Global Thin Wall Packaging Market Size, By Production Process (Thermoforming, Injection Molding), By Material (Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET)), By Region, And Segment Forecasts, By Geographic Scope And Forecast - 2032

Industry: Chemicals & MaterialsGlobal Thin Wall Packaging Market Size Insights Forecasts to 2032

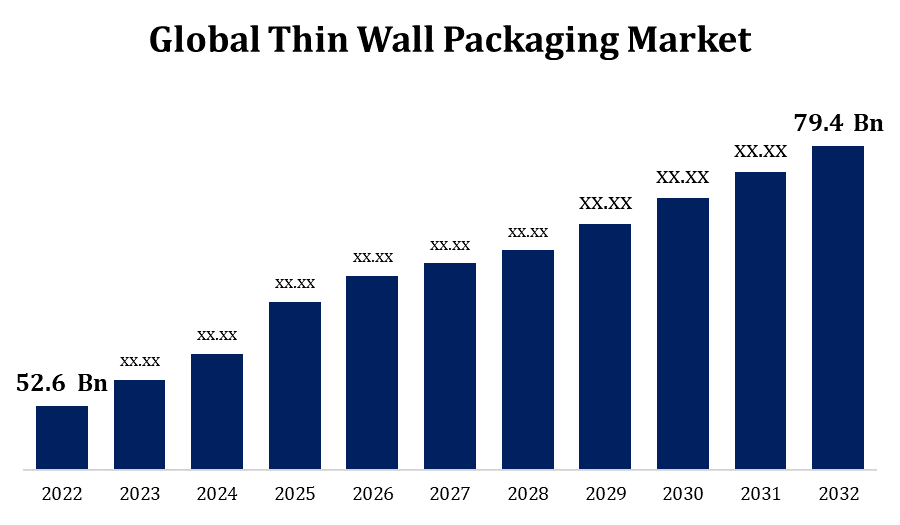

- The Thin Wall Packaging Market Size was valued at USD 52.6 Billion in 2022.

- The Market is growing at a CAGR of 6.2% from 2022 to 2032

- The worldwide Thin Wall Packaging Market Size is expected to reach USD 79.4 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Thin Wall Packaging Market Size is expected to reach USD 79.4 Billion by 2032, at a CAGR of 6.2% during the forecast period 2022 to 2032.

The industry that produces and distributes packaging solutions with thin walls is known as the thin wall packaging market. These strong, lightweight packaging materials are widely utilised for a variety of items in the consumer goods, healthcare, and food and beverage industries. Materials like polymers, especially polypropylene (PP) and high-density polyethylene (HDPE), are frequently used to make thin wall packing. These materials enable the package to be lightweight while still offering the required strength. A wide range of products, including dairy products, prepared meals, baked goods, fruits, and vegetables, are frequently packaged using thin wall packaging. It is also used in the healthcare industry for medical device and pharmaceutical packaging. Convenience for the consumer is a common theme in thin wall packaging design and operation. Constant expansion in the worldwide thin wall packaging industry has been fueled by urbanisation, shifting consumer preferences, and rising convenience food demand. A large portion of this market's expansion can be attributed to emerging economies.

Thin Wall Packaging Market Value Chain Analysis

Polymer resins, such as polypropylene (PP) and high-density polyethylene (HDPE), are the main basic materials used in thin wall packaging. These resins are purchased from producers of polymers or petrochemicals. To manufacture thin wall packaging containers, polymer resins are processed using machinery for injection moulding and extrusion. The materials are shaped and formed into the appropriate packaging structures during this procedure. The goal of packaging design businesses is to provide thin wall packaging solutions that are both visually appealing and effective. This entails taking branding, consumer convenience, and product protection into account. The thin wall packaging can have labels, logos, and information added by printing firms. Identification of the product, branding, and regulatory compliance all depend on this stage. A network of distribution centres handles the distribution of finished thin wall packaging items to different locations. Order fulfilment, warehousing, and transportation must all be coordinated in the distribution process. Products in thin wall packaging are sold to supermarkets, convenience stores, and other types of retail establishments. Following that, end users are seeing the package via these retail channels. Products with thin wall packaging, such food, drinks, or personal care goods, are bought and used by the ultimate consumers.

Thin Wall Packaging Market Opportunity Analysis

Manufacturers of thin wall packaging have a chance to create and market environmentally friendly packaging options because of the growing emphasis on sustainability on a global scale. Enhancing market competitiveness can be achieved through encouraging a circular economy, using recycled materials, and optimising container designs for recyclability. The emergence of e-commerce offers thin wall packaging a substantial possibility. Opening up new business opportunities can be achieved by creating packaging solutions that are appropriate for online retail, guaranteeing product protection during delivery, and attending to the particular requirements of e-commerce logistics. Solutions for branded and customised packaging are becoming more and more popular. To boost product visibility and appeal to consumers, thin wall packaging makers can leverage this by providing customisation options, such as distinctive shapes, colours, and branding components.

Global Thin Wall Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 52.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.2% |

| 2032 Value Projection: | USD 79.4 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Production Process, By Material, Polyethylene (PE), Polyethylene Terephthalate (PET)), By Region, And Segment Forecasts, By Geographic Scope |

| Companies covered:: | Amcor plc, Berry Global Inc., SILGAN HOLDINGS INC., PACCOR GROUP, Mold-Tek Packaging Ltd., Greiner Packaging, DOUBLE H PLASTICS, INC., Novio Packaging B.V., GUILLIN Group, Omniform, Takween Advanced Industries, Sanpac, Uniplast Knauer GmbH & Co. KG, Sunrise Plastics, Insta Polypack, PLASTIPAK INDUSTRIES INC., Jrd International, Shree Rama Multi-Tech Ltd., ACMEPAK PLASTIC PACKAGING, LTD., Faerch A/S, and other key vendors |

| Growth Drivers: | Increasing need of minimizing packaging weight |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Thin Wall Packaging Market Dynamics

Increasing need of minimizing packaging weight

Using lightweight materials, like thin-gauge plastics, helps reduce the weight of packaging. For producers, this means lower costs for materials, transportation, and overall manufacturing. Lighter packaging materials lessen the environmental impact of package manufacturing, transportation, and disposal, which supports sustainability initiatives. Reduced carbon footprint and resource use are the outcomes of lower material utilisation. When it comes to e-commerce, where shipping expenses are a major factor, manufacturers and retailers can save money by using lighter packing. It also helps to make transportation and logistics more effective. Customers typically find lightweight packing easier to handle. Furthermore, it could make recycling or disposal procedures simpler, in line with customer desires for packaging that is manageable and ecologically benign.

Restraints & Challenges

It can be difficult to develop new, yet reasonably priced materials for thin wall packaging. Research and development activities must be ongoing in order to strike a balance between the demand for lightweight materials and durability and cost effectiveness. Customers may still be sceptical of thin wall packaging's perceived strength and safety, despite the increased need for lightweight, environmentally friendly packaging. Gaining and preserving customer trust is essential. Natural catastrophes, geopolitical upheavals, or other unanticipated occurrences can cause global supply chain disruptions that might affect the sourcing of raw materials and cause havoc with production and distribution procedures. The emergence of e-commerce brings with it particular difficulties, such as the requirement for packing options that can endure the rigours of handling and shipment. There are special problems in creating packaging that is both protective and lightweight.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Thin Wall Packaging market from 2023 to 2032. North America's thin wall packaging industry has been steadily expanding due to a number of factors, including the growing popularity of e-commerce, the need for environmentally friendly and lightweight packaging options, and consumer preference for ease. North American packaging trends have been influenced by the expansion of e-commerce. The importance of thin wall packaging with features like simple handling, protection, and space efficiency for online shopping has grown. In North America, one of the biggest markets for thin wall packaging is the food and beverage sector. Dairy goods, convenience foods, and ready-to-eat meals all frequently use effective and lightweight packaging.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The market for thin wall packaging has seen substantial growth from the Asia-Pacific area. The market has grown rapidly due to factors like urbanisation, population expansion, and the rising need for lightweight and convenient packaging. Because some of the most populous countries in the world are located in the Asia-Pacific area, there is a sizable and expanding consumer market there. This demographic component fuels the need for effective and affordable packaging solutions by adding to the increasing demand for packaged goods. Packaging patterns have been significantly impacted by the Asia-Pacific region's rapid expansion in e-commerce. There has been a rise in demand for thin wall packaging made to meet the unique needs of online retail, namely space efficiency and durability.

Segmentation Analysis

Insights by Material

The Polystyrene segment accounted for the largest market share over the forecast period 2023 to 2032. Polystyrene is a lightweight material that works well for thin wall packaging. This quality is especially crucial in sectors like food and beverage manufacturing, where lightweight packaging can reduce transportation costs. The ability to mould polystyrene into a wide range of sizes and forms allows for flexibility in packaging design. Because of its adaptability, unique and creative thin wall packaging solutions can be developed to satisfy particular product and market demands. Because of its strong impact resistance, polystyrene helps to keep packaged goods safe during handling and transportation. Ensuring the integrity of the contents within the thin wall packaging is made possible by this unique quality. Polystyrene packaging's resilience guarantees product protection by averting breakage or damage while in transportation.

Insights by Production Process

Injection molding technique segment is witnessing the fastest market growth over the forecast period 2023 to 2032. Significant design flexibility is provided by the injection moulding technique, which makes it possible to create detailed and complicated designs in thin wall packaging. For producers looking for creative and personalised packaging solutions, this adaptability is useful. When making thin wall packaging, injection moulding offers great levels of consistency and precision. Adhering to stringent quality requirements and guaranteeing consistency in the packaging's size and attributes are crucial. The surge in e-commerce has resulted in a greater need for packaging options that can endure the challenges of transportation. Thin wall packaging suitable for online retail can be made with strength and protection due to injection moulding.

Recent Market Developments

- On May 2020, Berry Global and Mondelez International collaborated to provide Philadelphia with packaging made of recycled plastic.

Competitive Landscape

Major players in the market

- Amcor plc

- Berry Global Inc.

- SILGAN HOLDINGS INC.

- PACCOR GROUP

- Mold-Tek Packaging Ltd.

- Greiner Packaging

- DOUBLE H PLASTICS, INC.

- Novio Packaging B.V.

- GUILLIN Group

- Omniform

- Takween Advanced Industries

- Sanpac

- Uniplast Knauer GmbH & Co. KG

- Sunrise Plastics

- Insta Polypack

- PLASTIPAK INDUSTRIES INC.

- Jrd International

- Shree Rama Multi-Tech Ltd.

- ACMEPAK PLASTIC PACKAGING, LTD.

- Faerch A/S

- other key vendors

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Thin Wall Packaging Market, Production Process Analysis

- Thermoforming

- Injection Molding

Thin Wall Packaging Market, Material Analysis

- Polypropylene (PP)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

Thin Wall Packaging Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Thin Wall Packaging Market?The global Thin Wall Packaging Market is expected to grow from USD 52.6 Billion in 2023 to USD 79.4 Billion by 2032, at a CAGR of 6.2% during the forecast period 2023-2032.

-

2. Who are the key market players of the Thin Wall Packaging Market?Some of the key market players of market are Amcor plc; Berry Global Inc.; SILGAN HOLDINGS INC.; PACCOR GROUP; Mold-Tek Packaging Ltd.; Greiner Packaging; DOUBLE H PLASTICS, INC.; by Novio Packaging B.V.; GUILLIN Group; Omniform; Takween Advanced Industries; Sanpac; Uniplast Knauer GmbH & Co. KG; Sunrise Plastics; Insta Polypack; PLASTIPAK INDUSTRIES INC.; Jrd International; Shree Rama Multi-Tech Ltd.; ACMEPAK PLASTIC PACKAGING, LTD.; Faerch A/S.

-

3. Which segment holds the largest market share?Injection moulding technique segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Thin Wall Packaging Market?North America is dominating the Thin Wall Packaging Market with the highest market share.

Need help to buy this report?