Global Tabular Alumina Market Size, Share, and COVID-19 Impact Analysis, By Type (Coarse and Fine), By Application (Refractories, Ceramics, Glass, Metallurgy, and Specialty Chemicals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Tabular Alumina Market Insights Forecasts to 2035

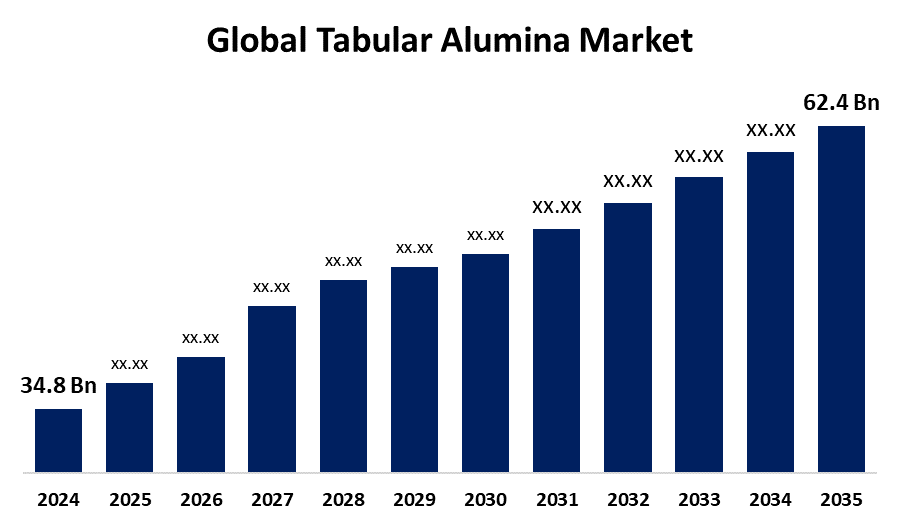

- The Global Tabular Alumina Market Size Was Estimated at USD 34.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.45% from 2025 to 2035

- The Worldwide Tabular Alumina Market Size is Expected to Reach USD 62.4 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global tabular alumina market size was worth around USD 34.8 billion in 2024 and is predicted to grow to around USD 62.4 billion by 2035 with a compound annual growth rate (CAGR) of 5.45% from 2025 to 2035. An increasing demand for tabular alumina across various end-user industries, along with the emphasis on innovation and improvement in the properties of tabular alumina, is driving the tabular alumina market globally.

Market Overview

The tabular alumina market refers to the market encompassing the production, distribution, and application of tabular alumina, a high-purity, sintered alpha alumina with a unique crystalline structure. Tabular alumina is a refractory material made from aluminium oxide, produced by sintering ball-formed calcined alumina. There is an increasing use of tabular alumina in adsorbents and desiccants driven by an increasing demand from automotive, process industries, and water treatment. Furthermore, tabular alumina is in high demand in the end-use categories, including construction, oil & gas, pharmaceutical, and water treatment plants. The growing need for high-performance materials across emerging industries like renewable energy, aerospace, and electronics is driving the demand for tabular alumina. Furthermore, the growing inclination towards sustainability and greener energy solutions is escalating the market growth opportunities for tabular alumina.

Report Coverage

This research report categorizes the tabular alumina market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the tabular alumina market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the tabular alumina market.

Tabular Alumina Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 34.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.45% |

| 2035 Value Projection: | USD 62.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Almatis BV, AluChem Inc., Zibo Biz-Harmony International Co. Ltd., Bisley & Company Pty. Ltd., Imerys, KT Refractories US Co., Luoyang Zhongsen Refractory Co., Possehl Erzkontor GmbH & Co. KG, Ransom & Randolph Co., SILKEM Doo, Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The use of tabular alumina in the steel industry for the production of refractory linings for steel-making furnaces and ladles is driving the market growth. Several advantages of tabular alumina include high thermo-mechanical strength, chemical stability, high thermal shock resistance, high abrasion resistance, and consistent properties are responsible for driving the market. Further, the optimization of production techniques for enhancing the product quality, cost-effectiveness, and sustainability is contributing to propelling the market growth for tabular alumina.

Restraining Factors

The heightened production cost of tabular alumina and restricted supply of raw materials are hampering the market of tabular alumina. Further, the increasing competition among key market players is challenging the market growth.

Market Segmentation

The tabular alumina market share is classified into type and application.

- The coarse segment accounted for the largest share of the tabular alumina market in 2023 and is anticipated to grow at a significant CAGR during the projected period.

Based on the type, the tabular alumina market is divided into coarse and fine. Among these, the coarse segment accounted for the largest share of the tabular alumina market in 2023 and is anticipated to grow at a significant CAGR during the projected period. Coarse aggregates of tabular alumina with particle sizes above 10 mm are used in the refractory industry, including monolithic refractory products. The widespread use of coarse tabular alumina in the production of refractory materials, especially in the steel and cement industries, is responsible for driving the market growth in the coarse segment.

- The refractories segment dominated the tabular alumina market with a major revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the tabular alumina market is divided into refractories, ceramics, glass, metallurgy, and specialty chemicals. Among these, the refractories segment dominated the tabular alumina market with a major revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Tabular alumina is increasingly used for applications including steel, foundries, petrochemistry, and ceramics. The growing use of tabular alumina as a crucial raw material in the refractories sector, along with growing industrialization and infrastructure development, is driving the market growth in the refractories segment.

Regional Segment Analysis of the Tabular Alumina Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the tabular alumina market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the tabular alumina market over the predicted timeframe. The region’s expanding digital economy, growing smartphone penetration, and adoption of cloud-based technologies are contributing to driving the tabular alumina market growth. An increasing demand for tabular alumina across major industries, including aerospace, automotive, and construction, is propelling the market demand. The presence of cleaner and greener industries in the region is driving up the uptake of new technologies in alumina production, which thereby contributing to the market growth of tabular alumina.

Asia Pacific is expected to grow at a rapid CAGR in the tabular alumina market during the forecast period. The region’s strong demand for tabular alumina from steel manufacturing and aluminum production industries is driving the regional market demand for tabular alumina. The growing infrastructure investments, including building, transportation, and urban expansion, which drive up the demand for construction materials like refractories, ceramics, and abrasives, resulting in propelling the tabular alumina market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the tabular alumina market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Almatis BV

- AluChem Inc.

- Zibo Biz-Harmony International Co. Ltd.

- Bisley & Company Pty. Ltd.

- Imerys

- KT Refractories US Co.

- Luoyang Zhongsen Refractory Co.

- Possehl Erzkontor GmbH & Co. KG

- Ransom & Randolph Co.

- SILKEM Doo

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, Almatis introduced low-carbon tabular alumina, the same alumina, nearly 15% lighter, aligning with its commitment to sustainability. This breakthrough reduces the carbon footprint from 1.1 to 0.9 Mt CO2e/Mt alumina, achieving a remarkable 13% CO2e reduction.

- In November 2022, Almantis, a group company of OYAK, celebrated the official opening of its fully integrated tabular alumina facility in Falta, India. The inauguration was announced by OYAK through a press release on their website.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the tabular alumina market based on the below-mentioned segments:

Global Tabular Alumina Market, By Type

- Coarse

- Fine

Global Tabular Alumina Market, By Application

- Refractories

- Ceramics

- Glass

- Metallurgy

- Specialty Chemicals

Global Tabular Alumina Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the tabular alumina market over the forecast period?The global tabular alumina market is projected to expand at a CAGR of 5.45% during the forecast period.

-

2. What is the market size of the tabular alumina market?The global tabular alumina market size is expected to grow from USD 34.8 Billion in 2024 to USD 62.4 Billion by 2035, at a CAGR of 5.45% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the tabular alumina market?North America is anticipated to hold the largest share of the tabular alumina market over the predicted timeframe.

Need help to buy this report?