U.S. Industrial Gases Market Size, Share, By Product Type (Nitrogen, Oxygen, Carbon Dioxide, Hydrogen, Helium, Argon, Ammonia, Methane, and Others), By End-User Industry (Chemical Processing and Refining, Electronics, Food and Beverage, Oil and Gas, Metal Manufacturing and Fabrication, Medical and Pharmaceutical, Automotive and Transportation, and Others), U.S. Industrial Gases Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsU.S. Industrial Gases Market Insights Forecasts to 2035

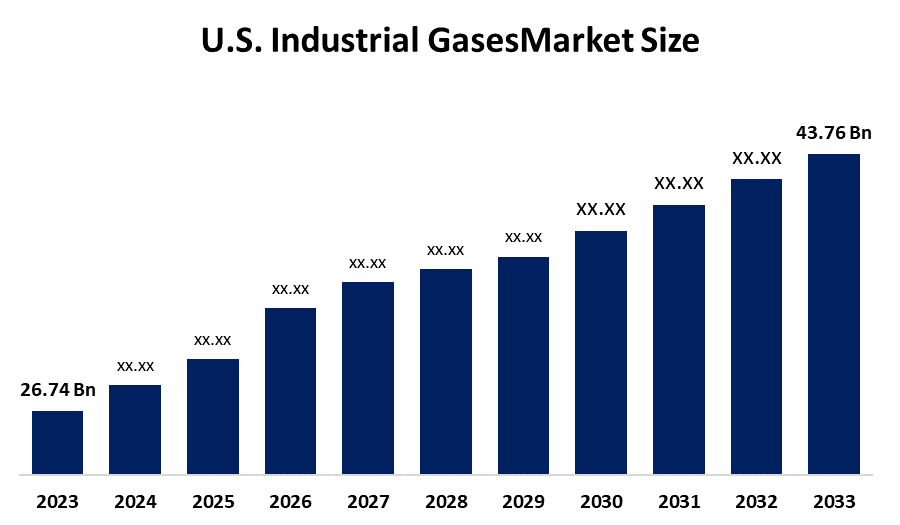

- U.S. Industrial Gases Market Size 2024: USD 26.74 Bn

- U.S. Industrial Gases Market Size 2035: USD 43.76 Bn

- U.S. Industrial Gases Market CAGR 2025-2035: 4.5%

- U.S. Industrial Gases Market Segments: Product Type and End-User Industry

Get more details on this report -

The U.S industrial gases market comprises activities related to manufacturing, storage, distribution, and supply of industrial gases including oxygen, nitrogen, hydrogen, carbon dioxide, argon, and other specialty gases, which cater to various prime sectors of healthcare, manufacturing, energy, electronics, and food. A number of market drivers promote and sustain the market of US Industrial Gases, including an increasing use of medical gases in hospitals, manufacturing and fabrication, and use of clean energy technologies, such as hydrogen manufacturing.

The market is aided by technological developments such as cryogenic and non-cryogenic air separation, on-site gas generation, IoT-based monitoring solutions, and superior distribution networks. Also, the efforts by governments and regulations to promote the establishment of clean hydrogen infrastructure and adherence to environmental regulations are boosting the market. The key players of the U.S. industrial gases market are ensuring that there is a focus on achieving efficiencies and complying with regulations by adopting advanced technologies and meeting essential requirements in various industries.

Market Dynamics of the U.S. Industrial Gases Market:

The growing demand for medical and specialty gases in the healthcare industry, the rising manufacturing and fabrication operations, and the increasing adoption of clean energy solutions such as hydrogen production are some factors fueling the industrial gases industry in the U.S. The rising demand for high purity gases for electronics, biotech, and semiconductor applications, combined with technological advancements in on-site gas generation, IoT gas monitoring, and advanced gas distribution networks, is also promoting investments in efficient gas supply solutions in the industry.

The US industrial gases market faces restraints in terms of infrastructure and operating cost, energy price fluctuations, stringent safety measures, and occasionally faced supply chain inventory disruptions. The complexity involved in manufacturing highly purified gases and the requirement for expertise in gas handling, storage, and distribution also act as some hindering factors in this context.

The future prospects for the US industrial gas market look promising, with new opportunities emerging from clean hydrogen-based projects, digital monitoring technology, IoT-connected distribution, and cryogenic/non-cryogenic separation techniques. Implementation of automate technology, predictive maintenance, and eco-friendly production methods will improve efficiency, reduce expenses, and satisfy changing demands.

U.S. Industrial Gases Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26.74 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.5% |

| 2035 Value Projection: | USD 43.76 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type,By End-User Industry |

| Companies covered:: | Air Liquide,Air Products and Chemicals Inc,AIR WATER INC,American Gas Products,Atlas Copco North America LLC,BASF,Cryoin Engineering Ltd,GENERON,Holston Gases,Iwatani Corporation,Linde PLC,Matheson Tri-Gas Inc,Messer North America, Inc,nexAir LLC,Norco Inc,Peak Scientific Instruments,UIG,Western International Gas and Cylinders, Inc. (WIGC) And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The U.S. Industrial Gases Market Share is classified into product type and end-user industry.

By Product Type:

The U.S. industrial gases market is divided by product type into nitrogen, oxygen, carbon dioxide, hydrogen, helium, argon, ammonia, methane, and others. Among these, the nitrogen segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Its growth is primarily attributed to the widespread consumption of the product in chemical synthesis, metal treatment, and food preservation processes. Besides, the escalating requirement for industrial, grade nitrogen in manufacturing and energy sectors in the U.S. has also contributed significantly to its expansion.

By End-User Industry:

The U.S. industrial gases market is divided by end-user industry into chemical processing and refining, electronics, food and beverage, oil and gas, metal manufacturing and fabrication, medical and pharmaceutical, automotive and transportation, and others. Among these, the chemical processing and refining segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment growth is driven by the ever, growing demand for gases in refining, chemical reactions, and large, scale industrial operations. The trend is also influenced by the rising adoption of automation and on, site gas generation in U.S. chemical plants.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the U.S. industrial gases market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in U.S. Industrial Gases Market:

- Air Liquide

- Air Products and Chemicals Inc.

- AIR WATER INC.

- American Gas Products

- Atlas Copco North America LLC.

- BASF

- Cryoin Engineering Ltd.

- GENERON

- Holston Gases

- Iwatani Corporation

- Linde PLC

- Matheson Tri-Gas Inc.

- Messer North America, Inc.

- nexAir LLC

- Norco Inc.

- Peak Scientific Instruments

- UIG

- Western International Gas and Cylinders, Inc. (WIGC)

Recent Developments in U.S. Industrial Gases Market:

In October 2025, Air Liquide is increasing its hydrogen compression and storage capacity on the Gulf Coast by 50 million dollars. The expansion, which is to happen in the United States, is meant to help the refinery operations that are changing to low, carbon feedstocks and to consolidate the supply infrastructure of clean hydrogen in the main industrial hubs.

In February 2025, Air Products took a USD 3.1 billion write, down on their three U.S. projects without firm offtake. They still managed to successfully commission a contracted air, separation unit in Ohio, which allows the company to continue providing high, purity gases for the industrial and energy sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2024 to 2035. Decisions Advisors has segmented the U.S. industrial gases market based on the below-mentioned segments:

U.S. Industrial Gases Market, By Product Type

- Nitrogen

- Oxygen

- Carbon Dioxide

- Hydrogen

- Helium

- Argon

- Ammonia

- Methane

- Others

U.S. Industrial Gases Market, By End-User Industry

- Chemical Processing and Refining

- Electronics

- Food and Beverage

- Oil and Gas

- Metal Manufacturing and Fabrication

- Medical and Pharmaceutical

- Automotive and Transportation

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the U.S. industrial gases market size?A: USD 26.74 billion in 2024, expected to reach USD 43.76 billion by 2035 at a CAGR of 4.5%.

-

Q: What drives market growth?A: Rising demand for medical and specialty gases, manufacturing expansion, clean energy adoption, and technological advancements in gas generation and distribution

-

Q: What restrains the market?A: High infrastructure costs, energy price fluctuations, safety regulations, supply chain issues, and shortage of skilled professionals.

-

Q: How is the market segmented by product type?A: Nitrogen, Oxygen, Carbon Dioxide, Hydrogen, Helium, Argon, Ammonia, Methane, Others.

-

Q: How is the market segmented by end-user industry?A: Chemical Processing & Refining, Electronics, Food & Beverage, Oil & Gas, Metal Manufacturing & Fabrication, Medical & Pharmaceutical, Automotive & Transportation, Others

-

Q: Who are the key players?A: Air Liquide, Air Products and Chemicals Inc., AIR WATER INC., American Gas Products, Atlas Copco North America LLC., BASF, Cryoin Engineering Ltd., GENERON, Holston Gases, Iwatani Corporation, Linde PLC, Matheson Tri-Gas Inc., Messer North America, Inc., nexAir LLC, Norco Inc., Peak Scientific Instruments, UIG, Western International Gas and Cylinders, Inc. (WIGC).

-

Q: Who is the target audience?A: Market players, investors, end-users, government authorities, consulting/research firms, VCs, VARs.

Need help to buy this report?