Global Ulexite Market Size, Share, and COVID-19 Impact Analysis, By Type (White and Transparent), By Application (Agriculture, Glass and Fiberglass, Oilfield, Ceramics, Pulp and Paper, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ulexite Market Size Insights Forecasts to 2035

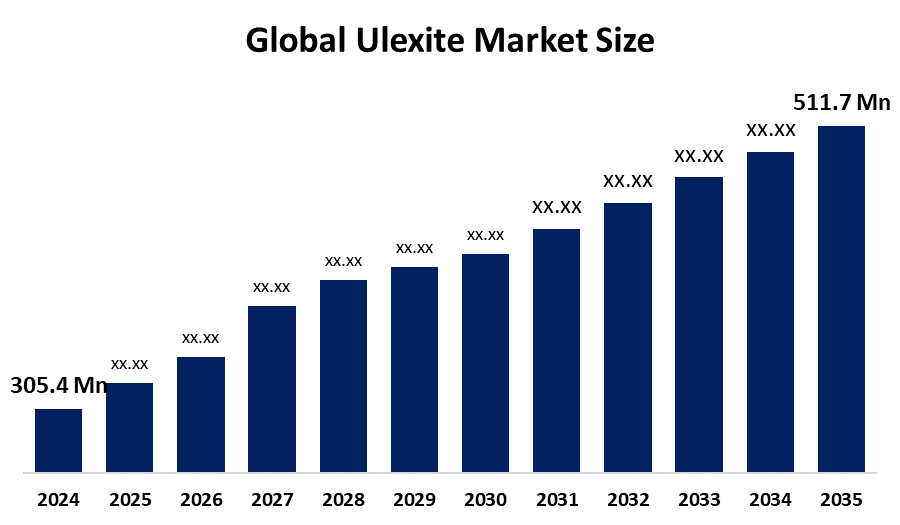

- The Global Ulexite Market Size Was Estimated at USD 305.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.8% from 2025 to 2035

- The Worldwide Ulexite Market Size is Expected to Reach USD 511.7 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Ulexite Market Size was worth around USD 305.4 Million in 2024 and is predicted to Grow to around USD 511.7 Million by 2035 with a compound annual growth rate (CAGR) of 4.8% from 2025 to 2035. The expansion in the global market for ulexite is largely attributed to growing demand for boron-based fertilizers, the escalating glass industry, the need to improve agricultural productivity in developing nations, and the growing borate usage in detergents, insulation materials, and environmentally friendly industry applications in developing nations and developed nations as well.

Market Overview

The market involving ulexite products refers to business activities involving ulexite, a major source of boron compounds, as an essential material in borate-based products in the production of ceramics, glass, fertiliser, and various other special compounds. Notably, borate is a major contributor to the glass and ceramics markets, where borate compounds have a significant effect on improving the thermal resistance, durability, and tensile stress in glass products, especially. Additionally, increased construction activities, the development and construction of electronics, as well as increased development in renewable power generation, are key factors that play a critical role in increasing the need for borate compounds. In other respects, increased awareness regarding soil treatment, alongside improving crop yields in regions where boron is lacking, also lies within the market involving ulexite products.

The US Geological Survey added boron to the U.S. Critical Minerals List in the month of November 2025. The move can provide access to federal funding, permitting, and promoting boron mining operations to favor Ulexite production as well as the related industries. Some of the market opportunities associated with Ulexite include the production of low-impurity, high-grade Ulexite crystals, used in the production of materials necessary for the field of optics as well as electronics. Another factor is the developed boron compound materials, suitable only for niche markets. Another opportunity arises when Ulexite mining is connected to boron component processing.

Report Coverage

This research report categorizes the ulexite market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ulexite market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ulexite market.

Global Ulexite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 305.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.8% |

| 2035 Value Projection: | USD 511.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Minera Santa Rita, BISLEY, ETI MADEN, Quiborax S.A., American Borate Company, Rio Tinto Group, Industrial Tierra S.A., Inca Mining Pty Ltd, Orocobre Limited, InCide Technologies Inc., Searles Valley Minerals Inc., Inkabor S.A.C., Dalian Jinma Boron Technology Group Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The factors influencing the global ulexite market include the rising demand for boron fertilizers to compensate for deficiencies in the soil, as well as to maximize crop production patterns. Another factor is the growth in the fibreglass and insulation markets. There is also the growth of the automobile sector as well as the alternative energy space, particularly wind energy, thus promoting the growth of borosilicate glass as opposed to other materials. There is also the growth in the levels of investment in nascent markets, as well as the shift to alternative forms of farming. Finally, the demand for high-purity varieties of ulexite serves as the motivation behind market growth.

Restraining Factors

Major restraints for the ulexite global market consist of a naturally low supply and geographical constraints, together with the presence of a naturally high-cost factor during mining and purification. Environmental laws and regulations, purification procedures involving a large logistics factor for the transport of the raw materials, as well as the presence of substitutes for Boron like colemanite, also function to negatively influence the ulexite Market.

Market Segmentation

The ulexite market share is classified into type and application.

- The white segment dominated the market in 2024, approximately 67% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the ulexite market is divided into white and transparent. Among these, the white segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This dominance can be attributed to the high level of purity, concentration of boron contained in the variety, and the commercial as well as agricultural uses. The white variety is most sought after by boron-rich glass and ceramic makers since they can easily produce products with minimal impurities. Other factors are the fertilizer and chemical industry uses of the white boron, which are likely to promote continuous market performance.

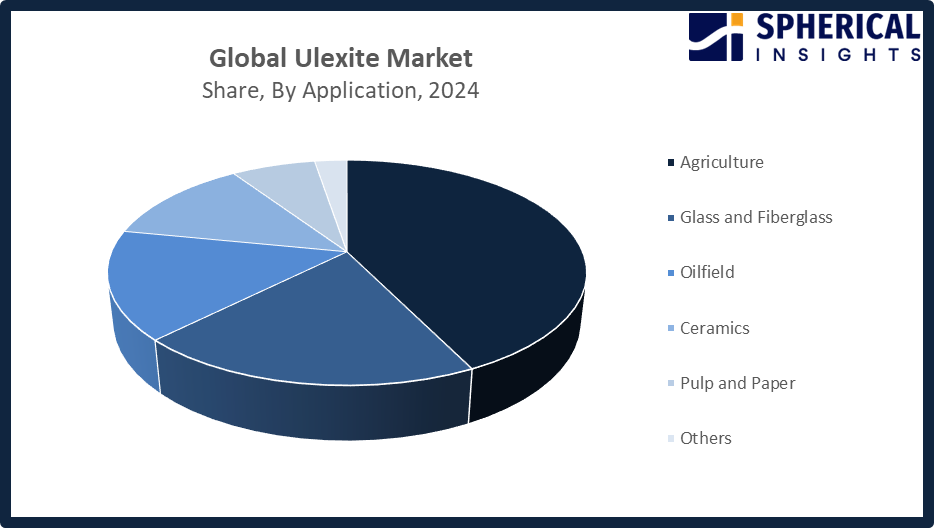

- The agriculture segment accounted for the highest market revenue in 2024, approximately 43% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the ulexite market is divided into agriculture, glass and fiberglass, oilfield, ceramics, pulp and paper, and others. Among these, the agriculture segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is due to ulexite's contribution as a natural boron resource to support agriculture through slow-release technology to enhance boron-deficient soils; the need for ulexite is rising. Its influence on crop yield and quality, along with the emphasis placed on green and healthy farming practices and the need for balancing nutrient levels, has placed agriculture at the forefront of the global ulexite market.

Get more details on this report -

Regional Segment Analysis of the Ulexite Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the ulexite market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the ulexite market over the predicted timeframe. The Asia-Pacific is expected to account for a 43% share of the overall worldwide Ulexite business, and major drivers will include the agriculture, glass, and ceramics segments. Countries such as China, India, and Japan will contribute to Ulexite’s growth, and China will have a requirement for boron for industrial purposes, while India will have a need for boron-based fertilizers for better yield management. Additionally, government plans to develop infrastructure and plans to enhance boron mining and processing facilities will also boost Ulexite usage. Moreover, boric acid will have a strong growth rate in the Asia-Pacific region during January 2026, focusing on electronics, electric vehicles, and agriculture.

North America is expected to grow at a rapid CAGR in the ulexite market during the forecast period. The market for ulexite in North America is expected to have a 30% market share, especially in the USA, being a major boron-consuming nation. Agriculture, glass/ceramic, renewable energy, boron-based fertilizers, high-performance construction materials, etc., are fuelling the market. This includes U.S. government initiatives that have made boron a critical mineral and that have been making adjustments to imports, as of January 2026, under Section 232, to decrease dependence on China and other foreign sources, increase U.S. production, and enhance supply chain resiliency to enable strategic mineral security and the growth of ulexite and boron-derived products in key industries.

The primary drivers of market growth within the ulexite market in Europe are the demand for ulexite within the European region, such as the demand for ulexite within the major economies of the European region, such as Germany, France, and Italy, where the demand for boron containing materials, such as glass, ceramics, and building materials, is robust. The demand for energy-efficient, high-performance ulexite-based materials, along with the use of environmentally friendly ulexite-based fertilizers for agricultural use, drives the ulexite market within Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ulexite market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Minera Santa Rita

- BISLEY

- ETI MADEN

- Quiborax S.A.

- American Borate Company

- Rio Tinto Group

- Industrial Tierra S.A.

- Inca Mining Pty Ltd

- Orocobre Limited

- InCide Technologies Inc.

- Searles Valley Minerals Inc.

- Inkabor S.A.C.

- Dalian Jinma Boron Technology Group Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Chinas retaliatory tariffs on eastern Kerns borax exports put focus on Rio Tintos Boron mine, which produces a third of global borates and employs 1,000 workers. Local officials may seek congressional support or financial aid to protect this key supplier for solar panels, semiconductors, and ceramics.

- In June 2025, Glass Point announced a partnership with Searles Valley Minerals, a leading producer of soda ash and borates, to enhance U.S. mineral competitiveness and reduce costs. In the first phase, 750 MWth of solar thermal technology will be installed at SVMs Trona, California facility, cutting carbon emissions by up to 500,000 metric tons annually.

- In September 2024, Turkives Eti Maden launched the Bigadic Granular Boron Production Facility in Balkesir, producing high-value granular boron fertilizers. The facility aims to address soil micronutrient deficiencies, expand exports, and strengthen vertical integration, reinforcing Eti Maden's leadership in the global borates and ulexite industry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ulexite market based on the below-mentioned segments:

Global Ulexite Market, By Type

- White

- Transparent

Global Ulexite Market, By Application

- Agriculture

- Glass and Fiberglass

- Oilfield

- Ceramics

- Pulp and Paper

- Others

Global Ulexite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ulexite market over the forecast period?The global ulexite market is projected to expand at a CAGR of 4.8% during the forecast period.

-

2. What is the ulexite market?The global ulexite market involves trading a calcium-sodium borate mineral used in fertilizers, fiberglass, ceramics, and specialty glass, with significant growth.

-

3. What is the market size of the ulexite market?The global ulexite market size is expected to grow from USD 305.4 million in 2024 to USD 511.7 million by 2035, at a CAGR of 4.8% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the ulexite market?Asia Pacific is anticipated to hold the largest share of the ulexite market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global ulexite market?Minera Santa Rita, BISLEY, ETI MADEN, Quiborax S.A., American Borate Company, Rio Tinto Group, Industrial Tierra S.A., Inca Mining Pty Ltd, Orocobre Limited, InCide Technologies Inc., and Others.

-

6. What factors are driving the growth of the ulexite market?Key factors driving the ulexite market include rising demand for boron-based fertilizers in agriculture, growth in fiberglass insulation, increasing use in high-performance borosilicate glass, and renewable energy applications like solar.

-

7. What are the market trends in the ulexite market?Ulexite trends include growing demand for boron fertilizers, high-performance fiberglass insulation, 3D-printed ceramics, and a shift toward sustainable, high-purity processing.

-

8. What are the main challenges restricting wider adoption of the ulexite market?Key challenges restricting wider ulexite market adoption include high extraction/refining costs, limited geographical availability of deposits, stringent environmental regulations, and logistical bottlenecks, which altogether hinder price stability and competitive market expansion.

Need help to buy this report?