Taiwan Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Product Form (Anhydrous Ammonia, Aqueous Ammonia, and Ammonium Compounds), By End Use (Agriculture, Chemical & Petrochemical, Food & Beverage, Mining & Metallurgy, Energy & Utilities, and Others), and Taiwan Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsTaiwan Ammonia Market Insights Forecasts to 2035

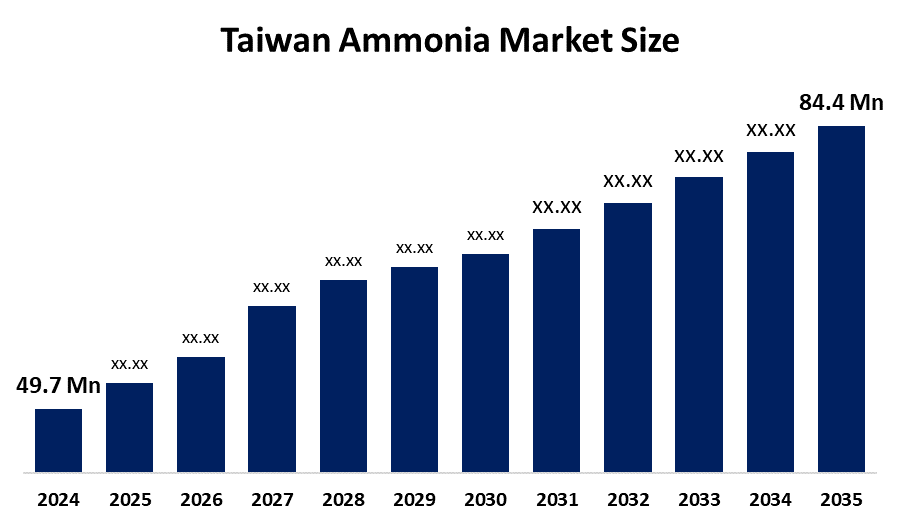

- The Taiwan Ammonia Market Size Was Estimated at USD 49.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.93% from 2025 to 2035

- The Taiwan Ammonia Market Size is Expected to Reach USD 84.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Taiwan ammonia market size is anticipated to reach USD 84.4 million by 2035, growing at a CAGR of 4.93% from 2025 to 2035. The ammonia market in Taiwan is driven by rising fertilizer demand, robust growth in semiconductor and chemical production, growing wastewater treatment requirements, energy transition programs, and consistent industrial expansion backed by government infrastructure investments.

Market Overview

The Taiwan ammonia market includes all activities that involve producing ammonia, distributing it, and using it as an essential industrial chemical and energy resource. Ammonia functions as a vital component in various industries, which include fertilizer production, semiconductor manufacturing, chemical processing, wastewater management, refrigeration, and food storage. The advanced electronics industry, strong agricultural support activities, and rising use of ammonia for environmental management and clean energy transition projects make ammonia vital to Taiwans development.

Taiwans government uses its 2050 net zero policy to assist the ammonia market by designating ammonia as a hydrogen carrier and clean fuel. The initiatives involve Taiwan Fertilizer expanding its ammonia storage capacity and semiconductor companies implementing low carbon ammonia and public-private agreements for fuel-ammonia value-chain development.

Taiwans Green Harvest and Amogy partnered in July 2025 to deploy the first ever ammonia to power system, which converts ammonia into hydrogen for industrial decarbonization, with installation planned for late 2026 or early 2027. The achievement enables clean energy implementation while creating new possibilities for developing low carbon power systems and hydrogen infrastructure.

Report Coverage

This research report categorizes the market for the Taiwan ammonia market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Taiwan ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the Taiwan ammonia market.

Taiwan Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 49.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.93% |

| 2035 Value Projection: | USD 84.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Form, By End Use |

| Companies covered:: | Taiwan Fertilizer Co., Ltd,Moler Chemical Enterprise Co., Ltd,Linde Lienhwa Industrial Gases Co. Ltd,Chan Sieh Enterprises Co. Ltd,TSMC Taiwan Semiconductor Manufacturing Co,Various industrial chemical distributors in Taiwan And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The ammonia market in Taiwan is driven by the rising fertilizer needs for domestic agricultural needs, the expansion of semiconductor and chemical production facilities, and industrial wastewater treatment and refrigeration systems. The market growth receives support from government policies, which encourage low carbon energy transition through ammonia hydrogen carrier research and from storage infrastructure investments, clean-energy technology development, and export targeted industrial expansion. The worldwide need for clean ammonia, together with Taiwan's commitment to decarbonization, creates ongoing business development possibilities for clean ammonia production.

Restraining Factors

The ammonia market in Taiwan is mostly constrained by the expensive production expenses and high operational costs, and because of strict environmental regulations and safety regulations, insufficient domestic feedstock resources, and the need to import materials, global ammonia prices experience price fluctuations, which affect market development and investment capacity.

Market Segmentation

The Taiwan ammonia market share is classified into product form and end use.

- The anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Taiwan ammonia market is segmented by product form into anhydrous ammonia, aqueous ammonia, and ammonium compounds. Among these, the anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its high nitrogen concentration, which makes it perfect for energy applications, industrial chemical synthesis, and fertilizer manufacture, accounts for its domination. The greatest revenue share and steady market expansion are fueled by its effectiveness in large-scale industrial and agricultural applications as well as its ease of storage and transportation for high-volume activities.

- The agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The Taiwan ammonia market is segmented by end use into agriculture, chemical petrochemical, food & beverage, mining metallurgy, energy utilities, and others. Among these, the agriculture segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The widespread use of ammonia in nitrogen based fertilizers, which are essential for maintaining Taiwans agricultural productivity and food security, is what propels this dominance. Ammonias effectiveness in large scale fertilizer production, government backing for modern farming, and steady domestic demand all contribute to this segment's dominant market share and steady growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the Taiwan ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Taiwan Fertilizer Co., Ltd.

- Moler Chemical Enterprise Co., Ltd.

- Linde Lienhwa Industrial Gases Co. Ltd.

- Chan Sieh Enterprises Co. Ltd.

- TSMC Taiwan Semiconductor Manufacturing Co.

- Various industrial chemical distributors in Taiwan

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In December 2025, Taiwan Fertilizer TFC increased its blue ammonia exports during 2025 to provide support for the green semiconductor supply chain, while the company expects additional volume increases in 2026.

- In July 2025, Amogy and GreenHarvest established a partnership to launch Taiwan's first ammonia to power system, which transforms ammonia into hydrogen for industrial decarbonization purposes; the pilot project will begin installation between late 2026 and early 2027.

- In August 2024, Mitsubishi Heavy Industries and Taiwan Fertilizer Co., TFC, signed an MoU to study developing a fuel ammonia value chain in Taiwan, supporting net zero goals.

Market Segment

This study forecasts revenue at the Taiwan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Taiwan ammonia market based on the below-mentioned segments:

Taiwan Ammonia Market, By Product Form

- Anhydrous Ammonia

- Aqueous Ammonia

- Ammonium Compounds

Taiwan Ammonia Market, By End Use

- Agriculture

- Chemical & Petrochemical

- Food & Beverage

- Mining & Metallurgy

- Energy & Utilities

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Taiwan ammonia market size?A: Taiwan ammonia market size is expected to grow from USD 49.7 million in 2024 to USD 84.4 million by 2035, growing at a CAGR of 4.93% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising fertilizer needs for domestic agricultural needs, the expansion of semiconductor and chemical production facilities, and industrial wastewater treatment and refrigeration systems.

-

Q: What factors restrain the Taiwan ammonia market?A: Constraints include the expensive production expenses and high operational costs, as well as strict environmental regulations and safety regulations.

-

Q: How is the market segmented by product form?A: The market is segmented into anhydrous ammonia, aqueous ammonia, and ammonium compounds.

-

Q: Who are the key players in the Taiwan ammonia market?A: Key companies include Taiwan Fertilizer Co., Ltd., Moler Chemical Enterprise Co., Ltd., Linde Lienhwa Industrial Gases Co., Ltd., Chan Sieh Enterprises Co., Ltd., TSMC (Taiwan Semiconductor Manufacturing Co.), Various industrial chemical distributors in Taiwan, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?