Global Tryptophan Market Size, Share, and COVID-19 Impact Analysis, By Grade (Feed and Food), By Type (L-Tryptophan and D-Tryptophan), By Application (Animal Feed, Food and Dietary Supplements, Pharmaceuticals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Tryptophan Market Size Insights Forecasts to 2035

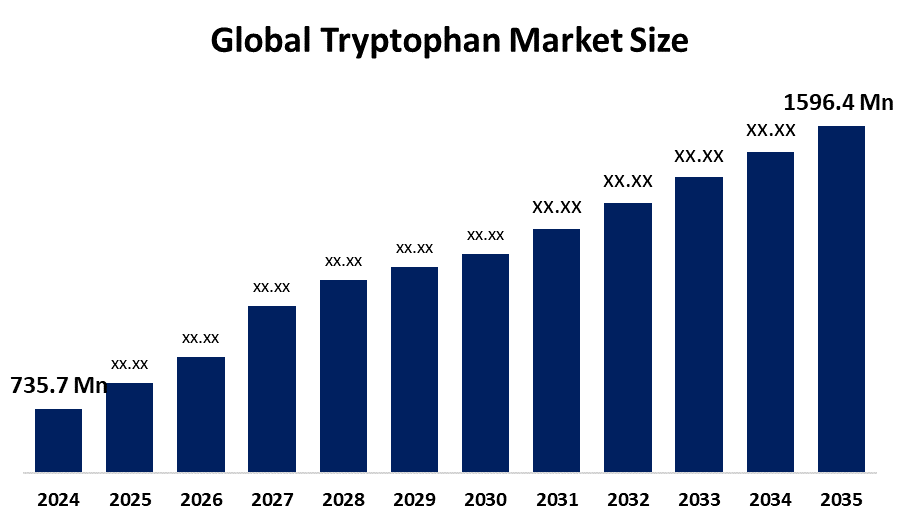

- The Global Tryptophan Market Size Was Estimated at USD 735.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.3% from 2025 to 2035

- The Worldwide Tryptophan Market Size is Expected to Reach USD 1596.4 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Tryptophan Market Size was worth around USD 735.7 Million in 2024 and is predicted to Grow to around USD 1596.4 Million by 2035 with a compound annual growth rate (CAGR) of 7.3% from 2025 to 2035. The growth of the tryptophan market is spurred by rising demand for animal feed, which has the ability to improve livestock and poultry health and productivity. Increasing consumer consciousness about their health also enhances its application in dietary supplements and functional foods for mood and sleep support.

Market Overview

The global tryptophan market refers to the business engaged in the production and sale of tryptophan, a required amino acid important in protein synthesis and animal and human biosynthesis of serotonin, melatonin, and niacin. Tryptophan is widely applied in dietary supplements, functional foods, pharmaceuticals, and animal feed to promote growth, improve mood, and control sleep. Market growth is driven by rising consciousness towards health and well-being among consumers, the expanding nutraceuticals market, and increased demand for quality animal nutrition products in poultry and livestock markets. Furthermore, the growing prevalence of stress disorders and sleep disorders is driving demand for tryptophan-based supplements. Advances in technology in microbial fermentation processes and environmentally friendly production processes have improved the yield efficiency and reduced environmental impact, thereby fueling market growth.

Opportunities are in the production of plant-based and bioengineered tryptophan, as a response to the growing demand for vegan and clean-label products. Additionally, the rising pharmaceutical applications of tryptophan for the treatment of depression and anxiety provide lucrative opportunities for producers. Key industry stakeholders such as Ajinomoto Co., Inc., Evonik Industries AG, CJ CheilJedang, and Amino GmbH invest significantly in research and development, strategic alliances, and capacity building to enhance their global presence. Between October 25 and November 25, 2024, the Canadian Food Inspection Agency (CFIA commented on a new single ingredient feed (SIF) aimed at L-tryptophan produced by fermentation. New and revised SIFs are subject to pre-market approval under the Feeds Regulations 2024 before they can be added to the Canadian Feed Ingredients Table (CFIT) as safe, effective, and accurately labelled.

Report Coverage

This research report categorizes the tryptophan market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the tryptophan market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the tryptophan market.

Global Tryptophan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 735.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.35% |

| 2035 Value Projection: | USD 1596.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Grade, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Ajinomoto Co., Inc, Evonik Industries, CJ CheilJedang, Fufeng Group, Glanbia Plc, Archer Daniels Midland, Henan Julong, Daesang Corporation, Xiangyu Biochemical, Meihua Holdings Group, Wuxi Jinghai Amino Acid Co. Ltd., Zhejiang Guoguang Biochemistry Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for tryptophan is growing strongly due to the rising consumer awareness regarding mental disorders has created a strong demand for tryptophan supplementation, since tryptophan is the precursor to serotonin and melatonin, which are important mood regulators and sleep promoters. Growing cases of anxiety, depression, and insomnia globally reinforce such demand. In addition, the increasing demand for functional foods and dietary supplements, as well as improvement in fermentation technology, has increased applications of tryptophan in different industries such as pharmaceuticals, nutraceuticals, and animal feed. All these factors combined are responsible for the strong growth of the tryptophan market.

Restraining Factors

Restraining factors in the tryptophan market are negative side effects of consumption, including eosinophilia and kidney issues. Geopolitical tensions and trade barriers lead to supply chain shocks and raw material price volatility. Additionally, strict government regulations related to product quality and safety are a challenge for producers and restrict market growth.

Market Segmentation

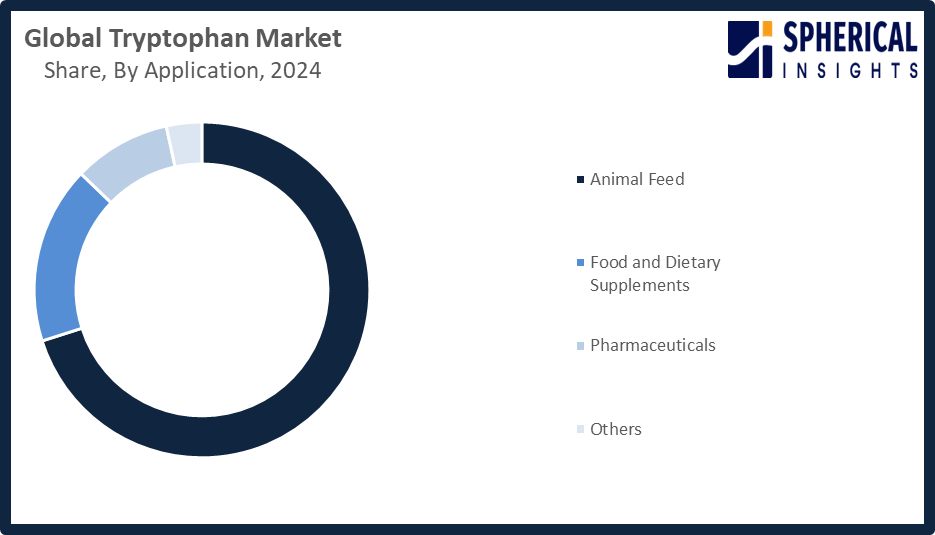

The tryptophan market share is classified into grade, type, and application.

- The feed segment dominated the market in 2024, approximately 72% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the tryptophan market is divided into feed and food. Among these, the feed segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Feed grade tryptophan is widely used due to it is more economical and is in high demand for livestock feeding, promoting growth, feed efficiency, and overall well-being in poultry, pigs, and aquaculture. With less rigorous standards of purity than for food-grade tryptophan, it is cheaper for large-scale agriculture, with its formulations more about quantity than ultra-high purity.

- The L-tryptophan segment accounted for the largest share in 2024, approximately 92% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the tryptophan market is divided into L-tryptophan and D-tryptophan. Among these, the L-tryptophan segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment leads to improving bioavailability and biological necessity. Being the natural isomer in human beings and animals, it is a precursor to neurotransmitters such as serotonin and melatonin, and is the regulator of mood and sleep. Its ease in absorption and metabolism makes it a very effective ingredient in supplements for mental wellness and sleep aid.

- The animal feed segment accounted for the highest market revenue in 2024, approximately 70% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the tryptophan market is divided into animal feed, food and dietary supplements, pharmaceuticals, and others. Among these, the animal feed segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment of animal feed leads in the tryptophan global market, owing to its critical function in encouraging livestock growth, improving feed conversion rates, and optimizing overall animal well-being. Robust demand in poultry, swine, and aquaculture markets, combined with the increasing demand for quality animal protein, is set to propel market growth.

Get more details on this report -

Regional Segment Analysis of the Tryptophan Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the tryptophan market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the tryptophan market over the predicted timeframe. The Asia Pacific region is expected to account for a 40% share in the global market for tryptophan during the forecast period, following the rapid expansion of the livestock and aquaculture sectors, growing need for high-quality animal protein, and increasing use of feed-grade tryptophan in animal nutrition. Major countries such as China, India, and Japan are major contributors. China leads owing to massive poultry and pig farming, India's growing livestock industry drives the demand for supplements, and Japan focuses on functional foods and nutraceuticals, all driving strong regional market growth.

North America is expected to grow at a rapid CAGR in the tryptophan market during the forecast period. North America is rapidly growing in the market for tryptophan through the forecast period, with approximately 28% of market share, due to increasing health consciousness, growing dietary supplement demand, and growth in the pharma and nutraceutical industries. The United States is the major driver, driven by extensive consumption of functional foods and supplements with L-tryptophan to promote sleep, mood, and overall health. Further, advances in poultry and livestock feed-grade tryptophan, as well as quality controls in the region, also complement favorable market growth in the region.

Europe plays an important role in the tryptophan market, with demand for dietary supplements, functional foods, and feed additives on the rise. Germany stands out as an important contributor with well-developed pharmaceutical and nutraceutical industries and strong consumer consciousness toward health and wellness. High-purity L-tryptophan production is secured through strict regulatory conditions for quality and safety, and the growth of animal nutrition products ensures feed-grade tryptophan growth, both driving the region's market growth.

In 2025, the European Food Safety Authority (EFSA) continued assessing L-tryptophan feed additives. On April 2, 2025, EFSA issued a scientific opinion on the safety and efficacy of L-tryptophan produced using Corynebacterium glutamicum KCCM 80346 for use in animal feed across various species.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the tryptophan market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto Co., Inc

- Evonik Industries

- CJ CheilJedang

- Fufeng Group

- Glanbia Plc

- Archer Daniels Midland

- Henan Julong

- Daesang Corporation

- Xiangyu Biochemical

- Meihua Holdings Group

- Wuxi Jinghai Amino Acid Co. Ltd.

- Zhejiang Guoguang Biochemistry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, ADM and Alltech announced a definitive agreement to form a North American animal feed joint venture. Combining decades of expertise and innovative capabilities, the partnership aims to deliver enhanced solutions and create new advantages for customers across the animal nutrition and feed industry.

- In June 2024, Evonik demonstrated the environmental advantages of its poultry and swine feeding solutions. A comparative life cycle assessment (LCA) highlighted the ecological benefits of using Evonik’s feed amino acids and tailored feeding concepts versus conventional animal nutrition practices.

- In May 2023, Octarine Bio partnered with Ginkgo Bioworks to explore tryptophan pathway compounds. The collaboration focuses on engineering a strain to produce violacein, a natural bis-indole pigment with antimicrobial, antioxidant, and UV-protective properties.

- In May 2023, CJ BIO, part of CJ CheilJedang Corp., expanded its Piracicaba, Brazil, facility by 10,000 tons/year, increasing total tryptophan production capacity to 50,000 tons/year, enhancing its global supply capabilities.

- In September 2022, Zesty Paws launched three new cat supplements, Hemp Elements Plus Calming Bites, Hairball Bites, and Aller Immune Bites, developed with CBDistillery. The calming bites contain 3 mg CBD per two chews, plus L-Theanine, L-Tryptophan, chamomile, ashwagandha, melatonin, and valerian root to support stress

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the tryptophan market based on the below-mentioned segments:

Global Tryptophan Market, By Grade

- Feed

- Food

Global Tryptophan Market, By Type

- L-Tryptophan

- D-Tryptophan

Global Tryptophan Market, By Application

- Animal Feed

- Food and Dietary Supplements

- Pharmaceuticals

- Others

Global Tryptophan Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the tryptophan market over the forecast period?The global tryptophan market is projected to expand at a CAGR of 7.3% during the forecast period.

-

2. What is the market size of the Tryptophan market?The global tryptophan market size is expected to grow from USD 735.7 million in 2024 to USD 1596.4 million by 2035, at a CAGR of 7.3% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the tryptophan market?Asia Pacific is anticipated to hold the largest share of the tryptophan market over the predicted timeframe.

-

4. What is the tryptophan market?The tryptophan market is a global industry for the production and sale of the essential amino acid tryptophan, primarily driven by its use in animal feed, dietary supplements, and functional foods.

-

5. Who are the top 10 companies operating in the global tryptophan market?Ajinomoto Co., Inc., Evonik Industries, CJ CheilJedang, Fufeng Group, Glanbia Plc, Archer Daniels Midland, Henan Julong, Daesang Corporation, Xiangyu Biochemical, Meihua Holdings Group, Wuxi Jinghai Amino Acid Co., Ltd., Zhejiang Guoguang Biochemistry Co., Ltd., and Others.

-

6. What factors are driving the growth of the tryptophan market?The growth of the tryptophan market is driven by increased demand from the animal feed sector due to rising meat consumption, and from the nutraceutical and pharmaceutical industries due to growing consumer awareness of mental health and sleep disorders.

-

7. What are the market trends in the tryptophan market?Key market trends in the tryptophan market include a high demand from the animal feed industry, increasing use in dietary supplements for mental wellness and sleep, and strong growth in the Asia-Pacific region.

-

8. What are the main challenges restricting wider adoption of the tryptophan market?The main challenges restricting wider adoption of the tryptophan market include price volatility, stringent and complex regulations, competition from alternative products, and limited awareness in developing regions.

Need help to buy this report?