UAE Gold Market Size, Share, and COVID-19 Impact Analysis, By Type (Alloyed Gold and Layered Gold), By Application (Jewellery, Electronics, Awards and Status Symbols, and Other Applications), and UAE Gold Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUAE Gold Market Insights Forecasts to 2035

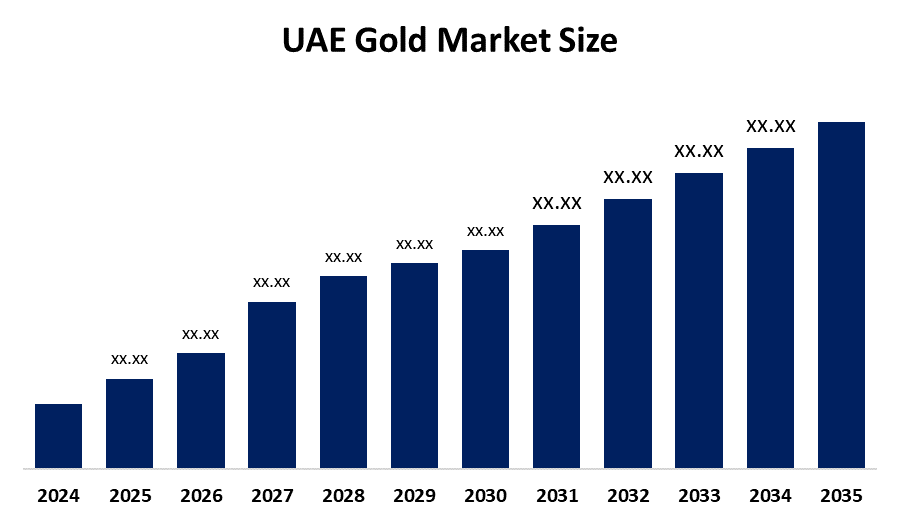

- The UAE Gold Market size is Expected to Grow at a CAGR of around 7.2% from 2025 to 2035

- The UAE Gold Market size is expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UAE Gold Market Size is Anticipated to Grow at a CAGR of 7.2% from 2025 to 2035. The market is driven by robust trading infrastructure and regulatory credibility, supported by VAT efficiency and global investor confidence.

Market Overview

The UAE gold market relates to the trade, refining, retailing and investing in Gold in the United Arab Emirates, with Dubai being the international node connecting the global supply and demand. Dubai is known as the “City of Gold” and facilitates the flows of bullion on an industrial scale, jewelry sales on a global scale, and the growing sector of gold-backed financial products. Dubai's infrastructure such as the DMCC and DGCX provides sophistication and innovation to facilitate these trades. The market is driven by its strategic location, free-zone policies, and access to an advanced logistics network, allowing UAE to be the global trading hub. While market's regulatory environment improves with the removal of the UAE from the Financial Action Task Force (FATF), the EU's grey and black list, and the implementation of the VAT reverse-charge methodology. Investment continues to drive stable growth in the UAE Gold Market, since it currently seems that prices are inhibiting jewelry demand.

Report Coverage

This research report categorizes the market for the UAE gold market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UAE gold market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UAE gold market.

UAE Gold Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 130 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Application. |

| Companies covered:: | AngloGold Ashanti, Newmont Mining Corporation, Barrick Gold Corporation, Emirates Gold, Al Etihad Gold, Kaloti Precious Metals, Gulf Gold Refinery and Other. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UAE gold market is sustained by Dubai's position as a global hub, which is supported by DMCC and DGCX, with world-class infrastructure, logistics, and global trade services. Regulatory reforms of very high standards, such as delisting from the FATF and the EU, created more global confidence in commodity trading. Regulatory developments, such as VAT Reverse-Charge have created new efficiencies in trade. Increased demand from investors for bullion and investment coins is motivation for a growing gold market.

Restraining Factors

The UAE gold market is limited by gold prices which cause consumers to have reduced demand for conventional jewelry designs causing consumers to want lighter designs. More recently the compliance rules and supply-chain paperwork has added cost to the trade and has seriously disadvantaged the smaller trader and retailers.

Market Segmentation

The UAE gold market share is classified into type and application.

- The alloyed gold segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UAE gold market is segmented by type into alloyed gold and layered gold. Among these, the alloyed gold segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The reason for this is due to its strength, durability and mass acceptance as a raw material in jewellery making and bullion. 18K, 21K, and 22K jewellery are heavily favoured in both residents and tourists alike. The layered gold segment, while smaller is growing in the more cost-sensitive consumer categories and ornamental products where cost is more of a factor.

- The jewellery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UAE gold market is segmented by application into jewellery, electronics, awards and status symbols, and other applications. Among these, the jewellery segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is result of Dubai's international hub location, tax-friendly conditions, demand for cultural wedding and festival markets, and the high level of consumer trust in purities and design varieties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UAE gold market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AngloGold Ashanti

- Newmont Mining Corporation

- Barrick Gold Corporation

- Emirates Gold

- Al Etihad Gold

- Kaloti Precious Metals

- Gulf Gold Refinery

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UAE, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UAE gold market based on the below-mentioned segments:

UAE Gold Market, By Type

- Alloyed Gold

- Layered Gold

UAE Gold Market, By Application

- Jewellery

- Electronics

- Awards and Status Symbols

- Other Application

Frequently Asked Questions (FAQ)

-

1. What is the expected growth rate of the UAE Gold Market?The market is projected to grow at a CAGR of 7.2% during the forecast period 2025–2035, holding a significant share by 2035.

-

2. What factors are driving the growth of the UAE Gold Market?Growth is driven by Dubai’s role as a global gold hub, supported by DMCC and DGCX infrastructure, strong logistics, regulatory reforms, VAT efficiencies, and rising investor demand for bullion and gold-backed products.

-

3. What challenges or restraints does the market face?The market faces challenges from fluctuating gold prices that dampen jewelry demand, compliance costs, and supply-chain paperwork that disadvantage smaller traders and retailers.

-

4. Which type segment dominates the UAE Gold Market?The alloyed gold segment held the largest share in 2024 and is expected to continue growing, due to its strength, durability, and wide use in jewelry making, with 18K, 21K, and 22K jewelry being especially popular.

-

5. Which application segment leads the market?The jewelry segment dominated in 2024 and is expected to grow significantly, supported by strong demand from both residents and tourists, despite some shift toward lighter designs due to higher gold prices.

Need help to buy this report?