Global Synthetic Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Product (Esters, Polyalphaolefin (PAO), and Polyalkylene glycol (PAG)), By Application (Engine Oil, Heat Transfer Fluids (HTFs), Transmission Fluids, Metalworking Fluids, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Synthetic Lubricants Market Insights Forecasts to 2035

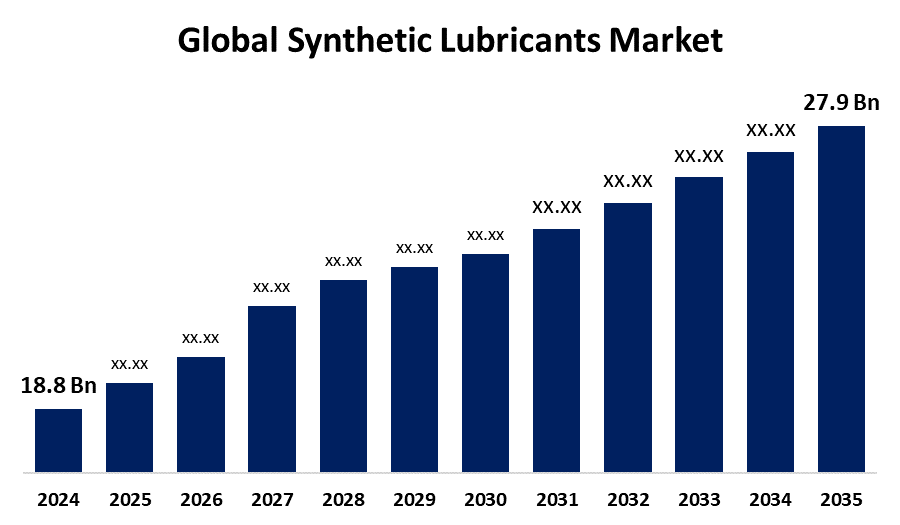

- The Global Synthetic Lubricants Market Size Was Estimated at USD 18.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.65% from 2025 to 2035

- The Worldwide Synthetic Lubricants Market Size is Expected to Reach USD 27.9 Billion by 2035

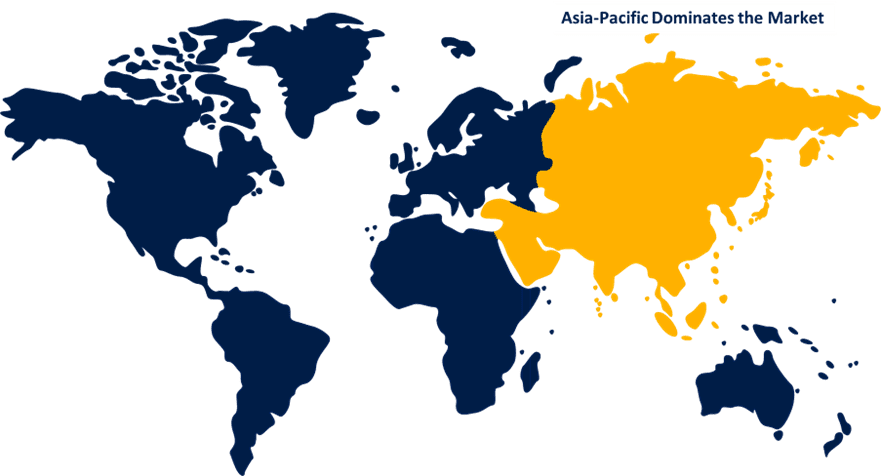

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Synthetic Lubricants Market Size was worth around USD 18.8 Billion in 2024 and is predicted to Grow to around USD 27.9 Billion by 2035 with a compound annual growth rate (CAGR) of 3.65% from 2025 to 2035. The growing vehicle ownership, demand for high-performance & sustainable products in the automotive & industrial sectors, and technological advancements are driving the synthetic lubricants market.

Market Overview

The synthetic lubricants market is an industry that emphasizes lubricants created through chemical processes rather than being derived directly from crude oil. Synthetic lubricants are chemically synthesized, crafted from specific chemical compounds rather than being refined from natural sources such as crude oil. They are better than traditional mineral-based oils in terms of performance, offering increased resistance to oxidation, thermal stability, and viscosity stability, which can contribute to enhancing equipment life and efficiency. Further, synthetic lubricants are more environmentally friendly due to their lower volatility and reduced emissions. They have widespread application in construction, mining, food processing, oil & gas, textile, chemical, and automotive industries. The increasing use of electric vehicles, with growing manufacturers' focus on the production of sustainable, lightweight, and fuel-efficient vehicles, is majorly contributing to driving the market demand for synthetic lubricants. Consistent change in vehicle design, along with the adoption of modern new-age engines, is offering growth opportunities for the synthetic lubricants market.

Report Coverage

This research report categorizes the synthetic lubricants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the synthetic lubricants market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the synthetic lubricants market.

Global Synthetic Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.65% |

| 2035 Value Projection: | USD 27.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product (Esters, Polyalphaolefin (PAO), and Polyalkylene glycol (PAG)), By Application (Engine Oil, Heat Transfer Fluids (HTFs), Transmission Fluids, Metalworking Fluids, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) |

| Companies covered:: | BP Lubricants Pvt. Ltd., Chevron Corporation, LANXESS, Valvoline, FUCHS, Pennzoil, Phillips 66 Company, Motul, AMSOIL INC., Agip, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing vehicle ownership due to the growing emphasis on personal transportation, with the growing urbanization, is expected to drive the market demand. Synthetic lubricants provide superior protection, extended engine life, and improved fuel efficiency, as well as a feature of lower environmental impact in high-performance and sustainable automobile applications. Further, the stringent environmental regulations and adoption of high-performance technologies are responsible for market growth. In addition, the emergence of electric vehicles (EVs), driving the need for sophisticated lubricants for operation, results in propelling the market demand in the automotive sector.

Restraining Factors

The availability of bio-based lubricants as a substitute for synthetic lubricants is restraining the market. Further, raw material price fluctuation impacting the production cost of synthetic lubricant is hampering the market growth.

Market Segmentation

The synthetic lubricants market share is classified into product and application.

- The polyalphaolefin (PAO) segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the synthetic lubricants market is divided into esters, polyalphaolefin (PAO), and polyalkylene glycol (PAG). Among these, the polyalphaolefin (PAO) segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Polyalphaolefin is a commonly used synthetic lubricant in the industrial and automotive sectors. The high viscosity index and hydrolytic stability offered by polyalphaolefin are responsible for driving the market growth. Further, its growing usage in automotive and industrial sectors is propelling the market demand in the polyalphaolefin (PAO) segment.

- The engine oil segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the synthetic lubricants market is divided into engine oil, heat transfer fluids (HTFs), transmission fluids, metalworking fluids, and others. Among these, the engine oil segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Synthetic lubricants provide superior lubrication, reduce friction, and improve engine performance as compared to conventional mineral oils. The rising automotive industry, including cargo and personal vehicles, is contributing to driving market demand in the engine oil segment as the lubricant aids in minimizing the friction between metals, reducing damage.

Regional Segment Analysis of the Synthetic Lubricants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the synthetic lubricants market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the synthetic lubricants market over the predicted timeframe. The presence of several automobile and petrochemical industries is responsible for driving the synthetic lubricant market. Further, an increasing number of smart city projects in countries like India and China, driving demand for access control from these countries, ultimately results in propelling the regional market for synthetic lubricants. Stringent emission restrictions along with rising vehicle ownership are responsible for driving synthetic lubricants market.

North America is expected to grow at a rapid CAGR in the synthetic lubricants market during the forecast period. The increasing demand for synthetic lubricants from the engine oil application, along with the growing automotive sector in the region, is responsible for driving the market. Further, increasing data security concerns drive the access control demand, ultimately driving the synthetic lubricant market in the region.

Europe is expected to hold a significant share of the synthetic lubricants market during the projected period. The demand for high-performance lubricants for optimizing equipment efficiency and reliability is propelling the market demand for synthetic lubricants. The growing emphasis on carbon dioxide emissions from vehicles and the supply of base oil is driving the synthetic lubricants market. The rising trend toward personalized and smart houses in urban regions is contributing to the market growth for synthetic lubricants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the synthetic lubricants market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BP Lubricants Pvt. Ltd.

- Chevron Corporation

- LANXESS

- Valvoline

- FUCHS

- Pennzoil

- Phillips 66 Company

- Motul

- AMSOIL INC.

- Agip

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Shell, a leader in finished lubricants, has launched Shell Helix HX6 5W-30 and Shell Helix SUV 5W-30, a new range of synthetic BS-VI-compliant engine oils in India that are designed to deliver enhanced engine protection, fuel efficiency, and longer engine life for the PCMO (passenger care motor oil) segment.

- In March 2023, Leading automotive solutions supplier Uno Minda announced the launch of its new BS6 Phase compliant with mid-capacity motorcycles. The new line of engine oils will address the growing demand for energy-efficient lubricants in the segment and cater to the evolving needs of consumers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the synthetic lubricants market based on the below-mentioned segments:

Global Synthetic Lubricants Market, By Product

- Esters

- Polyalphaolefin (PAO)

- Polyalkylene glycol (PAG)

Global Synthetic Lubricants Market, By Application

- Engine Oil

- Heat Transfer Fluids (HTFs)

- Transmission Fluids

- Metalworking Fluids

- Others

Global Synthetic Lubricants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the synthetic lubricants market over the forecast period?The global synthetic lubricants market is projected to expand at a CAGR of 3.65% during the forecast period.

-

2. What is the market size of the synthetic lubricants market?The global synthetic lubricants market size is expected to grow from USD 18.8 Billion in 2024 to USD 27.9 Billion by 2035, at a CAGR of 3.65% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the synthetic lubricants market?Asia Pacific is anticipated to hold the largest share of the synthetic lubricants market over the predicted timeframe.

Need help to buy this report?