Global Systems Administration Management Tools Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (Cloud Based and On-Premise), By Application (System Performance Monitoring, Capacity Planning, Customers Reporting, Application Monitoring, Infrastructure Monitoring, and Others), By End User (Government, Manufacturing, IT & Telecom, Healthcare, Retail, Logistics, Financial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Systems Administration Management Tools Market Insights Forecasts to 2035

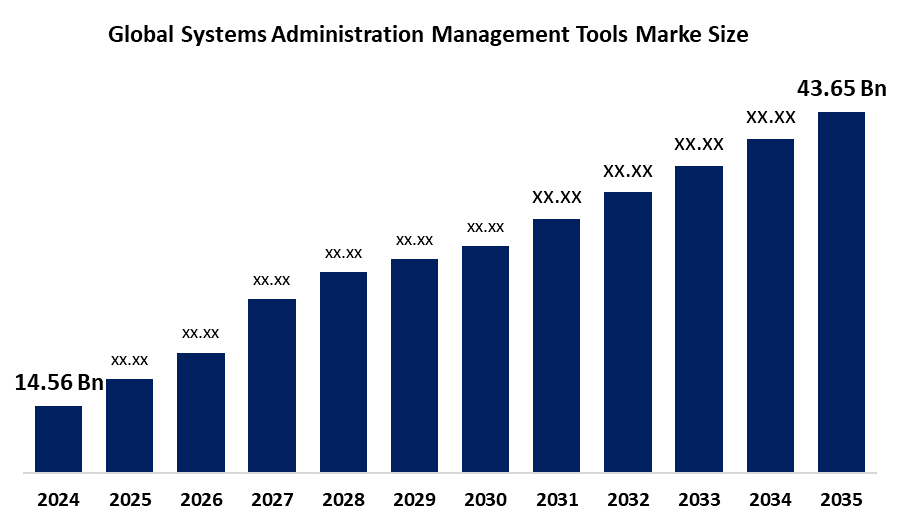

- The Global Systems Administration Management Tools Market Size Was Estimated at USD 14.56 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.5% from 2025 to 2035

- The Worldwide Systems Administration Management Tools Market Size is Expected to Reach USD 43.65 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global systems administration management tools market size was worth around USD 14.56 billion in 2024 and is predicted to grow to around USD 43.65 billion by 2035 with a compound annual growth rate (CAGR) of 10.5% from 2025 to 2035. The market for systems administration management tools is expanding, due to the rising use of cloud computing, the growing requirement for automation and AI and the necessity to efficiently handle intricate distributed IT infrastructures.

Market Overview

The worldwide systems administration management tools (SAMTs) market refers to software applications that assist IT teams in managing and governing their infrastructure through one centralized platform. These tools facilitate the automation of operations such as patching and configuration tracking, system performance and security and maintain compliance across varied, frequently hybrid IT settings. Major factors driving the market include the rising complexity of IT, the swift adoption of cloud computing and hybrid work arrangements, and the heightened focus on IT governance and data protection laws, such as GDPR and HIPAA. Market opportunities exist in incorporating AI/ML for analytics and creating more intuitive interfaces, along with strong cross-platform compatibility to efficiently handle both legacy and contemporary cloud systems. Leading companies in the market, such as IBM, Microsoft, Oracle, SolarWinds, ManageEngine, BMC Software and ServiceNow, are consistently enhancing their products to address these changing needs. The EU’s Digital Operational Resilience Act (DORA) was fully implemented on January 17 2025, creating a structure for digital resilience. Financial entities and essential ICT providers are required to handle technology risks, encompassing governance, supervision of parties, resilience assessments and incident notification affecting service providers, within the EU and worldwide.

Report Coverage

This research report categorizes the systems administration management tools market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the systems administration management tools market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the systems administration management tools market.

Global Systems Administration Management Tools Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.56 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 10.5% |

| 2035 Value Projection: | USD 43.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Microsoft, IBM, SAP, Oracle, SolarWinds, Atlassian, BMC Software, Broadcom, Hewlett-Packard, ManageEngine, Cisco Systems, Inc., VMware, Inc., ServiceNow, HCL Technologies & Infosys,and other players Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for global systems administration management tools is propelled by the growing need for IT infrastructure management, automation and monitoring within enterprises. Companies look for solutions to oversee servers, networks, applications and cloud platforms, guaranteeing optimal performance, security and availability. The expansion of transformation efforts increased cloud computing adoption, and the spread of intricate IT environments stimulates market development. Furthermore, the demand for real-time analytics, predictive upkeep and adherence to requirements drives companies to invest in sophisticated management solutions. The ability to scale manage remotely. Maintaining cost-effectiveness also boosts adoption, aiding the growth of the worldwide market.

Restraining Factors

The main restraining factors in the global systems administration management tools market are high implementation and integration costs, significant data security and privacy concerns, and a shortage of skilled IT professionals. Additionally, user resistance to new technology adoption and the complexity of integrating with diverse legacy systems hinder market growth.

Market Segmentation

The systems administration management tools market share is classified into deployment type, application, and end user.

- The cloud based segment dominated the market in 2024, approximately 62% and is projected to grow at a substantial CAGR during the forecast period.

Based on the deployment type, the systems administration management tools market is divided into cloud based and on-premise. Among these, the cloud based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Cloud-based deployment leads due to its on-demand infrastructure handling and lower upfront and upkeep costs. Companies are progressively opting for solutions for remote management, ongoing updates and seamless third-party service integration. Consolidated patching, onboarding and usage-based pricing also enhance its appeal, establishing cloud deployment as the favored option for dynamic contemporary IT settings.

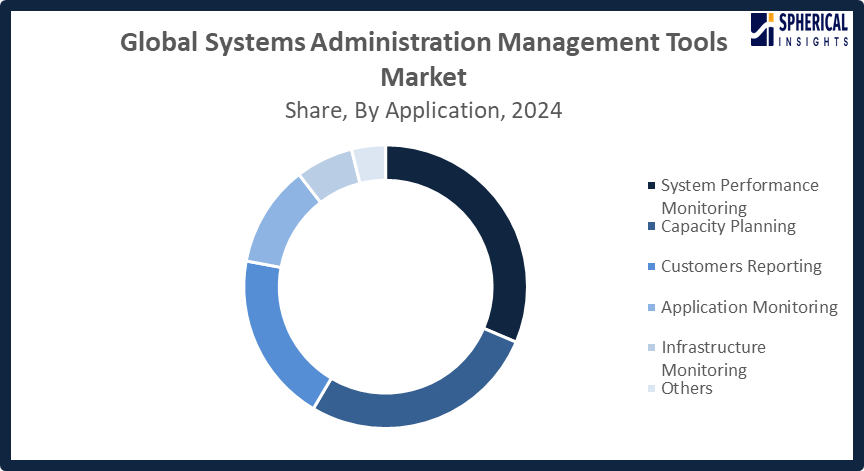

- The system performance monitoring segment accounted for the largest share in 2024, approximately 31% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the systems administration management tools market is divided into system performance monitoring, capacity planning, customers reporting, application monitoring, infrastructure monitoring, and others. Among these, the system performance monitoring segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment for system performance monitoring dominated due to the increasing need for real-time insights into servers, networks and applications. Companies are progressively dependent on these solutions to avoid downtime, enhance resource use, and uphold service-level commitments. The expansion of cloud platforms, hybrid systems and digital transformation efforts further boosts adoption, rendering performance monitoring for dependable IT operations.

Get more details on this report -

- The IT & telecom segment accounted for the highest market revenue in 2024, approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the systems administration management tools market is divided into government, manufacturing, IT & telecom, healthcare, retail, logistics, financial, and others. Among these, the IT & telecom segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment market growth is due to its reliance on large, complex, and constantly evolving digital infrastructures. Rising data traffic, widespread cloud adoption, 5G expansion, and the need for uninterrupted network performance drive demand for advanced system administration tools. These solutions enhance automation, cybersecurity, and service reliability, making them essential for telecom and technology providers.

Regional Segment Analysis of the Systems Administration Management Tools Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the systems administration management tools market over the predicted timeframe.

North America is anticipated to hold the largest share of the systems administration management tools market over the predicted timeframe. North America is expected to dominate the systems administration management tools market, with an approximate market share of 38%, propelled by IT infrastructure, widespread cloud adoption and heightened cybersecurity consciousness. The United States is at the forefront, bolstered by technology companies, hyperscale data centers and government modernization initiatives. Increasing need for management, performance tracking and compliance-oriented tools further reinforces its dominance. In October 2024, the US Technology Modernization Fund allocated $50.2 million to enhance services covering HUD identity management and SSA modernization initiatives, with digital forms, improved communication systems and AI-supported disability claim handling, fostering more agile and efficient government functions.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the systems administration management tools market during the forecast period. The Asia Pacific region is anticipated to have a 22% market share, expansion in the systems administration management tools sector due to rapid digital transformation, growing IT and telecom infrastructure, and increasing cloud adoption. China and India lead the way, driven by transformation in businesses, growth in e-commerce and government digital initiatives. Increasing investments in automation, cybersecurity and data center enhancements are driving demand. In 2024, programs such as India’s MeghRaj/GI-Cloud have increased usage and centralized digital frameworks, heightening the requirement for automated infrastructure management, monitoring and compliance solutions to guarantee secure, efficient and scalable cloud operations throughout the region.

Europe is witnessing steady growth in the systems administration management tools market, driven by strict cybersecurity regulations, cloud migration, and digital transformation. Germany, the UK, and France lead, supported by enterprise IT spending and data-center expansion. The EU’s 2024 NIS2 Directive broadens cybersecurity rules, requiring 24-hour incident reporting, supply-chain due diligence, and risk management. This drives adoption of advanced monitoring, automation, and management tools to ensure compliance, operational resilience, and secure IT infrastructure across enterprises.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the systems administration management tools market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Microsoft

- IBM

- SAP

- Oracle

- SolarWinds

- Atlassian

- BMC Software

- Broadcom

- Hewlett-Packard

- ManageEngine

- Cisco Systems, Inc.

- VMware, Inc.

- ServiceNow

- HCL Technologies & Infosys

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, IBM unveiled new capabilities across its software and infrastructure portfolios to help enterprises operationalize AI. Designed to overcome hybrid environment fragmentation, data quality issues, and limited AI readiness, these updates enable businesses to integrate AI into core workflows, moving beyond experimentation to achieve measurable productivity gains.

- In June 2025, Broadcom announced the general availability of the upgraded VMware Tanzu CloudHealth, featuring AI-powered tools like Intelligent Assist and Smart Summary. The enhanced platform delivers accurate data and actionable insights for FinOps teams, improving financial operations, investment alignment, and decision-making across enterprises.

- In March 2025, IBM announced IBM Storage Ceph as a Service, expanding its flexible as-a-service on-premises infrastructure portfolio. Alongside IBM Power as a Service, the offering provides distributed computing with new form factors and adaptable consumption options, enhancing enterprise IT flexibility and scalability.

- In October 2024, SolarWinds launched the next-generation SolarWinds Observability, offering enhanced IT management and monitoring capabilities, now available in both self-hosted and SaaS options, delivering flexible, secure, and powerful observability solutions for enterprises.

- In August 2024, Hitachi Vantara and Broadcom unveiled a new private and hybrid cloud solution, combining Hitachi’s Unified Compute Platform RS with VMware Cloud Foundation. The co-engineered platform helps organizations manage growing data volumes and meet increasing AI infrastructure demands efficiently and securely.

- In April 2024, SolarWinds introduced a consultative approach to enhance enterprise IT service management (ITSM) solutions, delivering maximum value without the high costs or staffing demands of traditional IT consultancy, reinforcing its position as a leader in secure, powerful IT management software.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the systems administration management tools market based on the below-mentioned segments:

Global Systems Administration Management Tools Market, By Deployment Type

- Cloud Based

- On-Premise

Global Systems Administration Management Tools Market, By Application

- System Performance Monitoring

- Capacity Planning

- Customers Reporting

- Application Monitoring

- Infrastructure Monitoring

- Others

Global Systems Administration Management Tools Market, By End User

- Government

- Manufacturing

- IT & Telecom

- Healthcare

- Retail

- Logistics

- Financial

- Others

Global Systems Administration Management Tools Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the systems administration management tools market over the forecast period?The global systems administration management tools market is projected to expand at a CAGR of 10.5% during the forecast period

-

2. What is the market size of the systems administration management tools market?The global systems administration management tools market size is expected to grow from USD 14.56 billion in 2024 to USD 43.65 billion by 2035, at a CAGR of 10.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the systems administration management tools market?North America is anticipated to hold the largest share of the systems administration management tools market over the predicted timeframe

-

4. What is the systems administration management tools market?The systems administration management tools (SAMT) market involves software for IT teams to centrally monitor, manage, and automate complex IT infrastructures, covering performance, security, user provisioning, patching, and cloud/on-premise resources.

-

5. Who are the top 10 companies operating in the global systems administration management tools market?Microsoft, IBM, SAP, Oracle, SolarWinds, Atlassian, BMC Software, Broadcom, Hewlett-Packard, ManageEngine, and Others.

-

6. What factors are driving the growth of the systems administration management tools market?The systems administration management tools market is booming due to massive digital transformation, the shift to cloud/hybrid environments, the explosion of data/IoT, the rise of remote work, and the need for automation (AI/ML) to handle complex IT, driving efficiency, security, and cost savings across industries

-

7. What are the market trends in the systems administration management tools market?The systems administration management tools market is being shaped by several key trends, primarily the widespread adoption of cloud and hybrid environments, the integration of AI and automation, and a growing focus on robust cybersecurity and compliance

-

8. What are the main challenges restricting wider adoption of the systems administration management tools market?The main challenges restricting the wider adoption of IT systems administration management tools include resistance to change, high costs and budget constraints, integration difficulties with legacy systems, and a lack of skilled professionals

Need help to buy this report?