Global Threonine Market Size, Share, and COVID-19 Impact Analysis, By Source (Plant-Based and Animal Based), By Form (Powder and Liquid), By End-Users (Animal Feed, Pharmaceuticals, Food and Beverages, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Threonine Market Insights Forecasts to 2035

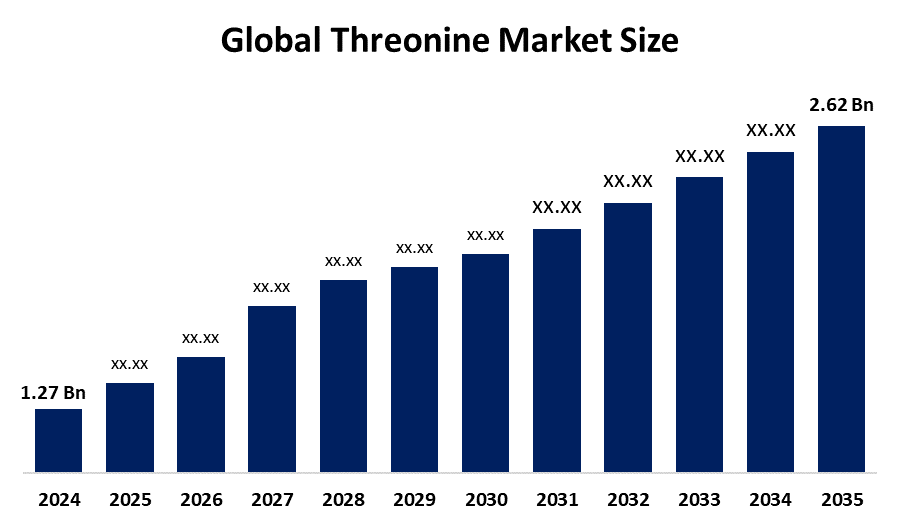

- The Global Threonine Market Size Was Estimated at USD 1.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.8% from 2025 to 2035

- The Worldwide Threonine Market Size is Expected to Reach USD 2.62 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global threonine market size was worth around USD 1.27 billion in 2024 and is predicted to grow to around USD 2.62 billion by 2035 with a compound annual growth rate (CAGR) of 6.8% from 2025 to 2035. The demand for high-quality animal feed, increasing meat consumption, advancement in fermentation technology, and more awareness of efficiency in the nutrition of livestock all contribute to broadening the use of threonine as an amino acid supplement.

Market Overview

The Global Market Size for threonine, an amino acid essential for the synthesis of proteins, the functioning of the immune system, and maintaining gut health, is gaining significant steam. As animals and humans cannot synthesise it, threonine has to be supplied exogenously, thereby increasing its demand in the animal feed, human nutrition, and pharmaceutical sectors. In animal feed, threonine helps improve growth in poultry, swine, and aquaculture species, increases feed efficiency, and reduces nitrogen excretion, thus aligning with sustainability goals. Key market drivers include increasing global demand for animal-based protein in tandem with growing meat, dairy, and aquaculture production, coupled with a growing interest in nutritionally optimized diets in livestock and humans. Technological innovation is driving the industry forward fermentation-based industrial routes are becoming more efficient and cost-effective, plant-based feedstocks and greener routes are emerging, and tailored formulations for human health, functional foods, and medical nutrition will be increasingly adopted.

The most significant opportunities will lie in high-growth emerging markets, especially the Asia Pacific, where the livestock and aquaculture sectors are growing very fast, and diversification into more value-generating applications in human nutrition and pharmaceuticals beyond traditional applications in feed. Dominant companies include Evonik Industries AG, CJ CheilJedang Corporation, Ajinomoto Co., Inc., and Meihua Holdings Group Co., Ltd., which benefit from strong positions created by extensive fermentation capacity, worldwide supply networks, and heavy R&D muscles. The threonine market fundamentals remain strong in feed and nutrition, combined with innovation and segmentation, and are poised for further growth with evolving production methods and expanded uses. At the European Food Safety Authority (EFSA) Panel meeting on 12 March 2024, L-threonine produced with Escherichia coli CGMCC 7.455 was considered safe for target animal species, consumers, and the environment. Simultaneous administration of the additive through feeding stuffs and water might raise concerns due to amino acid imbalances or hygiene issues.

Report Coverage

This research report categorizes the threonine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Threonine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Threonine market.

Global Threonine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.8% |

| 2035 Value Projection: | USD 2.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By Form |

| Companies covered:: | Ajinomoto Co., Inc., BASF SE, Evonik Industries AG, Meihua Holdings Group Co., Ltd., Archer Daniels Midland (ADM), NB Group Co., Ltd., CJ Cheiljedang, Fufeng, Kemin Industries, Inc., Guoguang Biochemistry, Cargill, Incorporated, Prinova Group LLC, Sumitomo Chemical Co., Ltd., Royal DSM N.V., Novus International, Inc., And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The threonine market is driven by the growing demand for animal feed additives, of which threonine is an important amino acid that fosters growth and improves feed efficiency in poultry, swine, and aquaculture. Demand continues to mount as world meat consumption rises along with increasing awareness of animal nutrition. Improved biotechnology and fermentation techniques have also reduced production costs and enhanced the throughput of threonine. As a building block of proteins, threonine plays a role in protein synthesis and supports immune function, leading to its increased application in pharmaceuticals and food supplements. Emerging livestock industries, especially in the Asia Pacific and Latin America, will further drive this market.

Restraining Factors

Fluctuating prices of the raw materials used in threonine production restrain the market, since price fluctuations directly affect production cost and profitability. Limited awareness regarding amino acid supplementation is another factor restraining demand in underdeveloped regions. High regulatory standards, expensive production, and competition from other sources of proteins restrict the market growth, especially in the price-sensitive and emerging markets.

Market Segmentation

The threonine market share is classified into source, form, and end-users.

- The plant-based segment dominated the market in 2024, approximately 67% and is projected to grow at a substantial CAGR during the forecast period.

Based on the source, the threonine market is divided into plant-based and animal based. Among these, the plant-based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The dominant segment of the threonine market is plant-based, owing to the rising demand for sustainable and eco-friendly feed and nutrition solutions. Growing awareness of environmental impacts, together with the preference for non-animal-derived ingredients in livestock feed and human supplements, has fueled the adoption. Moreover, improvements in fermentation technologies for plant-based production, along with supportive government policies, are further contributing to making this segment highly attractive.

- The powder segment accounted for the largest share in 2024, approximately 78% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the threonine market is divided into powder and liquid. Among these, the powder segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The powder segment is driven mainly by ease of handling, long shelf life, and application versatility in feed and nutritional formulation. Its wide uses in animal feed, dietary supplements, and pharmaceutical applications support the consistent demand it receives. Also, cost-effective production, along with efficient incorporation into various products, fuels its adoption.

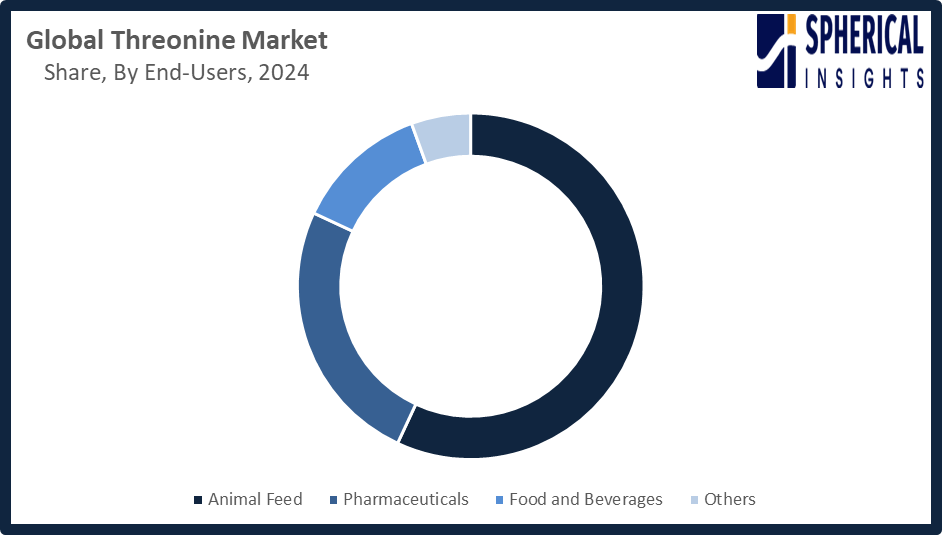

- The animal feed segment accounted for the highest market revenue in 2024, approximately 57% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-users, the threonine market is divided into animal feed, pharmaceuticals, food and beverages, and others. Among these, the animal feed segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The animal feed segment dominated the threonine market due to its critical role in improving the growth of animals, feed efficiency, nutrient absorption, and reducing nitrogen excretion. With the growing demand for meat, poultry, and aquaculture products globally, combined with increased focus on sustainable and optimized animal nutrition, threonine is seeing widespread adoption.

Get more details on this report -

Regional Segment Analysis of the Threonine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the threonine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the threonine market over the predicted timeframe. The Asia Pacific is expected to dominate the 44% share of the threonine market during the forecast period. This growth can be attributed to rapid expansion in livestock, poultry, and aquaculture production across the region. Major countries contributing to this are China, India, and Thailand. China accounts for the largest production and consumption owing to a wide animal farming business and strong demand for feed additives. Increasing meat and seafood consumption, initiatives by the government to promote amino acid production, and growing awareness about sustainable nutrition practices are further boosting the market. Advancements in fermentation techniques to produce threonine improve supply and affordability in the region.

North America is expected to grow at a rapid CAGR in the threonine market during the forecast period. North America is rapidly expanding the threonine market, with an approximate 26% market share, driven by growing demand for high-quality animal feed and nutritional supplements during the forecast period. The United States is the major revenue contributor in the region owing to its large livestock and poultry industry, strict quality regulations, and increasing adoption of amino acid-fortified feed for animal growth and better feed efficiency. Growing awareness about sustainable farming practices and advancement in fermentation-based threonine production further accelerate the growth of the market in North America.

In Europe, the threonine market is witnessing growth driven by strict regulatory standards, such as those regarding the European Food Safety Authority and Feed Additives Regulation, which encourage efficient livestock nutrition and minimise environmental impact. With well-developed feed-mill infrastructure and the use of precision livestock farming methods, countries such as Germany continue to set the pace, while France and the United Kingdom move further toward sustainable and antibiotic-free means of animal production. These factors are leading to higher inclusion levels for threonine in animal feed, thereby supporting consistent market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the threonine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto Co., Inc.

- BASF SE

- Evonik Industries AG

- Meihua Holdings Group Co., Ltd.

- Archer Daniels Midland (ADM)

- NB Group Co., Ltd.

- CJ Cheiljedang

- Fufeng

- Kemin Industries, Inc.

- Guoguang Biochemistry

- Cargill, Incorporated

- Prinova Group LLC

- Sumitomo Chemical Co., Ltd.

- Royal DSM N.V.

- Novus International, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, ADM and Alltech signed a definitive agreement to launch a North American animal feed joint venture, combining decades of expertise and capabilities to deliver innovative solutions and create enhanced value and advantages for customers.

- In April 2025, at the China Feed Industry Expo, Evonik highlighted its efficient and sustainable product portfolio, emphasizing MetAMINO’s 35% lower carbon footprint. The company also introduced the poultry probiotic Ecobiol and showcased AMINONIR analytical services to enhance feed efficiency and minimise environmental impact.

- In March 2025, Kemin Industries launched PROSIDIUM, a new feed pathogen control solution, at VIV Asia in Bangkok, Asia’s largest feed and animal production tradeshow. The product supports Kemin’s mission to sustainably improve the quality of life for 80% of the global population.

- In November 2024, CJ CheilJedang announced plans to seek potential buyers for its bio business division, which produces amino acids such as threonine for microbial-based food and feed. This move reflects a strategic shift in the company’s biotechnology segment, aiming to realign its focus and resources.

- In July 2023, CJ CheilJedang’s BESTAMINO was named to Clarivate Analytics’ Top 100 New Brands 2023 for its innovation and global competitiveness. Recognised for microbial fermentation and refining technology, BESTAMINO is uniquely offered in powder, liquid, and granule forms across its feed-grade amino acid portfolio.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the threonine market based on the below-mentioned segments:

Global Threonine Market, By Source

- Plant-Based

- Animal Based

Global Threonine Market, By Form

- Powder

- Liquid

Global Threonine Market, By End-Users

- Animal Feed

- Pharmaceuticals

- Food and Beverages

- Others

Global Threonine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the threonine market over the forecast period?The global threonine market is projected to expand at a CAGR of 6.8% during the forecast period.

-

2. What is the market size of the threonine market?The global threonine market size is expected to grow from USD 1.27 billion in 2024 to USD 2.62 billion by 2035, at a CAGR of 6.8% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the threonine market?Asia Pacific is anticipated to hold the largest share of the threonine market over the predicted timeframe.

-

4. What is the threonine market?The threonine market is the global industry for the production and sale of threonine, an essential amino acid used in animal feed, pharmaceuticals, and food & beverages.

-

5. Who are the top 10 companies operating in the global threonine market?Ajinomoto Co., Inc., BASF SE, Evonik Industries AG, Meihua Holdings Group Co., Ltd., Archer Daniels Midland (ADM), NB Group Co., Ltd., CJ Cheiljedang, Fufeng, Kemin Industries, Inc., Guoguang Biochemistry, Cargill, Incorporated, and Others.

-

6. What factors are driving the growth of the threonine market?The growth of the threonine market is driven by several key factors, primarily the increasing demand in the animal feed industry, expanding applications in the pharmaceutical sector, and advancements in biotechnology production methods.

-

7. What are the market trends in the threonine market?Market trends in threonine include a robust growth driven by demand in animal nutrition and a rising pharmaceutical sector, the increasing adoption of sustainable, plant-based production, and the integration of advanced technologies such as AI in animal feed.

-

8. What are the main challenges restricting wider adoption of the threonine market?The main challenges restricting wider adoption of the threonine market include input cost inflation and raw material price volatility, stringent regulatory compliance, and a shortage of skilled personnel.

Need help to buy this report?