Global Travel Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage Type (Annual Multi-Trip Travel Insurance and Single-Trip Travel Insurance), By Distribution Channel (Insurance Brokers, Insurance Companies, Banks, Insurance Aggregators, and Insurance Intermediaries), and By End User (Family Travelers, Education Travelers, Business Travelers, Senior Citizens, and Others), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 - 2030

Industry: Banking & FinancialGlobal Travel Insurance Market Insights Forecasts to 2030

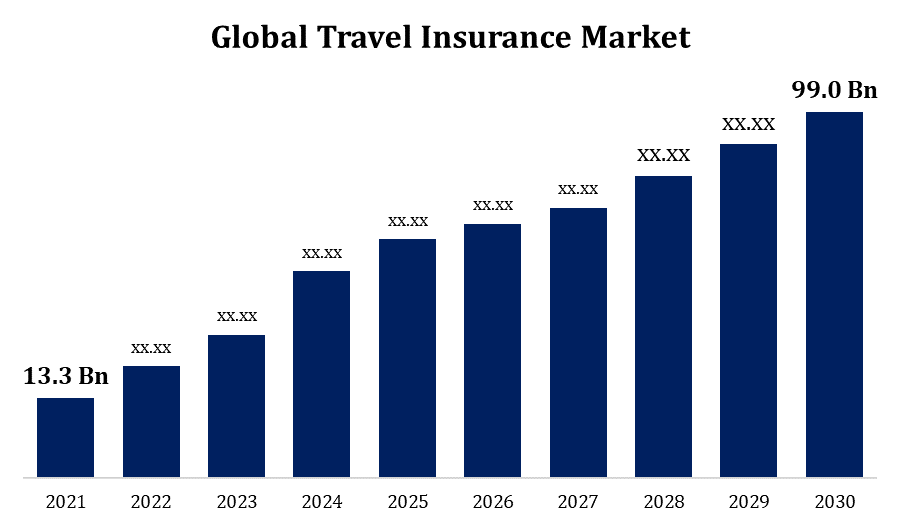

- The global travel insurance market was valued at USD 13.3 billion in 2021.

- The market is growing at a CAGR of 25% from 2021 to 2030

- The global travel Insurance market is expected to reach USD 99.0 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global travel Insurance market is expected to reach USD 99.0 billion by 2030, at a CAGR of 25% during the forecast period 2021 to 2030. The travel insurance market has grown due to the increasing demand for travel insurance post the outbreak of the COVID-19 pandemic. There are advancements in new technologies to help ease the travel experience of people, which is expected to provide growth opportunities for the market during the forecast period.

Market Overview

The travel industry has been proliferating owing to the proliferation of budget and luxury accommodations in the past few years. And with the increasing number of people traveling for leisure, the need for travel insurance is increasing rapidly. According to the World Health Organization (WHO), around 1.5 billion people travel annually, which is expected to increase in the coming years. Travel insurance helps travelers prepare for an unprecedented event that might affect their travel in a negative way. Moreover, post the outbreak of the COVID-19 pandemic, the need for travel insurance increased rapidly. It started covering Covid-19 tests and quarantine costs. Furthermore, the increasing demand for tourism is expected to propel the market's growth. In addition, the strict government policies related to travel are expected to further fuel the growth of the travel insurance market. However, there are very few insurance policies that cover travel. This is expected to limit the market’s growth during the forecast period. There are advancements in new technologies to help ease the travel experience of people, which is expected to provide growth opportunities for the market during the forecast period. The deaths due to the Covid-19 pandemic also posed challenges for the market’s growth over the forecast period as several insurance companies were not ready to cover death under their insurance policies. People in developing and underdeveloped countries are still reluctant to spend money on insurance facilities which hamper the market’s growth.

Global Travel Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 13.3 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 25% |

| 2030 Value Projection: | USD 99.0 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Coverage Type, By Distribution Channel, By End User, by Region |

| Companies covered:: | Zurich Insurance Group Ltd, Arch Capital Group Ltd., Aviva PLC, Berkshire Hathaway Specialty Insurance, China Pacific Insurance Co., Ltd., Chubb Limited, Assicurazioni Generali Group, Groupama Sigorta AS, American International Group Inc.,InsureandGo HanseMerkur Insurance Group,Ping An Insurance Company of China, Ltd., Seven Corners Inc. (US), SOMPO Holdings, Inc., American Express, Travelex Insurance Services Inc., Allianz Partners |

| Growth Drivers: | The annual multi-trip travel insurance segment dominated the market with the largest market share |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Report Coverage

This research report categorizes the market for global travel insurance based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global travel insurance market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global travel insurance market sub-segments.

Segmentation Analysis

- In 2021, the annual multi-trip travel insurance segment dominated the market with the largest market share of 58.7% and market revenue of 7.7 billion.

Based on the coverage type, the global travel insurance market is categorized into annual multi-trip travel insurance and single-trip travel insurance. In 2021, the annual multi-trip travel insurance segment dominated the market with the largest market share of 58.7% and market revenue of 7.7 billion. The Annual Multi-Trip Travel Insurance segment will account for the greatest revenue in the market as travel restrictions were eased post the outbreak of the Covid-19 pandemic. Furthermore, there is rapid growth in the travel and tourism sector which propels the segments’ growth. In addition, the multi-trip travel insurance segment provides travelers with appropriate insurance coverage, ensuring that their annual vacations go smoothly without any disturbance or health-related issues.

- In 2021, the insurance intermediaries segment accounted for the largest share of the market, with 21.6% and market revenue of 2.8 billion.

The travel insurance market is categorized based on distribution channels into insurance brokers, insurance companies, banks, insurance aggregators, and insurance intermediaries. In 2021, the insurance intermediaries segment accounted for the largest share of the market, with 21.6% and market revenue of 2.8 billion. The insurance intermediaries segment has accounted for the largest revenue in the market as they offer several benefits and travel insurance. Several travel intermediaries are also upgrading their services and making it easy for consumers to choose the services from their online portals. The use of software such as the global distribution system (GDS) enables users to make their transactions easy between service providers of the travel industry, such as car rental companies, hotels, airlines, and travel agencies.

- In 2021, the family travelers segment accounted for the largest share of the market, with 28.1% and a market revenue of 3.73 billion.

Based on end-User, the travel insurance market is categorized into family travelers, education travelers, business travelers, senior citizens, and others. In 2021, the family travelers segment accounted for the largest share of the market, with 28.1% and a market revenue of 3.73billion. The family travelers segment has accounted for the largest revenue in the market due to the increasing focus on preventing infection from one patient to another. In addition, the rising demand for travel insurance services when consumers travel with their families. A family consists of several members, including people of all ages and with various health-related issues. This increases the need for travel insurance for the family as it necessitates more improved planning and risk mitigation, resulting in better travel experiences among the family members.

Regional Segment Analysis of the Travel Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

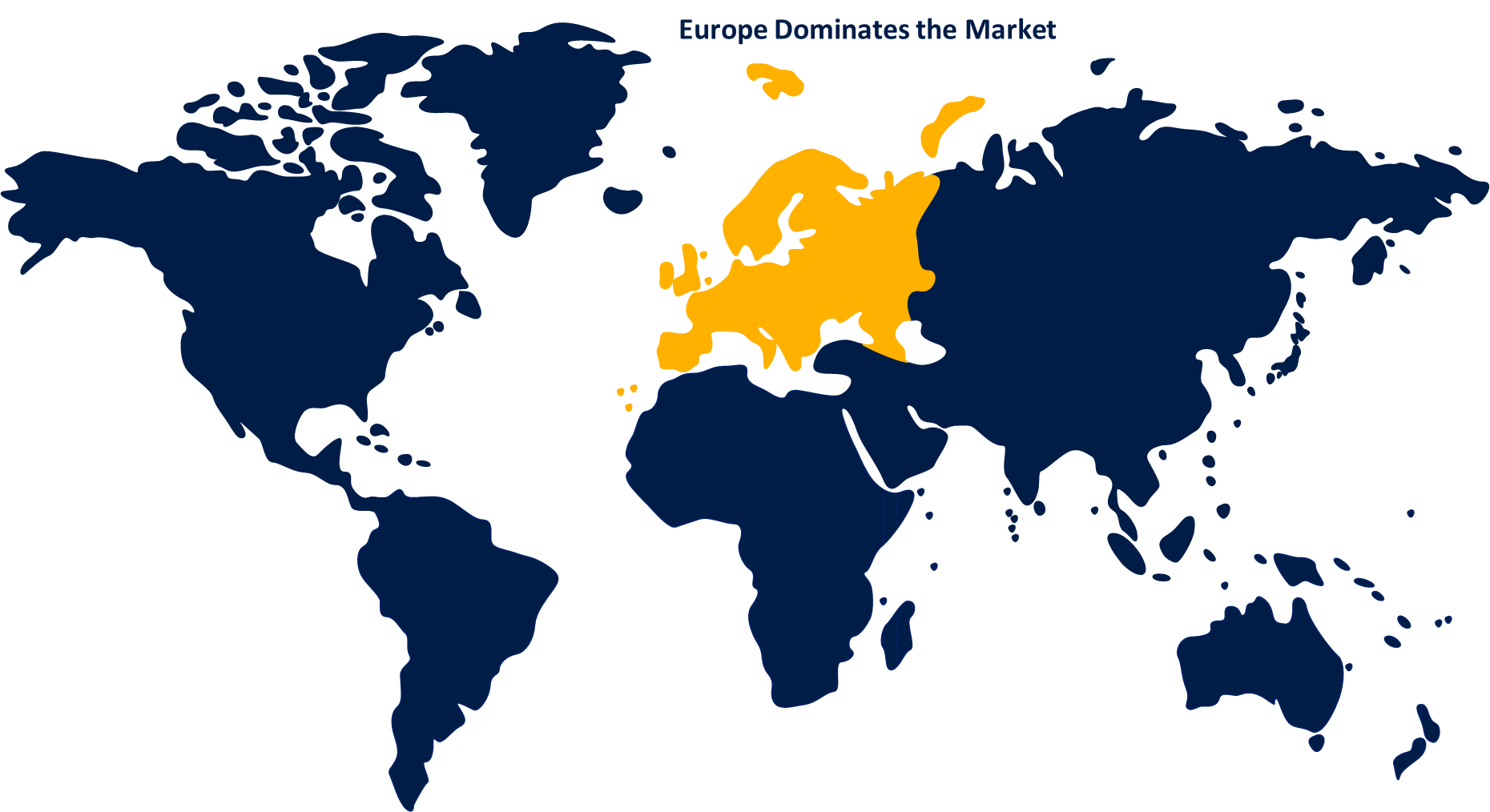

Europe emerged as the largest market for the global travel insurance market, with a market share of around 34.7% and 4.6 billion of the market revenue in 2021.

- Europe emerged as the largest market for the global travel insurance market, with a market share of around 34.7% and 4.6 billion of the market revenue in 2021. Europe is expected to be the largest market. This is mostly due to the European region's growing demand for travel and tourism. Furthermore, the rapid economic growth in the region, coupled with increasing advantages given by travel insurance companies to frequent travelers, is expected to drive the market’s growth in the region. Mandatory rules & regulations by the European government force consumers to take up travel insurance services as a compulsory service before obtaining a VISA. In addition, the increase in tourism and the travel industry has caused several incidences with consumers, such as trip cancellations, medical emergencies, and loss of luggage & important documents, which increases the need for travel insurance in the region.

- The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2030, owing to the increasing demand for an increasing number of organizations promoting business travel to employees with travel insurance facilities. Furthermore, there is rapid growth in the travel and tourism sector in several countries of the Asia Pacific, such as India, Pakistan, Bangladesh, China, etc., which propel the market’s growth in the region. In addition, the increasing awareness about the benefits of travel insurance among consumers in the region is expected to propel the market’s growth during the forecast period.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global travel insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Zurich Insurance Group Ltd

- Arch Capital Group Ltd.

- Aviva PLC

- Berkshire Hathaway Specialty Insurance

- China Pacific Insurance Co., Ltd.

- Chubb Limited

- Assicurazioni Generali Group

- Groupama Sigorta AS

- American International Group Inc.

- InsureandGo, HanseMerkur Insurance Group

- Ping An Insurance Company of China, Ltd.

- Seven Corners Inc. (US)

- SOMPO Holdings, Inc.

- American Express

- Travelex Insurance Services Inc.

- Allianz Partners

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In December 2021, Allianz Global partnered with Porter Airlines, a regional airline. The main aim of this partnership was to introduce All-Inclusive Insurance, Emergency Travel Medical Insurance, and Trip Cancellation Insurance. Additionally, Porter consumers have entry to Allianz affirm inquiry, expert support, and urgent assistance with the help of pre-trip planning.

- In July 2021, Saga plc developed key travel and insurance division developments. Spirit of Discovery, which is the first-ever multi-purpose-built cruise ship by Saga Plc, will sail with a maximum of 523 crew and 999 guests worldwide.

- In July 2021, Saga Plc launched a three-year advertising campaign for fixed-price insurance, focusing on rewarding customer loyalty and growing direct channels.

Market Segment

This study forecasts global, regional, and country revenue from 2021 to 2030. Spherical Insights has segmented the global Travel Insurance market based on the below-mentioned segments:

Global Travel Insurance Market, By Coverage Type,

- Single-Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

Global Travel Insurance Market, By Distribution Channel

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

Global Travel Insurance Market, By End-User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

Global Travel Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the global Travel Insurance market?As per Spherical Insights, the size of the Travel Insurance market was valued at USD 13.3 Billion in 2021 to USD 99.0 Billion by 2030.

-

What is the market growth rate of the global Travel Insurance market?The global Travel Insurance market is growing at a CAGR of 25% during the forecast period 2021-2030.

-

Which region dominates the global Travel Insurance market?The Europe emerged as the largest market for Travel insurance.

-

What is the significant driving factor for the Travel Insurance market?Increasing demand for tourism and travel will influence the market's growth.

-

Which factor is limiting the growth of the Travel Insurance market?Less penetration could hamper the market growth.

-

What is an opportunity for the Travel Insurance market?Technological advancements will provide considerable opportunities to the market.

-

Who are the key players in the global Travel Insurance market?Who are the key players in the global Travel Insurance market?

-

What is the market size of the global Travel Insurance market?As per Spherical Insights, the size of the Travel Insurance market was valued at USD 13.3 Billion in 2021 to USD 99.0 Billion by 2030.

-

What is the market growth rate of the global Travel Insurance market?The global Travel Insurance market is growing at a CAGR of 25% during the forecast period 2021-2030.

-

Which region dominates the global Travel Insurance market?The Europe emerged as the largest market for Travel insurance.

-

What is the significant driving factor for the Travel Insurance market?Increasing demand for tourism and travel will influence the market's growth.

-

Which factor is limiting the growth of the Travel Insurance market?Less penetration could hamper the market growth.

-

What is an opportunity for the Travel Insurance market?Technological advancements will provide considerable opportunities to the market.

-

Who are the key players in the global Travel Insurance market?Key players of the Travel Insurance market are Allianz Partners, American Express, American International Group Inc., Arch Capital Group Ltd., Aviva PLC, Berkshire Hathaway Specialty Insurance, China Pacific Insurance Co., Ltd., Chubb Limited, Assicurazioni Generali Group, Groupama Sigorta AS, HanseMerkur Insurance Group, InsureandGo, Ping An Insurance Company of China, Ltd., Seven Corners Inc. (US), SOMPO Holdings, Inc., Travelex Insurance Services Inc., Zurich Insurance Group Ltd,

Need help to buy this report?