Global Transfer Case Market Size, Share, and COVID-19 Impact Analysis, By Vehicle (ICE Vehicles, Hybrid Vehicles, Off Highway Vehicles), By Drive (Gear Driven, Chain Driven), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Transfer Case Market Insights Forecasts to 2033

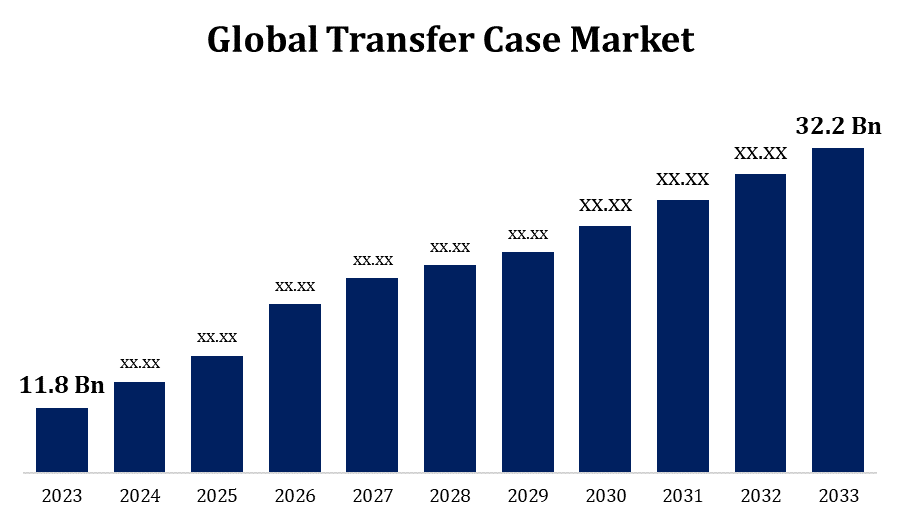

- The Transfer Case Market Size was valued at USD 11.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.56% from 2023 to 2033.

- The Global Transfer Case Market Size is expected to reach USD 32.2 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Transfer Case Market Size is expected to reach USD 32.2 Billion By 2033, at a CAGR of 10.56% during the forecast period 2023 to 2033.

The transfer case market is witnessing steady growth due to rising demand for all-wheel-drive (AWD) and four-wheel-drive (4WD) vehicles across both on-road and off-road applications. As key components in drivetrains, transfer cases distribute power from the transmission to the front and rear axles, enhancing traction and vehicle control. Growth is driven by increasing consumer preference for SUVs, pickup trucks, and high-performance vehicles, particularly in regions with challenging terrains or weather conditions. Technological advancements, such as lightweight materials and electronic shift-on-the-fly systems, are further boosting adoption. Additionally, the electric and hybrid vehicle segments are integrating advanced transfer cases to improve efficiency and performance. Asia-Pacific is emerging as a key region due to rising automotive production and demand. Environmental regulations may influence future designs and innovations.

Transfer Case Market Value Chain Analysis

The transfer case market value chain involves multiple interconnected stages, starting with raw material suppliers who provide metals, alloys, and electronic components. These materials are used by manufacturers to design and produce transfer cases, incorporating machining, casting, and assembly processes. OEMs (original equipment manufacturers) integrate these transfer cases into vehicles during production, ensuring compatibility with AWD and 4WD systems. Tier 1 and Tier 2 suppliers play a crucial role in delivering precision-engineered parts and subassemblies. Distributors and aftermarket suppliers handle logistics, repairs, and replacements, ensuring product availability and customer service. Research and development drive innovation, focusing on weight reduction, fuel efficiency, and electronic controls. End-users, including automakers and consumers, influence the chain through demand trends and performance expectations. Regulatory bodies also impact design standards and sustainability practices.

Transfer Case Market Opportunity Analysis

The transfer case market presents strong growth opportunities fueled by evolving automotive trends. The rise of electric and hybrid vehicles is generating demand for advanced transfer cases that can efficiently distribute power in dual-motor and hybrid setups. The increasing global popularity of SUVs and off-road vehicles, particularly in Asia-Pacific, further drives the need for reliable and high-performance transfer systems. Technological progress in materials and electronic control systems enables lighter, more efficient, and emission-compliant transfer cases. Additionally, the expanding aftermarket and growing interest in vehicle customization create space for specialized, performance-oriented solutions. As fuel efficiency and regulatory standards become stricter, innovation in transfer case design becomes even more critical. These combined factors indicate a positive outlook, with multiple avenues for growth, innovation, and market penetration.

Global Transfer Case Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 11.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.56% |

| 2033 Value Projection: | USD 32.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Vehicle, By Drive, By Region and COVID-19 Impact Analysis |

| Companies covered:: | BorgWarner Inc., Magna International Inc., American Axle & Manufacturing, Inc., JTEKT Corporation, Schaeffler AG, ZF Friedrichshafen AG, Melrose Industries PLC (GKN Ltd), Aisin Corporation, Dana Incorporated, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Transfer Case Market Dynamics

Rising demand for SUVs and luxury sedans to boost the market growth

The rising demand for SUVs and luxury sedans is a key driver of growth in the transfer case market. These vehicle segments typically require advanced drivetrain systems to enhance performance, stability, and traction, especially in varying terrain and weather conditions. Transfer cases, which play a vital role in distributing power between axles in all-wheel-drive (AWD) and four-wheel-drive (4WD) configurations, are increasingly being integrated into modern SUVs and high-end sedans. Consumers’ growing preference for vehicles offering comfort, safety, and off-road capabilities is pushing automakers to adopt sophisticated powertrain technologies. Additionally, luxury sedans equipped with AWD systems for enhanced handling and ride quality further contribute to market expansion. As demand for performance-oriented and versatile vehicles continues to rise globally, the transfer case market is set to benefit significantly from this trend.

Restraints & Challenges

One major issue is the rising adoption of electric vehicles (EVs), which often use simpler drivetrains that eliminate the need for traditional transfer cases. Additionally, the high production costs of advanced transfer cases especially those with electronic controls and lightweight components can limit their adoption in price-sensitive markets. Integration complexity across different vehicle platforms demands significant R&D investment, posing a burden for smaller manufacturers. Stringent emission and fuel efficiency regulations also pressure manufacturers to redesign transfer cases without compromising performance. Moreover, fluctuating raw material prices, such as steel and aluminum, can increase production costs. The market is further constrained by a shortage of skilled technicians required for the development and servicing of modern, technologically advanced transfer case systems.

Regional Forecasts

North America Market Statistics

North America is anticipated to dominate the Transfer Case Market from 2023 to 2033. The region has a high adoption rate of all-wheel-drive (AWD) and four-wheel-drive (4WD) systems, making transfer cases essential for enhancing vehicle performance, safety, and handling. Consumer preferences for powerful, versatile vehicles that perform well in various weather and road conditions are contributing to increased integration of advanced transfer case technologies. Additionally, manufacturers are focusing on innovation, including electronic shift mechanisms and lightweight materials, to meet evolving fuel efficiency and emission standards. The presence of leading automotive OEMs and a mature aftermarket network further support market development. With growing trends toward vehicle electrification, the North American transfer case market is also exploring new hybrid-compatible and EV-specific solutions.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, and Australia are seeing a shift toward vehicles that offer improved traction and performance, boosting the need for advanced transfer cases. The region’s automotive sector is adopting sophisticated drivetrain technologies, including electronic and hybrid transfer cases, to meet consumer expectations and comply with stricter emission standards. Additionally, the rise of electric vehicle production in Asia-Pacific is driving innovation in transfer case design to optimize power distribution in dual-motor systems. The strong presence of major automotive manufacturers and suppliers in the region further accelerates market growth and technological advancements, making Asia-Pacific a key hub for transfer case development and adoption.

Segmentation Analysis

Insights by Vehicle

The Internal Combustion Engine (ICE) vehicles segment accounted for the largest market share over the forecast period 2023 to 2033. ICE-powered SUVs, pickup trucks, and off-road vehicles rely extensively on transfer cases to manage power distribution between front and rear axles, ensuring enhanced traction and stability across various terrains. The popularity of all-wheel-drive (AWD) and four-wheel-drive (4WD) systems in ICE vehicles further drives the demand for advanced transfer case technologies. Despite growing interest in electric vehicles, ICE vehicles remain favored because of their affordability and extensive fueling infrastructure. This enduring preference maintains a strong market for transfer case systems within ICE-powered vehicles, highlighting their ongoing significance in the automotive industry.

Insights by Drive

The Chain-driven transfer cases segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the rising demand for lighter, more fuel-efficient, and quieter drivetrain systems, especially in passenger cars and hybrid electric vehicles. Compared to gear-driven transfer cases, chain-driven systems offer advantages such as reduced weight and lower noise levels, which improve overall vehicle performance and comfort. These benefits align closely with the automotive industry's focus on enhancing fuel economy and complying with stricter emission standards. Consequently, many manufacturers are increasingly choosing chain-driven transfer cases, contributing to their swift market adoption and expansion. This growth trend is expected to persist as consumer preferences continue shifting toward more efficient and environmentally conscious vehicle technologies.

Recent Market Developments

- In January 2024, BorgWarner unveiled a complete electric propulsion system that combines the motor, power electronics, and battery components to enhance efficiency in electric vehicles.

Competitive Landscape

Major players in the market

- BorgWarner Inc.

- Magna International Inc.

- American Axle & Manufacturing, Inc.

- JTEKT Corporation

- Schaeffler AG

- ZF Friedrichshafen AG

- Melrose Industries PLC (GKN Ltd)

- Aisin Corporation

- Dana Incorporated

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Transfer Case Market, Vehicle Analysis

- ICE Vehicles

- Hybrid Vehicles

- Off Highway Vehicles

Transfer Case Market, Drive Analysis

- Gear Driven

- Chain Driven

Transfer Case Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Transfer Case Market?The global Transfer Case Market is expected to grow from USD 11.8 billion in 2023 to USD 32.2 billion by 2033, at a CAGR of 10.56% during the forecast period 2023-2033.

-

2. Who are the key market players of the Transfer Case Market?Some of the key market players of the market are BorgWarner Inc., Magna International Inc., American Axle & Manufacturing, Inc., JTEKT Corporation, Schaeffler AG, ZF Friedrichshafen AG, Melrose Industries PLC (GKN Ltd), Aisin Corporation, Dana Incorporated.

-

3. Which segment holds the largest market share?The ICE vehicles segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?