Global Tank Insulation Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Fiberglass Insulation, Foam Insulation, Mineral Wool Insulation), By Tank Type (Aboveground Tanks, Underground Tanks), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Tank Insulation Market Size Insights Forecasts to 2035

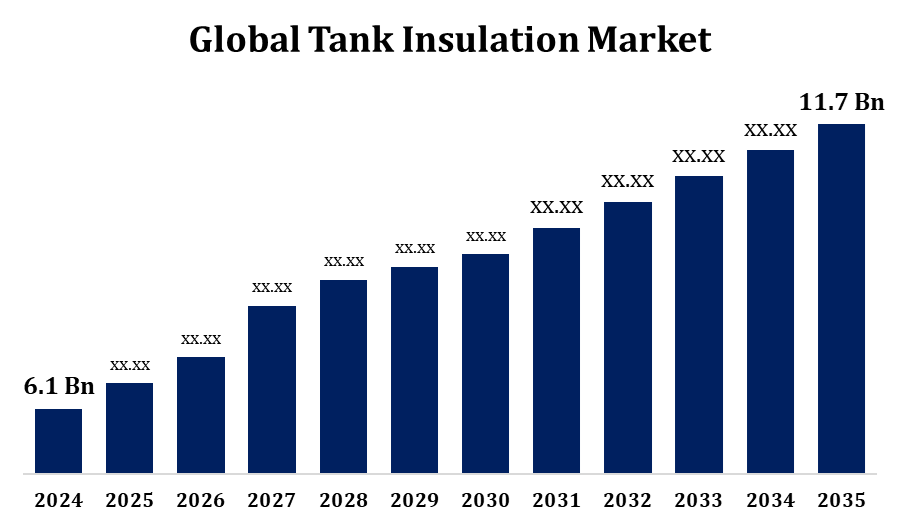

- The Global Tank Insulation Market Size Was Valued at USD 6.1 Billion in 2024.

- The Market Size is Growing at a CAGR of 6.73% from 2025 to 2035.

- The Worldwide Tank Insulation Market Size is Expected to reach USD 11.7 Billion by 2035.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Tank Insulation Market Size is Expected to reach USD 11.7 Billion by 2035, at a CAGR of 6.73% During The Forecast Period 2025 to 2035.

The tank insulation market is witnessing steady growth due to increasing demand for energy efficiency and temperature control across various industries. Key sectors such as oil & gas, chemicals, food & beverage, and power generation rely heavily on insulated storage tanks to minimize energy loss and ensure product integrity. Tank insulation is used for both cold and hot applications, depending on the stored material, and helps maintain consistent internal temperatures regardless of external conditions. Materials like polyurethane foam, rockwool, fiberglass, and elastomeric foam are widely used for their thermal resistance and durability. The Asia-Pacific region leads the market, driven by industrial expansion and infrastructure development, particularly in China and India. Additionally, advancements in sustainable insulation materials and smart insulation technologies are shaping the future of the industry.

Tank Insulation Market Value Chain Analysis

The tank insulation market value chain comprises several interconnected stages, starting with raw material suppliers providing insulation materials such as polyurethane foam, fiberglass, rockwool, and elastomeric foam. These materials are then processed by insulation manufacturers who design and produce insulation systems tailored for different tank types and industrial needs. Fabricators and engineering firms integrate these systems into tank designs, ensuring thermal efficiency and compliance with industry standards. Distributors and logistics partners facilitate the delivery of insulation products to end users, including industries like oil & gas, chemicals, food & beverage, and energy. Installation contractors play a crucial role in applying insulation on-site, often in coordination with maintenance teams. The chain concludes with end users benefiting from reduced energy loss, safety compliance, and improved operational performance. Innovation and sustainability influence each stage of this value chain.

Tank Insulation Market Opportunity Analysis

The tank insulation market presents significant growth opportunities driven by advancements in materials, digital technologies, and evolving industrial needs. Emerging insulation materials such as aerogels, vacuum panels, and bio-based foams offer enhanced thermal performance, durability, and sustainability, appealing to sectors with stringent efficiency requirements. The integration of smart technologies, including real-time monitoring and predictive maintenance systems, is gaining momentum as industries prioritize energy savings and operational control. Growing industrialization, particularly in the Asia-Pacific region, is fueling demand across sectors like chemicals, food & beverage, and renewable energy storage. Additionally, stricter environmental regulations are encouraging the adoption of eco-friendly and non-toxic insulation solutions. Companies investing in innovation, sustainability, and regional diversification are well-positioned to leverage these market trends and tap into a wide range of high-value applications.

Global Tank Insulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.73% |

| 2035 Value Projection: | USD 11.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Material Type, By Tank Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Johns Manville, Omkar Puf Insulation Pvt. Ltd., Isolatie Combinatie Beverwijk B.V., Rockwool International A/S, Cabot Corporation, Owens Corning, Saint-Gobain, Kingspan Group, Armacell International S.A., Knauf Insulation, Covestro AG, and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Tank Insulation Market Dynamics

The increasing focus on enhancing energy efficiency and promoting sustainability across diverse industries

The tank insulation market is experiencing steady growth, largely driven by the increasing focus on enhancing energy efficiency and promoting sustainability across diverse industries. Sectors such as oil & gas, chemicals, food & beverage, and energy are adopting advanced insulation solutions to reduce energy loss, lower operational costs, and comply with environmental regulations. Modern insulation materials like polyurethane foam, fiberglass, and rockwool provide effective thermal resistance and help maintain stable temperatures, improving safety and efficiency. Additionally, the rising adoption of renewable energy and cryogenic storage systems further boosts demand for high-performance insulation. Governments and industry bodies are also encouraging sustainable practices, prompting the use of eco-friendly, non-toxic, and recyclable insulation materials. These trends, combined with ongoing industrialization and infrastructure development especially in emerging markets are creating long-term opportunities for innovation and expansion in the tank insulation market.

Restraints & Challenges

One major concern is the high initial investment required for quality insulation materials and installation, which can be a barrier for small and medium-sized enterprises. Additionally, the installation process is often complex and labor-intensive, requiring skilled professionals who are in limited supply. Fluctuations in raw material prices, particularly for petrochemical-based products like polyurethane and fiberglass, can impact production costs and profit margins. The market also contends with evolving environmental and safety regulations, which demand continual adjustments in product standards and compliance measures. Moreover, competition from alternative insulation technologies such as spray coatings and inflatable systems presents a challenge, as these options may offer easier application or lower upfront costs, making them attractive substitutes in certain applications.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Tank Insulation Market from 2025 to 2035. Key industries such as oil & gas, LNG, chemicals, and power generation are major consumers of tank insulation, with growing demand for both hot and cold storage applications. The region sees high adoption of polyurethane foam due to its superior thermal performance and moisture resistance. Technological advancements, including smart insulation systems with real-time monitoring capabilities, are increasingly being implemented to enhance operational efficiency. Canada and Mexico are also witnessing growth, supported by rising investments in LNG infrastructure and petrochemicals.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. China dominates the regional landscape, supported by large-scale investments in petrochemical facilities, LNG terminals, and cold-chain logistics. Other key markets like India, Japan, South Korea, and Southeast Asian countries are also witnessing strong growth, driven by expanding industrial activity and stricter energy efficiency regulations. Widely used insulation materials include elastomeric foam for cryogenic applications and polyurethane for both hot and cold storage due to their effective thermal properties. Additionally, the availability of cost-effective local materials like fiberglass and mineral wool makes insulation more accessible. This combination of industrial momentum and policy support positions Asia-Pacific as a major contributor to global market expansion.

Segmentation Analysis

Insights by Material Type

The fiberglass insulation segment accounted for the largest market share over the forecast period 2025 to 2035. Known for its excellent thermal resistance and structural rigidity, fiberglass is particularly well-suited for insulating large or irregularly shaped tanks. It effectively minimizes heat transfer, making it ideal for both hot and cryogenic storage applications. Its strong resistance to chemical exposure especially in harsh environments like oil, gas, and chemical processing adds to its appeal. Moreover, its affordability compared to some advanced materials makes it a preferred choice for industries seeking efficient yet economical insulation solutions. As industries increasingly focus on energy conservation and regulatory compliance, the demand for fiberglass insulation is expected to grow, driven by its balanced performance, durability, and widespread availability.

Insights by Tank Type

The aboveground tanks segment accounted for the largest market share over the forecast period 2025 to 2035. These tanks are widely used in industries such as oil & gas, chemicals, power generation, and food & beverage, where effective insulation is essential to reduce heat transfer, maintain product integrity, and ensure safety. Materials like polyurethane and elastomeric foam are increasingly favored for their excellent thermal performance and ease of application on large, vertical surfaces. Additionally, the adoption of smart insulation technologies is enhancing real-time monitoring and operational efficiency, especially for tanks exposed to varying environmental conditions. As infrastructure development accelerates across both developed and emerging markets, the demand for insulated aboveground storage tanks continues to rise, supported by regulatory mandates and growing awareness of energy conservation.

Recent Market Developments

- In December 2021, Saint-Gobain has acquired 100% ownership of Rockwool India Pvt Ltd., a key stone wool manufacturer in India, from the Alghanim Group. Rockwool India offers a comprehensive range of insulation solutions focused on thermal insulation, fire safety, and acoustic performance.

Competitive Landscape

Major players in the market

- BASF SE

- Johns Manville

- Omkar Puf Insulation Pvt. Ltd.

- Isolatie Combinatie Beverwijk B.V.

- Rockwool International A/S

- Cabot Corporation

- Owens Corning

- Saint-Gobain

- Kingspan Group

- Armacell International S.A.

- Knauf Insulation

- Covestro AG

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Tank Insulation Market, Material Type Analysis

- Fiberglass Insulation

- Foam Insulation

- Mineral Wool Insulation

Tank Insulation Market, Tank Type Analysis

- Aboveground Tanks

- Underground Tanks

Tank Insulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Tank Insulation Market?The global Tank Insulation Market is expected to grow from USD 6.1 billion in 2024 to USD 11.7 billion by 2035, at a CAGR of 6.73% during the forecast period 2025-2035.

-

2. Who are the key market players of the Tank Insulation Market?Some of the key market players of the market are BASF SE, Johns Manville, Omkar Puf Insulation Pvt. Ltd., Isolatie Combinatie Beverwijk B.V., Rockwool International A/S, Cabot Corporation, Owens Corning, Saint-Gobain, Kingspan Group, Armacell International S.A., Knauf Insulation, and Covestro AG.

-

3. Which segment holds the largest market share?The aboveground tanks segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?