Global Sweet Potato Flour Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Product Type (White, Orange, and Purple), By End Use (Bakery, Noodles and Pasta, and Snacks), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerSweet Potato Flour Market Summary, Size & Emerging Trends

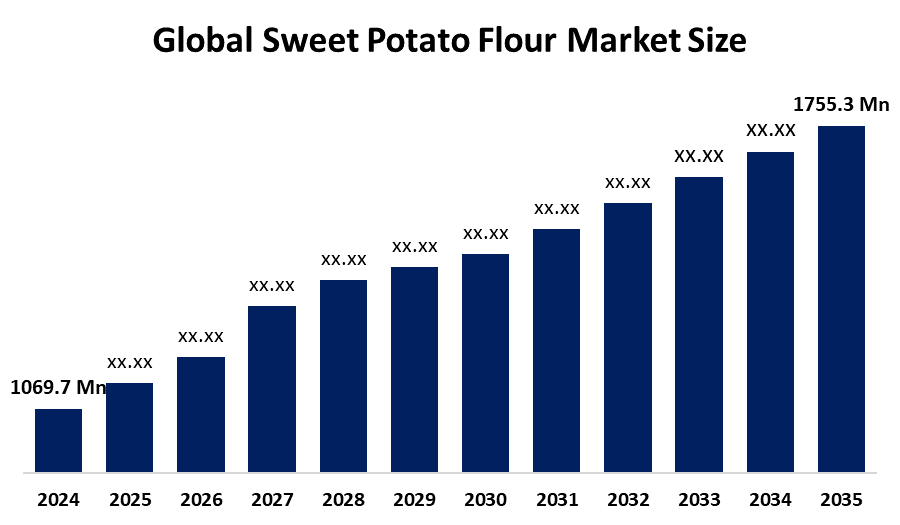

According to Decision Advisor, The Global Sweet Potato Flour Market Size is expected to grow from USD 1069.7 Million in 2024 to USD 1755.3 Million by 2035, at a CAGR of 4.61% during the forecast period 2025-2035. Increasing demand for gluten-free and nutrient-rich food products, particularly in functional foods and healthy snacking categories, is a key driving factor for the sweet potato flour market.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to account for the largest share in the sweet potato flour market during the forecast period.

- In terms of product type, the orange sweet potato flour segment dominated in terms of revenue during the forecast period.

- In terms of end use, the bakery segment accounted for the largest revenue share in the global sweet potato flour market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1069.7 Million

- 2035 Projected Market Size: USD 1755.3 Million

- CAGR (2025-2035): 4.61%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Sweet Potato Flour Market

The sweet potato flour market focuses on the production of flour derived from dried and ground sweet potatoes, used widely in food processing. This naturally gluten-free and high-fiber flour offers an excellent alternative to wheat-based flours, particularly for people with gluten intolerance or celiac disease. The product is in high demand across bakery, snacks, and health food segments due to its nutritional benefits, including high vitamin A content and low glycemic index. Governments and food regulatory agencies globally are encouraging the use of functional ingredients in processed foods, and manufacturers are responding by launching healthier, clean-label products. Additionally, rising health awareness among consumers and a shift toward plant-based diets are accelerating demand for sweet potato flour in both developed and emerging economies.

Sweet Potato Flour Market Trends

- Rising demand for gluten-free and clean-label food products.

- Expansion of the healthy snacks and functional foods category.

- Product innovation using colored variants like purple sweet potato flour for enhanced visual appeal and nutrition.

- Increasing adoption of sweet potato flour in sports nutrition and wellness food products.

Sweet Potato Flour Market Dynamics

Driving Factors: Rising demand from the health food and gluten-free product industries

The sweet potato flour market is growing due to increasing health awareness and the rise of gluten-related disorders like celiac disease. Consumers are actively seeking nutrient-dense, low-glycemic alternatives to traditional flours. Sweet potato flour offers vitamins, fiber, and a natural sweet flavor, making it ideal for premium bakery and health food products. The growing popularity of plant-based diets and functional foods is further encouraging food manufacturers to innovate and include sweet potato flour in clean-label, health-focused product lines.

Restrain Factors: Limited awareness and high production costs

Despite its benefits, sweet potato flour faces hurdles such as low consumer awareness in many regions, especially outside health-conscious markets. Production costs remain relatively high due to labor-intensive farming, processing limitations, and inconsistent supply chains. Crop seasonality and regional availability can result in fluctuating yields and prices. Additionally, the lack of standardized quality metrics makes it difficult for large food processors to adopt sweet potato flour at scale, limiting its integration into mass-produced food products across global markets.

Opportunity: Rising demand for clean-label and ethnic foods

The market presents strong growth opportunities as demand increases for organic, non-GMO, and clean-label food ingredients. Consumers, especially in North America and Europe, are gravitating toward natural, minimally processed options. Sweet potato flour aligns with this trend, offering a nutritional, allergen-free profile. The growing popularity of ethnic foods in Western markets also supports adoption, as sweet potatoes are staples in African, Asian, and Latin cuisines. Manufacturers focusing on process innovation, storage, and packaging can leverage these shifts to expand market share.

Challenges: Supply chain disruptions and lack of processing infrastructure

The sweet potato flour market faces operational challenges, particularly in emerging economies where infrastructure is underdeveloped. Inconsistent access to modern drying, grinding, and storage facilities can affect product quality and output. Climate change and unpredictable weather patterns may also reduce crop reliability. Additionally, high transportation and logistics costs, combined with trade restrictions or import regulations, disrupt supply chains. These challenges require coordinated investments in agriculture, logistics, and processing to ensure consistent global availability and competitive pricing.

Global Sweet Potato Flour Market Ecosystem Analysis

The ecosystem comprises raw sweet potato producers, flour processors, distributors, and end users across food, nutrition, and bakery industries. Key producers are located in Asia and Africa, with growing investments in mechanized farming and processing. Governments are supporting agricultural innovation and post-harvest processing. The value chain is influenced by food safety regulations, consumer preferences, and trade policies, with innovation and sustainability being central to long-term market growth.

Global Sweet Potato Flour Market, By Product Type

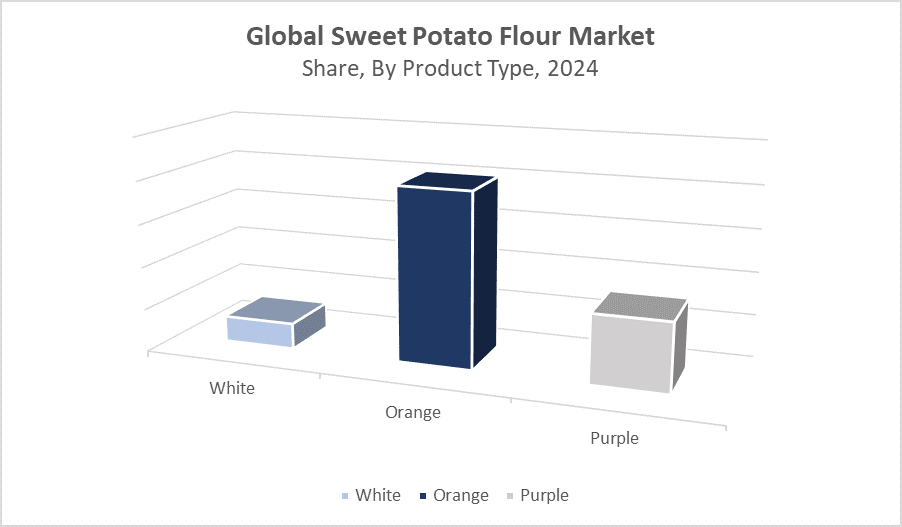

What factors enabled the orange sweet potato flour segment to hold the largest share of approximately 58% of the global market during the forecast period?

The orange sweet potato flour segment captured the largest share of approximately 58% of the global market during the forecast period because it offers several key advantages. First, it has a superior nutritional profile compared to many other flours, being rich in vitamins, antioxidants, and dietary fiber, which aligns well with the growing consumer preference for healthier, nutrient-dense foods. Additionally, as more consumers seek gluten-free alternatives due to dietary restrictions or lifestyle choices, orange sweet potato flour serves as an excellent substitute, further driving its demand.

Get more details on this report -

Why did the purple sweet potato flour segment secure a 22% share in the global sweet potato flour market during the forecast period?

The purple sweet potato flour segment accounted for an estimated 22% share of the global sweet potato flour market during the forecast period due to its unique nutritional benefits, appealing color and flavor profile, growing consumer interest in natural and functional foods, and its versatility in food applications. The presence of anthocyanins, powerful antioxidants, enhances its health appeal, while its distinct color makes it popular in specialty baked goods and snacks. Additionally, increasing awareness of its health benefits and expanding production capabilities helped the segment maintain a strong market position.

Global Sweet Potato Flour Market, By End Use

How did the bakery segment gain a competitive edge to achieve approximately 40% revenue share in the global sweet potato flour market during the forecast period?

The Bakery segment dominated the global sweet potato flour market with the largest revenue share of approximately 40% during the forecast period due to the growing demand for healthier and gluten-free baked products, the flour’s excellent functional properties that improve texture and moisture retention in baked goods, and the rising consumer preference for innovative and nutritious bakery items. The versatility of sweet potato flour in various bakery applications, such as bread, cakes, cookies, and pastries, combined with increasing awareness of its health benefits, fueled its widespread adoption. Additionally, expanding bakery industries and the trend toward clean-label ingredients further supported the segment’s strong market position and revenue generation.

What made the snacks segment a major contributor with a 30% market share in the global sweet potato flour market during the forecast period?

The snacks segment captured a significant market share of around 30% in the global sweet potato flour market during the forecast period due to the rising consumer demand for healthier, convenient, and gluten-free snack options. Sweet potato flour offers a nutritious alternative to traditional flours, enhancing the taste, texture, and nutritional profile of snack products such as chips, crackers, and extruded snacks. Its natural sweetness and vibrant color also appeal to manufacturers aiming to create innovative and visually attractive products. Additionally, growing health awareness and the trend toward clean-label, plant-based ingredients have driven the adoption of sweet potato flour in the snacks segment, contributing to its substantial market share.

Asia Pacific is projected to dominate the global sweet potato flour market, accounting for approximately 42% of total market revenue during the forecast period.

Get more details on this report -

This dominance is largely driven by traditional consumption patterns where sweet potatoes are a dietary staple in many countries. Additionally, the region’s expanding food processing industry is increasing the use of sweet potato flour in various products. Governments in countries like China, Vietnam, and Indonesia are actively supporting the development of sweet potato-based agriculture through subsidies and research, further boosting production and consumption in the region.

India is experiencing rapid growth, with a forecasted CAGR of about 10.3% during the forecast period.

This surge is driven by increasing consumer health awareness, urbanization, and rising demand for gluten-free and nutrient-rich food products. Significant investments in agro-processing infrastructure, especially in states like Odisha, Tamil Nadu, and West Bengal, are enhancing production capacity and supply chain efficiency. These factors collectively position India as a high-growth market within the Asia Pacific region for sweet potato flour.

North America is expected to register the fastest CAGR, capturing around 24% of the global market share during the forecast period.

This growth is fueled by a booming health-conscious consumer base increasingly adopting gluten-free, paleo, and organic diets. The region benefits from the strong presence of organic food brands, advanced food processing technologies, and a robust retail and distribution infrastructure. These factors support rapid adoption of sweet potato flour across multiple food segments.

The United States stands out as a major growth driver within North America, with expanding applications in baking, baby food, and healthy snacks. Innovations in clean-label products and advancements in food processing technologies have increased sweet potato flour’s appeal among manufacturers and consumers. Strong distribution networks across retail chains and e-commerce platforms further accelerate market penetration, making the U.S. a key contributor to North America’s rapid market growth.

WORLDWIDE TOP KEY PLAYERS IN THE SWEET POTATO FLOUR MARKET INCLUDE

- Saipro Biotech Pvt. Ltd.

- New Product Development Company

- Cargill Inc.

- Nikkken Foods Co., Ltd.

- Birkamidon Rohstoffhandels GmbH

- Jai Biotech

- Batata Food Tech

- Sinofi Ingredients

- Henan Alchemy Food Co., Ltd.

- Sakthi Exports

- Others

Product Launches in Sweet Potato Flour Market

- In March 2024, Saipro Biotech Pvt. Ltd. launched a new line of organic orange sweet potato flour specifically designed for the gluten-free baking industries in Europe and North America. This strategic product expansion addresses the rising consumer demand for premium, health-focused ingredients in the growing gluten-free market. By offering a high-quality, organic variant, Saipro aims to strengthen its presence in the health food segment, catering to consumers seeking natural, nutritious alternatives for bakery products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the sweet potato flour market based on the below-mentioned segments:

Global Sweet Potato Flour Market, By Product Type

- White

- Orange

- Purple

Global Sweet Potato Flour Market, By End Use

- Bakery

- Noodles and Pasta

- Snacks

Global Sweet Potato Flour Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

Q: What are the key drivers of growth in the Sweet Potato Flour Market?A: Major drivers include rising consumer demand for gluten-free, clean-label, and functional food products, growing awareness of nutritional benefits, and increased adoption in plant-based diets.

-

Q: What are the main restraints affecting the Sweet Potato Flour Market?A: Limited consumer awareness, high production costs, seasonal supply fluctuations, and inconsistent processing infrastructure are key restraints.

-

Q: What are the latest trends in the Sweet Potato Flour Market?A: Key trends include the use of colored variants like purple sweet potato flour, increasing product innovation in functional foods, and rising demand for natural, allergen-free ingredients.

-

Q: What are the top investment opportunities in the Sweet Potato Flour Market?A: Investment opportunities include organic and non-GMO sweet potato flour products, process innovation in drying and grinding technologies, and expansion into emerging health-conscious markets.

-

Q: Which startups or innovators are disrupting the Sweet Potato Flour Market?A: Startups like Batata Food Tech and Jai Biotech are innovating in value-added sweet potato flour products and expanding into international gluten-free markets.

-

Q: Can you provide a company profile for a leading Sweet Potato Flour manufacturer?A: Yes. For example, Saipro Biotech Pvt. Ltd. launched a new organic orange sweet potato flour line in March 2024 targeting gluten-free baking markets in Europe and North America, strengthening its health food portfolio.

-

Q: Which application segment is expected to grow the fastest over the next decade?A: The snacks segment is expected to see strong growth, holding around 30% market share due to increasing demand for nutritious, clean-label snack alternatives.

-

Q: How do Asia Pacific and North America compare in terms of market dynamics?A: Asia Pacific leads in market size due to traditional dietary use and agricultural support, while North America is the fastest-growing region, driven by clean-label trends and strong retail infrastructure.

Need help to buy this report?