Global Thermoform-Embedded Electronics Market Size, Share, and COVID-19 Impact Analysis, By Technology (In-Mould Electronics & Printed Circuitry, Thermoform-Integrated Sensors, Printed Electronics Lamination, Low-Cost Printed Electronics, and Others), By End User (Smart Food & Pharma Packs, Medical & Diagnostics, Consumer Electronics Packaging, Emerging Smart Packaging, Appliance Packaging, and High-Precision Electronics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Thermoform-Embedded Electronics Market Insights Forecasts to 2035

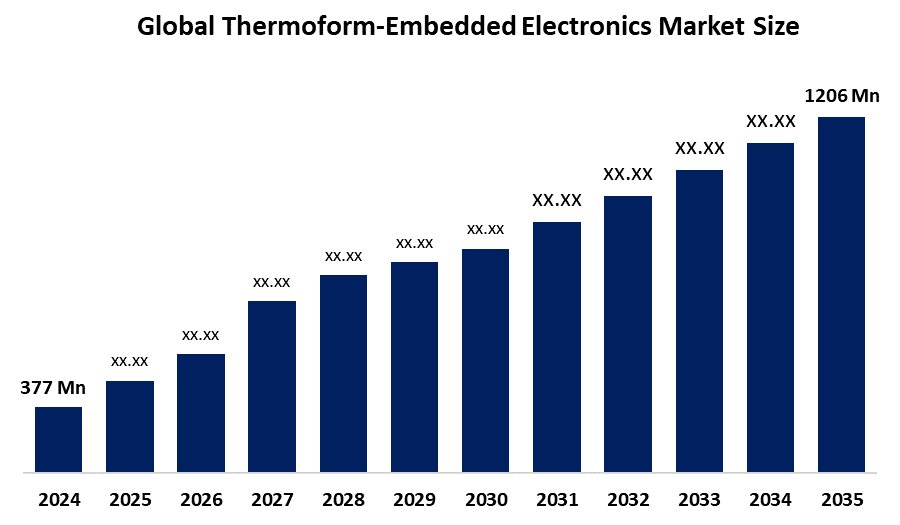

- The Global Thermoform-Embedded Electronics Market Size Was Estimated at USD 377 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.15% from 2025 to 2035

- The Worldwide Thermoform-Embedded Electronics Market Size is Expected to Reach USD 1206 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Thermoform-embedded Electronics Market Size was valued at USD 377 Million in 2024 and is predicted to Grow to around USD 1206 Million by 2035 with a compound annual growth rate (CAGR) of 11.15% from 2025 to 2035. The opportunities in the thermoform-embedded electronics market include improvements in flexible electronics, lightweight and robust designs, integration in consumer, healthcare, and automotive devices, and expansion in wearable and smart packaging technologies.

Market Overview

The global industry devoted to the creation, manufacturing, and marketing of electronic circuits and components embedded in thermoformed plastic structures is known as the thermoform-embedded electronics (TEE) market. In order to provide lightweight, flexible, and conformal 3D structural electronics, the thermoform-embedded electronics market includes the creative integration of electronic components, including sensors, circuits, LEDs, and antennas, directly into thermoformed plastic substrates during the molding process. By heating, shaping, and molding plastic sheets into precise shapes, a method known as thermoforming enables the direct integration of electronic components like sensors, antennas, circuits, and displays into the product's structure. According to the U.S. government launched a $1.4 million CHIPS Act initiative and NextFlex’s Flexible Hybrid Electronics Roadmap in January 2025, boosting domestic R&D and innovation in thermoform-embedded electronics. Smart sensing, connectivity, and interactive features are made possible by the growing integration of electronic functionality directly into consumer goods, car interiors, and packaging. Technological developments in flexible electronics, the growing need for lightweight and multipurpose gadgets, and the growing uptake of smart and connected products across many industries are driving the market.

Report Coverage

This research report categorizes the thermoform-embedded electronics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the thermoform-embedded electronics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the thermoform-embedded electronics market.

Global Thermoform-Embedded Electronics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 377 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 11.15% |

| 2035 Value Projection: | USD 1206 Million |

| Historical Data for: | 2020–2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology, By End User |

| Companies covered:: | LG Electronics; General Electric Company; Panasonic Corporation (Packaging Solutions); DuPont / DuPont Teijin Films; Flex Ltd. (formerly Flextronics); Sonoco Products Company; Klöckner Pentaplast; Brewer Science, Inc.; E Ink Holdings Inc.; PragmatIC Printing Ltd.; Shenzhen In-Mold Technology Co., Ltd.; Mold-Tek Packaging Ltd.; TactoTek Oy; Thin Film Electronics ASA / Ensurge Micropower ASA; and other players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing use of connected devices, smart packaging, and IoT-enabled products is driving the market's growth. One of the factors driving the thermoform-embedded electronics (TEE) market is the increasing demand for lightweight, flexible, and durable electronic components across a range of industries, including consumer electronics, wearables, automotive, and healthcare. Technological advancements in flexible and printed electronics have made it possible to seamlessly incorporate circuits, sensors, and displays into thermoformed materials, enhancing usefulness and design efficiency.

Restraining Factors

High manufacturing costs, restricted material compatibility, intricate integration procedures, a lack of standardized production methods, and technological difficulties in preserving the robustness, adaptability, and functionality of embedded electronic components in thermoformed structures are some of the factors restricting the thermoform-embedded electronics market.

Market Segmentation

The thermoform-embedded electronics market share is classified into technology and end user.

- The in-mould electronics & printed circuitry segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the technology, the thermoform-embedded electronics market is divided into in-mould electronics & printed circuitry, thermoform-integrated sensors, printed electronics lamination, low-cost printed electronics, and others. Among these, the in-mould electronics & printed circuitry segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The primary driver of this market is the widespread application of printed circuitry and in-mold electronics in a number of industries, including consumer electronics, automotive, healthcare, and smart packaging, where lightweight, flexible, and multipurpose electronic integration is becoming increasingly important. Circuits and sensors may be effortlessly integrated into thermoformed structures thanks to in-mold electronics, which reduces assembly complexity and increases product durability and design efficacy.

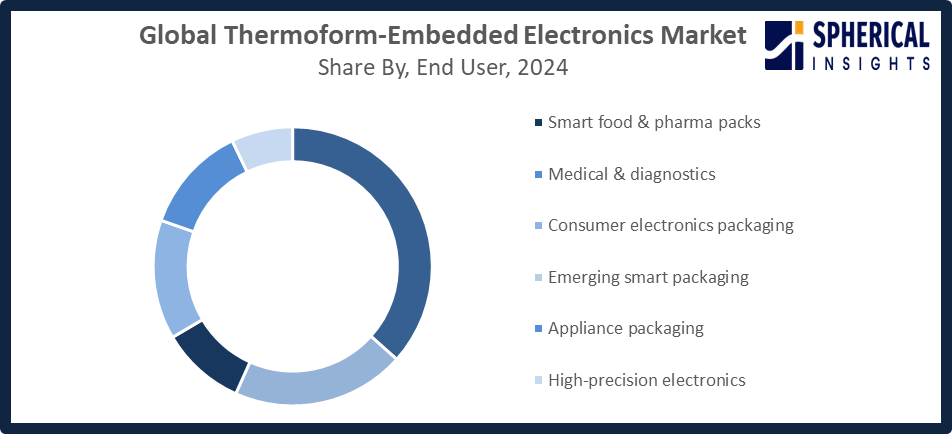

- The smart food & pharma packs segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the thermoform-embedded electronics market is divided into smart food & pharma packs, medical & diagnostics, consumer electronics packaging, emerging smart packaging, appliance packaging, and high-precision electronics. Among these, the smart food & pharma packs segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing need for sophisticated packaging solutions that incorporate electronic features like sensors, indicators, and conductive circuits to guarantee product safety, quality, and traceability is driving the smart food and pharmaceutical packs market. These smart packaging options improve supply chain transparency, stop tampering, and monitor storage conditions in real time in smart food and pharmaceutical packs.

Get more details on this report -

Regional Segment Analysis of the Thermoform-Embedded Electronics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the thermoform-embedded electronics market over the predicted timeframe.

North America is anticipated to hold the largest share of the thermoform-embedded electronics market over the predicted timeframe. The region of North America is credited with having a strong R&D environment, a well-established technological infrastructure, and top players in the flexible and embedded electronics market. The region's market leadership is further reinforced by supportive government efforts like the U.S. CHIPS Act, which provides substantial financing for innovative electronics and improved packaging. the CHIPS Act funding opportunity offered by the U.S. Department of Commerce in November 2025, which will provide funds for advanced microelectronics research and development to improve the country's competitiveness. Automobile interiors, industrial consumer goods, and food and beverage packaging are the main areas of demand. High-performance, processing-compatible materials and electronics integration solutions are offered by domestic providers.

Asia Pacific is expected to grow at a rapid CAGR in the thermoform-embedded electronics market during the forecast period. Growing industrialization, quick adoption of technology, and rising investments in electronics manufacturing are the main drivers of the Asia Pacific. A favorable environment for market expansion is being created by the significant demand for wearable technology, smart consumer electronics, automotive applications, and healthcare technologies in nations like China, Japan, South Korea, and India. Nationwide acceptance is being sustained via product innovation, recurring embedded component manufacture, and growth in manufacturing infrastructure. The Ministry of Trade, Industry, and Energy of South Korea allocated 500 million to printed ink innovation as part of its July 2025 plan for flexible hybrid electronics R&D.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the thermoform-embedded electronics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

• LG Electronics

• General Electric Company

• Panasonic Corporation (Packaging Solutions)

• DuPont / DuPont Teijin Films

• Flex Ltd. (formerly Flextronics)

• Sonoco Products Company

• Klöckner Pentaplast

• Brewer Science, Inc.

• E Ink Holdings Inc.

• PragmatIC Printing Ltd.

• Shenzhen In-Mold Technology Co., Ltd.

• Mold-Tek Packaging Ltd.

• TactoTek Oy

• Thin Film Electronics ASA / Ensurge Micropower ASA

• Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Amcor launched its AmSecure APET-based thermoform solution for medical and pharmaceutical applications, delivering PETG-like clarity, durability, sterilization compatibility, dimensional stability, and a more cost-effective, sustainable option.

- In September 2025, CANNON launched its patented e-Forming thermoforming machine range at K 2025, featuring the industry’s smallest footprint and Triplo tool-change system, enhancing safety, compatibility, and efficiency in thermoform-embedded electronics manufacturing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the thermoform-embedded electronics market based on the below-mentioned segments:

Global Thermoform-Embedded Electronics Market, By Technology

- In-mould electronics & printed circuitry

- Thermoform-integrated sensors

- Printed electronics lamination

- Low-cost printed electronics

- Others

Global Thermoform-Embedded Electronics Market, By End User

- Smart food & pharma packs

- Medical & diagnostics

- Consumer electronics packaging

- Emerging smart packaging

- Appliance packaging

- High-precision electronics

Global Thermoform-Embedded Electronics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the thermoform-embedded electronics market over the forecast period?The global thermoform-embedded electronics market is projected to expand at a CAGR of 11.15% during the forecast period.

-

2. What is the market size of the thermoform-embedded electronics market?The global thermoform-embedded electronics market size is expected to grow from USD 377 million in 2024 to USD 1206 million by 2035, at a CAGR of 11.15% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the thermoform-embedded electronics market?North America is anticipated to hold the largest share of the thermoform-embedded electronics market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global thermoform-embedded electronics market?LG Electronics, General Electric Company, Panasonic Packaging (Panasonic Corporation), DuPont / DuPont Teijin Films, Flex Ltd. (Flextronics), Sonoco, Klöckner Pentaplast, Brewer Science Inc., E Ink Holdings Inc., PragmatIC Printing Ltd., Shenzhen In‑Mold Tech, Mold‑Tek, TactoTek, Thin Film Electronics ASA / Ensurge Micropower ASA, and Others.

-

5. What factors are driving the growth of the thermoform-embedded electronics market?The market is driven by rising demand for lightweight, flexible, and durable electronics, advancements in flexible and printed electronics, growing adoption in automotive, healthcare, consumer devices, and increasing IoT integration.

-

6. What are the market trends in the thermoform-embedded electronics market?Innovation and multipurpose thermoform-embedded electronic solutions are being driven by the growing integration of flexible electronics in consumer, wearable, automotive, and healthcare devices; the adoption of smart packaging; IoT-enabled products; miniaturization; and partnerships.

-

7. What are the main challenges restricting the wider adoption of the thermoform-embedded electronics market?The widespread adoption of thermoform-embedded electronics across industries is hampered by high manufacturing costs, complicated integration, restricted material compatibility, lack of standardization, durability problems, and the need for specialist knowledge.

Need help to buy this report?