Thailand Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid, and Gas), By End Use (Agriculture, Textiles, Mining, Pharmaceutical, Refrigeration, and Others), and Thailand Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsThailand Ammonia Market Insights Forecasts to 2035

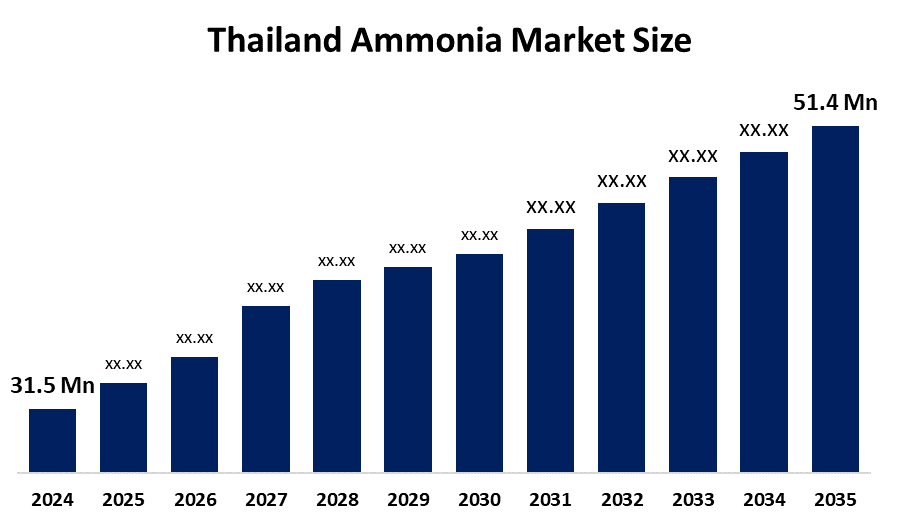

- The Thailand Ammonia Market Size Was Estimated at USD 31.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.55% from 2025 to 2035

- The Thailand Ammonia Market Size is Expected to Reach USD 51.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Thailand ammonia market size is anticipated to reach USD 51.4 million by 2035, growing at a CAGR of 4.55% from 2025 to 2035. The ammonia market in Thailand is driven by rising fertilizer demand, growing agricultural production, the expansion of the chemical and petrochemical industries, the need for wastewater treatment, and steady modernization backed by government infrastructure and sustainability programs.

Market Overview

The Thailand ammonia market encompasses all activities related to ammonia production and importation, distribution, and usage of ammonia in agricultural, industrial, and environmental sectors. Ammonia is widely used in nitrogen-based fertilizers, to produce chemical and petrochemical products, and during food processing, in refrigeration systems, wastewater treatment, and pharmaceuticals. The country of Thailand receives confirmation of its major role in the world through its agricultural needs, growing industrial base, and need for effective cooling and environmental control systems in commercial and industrial fields.

The Thai government supports agricultural development through fertilizer subsidies, which include a budget of THB 5 billion for farmer support, and it implements price controls and provides soft loans and sustainable agriculture programs to enhance fertilizer application and farming efficiency. The BCG economy model, together with hydrogen and ammonia value-chain development projects with PTT, EGAT, and ACWA Power, builds policies that establish green ammonia investment expansion.

Thailand is developing green ammonia projects through its 200,000-ton annual green ammonia supply agreement, which LTechUVC and MA Corporation Oil signed in June 2024 for $2.25 billion. Pre-feasibility studies with PTT and Mitsubishi explore 100 % ammonia gas turbine power generation. Future opportunities include green hydrogen/ammonia value chains and low-carbon power solutions.

Report Coverage

This research report categorizes the market for the Thailand ammonia market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Thailand ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Thailand ammonia market.

Thailand Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.5 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.55% |

| 2035 Value Projection: | USD 51.4 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | By Type,By End Use |

| Companies covered:: | Unique Gas and Petrochemicals Public Co. Ltd. Sumitronics Thailand Co. Ltd. KAO Industrial Thailand Co. Ltd. Practicum Engineering Co. Ltd. Thai Central Chemical Public Company Limited (TCCC) Thai Nitrate Co. Ltd. U V Holding Thailand Co. Ltd. Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ammonia market in Thailand is driven by the strong agricultural sector demand, which requires nitrogen-based fertilizers and receives support from government fertilizer subsidy programs and food-security initiatives. The demand for ammonia increases due to chemical and petrochemical manufacturing growth, ammonia applications in refrigeration and wastewater treatment, and the ongoing expansion of industrial activities. The BCG economic model enables Thailand to pursue clean energy goals through state-owned and private enterprise green ammonia and hydrogen projects, which will drive market development for the long term.

Restraining Factors

The ammonia market in Thailand is mostly constrained by its need to import ammonia, its sensitivity to international ammonia and natural gas price fluctuations, its compliance with strict environmental and safety standards, its expensive storage and transportation requirements, and its lack of sufficient domestic production capabilities.

Market Segmentation

The Thailand ammonia market share is classified into type and end use.

- The liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Thailand ammonia market is segmented by type into liquid, and gas. Among these, the liquid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its widespread usage in fertilizer manufacture, ease of storage and bulk transportation, and strong demand from the chemical, agricultural, and refrigeration industries all contribute to its supremacy. Higher consumption volumes are guaranteed by liquid ammonia's efficiency in large-scale applications, which yields the highest revenue share and a robust growth prognosis.

- The agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Thailand ammonia market is segmented by end use into agriculture, textiles, mining, pharmaceutical, refrigeration, and others. Among these, the agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Ammonia's vital function in the creation of nitrogen-based fertilizer, which sustains Thailand's sizable agricultural sector and food-export economy, accounts for this dominance. High ammonia consumption is fueled by ongoing fertilizer demand, government assistance programs for farmers, and the desire to increase agricultural yields, guaranteeing this market segment the biggest market share and robust future growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Thailand ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unique Gas and Petrochemicals Public Co. Ltd.

- Sumitronics Thailand Co. Ltd.

- KAO Industrial Thailand Co. Ltd.

- Practicum Engineering Co. Ltd.

- Thai Central Chemical Public Company Limited (TCCC)

- Thai Nitrate Co. Ltd.

- U V Holding Thailand Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In January 2025, to construct a 1 Mtpa green ammonia facility with Thailand as a main market, Oman, South Korea, and Thailand inked a tripartite green ammonia project agreement.

- In June 2024, in Bangkok, LTechUVC and MA Corporation Oil agree to sell green ammonia to Thailand at a rate of 200,000 tons per year for 15 years (a total of 3 million tons, or around $2.25 billion).

Market Segment

This study forecasts revenue at the Thailand, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Thailand ammonia market based on the below-mentioned segments:

Thailand Ammonia Market, By Type

- Liquid

- Gas

Thailand Ammonia Market, By End Use

- Agriculture

- Textiles

- Mining

- Pharmaceutical

- Refrigeration

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Thailand ammonia market size?A: Thailand ammonia market size is expected to grow from USD 31.5 million in 2024 to USD 51.4 million by 2035, growing at a CAGR of 4.55% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the strong agricultural sector demand, which requires nitrogen-based fertilizers and receives support from government fertilizer subsidy programs and food-security initiatives.

-

Q: What factors restrain the Thailand ammonia market?A: Constraints include its need to import ammonia, its sensitivity to international ammonia and natural gas price fluctuations.

-

Q: How is the market segmented by type?A: The market is segmented into liquid, and gas.

-

Q: Who are the key players in the Thailand ammonia market?A: Key companies include Unique Gas and Petrochemicals Public Co. Ltd., Sumitronics Thailand Co. Ltd., KAO Industrial Thailand Co. Ltd., Practicum Engineering Co. Ltd., Thai Central Chemical Public Company Limited (TCCC), Thai Nitrate Co. Ltd., U V Holding Thailand Co. Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?