Global Turbidity Equipment Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Equipment Type (Portable, Benchtop, and Online/Continuous), By Application (Water Treatment and Food & Beverage), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsTurbidity Equipment Market Summary, Size & Emerging Trends

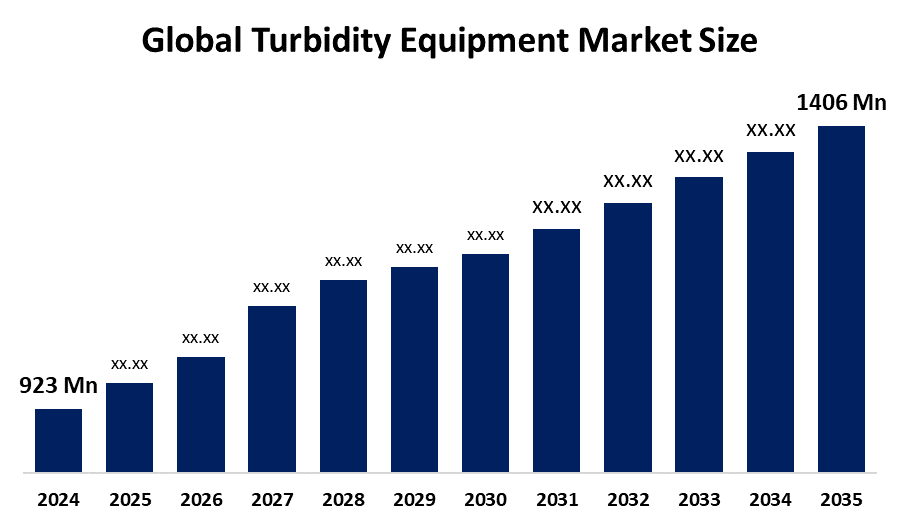

According to Decision Advisor, The Global Turbidity Equipment Market Size is expected to grow from USD 923 Million in 2024 to USD 1406 Million by 2035, at a CAGR of 3.9% during the forecast period 2025-2035. The rising need for accurate water quality monitoring in industrial, municipal, and environmental applications is a key driving factor for the turbidity equipment market.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to account for the largest share in the turbidity equipment market during the forecast period.

- In terms of equipment type, the portable segment dominated in terms of revenue during the forecast period.

- In terms of application, the water treatment segment accounted for the largest revenue share in the global turbidity equipment market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 923 Million

- 2035 Projected Market Size: USD 1406 Million

- CAGR (2025-2035): 3.9%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Turbidity Equipment Market

The turbidity equipment market revolves around devices used to measure the cloudiness or haziness in a fluid, a key indicator of water quality. These instruments are essential in ensuring regulatory compliance and operational efficiency across industries such as water treatment, pharmaceuticals, and food & beverage. Increasing global awareness about environmental sustainability and water pollution is driving widespread adoption of turbidity measurement technologies. With governments enforcing stricter water quality standards and industries shifting toward real-time monitoring systems, demand for advanced turbidity equipment is rising. These devices are crucial in both environmental monitoring and production environments where precision and consistency are vital. As digital transformation and automation grow in industrial operations, the turbidity equipment market is poised for stable, long-term growth supported by technological innovation and environmental regulations.

Turbidity Equipment Market Trends

- Increasing demand for real-time and remote water quality monitoring is driving the adoption of online turbidity equipment.

- Technological advancements are enabling integration with IoT platforms, supporting smart monitoring systems across industries.

- Key manufacturers are investing in portable and compact models to improve usability in field operations and developing regions.

Global Turbidity Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 923 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.9% |

| 2035 Value Projection: | USD 1406 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Equipment Type, By Application and By Region |

| Companies covered:: | Hach (a Danaher Company), Thermo Fisher Scientific, Xylem Inc., Emerson Electric Co., LaMotte Company, Hanna Instruments, Tintometer GmbH (Lovibond), SWAN Analytical Instruments, EUTECH Instruments, Yokogawa Electric Corporation, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Turbidity Equipment Market Dynamics

Driving Factors: Rising demand for water quality monitoring in environmental and industrial sectors

Key growth drivers for the turbidity equipment market include increasing global concerns over safe drinking water, stringent water quality regulations, and the expansion of water treatment facilities in both developed and emerging economies. Growth in the food & beverage industry also fuels demand for turbidity meters to ensure compliance with hygiene and clarity standards. Technological developments such as automation, digital interfaces, and data logging further enhance equipment performance, attracting broader adoption. The rising need for continuous monitoring and preventive maintenance across water-intensive sectors ensures steady market expansion.

Restrain Factors: High initial cost of advanced turbidity monitoring systems

Challenges in the turbidity equipment market include the high cost of sophisticated continuous or online monitoring systems, which can be a barrier for small utilities and companies in developing regions. Additionally, a lack of technical expertise in the proper calibration and maintenance of turbidity instruments may affect accuracy and performance. Variability in regional regulations and infrastructure development also influences adoption rates across countries. Furthermore, competition from multiparameter sensors that combine several water quality measurements in a single device may limit standalone turbidity meter sales.

Opportunity: Growing focus on decentralized water monitoring and smart infrastructure

The market presents numerous opportunities with the rise of smart cities and decentralized water management systems that require advanced, networked monitoring devices. Increasing deployment of turbidity sensors in remote and off-grid locations using solar-powered and IoT-enabled devices provides untapped growth avenues. Public and private investments in clean water initiatives, particularly in Africa and Southeast Asia, offer market expansion potential. Additionally, growth in bottled water, beverages, and dairy sectors further broadens the scope for application-specific turbidity equipment. Strategic partnerships with water utilities and environmental agencies can help companies capitalize on these emerging opportunities.

Challenges: Calibration complexity and need for skilled handling

Key challenges include calibration drift over time, frequent maintenance requirements, and operator dependency for accurate readings. In sectors lacking skilled labor or where continuous monitoring is not feasible, this limits broader deployment. Regulatory variances across countries can also create barriers to market entry. Additionally, environmental conditions such as temperature, suspended solids, and air bubbles can impact accuracy, necessitating advanced models and user training for optimal usage.

Global Turbidity Equipment Market Ecosystem Analysis

The global turbidity equipment market ecosystem includes component manufacturers, instrument suppliers, calibration service providers, and end-users in water treatment, food processing, and beverage industries. Major manufacturers like Hach, Thermo Fisher Scientific, and Xylem play a critical role in technology innovation and global distribution. Component suppliers ensure quality optics and sensors, while service providers offer maintenance and compliance assistance. End-users demand precision, real-time monitoring, and regulatory compliance. The ecosystem's success hinges on balancing innovation, cost-efficiency, and accessibility across regions.

Global Turbidity Equipment Market, By Equipment Type

The portable segment dominated in terms of revenue during the forecast period. Portable turbidity meters are favored for their ease of use in field monitoring, offering reliable results in real-time without the need for laboratory analysis. These handheld devices are extensively used in environmental monitoring, onsite water quality assessments, and rapid inspections at water treatment plants. Their affordability, portability, and accuracy make them ideal for remote and decentralized applications.

The benchtop segment accounted for a significant revenue share in the turbidity equipment market. These instruments are preferred in laboratory environments and industrial quality control where high-precision and reproducibility are essential. With features such as programmable settings, data storage, and multi-parameter capabilities, benchtop meters are used in applications ranging from municipal water testing to beverage production.

Global Turbidity Equipment Market, By Application

The water treatment segment accounted for the largest revenue share of approximately 58% in the global turbidity equipment market during the forecast period. Turbidity meters are vital for maintaining compliance with drinking water standards, ensuring filtration effectiveness, and monitoring sediment levels in treated water. The growing emphasis on water reuse and recycling across municipal and industrial sectors further fuels demand for turbidity monitoring equipment.

The food & beverage segment represented a significant share of the turbidity equipment market. These instruments ensure product clarity, consistency, and hygiene in processes such as beer brewing, juice clarification, and dairy processing. Rising global consumption of packaged food and beverages, combined with stricter hygiene regulations, is increasing the need for turbidity measurement in processing plants.

Asia Pacific is projected to hold the largest share approximately 43% of the global turbidity equipment market during the forecast period. This regional dominance is primarily driven by rapid industrialization, urban expansion, and growing

Get more details on this report -

investments in water infrastructure projects across major countries such as China, India, and nations in Southeast Asia. These developments are increasing the demand for advanced water quality monitoring systems. Moreover, stricter government regulations, particularly those related to public health and environmental safety, are further pushing utilities and industries to adopt turbidity monitoring solutions. As water quality becomes a critical concern in both urban and rural areas, the region is seeing an accelerated deployment of portable and online turbidity meters.

India is emerging as one of the fastest-growing markets within the Asia Pacific region. It is projected to grow at a CAGR of approximately 10.2% over the forecast period. This growth is fueled by a rising urban population, large-scale infrastructure and smart city projects, and tightening water quality regulations set by central and state governments. The expansion of industrial automation, combined with increased public investment in water treatment plants and sewage systems, is creating new opportunities for turbidity equipment manufacturers. The focus on digitalization and real-time water monitoring in both public and private sectors is accelerating market adoption.

North America is expected to register a strong CAGR and will account for approximately 22% of the global turbidity equipment market. The region benefits from ongoing modernization of aging water infrastructure, particularly in the United States and Canada, where municipalities are investing heavily in real-time and remote monitoring systems. These efforts are designed to ensure compliance with strict water quality standards and improve the efficiency of public water utilities. In parallel, the food and beverage sector a major end user of turbidity meters is increasingly prioritizing product clarity and hygiene, further boosting demand for precise turbidity measurement tools.

The United States plays a central role in the North American market and holds a significant share, due to its robust regulatory framework governed by the Environmental Protection Agency (EPA). The EPA enforces strict standards for drinking water, wastewater treatment, and industrial discharge, all of which require continuous turbidity monitoring. Additionally, there is strong R&D activity in the U.S. by leading turbidity equipment manufacturers who are developing advanced, IoT-enabled, and highly accurate systems. The integration of these technologies across municipal utilities, industrial plants, and laboratories has positioned the U.S. as a global leader in advanced water monitoring solutions.

WORLDWIDE TOP KEY PLAYERS IN THE TURBIDITY EQUIPMENT MARKET INCLUDE

- Hach (a Danaher Company)

- Thermo Fisher Scientific

- Xylem Inc.

- Emerson Electric Co.

- LaMotte Company

- Hanna Instruments

- Tintometer GmbH (Lovibond)

- SWAN Analytical Instruments

- EUTECH Instruments

- Yokogawa Electric Corporation

- Others

Product Launches in Turbidity Equipment Market

- In September 2023, Hach introduced an enhanced version of its portable turbidity analyzer, the model 2100Q. This upgraded device offers increased measurement accuracy by building on its existing two-detector optical system, which compensates for color, stray light, and fluctuations in samples to deliver laboratory-grade performance in the field. Additionally, the 2100Q now features reduced response times thanks to a new Rapidly Settling Turbidity (RST) mode, which uses an algorithm to estimate turbidity as particles begin to settle, shortening the time needed to get stable readings.

- In June 2023, Thermo Fisher Scientific developed a new turbidity measurement technology based on laser-based sensing, aimed at industries requiring real-time and rapid analysis, such as food and beverage and pharmaceuticals. This technology enables continuous, inline turbidity monitoring with high sensitivity and fast response times, supporting automation and quality control in industrial processes. The laser-based system improves measurement precision, especially for low turbidity levels and complex process waters, expanding capabilities beyond traditional nephelometric sensors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the turbidity equipment market based on the below-mentioned segments:

Global Turbidity Equipment Market, By Equipment Type

- Portable

- Benchtop

- Online/Continuous

Global Turbidity Equipment Market, By Application

- Water Treatment

- Food & Beverage

Global Turbidity Equipment Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: What is the market size of the Global Turbidity Equipment Market in 2024?Q: What is the market size of the Global Turbidity Equipment Market in 2024?

-

Q: What is the forecasted CAGR of the Global Turbidity Equipment Market from 2025 to 2035?A: The market is expected to grow at a CAGR of approximately 3.9% during 2025–2035.

-

Q: What is the projected market size of the Global Turbidity Equipment Market by 2035?Q: What is the projected market size of the Global Turbidity Equipment Market by 2035?

-

Q: Which region is expected to hold the largest market share in the turbidity equipment market during the forecast period?A: Asia Pacific is expected to hold the largest market share, approximately 43%, during the forecast period.

-

Q: Which region is expected to grow the fastest in the turbidity equipment market?A: North America is expected to register the fastest growth, driven by infrastructure modernization and regulatory compliance.

-

Q: Which equipment type dominates the turbidity equipment market in terms of revenue?A: The portable segment dominates the market in terms of revenue, due to its ease of use and real-time results for field monitoring.

-

Q: Which application segment accounts for the largest share in the turbidity equipment market?A: The water treatment segment accounts for the largest revenue share, approximately 58%, driven by the need for regulatory compliance and water quality monitoring.

-

Q: What are the key drivers for growth in the turbidity equipment market?A: Major growth drivers include increasing demand for accurate water quality monitoring, stringent water quality regulations, expansion of water treatment facilities, and growth in the food & beverage industry.

-

Q: What challenges are restraining the growth of the turbidity equipment market?A: High initial costs of advanced systems, calibration complexity, lack of skilled operators, and competition from multiparameter sensors are key challenges.

Need help to buy this report?