Global Time of Flight Sensor Market Size, Share, and COVID-19 Impact Analysis, By Sensor Type (Direct ToF, Indirect ToF, Structured Light, and Others), By Range (Short-Range, Long-Range, Ultra-Long-Range, and Very Short-Range), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Semiconductors & ElectronicsGlobal Time of Flight Sensor Market Insights Forecasts to 2035

- The Global Time of Flight Sensor Market Size Was Estimated at USD 5.42 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.38 % from 2025 to 2035

- The Worldwide Time of Flight Sensor Market Size is Expected to Reach USD 31.58 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global time of Flight Sensor Market Size was worth around USD 5.42 Billion in 2024 and is predicted to Grow to around USD 31.58 Billion by 2035 with a compound annual Growth rate (CAGR) of 17.38% from 2025 to 2035. Rising adoption in smartphones, autonomous vehicles, industrial automation, AR/VR devices, and smart home systems will create strong growth opportunities for the time of flight sensor market.

Market Overview

The time of flight (ToF) sensor market refers to the industry focused on sensors that measure distance by calculating the time taken by light to travel to an object and return. Market growth is driven by rising adoption in smartphones for 3D sensing, increasing use in autonomous vehicles, industrial automation, and AR/VR applications. Growing demand for advanced driver-assistance systems and robotics is further accelerating adoption. Government initiatives are also supporting growth, including smart city programs, Industry 4.0 adoption, and automation policies. For instance, over 70% of developed economies have launched national smart manufacturing or digital infrastructure initiatives, while investments in smart city projects are increasing annually, boosting demand for precise depth-sensing technologies like ToF sensors.

Report Coverage

This research report categorizes the time of flight Sensor market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Time of Flight Sensor market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Time of Flight Sensor market.

Global Time of Flight Sensor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.42 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 17.38% |

| 2035 Value Projection: | USD 31.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | STMicroelectronics N.V., Texas Instruments Incorporated, Infineon Technologies AG, Sony Semiconductor Solutions Corporation, Samsung Electronics Co., Ltd., ON Semiconductor Corporation, Broadcom Inc., Panasonic Corporation, Lumentum Operations LLC, ams-OSRAM AG, and Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the time of flight sensor market is driven by increasing adoption in smartphones for facial recognition and 3D imaging, rising demand for autonomous vehicles and advanced driver-assistance systems, and expanding use in industrial automation and robotics. Rapid growth of AR/VR devices, smart home applications, and gaming technologies is further fueling demand. Additionally, advancements in sensor accuracy, miniaturization, and declining component costs are encouraging wider adoption across consumer electronics, healthcare imaging, and security surveillance systems.

Restraining Factors

High manufacturing costs, integration complexity, power consumption issues, limited performance in bright lighting conditions, and competition from alternative sensing technologies restrict widespread adoption of time of flight sensors.

Market Segmentation

The time of flight sensor market share is classified into sensor type and range.

- The indirect ToF segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sensor type, the time of flight sensor market is divided into direct ToF, indirect ToF, structured light, and others. Among these, the indirect ToF segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The indirect time of flight (iToF) segment led the market in 2024, accounting for over 50% share, due to its extensive use in smartphones and consumer electronics. iToF sensors offer lower costs, compact integration, and reliable depth sensing, making them ideal for facial recognition and AR features. Smartphone shipments adopting 3D sensing exceeded 60% penetration, supporting strong CAGR growth.

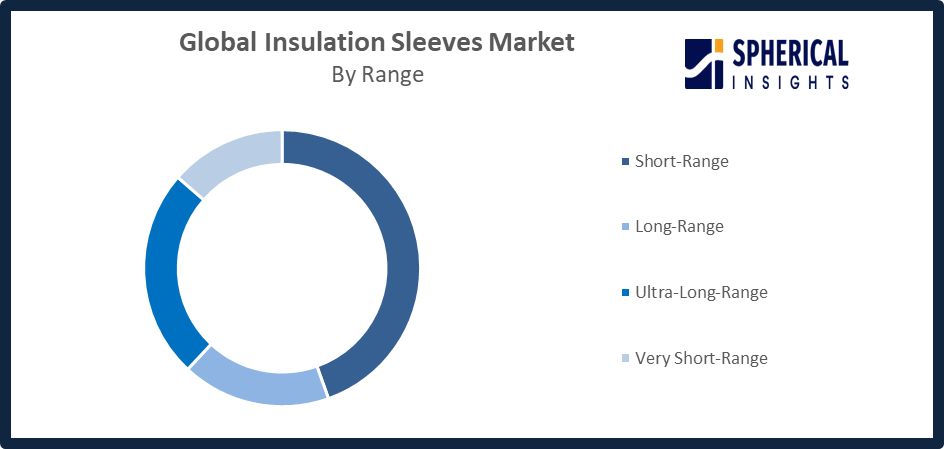

- The short-range segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the range, the time of flight sensor market is divided into short-range, long-range, ultra-long-range, and very short-range. Among these, the short-range segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The short-range segment dominated revenue in 2024, accounting for over 45% share, due to extensive adoption in smartphones, facial recognition, AR/VR, and consumer electronics. These applications require precise depth sensing within 0.1–5 meters. Growing smartphone penetration, where more than 60% of devices integrate 3D sensing, and rising use in indoor robotics and smart devices are supporting strong CAGR growth.

Get more details on this report -

Regional Segment Analysis of the Time of Flight Sensor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the time of flight sensor market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the time of flight sensor market over the predicted timeframe. Asia Pacific is expected to dominate the time of flight sensor market due to its strong electronics manufacturing base and high smartphone production. Rapid adoption of 3D sensing in consumer devices, growing automotive manufacturing, and increasing investments in industrial automation and smart factories in China, Japan, South Korea, and India are driving demand. Additionally, government initiatives promoting Industry 4.0 and smart city development further support sustained market growth across the region.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the time of flight sensor market during the forecast period. North America is expected to grow at a rapid CAGR in the time of flight sensor market due to strong adoption of advanced technologies across automotive, consumer electronics, and industrial automation sectors. Rising investments in autonomous vehicles, robotics, and AR/VR applications, along with early adoption of smart home and security systems, are driving demand. Additionally, supportive government funding for AI, smart manufacturing, and defense technologies is accelerating ToF sensor integration across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the time of flight sensor market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Infineon Technologies AG

- Sony Semiconductor Solutions Corporation

- Samsung Electronics Co., Ltd.

- ON Semiconductor Corporation

- Broadcom Inc.

- Panasonic Corporation

- Lumentum Operations LLC

- ams-OSRAM AG

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, STMicroelectronics has launched new multizone dToF sensors paired with advanced Human Presence Detection (HPD) technology that reduce device power use by over 20% while improving security and privacy in laptops and PCs, enabling features like multi-person detection and adaptive screen functions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the time of flight sensor market based on the below-mentioned segments:

Global Time of Flight Sensor Market, By Sensor Type

- Direct ToF

- Indirect ToF

- Structured Light

- Others

Global Time of Flight Sensor Market, By Range

- Short-Range

- Long-Range

- Ultra-Long-Range

- Very Short-Range

Global Time of Flight Sensor Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the time of flight sensor market over the forecast period?The global time of flight sensor market is projected to expand at a CAGR of 17.38% during the forecast period.

-

2.What is the market size of the time of flight sensor market?The global time of flight sensor market size is expected to grow from USD 5.42 billion in 2024 to USD 31.58 billion by 2035, at a CAGR of 17.38 % during the forecast period 2025-2035.

-

3.Which region holds the largest share of the time of flight sensor market?Asia Pacific is anticipated to hold the largest share of the time of flight sensor market over the predicted timeframe.

-

4.Who are the top 10 companies operating in the global time of flight sensor market?STMicroelectronics N.V., Texas Instruments Incorporated, Infineon Technologies AG, Sony Semiconductor Solutions Corporation, Samsung Electronics Co., Ltd., ON Semiconductor Corporation, Broadcom Inc., Panasonic Corporation, Lumentum Operations LLC, and ams-OSRAM AG.

-

5.What factors are driving the growth of the time of flight sensor market?Rising adoption in smartphones, autonomous vehicles, industrial automation, AR/VR devices, smart homes, and increasing demand for accurate 3D sensing technologies.

-

6.What are the market trends in the time of flight sensor market?Growing integration in smartphones, robotics, AR/VR, automotive LiDAR, miniaturization, AI-based sensing, and increasing demand for energy-efficient, high-accuracy depth detection systems.

-

7.What are the main challenges restricting the wider adoption of the time of flight sensor market?High manufacturing costs, integration complexity, limited performance in bright light, power consumption issues, and competition from alternative sensing technologies restrict adoption.

Need help to buy this report?