Global Sweet Corn Seed Market Size, Share, and COVID-19 Impact Analysis, By Seed Type (Hybrid Certified Seed, Open Pollinated Certified Seeds, and Farm Saved Seeds), By Farming Type (Organic and Conventional), By Distribution Channel (Agri-Specialty Retailers, Direct Sales, Online Sales Channel, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: AgricultureGlobal Sweet Corn Seed Market Insights Forecasts to 2035

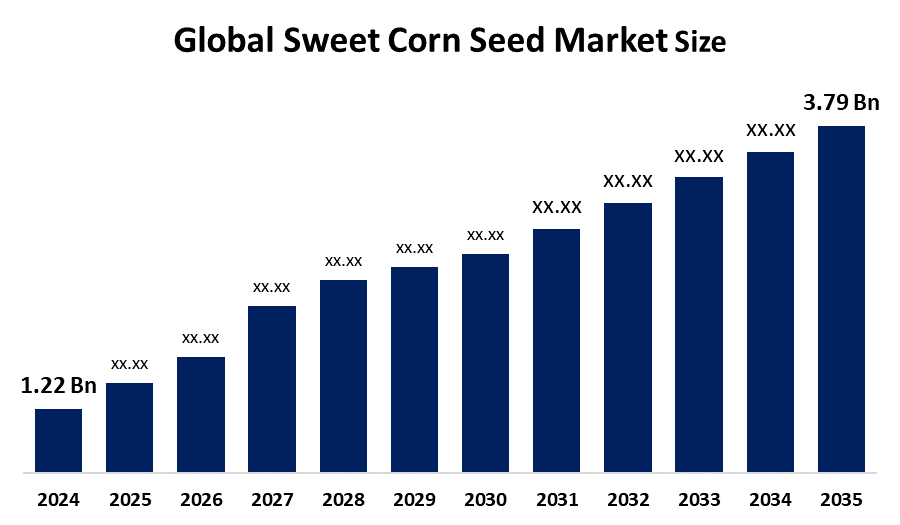

- The Global Sweet Corn Seed Market Size Was Estimated at USD 1.22 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.85% from 2025 to 2035

- The Worldwide Sweet Corn Seed Market Size is Expected to Reach USD 3.79 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global sweet corn seed market size was worth around USD 1.22 billion in 2024 and is predicted to grow to around USD 3.79 billion by 2035 with a compound annual growth rate (CAGR) of 10.85% from 2025 to 2035. Sweet corn seed market growth includes increased consumer demand for healthy and convenient foods, an increase in high-yield hybrid seed adoption, advances in seed technology, and government initiatives toward sustainable agriculture and increasing crop productivity.

Market Overview

The Global Sweet Corn Seed Market Size refers to the production and distribution of seeds used to grow sweet corn, a nutritional type of maize valued for its natural sweetness and multiple consumption uses. Sweet corn has broad applications in fresh, frozen, and processed forms, it is also finding its place in households, foodservice, and industrial food production, such as canned, snack, and ready-to-eat products. In the main, the market is driven by increasing demand from consumers seeking healthy, convenient, and nutritious foods, while the popularity of processed and packaged foods is on the rise. On top of this comes urbanization, increases in disposable incomes, and a shift in dietary patterns, all contributing to increased sweet corn consumption in international markets. Advances in technology, including hybrid and genetically enhanced varieties of seeds, have improved yield performance, disease tolerance, and adaptability to various climatic conditions, encouraging farmers to adopt the same. Furthermore, embracing precision agriculture and digital farming opens new vistas for efficient use of resources and increasing production output.

The Market has a good opportunity for the development of value-added products, organic varieties of sweet corn, and partnerships among seed producers, food processors, and agricultural research institutes. Key players in the market include Bayer Crop Science, Syngenta, Limagrain, Rijk Zwaan, and KWS, which have innovation, strategic partnerships, and regional expansion to strengthen their positions. Government initiatives toward high-quality seed development, sustainable agriculture, and food security encourage market growth, especially in emerging regions. In May 2025, the Government of Santa Catarina, through the State Secretariat for Agriculture and Livestock, will launch the Corn Seeds Project under the Terra Boa 2024 Program in June at Jacinto Machado. The project encourages acquiring corn seeds with high genetic value, increasing yield per hectare, and supplying grains for meat and silage for dairy production.

Report Coverage

This research report categorizes the sweet corn seed market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sweet corn seed market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sweet corn seed market.

Global Sweet Corn Seed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.22 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.85% |

| 2035 Value Projection: | USD 3.79 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Seed Type, By Distribution Channel |

| Companies covered:: | Syngenta Group Bayer AG Corteva Agriscience Rijk Zwaan Advanta Seeds KWS SAAT SE Schlessman Seed Company Vilmorin & Cie Atlee Burpee & Co. BASF SAKATA SEED CORPORATION FMC Corporation Harris Seeds Bejo Zaden B.V. Kaveri Seeds and others, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Global Sweet Corn Seed Market Size is driven by growing demands from consumers for healthy and convenient food products, which include fresh, frozen, and processed corn. Increasing urbanization and changes in diets, especially towards health-oriented ones, fuel the consumption of sweet corn. Technological changes in the development of seeds, such as hybrid and genetically enhanced kinds, result in increased yields, disease resistance, and adaptability to harsh climates. This encourages farmers to buy more. Government policies encouraging quality seed production, sustainable farming, and precision agriculture add to this growth. Lastly, growth in the food processing industry and high usage of sweet corn in ready-to-eat and packaged foods will continue to boost the market.

Restraining Factors

The factors that restrain the market size for sweet corn seeds are high seed costs and dependence on chemical fertilisers, ultimately hindering small-scale farmers from adopting them. Other factors include regulatory prohibitions against GM seeds, vulnerability to pests and diseases, and climatic changes that further hinder the market for sweet corn seeds, more so in developing regions with limited agricultural infrastructure.

Market Segmentation

The sweet corn seed market share is classified into seed type, farming type, and distribution channel.

- he hybrid certified seed segment dominated the market in 2024, approximately 64% and is projected to grow at a substantial CAGR during the forecast period.

Based on the seed type, the sweet corn seed market size is divided into hybrid certified seed, open pollinated certified seeds, and farm saved seeds. Among these, the hybrid certified seed segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The hybrid certified seed segment dominated the global sweet corn seed market growth owing to higher yield potential, superior resistance to pests and diseases, uniform crop quality, and adaptability to diverse climatic conditions. Growing farmer awareness, government support for high-performance seeds, and increasing demand for processed and fresh products made from sweet corn are also contributing to the growth of this segment.

Get more details on this report -

- The conventional segment accounted for the largest share in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the farming type, the sweet corn seed market is divided into organic and conventional. Among these, the conventional segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth of the conventional farming segment is driven by established cultivation practices, higher yield potential, widespread availability of conventional seeds, and cost-effectiveness. Additionally, strong adoption by commercial farmers, government support for conventional agriculture, and the rising demand for sweet corn in food processing and fresh markets further fuel the segment's growth.

- The agri-specialty retailers segment accounted for the highest market revenue in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the sweet corn seed market is divided into agri-specialty retailers, direct sales, online sales channel, and others. Among these, the agri-specialty retailers segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The agri-specialty retailers segment drives the growth due to its strong reach, personalized farmer support, availability of diverse seed varieties, and the presence of a high level of trust among farmers. Increased demand for quality seeds, government initiatives to encourage modern agriculture, and easy availability of hybrid and certified seeds are also factors contributing to the segment's growth.

Regional Segment Analysis of the Sweet Corn Seed Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the sweet corn seed market over the predicted timeframe.

North America is anticipated to hold the largest share of the sweet corn seed market over the predicted timeframe. North America is expected to have a 45% share of the global sweet corn seed market in the forecast period. Factors such as advanced agricultural infrastructure, high use of hybrid and genetically improved seeds, and strong demand for processed and fresh sweet corn products are driving the region's growth. Large-scale cultivation, research into seed genetics, and the headquarters of major seed producers make the United States the leading country in the regional market. In addition, Canada, with its expanding production, also contributes to the regional market by exporting frozen and canned sweet corn. Growing consumer preference for healthy, convenient foods and sustainable farming practices enhances market growth across the region.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the sweet corn seed market during the forecast period. The fastest growth of the sweet corn seed market is expected to be seen in the Asia Pacific region, with an approximate 30% market share, due to increased population, health awareness, and demand for nutritious and convenient food during the forecast period. This growth is driven by government initiatives promoting hybrid and high-yielding seed varieties, better irrigation facilities, and increased acceptance of modern farming techniques in countries such as China, India, and Thailand. Expanding food processing industries and increasing disposable incomes of consumers are also supporting sweet corn cultivation and its consumption across the region.

The Uttar Pradesh government aims to double maize production to 27.30 lakh metric tonnes by 2027 through the Rapid Maize Development Programme. This initiative expands cultivation, improves yields, and boosts farmer income, providing a subsidy of Rs 15,000 per quintal on all maize seeds, including hybrid, desi popcorn, baby corn, and sweet corn.

Europe is witnessing steady growth in the sweet corn seed market due to rising consumer demand for nutritional and plant-based foods, as well as a growing demand for the processing and freezing of corn. Major contributors include France, Spain, and the United Kingdom, owing to advanced agricultural practices and research in high-yielding hybrid seeds that offer good export potential. Moreover, the promotion of sustainable agriculture practices and non-GMO, organic varieties by governmental bodies further accelerates the market in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sweet corn seed market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Syngenta Group

- Bayer AG

- Corteva Agriscience

- Rijk Zwaan

- Advanta Seeds

- KWS SAAT SE

- Schlessman Seed Company

- Vilmorin & Cie

- Atlee Burpee & Co.

- BASF

- SAKATA SEED CORPORATION

- FMC Corporation

- Harris Seeds

- Bejo Zaden B.V.

- Kaveri Seeds

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Syngenta Vegetable Seeds concluded its Future of Veg event in Plainfield, attracting global visitors. Held August 12-14, the event showcased standout varieties of fresh and processing sweet corn and garden beans, demonstrating the company’s commitment to supporting producers and processors in the vegetable seed industry.

- In August 2024, Syngenta announced its largest NK Seeds corn portfolio in over a decade, adding eight new hybrids for the 2025 season. The launch highlights the company’s commitment to helping growers boost yields with high-performing seeds featuring unique traits and genetics adaptable to diverse farming conditions.

- In July 2024, Rijk Zwaan introduced new high-yield sweet corn seed varieties featuring improved growth traits and disease resistance, aiming to meet rising global sweet corn demand and promote sustainable agriculture through advanced, innovative seed technology.

- In April 2024, Sakata Seed Corporation announced an expansion of its sweet corn seed distribution across the Asia Pacific region. This initiative aims to meet rising demand in emerging markets and support local farmers by providing high-quality, regionally adapted seed varieties to enhance productivity and crop performance.

- In July 2023, Corteva, Inc. announced the Canadian launch of Vorceed Enlist corn. Available through Pioneer and Brevant seeds, it offers farmers advanced protection against corn rootworm with three above-ground and three below-ground insecticidal modes, including innovative RNAi technology for enhanced crop defense.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the sweet corn seed market based on the below-mentioned segments:

Global Sweet Corn Seed Market, By Seed Type

- Hybrid Certified Seed

- Open Pollinated Certified Seeds

- Farm Saved Seeds

Global Sweet Corn Seed Market, By Farming Type

- Organic

- Conventional

Global Sweet Corn Seed Market, By Distribution Channel

- Agri-Specialty Retailers

- Direct Sales

- Online Sales Channel

- Others

Global Sweet Corn Seed Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the sweet corn seed market over the forecast period?The global sweet corn seed market is projected to expand at a CAGR of 10.85% during the forecast period.

-

2. What is the market size of the sweet corn seed market?The global sweet corn seed market size is expected to grow from USD 1.22 billion in 2024 to USD 3.79 billion by 2035, at a CAGR of 10.85% during the forecast period 2025-2035.

-

3. What is the sweet corn seed market?The sweet corn seed market is the global industry for seeds of a maize variety bred for its high sugar content and human consumption.

-

4. Which region holds the largest share of the sweet corn seed market?North America is anticipated to hold the largest share of the sweet corn seed market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global sweet corn seed market?Syngenta Group, Bayer AG, Corteva Agriscience, Rijk Zwaan, Advanta Seeds, KWS SAAT SE, Schlessman Seed Company, Vilmorin & Cie, Atlee Burpee & Co., BASF, SAKATA SEED CORPORATION, and Others

-

6. What factors are driving the growth of the sweet corn seed market?The growth of the sweet corn seed market is driven by a combination of evolving consumer preferences, significant technological advancements in agriculture, and the expansion of the processed food industry.

-

7. What are the market trends in the sweet corn seed market?Market trends in sweet corn seeds include the increasing demand for convenience foods, growing health consciousness among consumers, and innovations in hybrid and organic seeds.

-

8. What are the main challenges restricting wider adoption of the sweet corn seed market?The main challenges restricting the wider adoption of the sweet corn seed market include high input costs, climate variability, inadequate infrastructure (storage, transport, processing), limited market access and price volatility, and farmer reluctance to adopt new varieties.

Need help to buy this report?