Global Torpedo Market Size, By Weight (Heavyweight Torpedoes and Lightweight Torpedoes), By Launch Platform (Air-Launched, Surface-Launched, and Underwater-Launched), By Propulsion (Electric Propulsion and Conventional Propulsion), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Torpedo Market Insights Forecasts to 2033

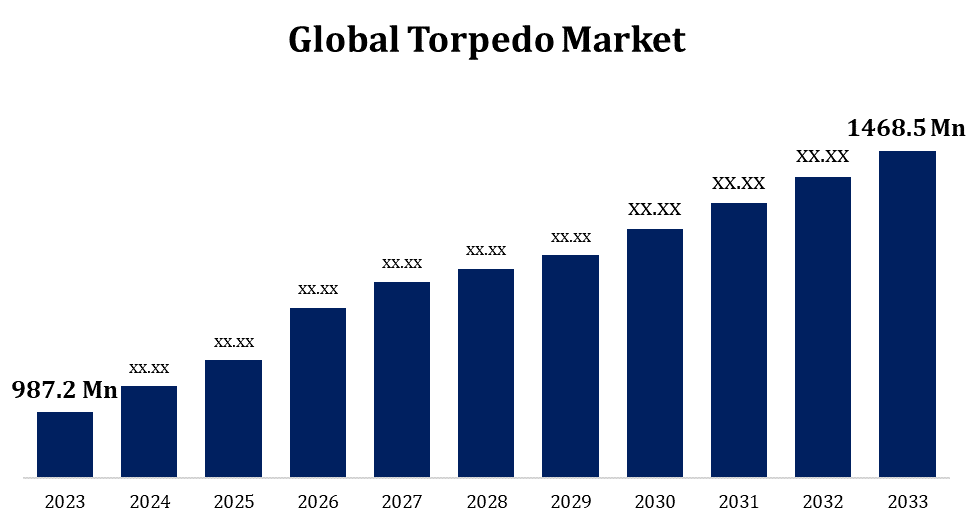

- The Global Torpedo Market Size was valued at USD 987.2 Million in 2023.

- The Market is Growing at a CAGR of 4.05% from 2023 to 2033

- The Worldwide Torpedo Market Size is Expected to reach USD 1468.5 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Torpedo Market Size is expected to reach USD 1468.5 Million by 2033, at a CAGR of 4.05% during the forecast period 2023 to 2033.

Next-generation torpedoes are being shaped by technological developments like higher stealth capabilities, better guiding systems, and more autonomy. These developments are intended to lessen the danger to friendly forces while increasing accuracy, range, and effectiveness. The need for torpedoes varies by area, with nations having substantial marine interests and naval powers being the main drivers of procurement. Increased investment in torpedo capabilities may be seen in areas facing maritime disputes or threats. Governments constantly regulate exports to make sure they abide by international accords and do not fuel destabilising wars. Export restrictions and regulations oversee the international trade of torpedoes.

Torpedo Market Value Chain Analysis

Torpedo systems are designed and developed through research and development, or they are improved upon using already-existing ones. Businesses spend money on research and development (R&D) to enhance capabilities including stealth, precision, and range in response to changing threats and advances in technology. The torpedoes are manufactured at facilities once the design is finalised. This entails obtaining supplies, assembling, inspecting, and testing to guarantee the torpedoes' dependability and effectiveness. Coordination of the purchase of parts and subsystems from several vendors is part of the supply chain. Propulsion systems, guidance systems, sensors, explosives, and other specialised parts fall under this category. Efficient management of the supply chain guarantees prompt delivery and inspection of components. Manufacturers and defence contractors promote their torpedo systems to prospective clients, such as governments and naval forces. Logistics networks are used to deliver torpedoes to naval vessels or military installations. This entails adhering to export laws, clearing customs, and coordinating with transportation companies.

Torpedo Market Opportunity Analysis

Globally, numerous fleets are conducting modernization initiatives to enhance their naval prowess. This includes swapping out outdated torpedo systems for more modern, sophisticated ones. Torpedo development and production companies might benefit from these modernization programmes by providing creative solutions that satisfy the changing requirements of naval forces. In order to secure their sea lanes, defend their maritime boundaries, and preserve their natural resources, emerging economies with growing marine interests are investing in naval capabilities. Manufacturers of torpedoes have a great chance to supply these nations with up-to-date systems that are customised to meet their unique needs. Defence firms could look into government-to-government sales or direct commercial contracts as means of exporting torpedo systems to other markets.

Global Torpedo Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 987.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.05% |

| 2033 Value Projection: | USD 1468.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Weight, By Launch Platform, By Propulsion, By Region. |

| Companies covered:: | Aselsan, Atlas Elektronik GmbH, BAE Systems, Bharat Dynamics Limited, Honeywell International Inc, Leonardo SpA, Lockheed Martin Corporation, Naval Group, Northrop Grumman Corporation, Raytheon Company, Rosoboronexport, Saab AB, Sechan Electronics Inc., and other key vendors. |

| Growth Drivers: | Increasing Maritime Border Conflicts between Nearby Nations to Spur Market Expansion |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Torpedo Market Dynamics

Increasing Maritime Border Conflicts between Nearby Nations to Spur Market Expansion

Conflicts over maritime borders frequently cause surrounding countries to become more militarily equipped and tense. In an effort to safeguard their interests and ward off possible threats, nations that aim to impose their sovereignty over contested maritime territory make investments in naval capabilities, such as anti-submarine warfare (ASW) devices like torpedoes. Governments may expedite their acquisition of cutting-edge torpedo systems to enhance their naval arsenals in response to disputes over maritime borders. Sophisticated guidance, navigation, and targeting systems on modern torpedoes are crucial for preserving maritime security and successfully fending off possible attacks from adversarial forces. Naval modernization initiatives to update ageing fleets and improve maritime defence capabilities sometimes coexist with maritime border conflicts.

Restraints & Challenges

Since military-grade weaponry must adhere to strict quality and safety standards, the development and production of torpedoes need significant financial investments due to the complexity of the systems involved. Budgetary restrictions in the defence sector may restrict the availability of torpedo procurement options, resulting in rivalry among competing defence priorities for little resources. To avoid unauthorised proliferation and protect national security interests, nations have implemented stringent export controls and prohibitions on the worldwide commerce of military torpedoes. Manufacturers may find it difficult to enter new markets and grow their businesses due to the complexity of export compliance regulations and acquiring the required export licences. To avoid unauthorised proliferation and protect national security interests, nations have implemented stringent export controls and prohibitions on the worldwide commerce of military torpedoes.

Regional Forecasts

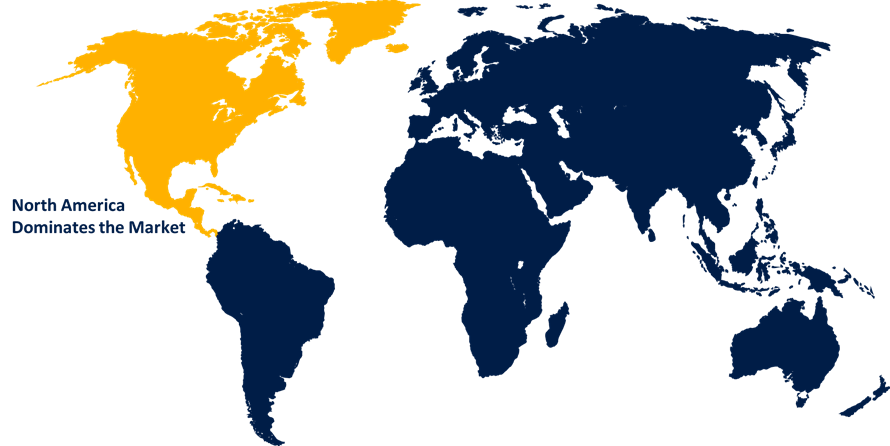

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Torpedo Market from 2023 to 2033. Torpedoes are purchased by the United States Navy (USN) for use by its surface ships and submarines, making it one of the biggest users of torpedoes in North America. The United States Navy makes consistent investments to update its torpedo stock in order to sustain a cutting-edge and proficient underwater warfare capacity. Modernization efforts are prioritised by North American navies, such as the USN and the Royal Canadian Navy (RCN), in order to equip their torpedo systems with advanced capabilities. The goal of these modernization projects is to improve torpedoes' efficacy, accuracy, and range in a variety of operational situations. Defence contractors in North America take use of export prospects to provide torpedoes to friendly and allied governments across the globe. In addition to bringing in money for manufacturers, exporting torpedoes strengthens regional security cooperation and bilateral defence ties.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, India, Japan, South Korea, Australia, and other nations in the Asia-Pacific area are among those making significant investments in military modernization initiatives. To improve underwater warfare capabilities and preserve maritime supremacy, these initiatives frequently involve the purchase of sophisticated torpedo systems. Numerous nations within the area are augmenting their armed forces by procuring fresh surface ships and submarines. These naval platforms would not be the same without their torpedoes, which are vital for protecting maritime interests and boundaries against both submarines and surface combat.

Segmentation Analysis

Insights by Weight

The heavyweight torpedo segment accounted for the largest market share over the forecast period 2023 to 2033. Around the world, a number of navies were undertaking modernization projects that involved acquiring cutting-edge torpedoes to improve their capacity for underwater defence. A key component of these purchases were heavyweight torpedoes, which are renowned for having a longer range and more devastating power. Countries were increasing their naval capacity investments to safeguard their maritime interests as a result of the escalating tensions in several regions. To address any threats from adversarial surface boats and submarines, this included the acquisition of cutting-edge torpedoes. More sophisticated torpedoes that could successfully neutralise contemporary submarine threats were required due to the growing use of submarines in naval operations for both strategic and conventional objectives.

Insights by Launch Platform

The underwater launched segment accounted for the largest market share over the forecast period 2023 to 2033. Submarines, surface ships, unmanned underwater vehicles (UUVs), and even underwater platforms like underwater drones are among the many platforms that navigators are using to expand their fleet. The need for torpedoes that can be launched from a variety of undersea platforms is rising as a result of this diversity. The capabilities and versatility of unmanned underwater vehicles (UUVs) have increased due to notable technological developments. Torpedoes that can be launched from these platforms are therefore becoming more and more necessary for a variety of missions, including as mine countermeasures, anti-submarine warfare, and surveillance. Because submarines are so commonplace throughout the world, anti-submarine warfare (ASW) continues to be a top priority for many nations. Underwater-launched torpedoes are essential to ASW operations because they give navies the capacity to locate and neutralise hostile submarines.

Insights by Propulsion

The electric propulsion segment accounted for the largest market share over the forecast period 2023 to 2033. Torpedoes with electric propulsion have made great strides towards increased performance, dependability, and efficiency. Propulsion control algorithms, batteries, power management systems, and electric motors are a few of these innovations. Torpedoes using electric propulsion systems, especially those with modern battery technologies, can have greater endurance and range. This increases the operating range and duration of torpedoes with electric propulsion, increasing their usefulness in a variety of mission scenarios. The increasing need for torpedoes with electric propulsion systems that may be easily linked with unmanned platforms has resulted from the expanding use of unmanned underwater vehicles (UUVs) in naval operations.

Recent Market Developments

- In February 2020, AN/SQQ-89A(V)15 anti-submarine warfare (ASW) and anti-torpedo systems for surface warships are to be built by Lockheed Martin under a contract valued at USD 59.5 million.

Competitive Landscape

Major players in the market

- Aselsan

- Atlas Elektronik GmbH

- BAE Systems

- Bharat Dynamics Limited

- Honeywell International Inc

- Leonardo SpA

- Lockheed Martin Corporation

- Naval Group

- Northrop Grumman Corporation

- Raytheon Company

- Rosoboronexport

- Saab AB

- Sechan Electronics Inc.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Torpedo Market, Weight Analysis

- Heavyweight Torpedoes

- Lightweight Torpedoes

Torpedo Market, Launch Platform Analysis

- Air-Launched

- Surface-Launched

- Underwater-Launched

Torpedo Market, Propulsion Analysis

- Electric Propulsion

- Conventional Propulsion

Torpedo Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Torpedo Market?The global Torpedo Market Size is expected to grow from USD 987.2 million in 2023 to USD 1468.5 million by 2033, at a CAGR of 4.05% during the forecast period 2023-2033.

-

2. Who are the key market players of the Torpedo Market?Some of the key market players of the market are Aselsan, Atlas Elektronik GmbH, BAE Systems, Bharat Dynamics Limited, Honeywell International Inc, Leonardo SpA,, Lockheed Martin Corporation, Naval Group, Northrop Grumman Corporation, Raytheon Company, Rosoboronexport, Saab AB, and Sechan Electronics Inc.

-

3. Which segment holds the largest market share?The electric propulsion segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Torpedo Market?North America is dominating the Torpedo Market with the highest market share.

Need help to buy this report?