Global Surgical Helmet System Market Size, Share, and COVID-19 Impact Analysis, By Product (Complete Surgical Helmet Systems, Ventilated Surgical Helmets, Surgical Helmets With LED Lighting, Powered Surgical Helmets, and Disposable Surgical Helmets), By Application (Orthopedic Surgery, Neurosurgery, Cardiac Surgery, ENT Surgery, General Surgery, and Others), By End-Use (Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Surgical Helmet System Market Insights Forecasts to 2035

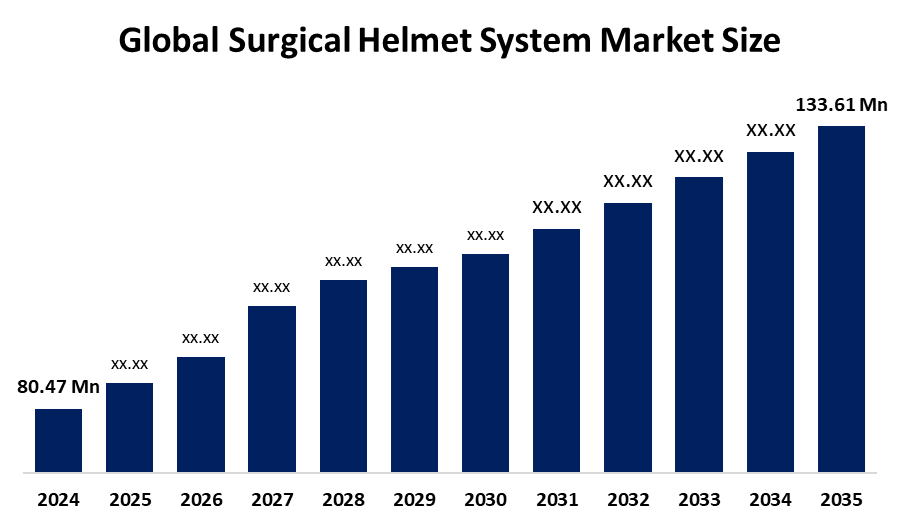

- The Global Surgical Helmet System Market Size Was Estimated at USD 80.47 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.72% from 2025 to 2035

- The Worldwide Surgical Helmet System Market Size is Expected to Reach USD 133.61 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global surgical helmet system market size was worth around USD 80.47 million in 2024 and is predicted to grow to around USD 133.61 million by 2035 with a compound annual growth rate (CAGR) of 4.72% from 2025 to 2035. The worldwide need for surgical helmet systems is increasing due to several procedures, heightened attention to infection prevention and worker safety, along with improvements in helmet design, airflow and built-in functionalities.

Market Overview

The worldwide market for surgical helmet systems refers to headgear equipped with ventilation, filtration and communication features intended to protect surgeons and operating room personnel from contaminants, fluid sprays and airborne pathogens. These helmets are commonly utilised in surgeries involving trauma and a high risk of infection. Market growth is driven by the rising number of procedures, strict infection control standards, and growing awareness of hospital-acquired infections. Opportunities exist in advancements such as frameworks, improved ventilation solutions and the integration of instruments alongside the expansion of healthcare infrastructure in emerging countries.

Expansion into high-growth regions such as the Asia-Pacific and the increasing number of ambulatory surgical centres (ASCs) also present significant opportunities. With financial limitations, companies such as Stryker Corporation, Zimmer Biomet, THI Total Healthcare Innovation and AAMI persist in funding innovations aimed at improving system comfort, efficiency and safety. In May 2025, the WHO progressed its 2024-2030 Global Infection Prevention and Control Strategy by publishing updated guidelines for conducting IPC surveys and aiding initiatives. These efforts seek to enhance safety measures in healthcare and indirectly encourage the use of gear such as surgical helmet systems.

Report Coverage

This research report categorizes the surgical helmet system market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the surgical helmet system market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the surgical helmet system market.

Global Surgical Helmet System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 80.47 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.72% |

| 2035 Value Projection: | USD 133.61 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product |

| Companies covered:: | Zimmer Biomet Holdings, Stryker Corporation, Cardinal Health, 3M Company, Medtronic plc, THI Total Healthcare Innovation, Ecolab Inc., AresAir, Maxair Systems, DuPont de Nemours, Medline Industries, Kaiser Technology Co., LTD., Prodancy Pvt. Ltd., Beijing ZKSK Technology Co., Ltd., Others, and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Primary factors propelling the surgical helmet system market consist of increasing needs for infection prevention and enhanced safety during orthopedic and trauma surgeries. Heightened consciousness about hospital-acquired infections (HAIs), combined with requirements, drives healthcare facilities to adopt protective equipment. Furthermore, the increase in procedures attributed to aging populations and widespread chronic diseases supports market expansion. Innovations, such as airflow technology, reduced weight and built-in communication capabilities, improve functionality and promote usage. Moreover, heightened focus on protecting staff during pandemics and the advancement of infrastructure in developing countries propels market growth.

Restraining Factors

Key restraining factors for the surgical helmet system market include the high cost of advanced helmet systems, which limits adoption in smaller healthcare facilities. Limited awareness in developing regions, maintenance requirements, and discomfort during prolonged use also hinder uptake. Additionally, stringent regulatory approvals can slow product availability.

Market Segmentation

The surgical helmet system market share is classified into product, application, and end-use.

- The complete surgical helmet systems segment dominated the market in 2024, approximately 51% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the surgical helmet system market is divided into complete surgical helmet systems, ventilated surgical helmets, surgical helmets with LED lighting, powered surgical helmets, and disposable surgical helmets. Among these, the complete surgical helmet systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment of surgical helmet systems led the market expansion as these systems efficiently reduce surgical site infections by providing a completely enclosed sterile setting that shields both patients and healthcare workers from airborne pathogens and exposure to bodily fluids. Growth is additionally supported by infection control regulations, a rise in high-risk orthopedic operations and technological improvements such as built-in airflow and anti-fog lenses that improve comfort and adherence.

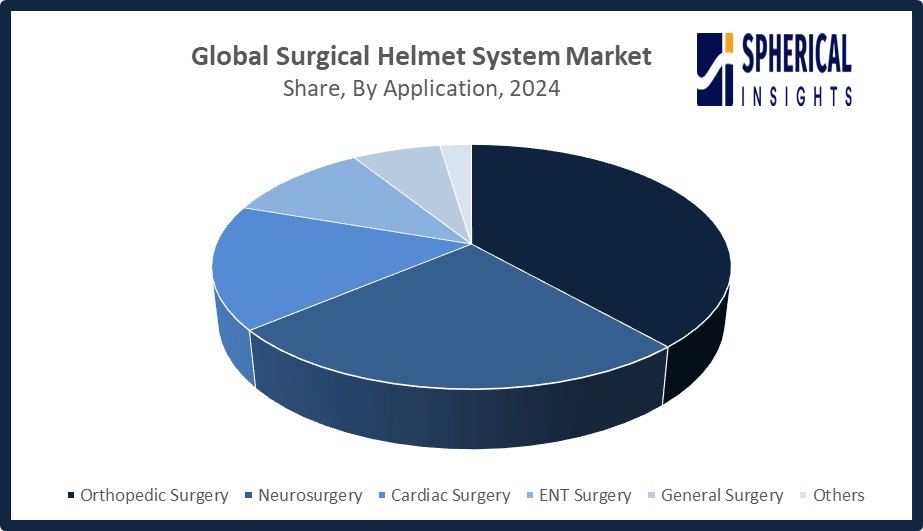

- The orthopedic surgery segment accounted for the largest share in 2024, approximately 38% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the surgical helmet system market is divided into orthopedic surgery, neurosurgery, cardiac surgery, ENT surgery, general surgery, and others. Among these, the orthopedic surgery segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Orthopedic surgery represents an application area for surgical helmet systems due to the large volume of joint replacement and spinal operations performed globally. These helmets shield surgeons from bone fragments, blood splashes and other contaminants. The growing incidence of conditions, along with an aging demographic, is boosting the frequency of orthopedic surgeries, thereby increasing the need for surgical helmet systems in this field.

Get more details on this report -

• The hospitals segment accounted for the largest share of market revenue in 2024, representing approximately 49%, and is expected to grow at a significant CAGR during the forecast period.

Based on end use, the surgical helmet system market is segmented into hospitals, ambulatory surgical centers (ASCs), and specialty clinics. Among these, hospitals dominated the market in 2024 due to high surgical procedure volumes and the widespread adoption of advanced surgical technologies. Increased investment in surgical helmet systems supports enhanced surgical safety, regulatory compliance, and improved patient outcomes. Additionally, the presence of well-established infrastructure and skilled healthcare professionals continues to drive demand, reinforcing hospitals as the primary end-use segment for surgical helmet system adoption.

Regional Segment Analysis of the Surgical Helmet System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the surgical helmet system market over the predicted timeframe.

North America is anticipated to hold the largest share of the surgical helmet system market over the predicted timeframe. North America is projected to have a 40% market share of the surgical helmet system market, attributed to its healthcare facilities, a large number of surgical procedures and stringent infection prevention policies. The United States spearheads this expansion with its developed hospitals, extensive adoption of cutting-edge surgical technology and increased focus on surgical safety. Additionally, government programs promoting hospital safety and the growing prevalence of intricate surgeries continue to boost demand. In September 2025, the U.S. Department of Commerce initiated a Section 232 inquiry into PPE imports, possibly implementing tariffs or incentives to enhance production and reinforce supply chain stability, for surgical helmet systems.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the surgical helmet system market during the forecast period. The Asia Pacific region is expected to have a 22% market share of the surgical helmet system market, fueled by increased healthcare spending, the development of hospital facilities and heightened awareness of infection control. China, India and Japan are at the forefront of this growth, propelled by an expanding population, a rise in orthopedic and trauma surgeries and the uptake of cutting-edge surgical technologies. Additionally, government programs that promote healthcare modernization and improve access to quality services contribute significantly to the growing demand. Furthermore, the WHO’s assistance to India’s Ministry of Health in formulating IPC guidelines enhances infection control initiatives, thereby raising the demand for surgical helmet systems in healthcare environments.

Europe’s surgical helmet system market is growing due to strict infection control regulations, widespread adoption of advanced surgical technologies, and rising surgical procedure volumes. Germany, the UK, and France lead growth, supported by robust healthcare infrastructure and awareness of hospital-acquired infection prevention. Government initiatives and investments in modern facilities further drive demand. In 2025, NHS England updated PPE protocols for high-risk infectious diseases, promoting staff protection and increasing adoption of certified surgical helmet systems across UK healthcare facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the surgical helmet system market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zimmer Biomet Holdings

- Stryker Corporation

- Cardinal Health

- 3M Company

- Medtronic plc

- THI Total Healthcare Innovation

- Ecolab Inc.

- AresAir

- Maxair Systems

- DuPont de Nemours

- Medline Industries

- Kaiser Technology Co., LTD.

- Prodancy Pvt. Ltd.

- Beijing ZKSK Technology Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Medtronic received CE Mark for its LigaSure RAS vessel-sealing technology, enhancing Hugo robotic-assisted surgery capabilities in Europe. As the first robotic-driven LigaSure instrument, it builds on two decades of use in over 35 million procedures across 65+ countries, marking a new era in vessel-sealing technology.

- In March 2025, Stryker unveiled its Steri-Shield 8 personal protection system, the latest addition to its PPE lineup. Developed through extensive research, testing, and collaboration with healthcare professionals, Steri-Shield 8 enhances surgical safety, comfort, and performance in clinical environments.

- In November 2024, Prodancy Pvt. Ltd., a Medtech startup specializing in surgical consumables for joint replacement, raised Rs 2.14 Crore in a funding round co-led by Campus Angels Network and Keiretsu Forum Chennai, with participation from C-CAMP and other angel investors, reinforcing confidence in the company’s growth.

- In February 2024, Zimmer Biomet showcased innovations at the AAOS annual meeting in San Francisco, featuring its ROSA Robotics for shoulder replacement, Persona OsseoTi Keel Tibia, HAMMR Hip Impaction System, ASC Solutions, and the newly launched ViVi Surgical Helmet System, highlighting key growth drivers in orthopedic surgery.

- In November 2023, Cardinal Health launched its SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets in the U.S. Designed for safe, efficient instrument access, each

- pocket holds one instrument, enhancing handling efficiency and allowing surgical teams to focus on delivering safe, high-quality patient care.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the surgical helmet system market based on the below-mentioned segments:

Global Surgical Helmet System Market, By Product

- Complete Surgical Helmet Systems

- Ventilated Surgical Helmets

- Surgical Helmets With LED Lighting

- Powered Surgical Helmets

- Disposable Surgical Helmets

Global Surgical Helmet System Market, By Application

- Orthopedic Surgery

- Neurosurgery

- Cardiac Surgery

- ENT Surgery

- General Surgery

- Others

Global Surgical Helmet System Market, By End-Use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Global Surgical Helmet System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the surgical helmet system market over the forecast period?The global surgical helmet system market is projected to expand at a CAGR of 4.72% during the forecast period.

-

2. What is the surgical helmet system market?The surgical helmet system market comprises protective headgear used in surgeries to safeguard surgeons from contaminants, blood, and airborne pathogens.

-

3. What is the market size of the surgical helmet system market?The global surgical helmet system market size is expected to grow from USD 80.47 million in 2024 to USD 133.61 million by 2035, at a CAGR of 4.72% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the surgical helmet system market?North America is anticipated to hold the largest share of the surgical helmet system market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global surgical helmet system market?Zimmer Biomet Holdings, Stryker Corporation, Cardinal Health, 3M Company, Medtronic plc, THI Total Healthcare Innovation, Ecolab Inc., AresAir, Maxair Systems, DuPont de Nemours, and Others.

-

6. What factors are driving the growth of the surgical helmet system market?The surgical helmet system market is driven by rising surgical volumes, strict infection-control regulations, growing orthopedic and trauma procedures, technological advancements, increasing healthcare awareness, and the demand for enhanced surgeon safety and protection.

-

7. What are the market trends in the surgical helmet system market?The surgical helmet system market trends include adoption of ergonomic, ventilated helmets, rising use of disposable systems, smart technology integration, and strict infection-control compliance.

-

8. What are the main challenges restricting wider adoption of the surgical helmet system market?The main challenges restricting the wider adoption of surgical helmet systems center around high costs, concerns over efficacy and contamination risk, and limited awareness and training among healthcare professionals.

Need help to buy this report?