Global Synthetic Ester Lubricant Market Size, Share, and COVID-19 Impact Analysis, By Viscosity Grade (ISO VG 32, ISO VG 46, ISO VG 68, ISO VG 100, and Others), By Performance Level (Standard, High Performance, and Ultra-High Performance), By Application (Engine Oils, Metalworking Fluids, and Industrial Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Synthetic Ester Lubricant Market Size Insights Forecasts to 2035

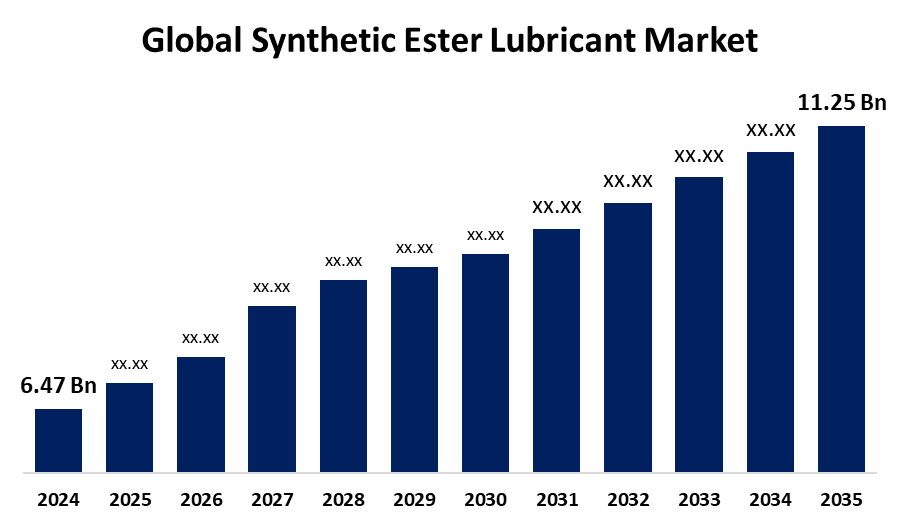

- The Global Synthetic Ester Lubricant Market Size Was Estimated at USD 6.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.16% from 2025 to 2035

- The Worldwide Synthetic Ester Lubricant Market Size is Expected to Reach USD 11.25 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Synthetic Ester Lubricant Market Size was worth around USD 6.47 Billion in 2024 and is predicted to grow to around USD 11.25 Billion by 2035 with a compound annual growth rate (CAGR) of 5.16% from 2025 to 2035. The growing need for high-performance lubricants in the automotive, industrial, and aerospace sectors is driving the synthetic ester lubricant market globally.

Market Overview

The synthetic ester lubricant market is an industry emphasizing the production and application of lubricants based on synthetic ester base oils. Synthetic ester lubricants are man-made fluids formulated with synthetic ester base oils, manufactured from carboxylic acids and alcohols. Esters are generally considered good boundary lubricants because they associate with metal surfaces and reduce the amount of metal-to-metal contact during sliding motion. Esters are suitable for high-temperature hydrodynamic applications as they survive in extreme environments where no other lubricant can. Further, factors such as chain length, amount of branching, and the location of linkages within the molecule are impacting the lubricity. The market of synthetic ester lubricant is primarily driven by an increasing need for synthetic ester lubricant across various industries like automotive, industrial, and aerospace. Development of biodegradable and environmentally friendly formulations that cater to an increasing demand for sustainable products is bolstering the market growth opportunities.

Report Coverage

This research report categorizes the synthetic ester lubricant market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the synthetic ester lubricant market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the synthetic ester lubricant market.

Global Synthetic Ester Lubricant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.47 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.16% |

| 2035 Value Projection: | USD 11.25 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 289 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Viscosity Grade, By Performance Level, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | ExxonMobil, Idemitsu Kosan, TotalEnergies, INEOS Group, Phillips 66, Sinopec, FUCHS, Repsol, The Lubrizol Corporation, BASF, Petrobras, SK Innovation, Royal Dutch Shell, JXTG Nippon Oil Energy, Chevron Corporation, and Other key vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The market is primarily driven by the growing need for high-performance lubricants in the automotive, industrial, and aerospace sectors. Synthetic ester used in various lubricating applications, including aviation turbine oils, air compressor oils, high temperature chain oils, 2-stroke and racing engine oils, or even ultra-low temperature hydraulic oils, which is driving market expansion. The contribution of synthetic esters towards sustainability, as they may decrease dependency on fossil resources, and contribute to fuel economy improvement and reduction of CO2 emissions, which augments the market growth.

Restraining Factors

The availability of synthetic ester lubricant-based oil alternatives like PAOs (polyalphaolefins) and vegetable oils is hindering the synthetic ester lubricant market. Further, the increasing raw material prices are a significant restraint on the synthetic ester lubricant market.

Market Segmentation

The synthetic ester lubricant market share is classified into viscosity grade, performance level, and application.

- The ISO VG 32 segment dominated the market with a significant share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the viscosity grade, the synthetic ester lubricant market is divided into ISO VG 32, ISO VG 46, ISO VG 68, ISO VG 100, and others. Among these, the ISO VG 32 segment dominated the market with a significant share in 2024 and is projected to grow at a substantial CAGR during the forecast period. ISO VG 32 synthetic ester lubricant is specifically formulated for refrigeration and air-conditioning compressors with the use of HFC refrigerants, providing effective wear protection for steel and aluminium surfaces for increased system life and improved efficiency. The low temperature characteristics and unparalleled chemical and thermal stability enable its use across a wide temperature range. The widespread application of ISO VG 32 synthetic ester lubricant in gearboxes, compressors, and turbines is driving the market.

- The ultra-high performance segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the performance level, the synthetic ester lubricant market is divided into standard, high performance, and ultra-high performance. Among these, the ultra-high performance segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. Ultra high-performance lubricants engineered for the most extreme conditions, offering superior protection against wear, extreme temperatures, and contamination, thereby aids in extending equipment life.

- The engine oils segment dominated the market with a major revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the synthetic ester lubricant market is divided into engine oils, metalworking fluids, and industrial applications. Among these, the engine oils segment dominated the market with a major revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Synthetic ester lubricants aid in significantly reducing the friction and wear by forming a strong lubricating film around metal surfaces. Further, it keeps the engine cleaner by enabling it to dissolve and suspend contaminants, thereby enhancing the lifespan of the engine. Its use in the automotive and machinery sectors is driving the market.

Regional Segment Analysis of the Synthetic Ester Lubricant Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the synthetic ester lubricant market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the synthetic ester lubricant market over the predicted timeframe. The growing need for synthetic ester lubricants in the automotive and industrial sectors is driving the market demand. The presence of large aircraft industries in the region, with the growth in aerospace and automotive industries, is propelling the market demand for synthetic ester lubricant.

Asia Pacific is expected to grow at a rapid CAGR in the synthetic ester lubricant market during the forecast period. An increasing use of the lubricant in the manufacturing industry, along with increased investment, is driving the synthetic ester lubricant market. The region’s increasing automobile production is anticipated to propel the market demand for synthetic ester lubricant in the region.

Europe is anticipated to hold a significant share of the synthetic ester lubricant market during the predicted timeframe. The adoption of synthetic ester lubricants in the transportation sector is responsible for driving the market. The growing advancement in lubricants for enhancing machinery performance and lowering maintenance expenses is propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the synthetic ester lubricant market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil

- Idemitsu Kosan

- TotalEnergies

- INEOS Group

- Phillips 66

- Sinopec

- FUCHS

- Repsol

- The Lubrizol Corporation

- BASF

- Petrobras

- SK Innovation

- Royal Dutch Shell

- JXTG Nippon Oil Energy

- Chevron Corporation

- Others

Recent Developments

- In June 2025, Perstorp launched three new saturated synthetic polyol esters-synthetic-EF 5, 15, and 22- to meet the evolving needs of the lubricant industry. This launch marks the next step towards becoming a recognized leader and supplier of specialty chemicals to the growing synthetic lubricants market.

- In June 2023, M&I Materials Limited, an international manufacturing company producing specialist material for industry and science, with a portfolio of successful brands, announced its new product – MIDEL Regen – engineered from used synthetic ester reclaimed from end-of-life transformers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the synthetic ester lubricant market based on the below-mentioned segments:

Global Synthetic Ester Lubricant Market, By Viscosity Grade

- ISO VG 32

- ISO VG 46

- ISO VG 68

- ISO VG 100

- Others

Global Synthetic Ester Lubricant Market, By Performance Level

- Standard

- High Performance

- Ultra-High Performance

Global Synthetic Ester Lubricant Market, By Application

- Engine Oils

- Metalworking Fluids

- Industrial Applications

Global Synthetic Ester Lubricant Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the synthetic ester lubricant market over the forecast period?The global synthetic ester lubricant market is projected to expand at a CAGR of 5.16% during the forecast period.

-

2.What is the market size of the synthetic ester lubricant market?The global synthetic ester lubricant market size is expected to grow from USD 6.47 Billion in 2024 to USD 11.25 Billion by 2035, at a CAGR of 5.16% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the synthetic ester lubricant market?North America is anticipated to hold the largest share of the synthetic ester lubricant market over the predicted timeframe.

Need help to buy this report?