Global Surimi Market Size, Share, and COVID-19 Impact Analysis, By Source (Tropical and Cold Water), By Form (Frozen and Fresh), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Surimi Market Insights Forecasts to 2035

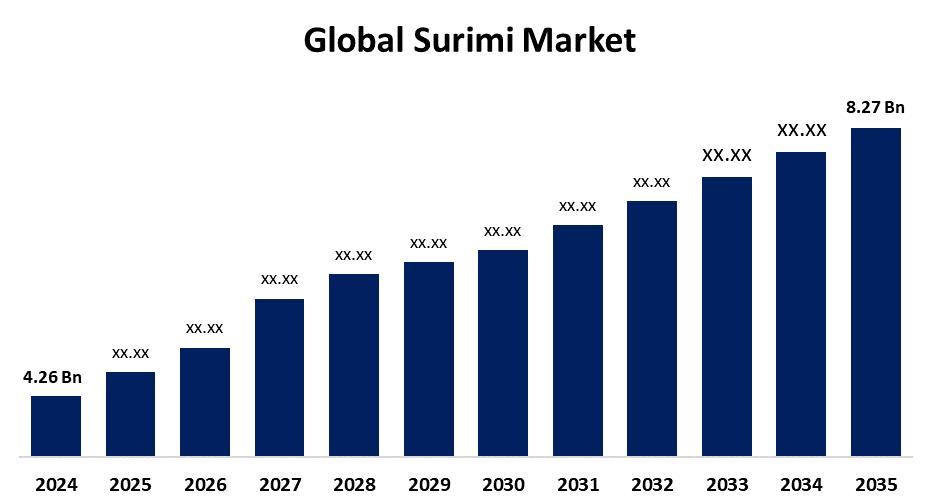

- The Global Surimi Market Size Was Estimated at USD 4.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.22% from 2025 to 2035

- The Worldwide Surimi Market Size is Expected to Reach USD 8.27 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Global Surimi Market Size was worth around USD 4.26 Billion in 2024 and is predicted to grow to around USD 8.27 Billion by 2035 with a compound annual growth rate (CAGR) of 6.22% from 2025 and 2035. Surimi is gaining appeal as a low-cost seafood substitute, particularly in Asian cuisine, driving industry expansion. Its excellent nutritional content, extended shelf life, and affordability are significant reasons driving worldwide demand, as seafood consumption grows in diverse countries.

Market Overview

The surimi market refers to a sector that produces, distributes, and consumes processed fish paste, which is utilised as a seafood substitute in a variety of culinary applications. The market for surimi is expanding as a result of consumers' growing knowledge of its many health advantages, including its high protein and low-fat content. The industry is expanding due to rising consumer demand for quick, reasonably priced, and healthful food alternatives. Surimi’s high nutritional value, including omega-3 fatty acids and protein, appeals to health-conscious and weight-conscious consumers. The growth of the surimi production sector is assisted by the growth of aquaculture. The aquatic business is expanding as a result of the rapidly rising demand for seafood. Global production of fisheries and aquaculture jumped to 223.2 million tonnes in 2022, a 4.4 percent rise from 2020, according to the 2024 edition of The State of World Fisheries and Aquaculture (SOFIA). This sector is growing because of increased global seafood demand. Surimi is becoming even more popular for use in crab sticks, fish cakes, spring rolls, and dumplings, mainly because of the growing popularity of Asian cuisine around the world. As consumer concern about red meat consumption rises due to health risks associated with eating red meat, there is more interest in non-meat protein replacements, driving market development. In recent years, there have been several changes in the players operating in the surimi sector. It is anticipated that market participants would experience volatility as a result of their usage of inorganic approaches and the entry of new, emerging businesses. One of the recent entries into the surimi market is Norwegian Cluster Pescamar Holding, which acquired the Argentinean Hoki Fishing and surimi processing firm San Arawa. All things considered, surimi's accessibility, health advantages, practicality, and cultural significance are major reasons for its rising demand worldwide.

Report Coverage

This research report categorizes the surimi market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the surimi market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the surimi market.

Global Surimi Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.26 Billion |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 8.27 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Source, By Form, By Regional Analysis |

| Companies covered:: | HAI THANH CO., LTD, MEENA Brand Surimi, APITOON GROUP, Starfish Co., Ltd., Java Seafood, PT. INDO SEAFOOD, Southern Marine, SEAPRIMEXCO, Zhejiang Longsheng Aquatic Products Co., Ltd., PT. Indonesia Bahari Lestari, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding due to increased acceptance of affordable, convenient seafood products like reproduction crab, valued for its high nutritional content. Food processors use it to enhance meat texture and flavor. Growing consumer awareness of healthy lifestyles drives demand for high-quality, natural, and organic foods. This shift encourages willingness to pay more for clean-label products, boosting market growth by favoring healthier and premium alternatives over conventional options.

Restraining Factors

Limited local raw material supplies and difficulties processing and storing aquatic goods swiftly hamper market expansion, resulting in food waste and decreased demand. Long production procedures and expensive initial plant setup costs further limit market development, and the possibility of microbial contamination raises storage costs.

Market Segmentation

The surimi market share is classified into source and form.

- The tropical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the source, the surimi market is divided into tropical and cold water. Among these, the tropical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Goatfish, threadfin bream, lizardfish and big eye snapper make up almost 90% of the tropical component. Tropical surimi offers consumers an economical alternative to other seafood options and is therefore an attractive option for consumers to eat seafood. In addition, tropical surimi utilises underutilized fish resources in tropical areas, allowing for a more sustainable solution than traditional seafood. This supports marine biodiversity by diversifying the sources of seafood consumed and reducing the reliance placed on overfished resources.

- The frozen segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the surimi market is divided into frozen and fresh. Among these, the frozen segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Frozen surimi has a longer shelf life than fresh fish and is more convenient for customers who don't have access to fresh choices or who would rather store frozen goods. The frozen surimi market is expanding due to it is more accessible since it is more readily distributed in many areas. The quality and flavour of frozen surimi have also been preserved due to developments in freezing and packaging technology, which will fuel the market's expansion in the upcoming years.

Regional Segment Analysis of the Surimi Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the surimi market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the surimi market over the predicted timeframe. Surimi is highly consumed in the Asia Pacific region due to its affordability, versatility, and flavor. Seafood is a common item and feature of local cuisine in many Asian countries. In addition, the fish industry has a high-profile history of marketing and advertising surimi across the Asia Pacific region, which has all contributed to selling such products. Surimi food products like fish balls, crab sticks, and kamaboko are commonly consumed as snacks or in recipes as a protein source.

Europe is expected to grow at a rapid CAGR in the surimi market during the forecast period. The region has experienced an increase in demand for sustainable and healthful protein sources, and surimi is viewed as a low-fat and nutritious substitute for other meat and seafood. Additionally, the European fish sector has been pushing goods made from surimi as a quick and cost-effective substitute for fresh seafood. Additionally, the industry is being driven by the increased knowledge and enjoyment of surimi-based goods, such as crab sticks and fish balls, brought about by the popularity of Asian cuisine in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the surimi market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HAI THANH CO., LTD

- MEENA Brand Surimi

- APITOON GROUP

- Starfish Co., Ltd.

- Java Seafood

- PT. INDO SEAFOOD

- Southern Marine

- SEAPRIMEXCO

- Zhejiang Longsheng Aquatic Products Co., Ltd.

- PT. Indonesia Bahari Lestari

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2024, Suzuhiro Kamaboko of Japan introduced a premium surimi powder for elite Asian restaurants. The product acquires a gel strength of 600-800 simply by adding water and stirring for one to two minutes. This innovative product provides a high-quality, convenient alternative to conventional surimi. Suzuhiro strives to improve texture and efficiency in premium seafood meals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the surimi market based on the below-mentioned segments:

Global Surimi Market, By Source

- Tropical

- Cold Water

Global Surimi Market, By Form

- Frozen

- Fresh

Global Surimi Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Surimi market over the forecast period?The global surimi market is projected to expand at a CAGR of 6.22% during the forecast period.

-

2. What is the market size of the Surimi market?The global surimi market size is expected to grow from USD 4.26 billion in 2024 to USD 8.27 billion by 2035, at a CAGR of 6.22% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Surimi market?Asia Pacific is anticipated to hold the largest share of the surimi market over the predicted timeframe.

Need help to buy this report?