Thailand Electronic Chemicals Market Size, Share, By Product Type (Solid, Gas, and Liquid), By End-User (Semiconductor & IC, PCB (Printed Circuit Boards), and Photovoltaic (PV)), and Thailand Electronic Chemicals Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsThailand Electronic Chemicals Market Insights Forecasts to 2035

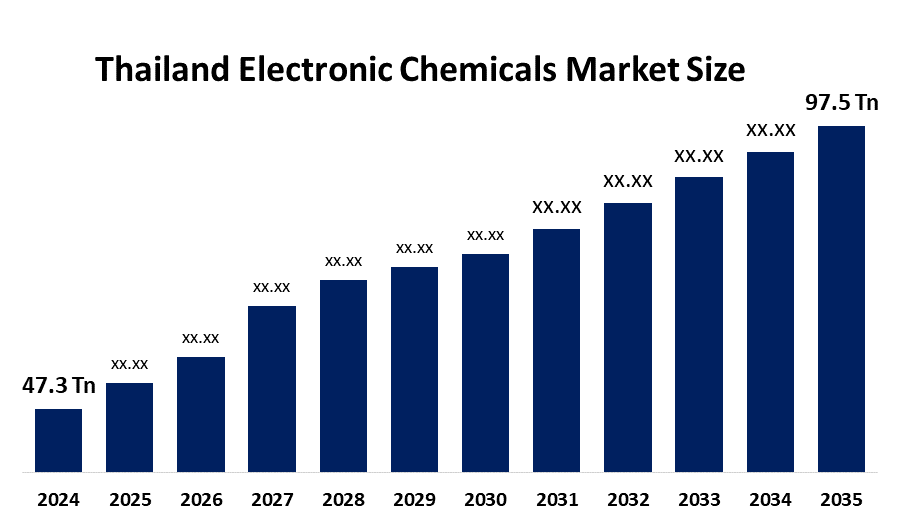

- Thailand Electronic Chemicals Market Size 2024: USD 47.3 Thousand Tonnes

- Thailand Electronic Chemicals Market Size 2035: USD 97.5 Thousand Tonnes

- Thailand Electronic Chemicals Market CAGR 2024: 6.8%

- Thailand Electronic Chemicals Market Segments: Product Type and End-User

Get more details on this report -

The production and distribution of high-purity chemicals in Thailand operates as an electronic chemicals market because these chemicals serve as essential materials for manufacturing semiconductors, printed circuit boards, display devices and electronic components in the United Arab Emirates.

MKS Instruments has begun construction on a significant chemical production facility and TechCentral project, which will be situated near Bangkok to manufacture process chemicals used in surface treatment and plating, and electronics manufacturing. The advanced laboratories for materials research and development and customer support will operate from the facility to enhance Thailand's PCB and electronics sector innovation capabilities. The company plans to start its operations during the second half of 2027.

THECA 2025 (Thailand Electronics Circuit Asia) operates as a government-backed platform that supports the complete electronics industry by providing business matchmaking and technology exhibitions, and global access to electronic materials and chemical suppliers.

The Thailand electronic chemicals market provides strong future growth potential because of semiconductor ecosystem development, smart manufacturing implementation, rising electronics demand and government support for advanced high-purity chemical production

Market Dynamics of the Thailand Electronic Chemicals Market:

The Thailand electronic chemicals market is driven by the current industrial landscape of the country experiences rapid changes because of multiple industrial diversification efforts which receive support from the government together with the expansion of semiconductor and electronics assembly operations and the increasing need for high-purity chemicals and the funding of smart factories and data centers and renewable energy systems and regional supply chain networks which operate according to national industrial policies. .

The Thailand electronic chemicals market is restrained by the country's facing multiple obstacles to semiconductor production because it has insufficient domestic manufacturing capacity, which leads to high import requirements, and it must meet strict quality requirements while facing production challenges and supply chain difficulties that arise from handling ultra-high-purity chemicals.

The future of Thailand's electronic chemicals market is bright and promising, with the country experiencing economic growth through government support for high-tech manufacturing, which attracted foreign investments and through the development of semiconductor supply chains and the market expansion of advanced chemical products with high purity standards.

Thailand Electronic Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 47.3 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.8% |

| 2035 Value Projection: | USD 97.5 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By End-User |

| Companies covered:: | PTT Global Chemical (GC), SCG Chemicals (SCGC), KCE Electronics, Bangkok Synthetics (BST), Thai Poly Chemicals, Sumitomo Chemical (Thailand), Nagase (Thailand), BASF (Thailand), Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Thailand electronic chemicals market share is classified into product type and end-user.

By Product Type:

The Thailand electronic chemicals market is divided by product type into solid, gas, and liquid. Among these, the solid segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The solid segment dominates Thailand’s electronic chemicals market due to its extensive use in semiconductor fabrication, printed circuit boards, and advanced packaging processes. Solids offer better stability, longer shelf life, and high-purity performance, while rising semiconductor investments and expanding electronics manufacturing in Thailand are expected to drive this segment’s remarkable CAGR during the forecast period.

By End-User:

The Thailand electronic chemicals market is divided by end-user into semiconductor & IC, PCB (printed circuit boards), and photovoltaic (PV). Among these, the semiconductor & IC segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This aligns with broader industry dynamics where semiconductor manufacturing accounts for the largest share of electronic chemicals demand due to intensive use of high-purity chemicals in chip fabrication and strong investments in chip capacity expansion, outpacing PCB and photovoltaic applications in growth and demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Thailand electronic chemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Thailand Electronic Chemicals Market:

- PTT Global Chemical (GC)

- SCG Chemicals (SCGC)

- KCE Electronics

- Bangkok Synthetics (BST)

- Thai Poly Chemicals

- Sumitomo Chemical (Thailand)

- Nagase (Thailand)

- BASF (Thailand)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Thailand, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Thailand electronic chemicals market based on the below-mentioned segments:

Thailand Electronic Chemicals Market, By Product Type

- Solid

- Gas

- Liquid

Thailand Electronic Chemicals Market, By End-User

- Semiconductor & IC

- PCB (Printed Circuit Boards)

- Photovoltaic (PV)

Frequently Asked Questions (FAQ)

-

Q:What is the Thailand electronic chemicals market size?A:Thailand electronic chemicals market is expected to grow from USD 47.3 thousand tonnes in 2024 to USD 97.5 thousand tonnes by 2035, growing at a CAGR of 6.8% during the forecast period 2025-2035.

-

Q:What are the key growth drivers of the market?A:Market growth is driven by the current industrial landscape of the country experiences rapid changes because of multiple industrial diversification efforts which receive support from the government together with the expansion of semiconductor and electronics assembly operations and the increasing need for high-purity chemicals and the funding of smart factories and data centers and renewable energy systems and regional supply chain networks which operate according to national industrial policies. ..

-

Q:What factors restrain the Thailand electronic chemicals market?A:Constraints include the country's facing multiple obstacles to semiconductor production because it has insufficient domestic manufacturing capacity, which leads to high import requirements, and it must meet strict quality requirements while facing production challenges and supply chain difficulties that arise from handling ultra-high-purity chemicals.

-

Q:How is the market segmented by product type?A:The market is segmented into solid, gas, and liquid.

-

Q:Who are the key players in the Thailand electronic chemicals market?A:Key companies include PTT Global Chemical (GC), SCG Chemicals (SCGC), KCE Electronics, Bangkok Synthetics (BST), Thai Poly Chemicals, Sumitomo Chemical (Thailand), Nagase (Thailand), BASF (Thailand), and Others.

-

Q:Who are the target audiences for this market report?A:The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?