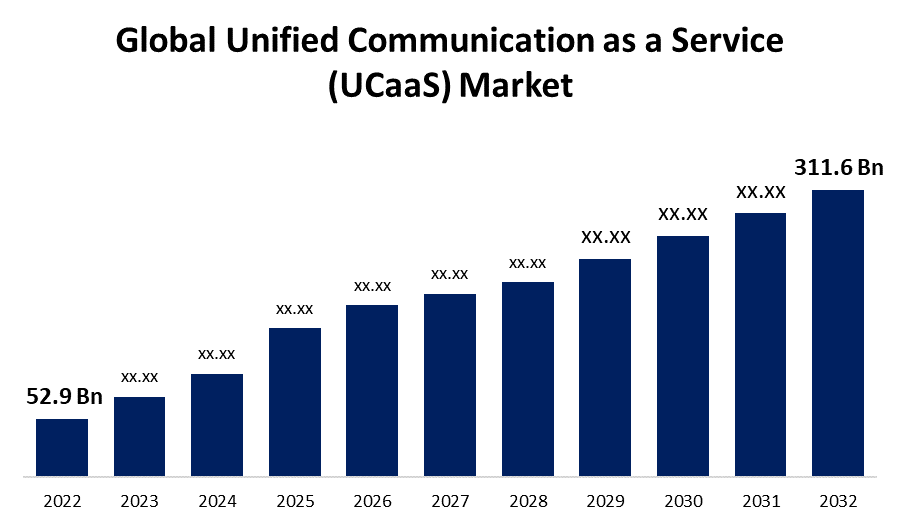

- The Unified Communication as a Service (UCaaS) Market Size was valued at USD 52.9 Billion in 2022.

- The Market is Growing at a CAGR of 19.4% from 2022 to 2032

- The Global Unified Communication as a Service (UCaaS) Market Size is expected to reach USD 311.6 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Unified Communication as a Service (UCaaS) Market Size is expected to reach USD 311.6 Billion by 2032, at a CAGR of 19.4% during the forecast period 2022 to 2032.

Unified Communications as a Service (UCaaS) is a cloud-based delivery paradigm that provides a wide range of communication and collaboration apps and services. Enterprise messaging, presence technologies, online meetings, team collaboration, telephony, and video conferencing are all characteristics of UCaaS. As organizations of all sizes replace obsolete communications systems and manage increasingly scattered workforces, UCaaS has grown in popularity. UCaaS is well-known for its capacity to provide flexibility and scalability for critical business functions. UCaaS is becoming one of the most regularly used technologies in any company's technological infrastructure. According to the analysts in "Spherical Insights," more than 80% of organizations will be utilizing UCaaS systems for their calling, meeting, and messaging activities by 2032. The number of adopters is skyrocketing due to a variety of drives, including the popularity of remote and hybrid work, the worldwide availability of the cloud, and a continually growing need for flexibility and scalability. The widespread use of 5G technology and high-speed internet is also likely to open up new commercial prospects in the future. Communication delivered via the cloud will become more reliable and resilient as connectivity evolves. Additionally, the growing usage of Communications Platform as a Service (CPaaS) and Application Program Interfaces (APIs) is likely to drive market expansion. Furthermore, cutting-edge technology like Artificial Intelligence (AI), Machine Learning (ML), voice assistance, and others provide unified communication services.

Market Outlook

Unified Communication as a Service (UCaaS) Market Price Analysis

Unified Communication as a Service (UCaaS) offers integrated communication tools including voice, video conferencing, messaging, and collaboration applications, all delivered through the cloud. Price analysis for UCaaS solutions can be multi-faceted due to the variety of features and services provided. Pricing often scales with the number of users. For instance, SMEs might pay less overall than large enterprises, but the per-user price might decrease for larger enterprises due to bulk discounts. In addition, some advanced features might not be included in the standard pricing and can be available as add-ons, like advanced analytics, additional storage, or specific integrations.The UCaaS market has become increasingly competitive, driving providers to enhance their offerings while also offering competitive pricing. Furthermore, as businesses worldwide have rapidly adopted remote work models, there's been an upsurge in demand for UCaaS solutions, further influencing price dynamics.

Unified Communication as a Service (UCaaS) Market Distribution Analysis

The Unified Communication as a Service market distribution analysis penetrates toward how UCaaS solutions reach their end-users and the channels through which enterprises and consumers acquire these services. Direct sales, value-added services, channel partners and distributors, managed service providers, online platforms, and cloud marketplaces are the primary providers of UCaaS solutions. While direct sales are preferable for high-value contracts with large organizations, utilizing channel partners, VARs, and online platforms can greatly increase visibility and cater to a broader audience. Furthermore, some UCaaS providers specialize in particular industries or verticals, adapting their solutions and distribution strategies to match the specific requirements of those companies.

Global Unified Communication as a Service (UCaaS) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 52.9 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 19.4% |

| 2032 Value Projection: | USD 311.6 Billion |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Offering, By Delivery Model, By End-users, By Geographic and COVID-19 Impact |

| Companies covered:: | RingCentral, 8x8, LogMeIn, Mitel, Cisco, Vonage, Fuze, Inc., Microsoft, Google, Verizon, BT, Orange S.A., DialPad, StarBlue, Zoom, Windstream, Alcatel-Lucent Enterprise, Intrado Corporation, NTT Communications Corporation, Masergy, Revation Systems, CenturyLink Inc., NEC Corporation, and Other Market Players |

| Growth Drivers: | Unified Communication as a Service (UCaaS) Market Dynamics |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Unified Communication as a Service (UCaaS) Market Dynamics

Transition from conventional communications platforms to cloud-based communication services is increasing.

Enterprises are eagerly searching for solutions to manage complexity, cut costs, and raise overall efficiency as corporate communications become more complicated. As a result, the popularity of unified communication as a service, a cloud-based idea, has grown. Firms are revising their strategy in order to improve flexibility, worker efficiency, and adaptability. More firms have adopted flexible and hybrid working practices and turned to cloud-based solutions for managing individuals across devices, departments, and time zones. Additionally, considering that they do not require onshore hosting infrastructure, are easier to expand or decrease, and have the latest and most up-to-date features and security, cloud-based solutions for unified communication as a service are often cheaper to deploy. Howebver, in the wake of high-profile breaches, the necessity to invest in cloud security has skyrocketed, making cloud security one of the most pressing challenges for all enterprises.

Rising government campaigns and strategies for UCaaS system rollout across various domains.

The rising government efforts and strategies for the adoption of unified communications platforms across varied industries give rise to the explosive development of the global unified communications as a service market. The government continually strives to establish unified communications in remote offices and branches. The use of unified communications technologies in government has attempted to bridge the communication gap. The government is additionally making significant investments in the global adoption of unified communications systems and solutions.

Restraints & Challenges

High competitiveness in the marketplace remains significant challenge in the adoption of the UCaaS market.

Cloud-based computing services offer features such as using a pay-as-you-go pricing model and do not require long-term contracts, which has increased vendor competition in the industry. As a result of the prospect of subscribing to UCaaS at any time, vendors are under tremendous obligation to engage in R&D and stay competitive by developing the most significant industry improvements. Furthermore, new entrants are characterized by severe market competition, particularly by extending their user base by lowering prices. This can result in the elimination of market competitors as well as low capital and profit margins, all of which could pose a severe challenge to the global unified communication as a service market over the projection period.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Unified Communication as a Service (UCaaS) market from 2023 to 2032. This is likely due to the increased acceptance of technology for enhancing productivity among North American organizations, as well as the presence of a significant number of UCaaS vendors such as Microsoft, Cisco, Google, and Amazon.com Inc. End-user firms in this region currently incorporate services such as video and audio conferencing, chat, mail, voice, and others into their day-to-day operations. Furthermore, developments such as 'Bring Your Own Device' (BYOD) large-scale high-speed broadband networking, and others are major drivers boosting the region's market growth. Several businesses are supporting this, it is likely and enterprise spending on client collaboration and telephony services is expected to expand significantly. Furthermore, the rising demand for the UCaaS market in North America is attributed to its cost-effectiveness and user-friendliness.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. This can be attributed to perpetual digital transformation and an increasingly mobile workforce, as the realm of technology continues to expand due to the bolstering penetration of 4G and 5G technology, as well as the development of several global enterprises that serve the region, which drives demand for UCaaS. Communication services such as Voice over Internet Protocol (VoIP), and audio and video conferencing are widely used in countries such as India, South Korea, China, Japan, and the Pacific region. Furthermore, the region's high cloud traffic is expected to fuel the need for Unified Communication as a Service market. Organizations are transforming through new technology to become artificial intelligence hubs, and there is significant potential for organizations that provide AI-related services on a worldwide scale.

Segmentation Analysis

Insights by Offering

The telephony segment accounted for the largest market share over the forecast period 2023 to 2032. In UCaaS, telephony primarily refers to VoIP (Voice over Internet Protocol) services, which allow users to make voice calls over the Internet rather than traditional phone lines. Most UCaaS providers have made this a foundational offering, upgrading the classic telephony experience with features like call forwarding, voicemail-to-email transcription, and software-based phone systems that can work on any device. The cost-effectiveness, flexibility, and expanded functionality offered by VoIP have fueled the significant move from traditional phone systems to cloud-based VoIP solutions throughout the years. As businesses continue to expand internationally and remote work becomes increasingly common, there is a strong demand for dependable and effective voice communication solutions.

Insights by Delivery Model

The hosted/cloud services segment accounted for the largest market share over the forecast period 2023 to 2032. Hosted or cloud services are UCaaS solutions that are entirely delivered through the cloud. Companies can swiftly scale up or down their operations based on demand. There is no need for large upfront hardware investments, and maintenance is handled by the service provider. This concept is especially appealing to SMEs (Small and Medium-sized Enterprises) and enterprises that need to function from multiple locations or have a big remote workforce. The growing acceptance of cloud technologies, combined with the cost-effectiveness, flexibility, and scalability benefits of cloud-based solutions, has driven enterprises toward hosted UCaaS solutions. Cloud-based communication solutions have become important for many firms, particularly in recent years since there has been a noticeable movement toward remote work and digital transformation.

Insights by End-users

The IT & telecommunications segment accounted for the largest market share over the forecast period 2023 to 2032. Many IT and telecom organizations' increasing emphasis on developing efficient communication among their geographically scattered workforce drives the market for UCaaS solutions. Employees in the information technology and telecommunications sectors typically engage with high-profile clients such as government agencies and federal organizations, necessitating a secure and effective information exchange development, and this is driving the UCaaS solution supplied by IT and telecom companies. Furthermore, IT and telecom businesses are partnering with worldwide distributors and collaborating to easily deploy the UCaaS solution. In addition, the IT industry's acceptance of the BYOD paradigm has contributed to the development of cloud-based UC solutions.

Competitive Landscape

Major players in the market

- RingCentral

- 8x8

- LogMeIn

- Mitel

- Cisco

- Vonage

- Fuze, Inc.

- Microsoft

- Verizon

- BT

- Orange S.A.

- DialPad

- StarBlue

- Zoom

- Windstream

- Alcatel-Lucent Enterprise

- Intrado Corporation

- NTT Communications Corporation

- Masergy

- Revation Systems

- CenturyLink Inc.

- NEC Corporation

Recent Market Developments

- On October 2023, Mitel, a global pioneer in business communications, announced the completion of its previously announced plans to buy Unify, the Atos group's Unified Communications and Collaboration (UCC) and Communication and Collaboration Services (CCS). Mitel and Unify currently have a combined customer base of more than 75 million users in over 100 countries.

- On July 2023, Tata Tele Business Services (TTBS), a major enabler of digital connectivity and cloud solutions for enterprises in India, has announced the launch of Smartflo Unified Communication as a Service (UCaaS), a unique voice solution integrated with Microsoft Teams. This paradigm combines the convenience of unified communication with user privacy. With a cloud-based call control system, it replaces traditional PBXs and allows key calling features.

- On July 2023, OMNIQ Corp. a leading provider of Supply Chain and Artificial Intelligence (AI)-based solutions, announced that it has signed a definitive agreement to acquire Tadiran Telecom, an international provider of Advanced Unified Communications and Collaboration (UC&C) Solutions enhancing its software. This strategic move enables omniQ to integrate the new UC&C capabilities with omniQ’s AI products delivering higher predictability, increased speeds with proactive real-time automated actions.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Unified Communication as a Service (UCaaS) Market, Offering Analysis

- Telephony

- Unified Messaging

- Collaboration Platforms

- Conferencing

- Others

Unified Communication as a Service (UCaaS) Market, Delivery Model Analysis

- Managed Services

- Hosted/Cloud Services

Unified Communication as a Service (UCaaS) Market, End-users Analysis

- BFSI

- IT and Telecommunications

- IT-enabled Services (ITeS)

- Education

- Retail and Consumer Goods

- Government and Defense

- Healthcare

- Others

Unified Communication as a Service (UCaaS) Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Unified Communication as a Service (UCaaS) Market?The Global Unified Communication as a Service (UCaaS) Market is expected to grow from USD 52.9 Billion in 2022 to USD 311.6 Billion by 2032, at a CAGR of 19.4% during the forecast period 2023-2032.

-

2.Who are the key market players of the Unified Communication as a Service (UCaaS) Market?RingCentral, 8x8, LogMeIn, Mitel, Cisco, Vonage, Fuze, Inc., Microsoft, Google, Verizon, BT, Orange S.A., DialPad, StarBlue, Zoom, Windstream, Alcatel-Lucent Enterprise, Intrado Corporation, NTT Communications Corporation, Masergy, Revation Systems, CenturyLink Inc., NEC Corporation.

-

3.Which segment holds the largest market share?Hosted/cloud services segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the Unified Communication as a Service (UCaaS) Market?North America is dominating the Unified Communication as a Service (UCaaS) Market with the highest market share.

Need help to buy this report?