Global Sunflower Lecithin Market Size Size, Share, and COVID-19 Impact Analysis, By Nature (Organic and Conventional), By Form (Liquid, Powder, and Others), By End Use Industry (Food & Beverage, Cosmetics, Nutraceutical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Sunflower Lecithin Market Size Insights Forecasts to 2035

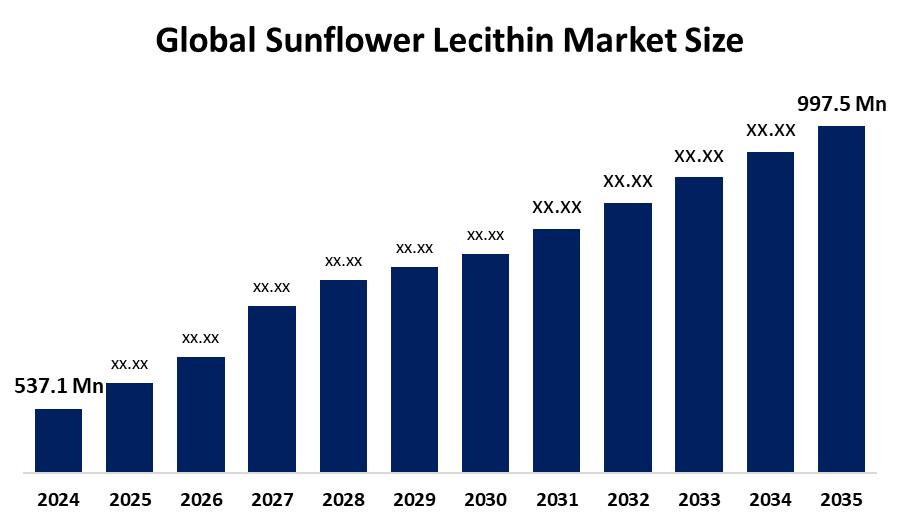

- The Global Sunflower Lecithin Market Size Was Estimated at USD 537.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.79% from 2025 to 2035

- The Worldwide Sunflower Lecithin Market Size is Expected to Reach USD 997.5 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, the global Sunflower Lecithin Market Size was worth around USD 537.1 Million in 2024 and is Predicted to Grow to Around USD 997.5 Million by 2035 with a compound annual growth rate (CAGR) of 5.79% from 2025 and 2035. The market for sunflower lecithin has a number of opportunities to grow due to the emergence of sunflower lecithin supplementation. With an increasing health and wellness sector, consumers' changing inclination towards products that promote cardiometabolic factors, appetite and hormonal regulations are escalating the Sunflower Lecithin Market Size.

Market Overview

The global industry of sunflower lecithin is the sector for natural, non-GMO, and allergen-free emulsifiers, driven by clean-label demands in food, pharmaceutical, and cosmetic industries. Sunflower lecithin is a fatty substance in sunflower seeds, benefitting health by supporting the digestive system, lowering cholesterol, supporting heart and brain health, and more. Some people take lecithin supplements to support the lecithin that the body naturally produces. The supplements are derived from various foods, including sunflower seeds. Lecithin from sunflower seeds has numerous possible health benefits, from managing cholesterol levels to improving heart health. An increasing use of sunflower lecithin in functional foods, supplements, and plant-based products, with increased focus on high-purity, powdered forms, and improved extraction technologies promoting the market of sunflower lecithin products.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and expanding partnerships. For instance, in August 2025, Bunge Global acquired IFF’s soy and lecithin business, poised to enhance Bunge’s product portfolio and strengthening its position in the F&B sector, and the agreement involves the purchase of nearly all assets related to IFF's lecithin, soy protein concentrate, and crush operations, which generated approximately $240 million in revenue in 2024.

Report Coverage

This research report categorizes the Sunflower Lecithin Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Sunflower Lecithin Market Size. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Sunflower Lecithin Market Size.

Sunflower Lecithin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 537.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.79% |

| 2035 Value Projection: | USD 997.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Nature, By Form |

| Companies covered:: | Ciranda, Inc., Sonic Biochem, Lecilite, ConnOils LLC, Process Agrochem Industries Pvt Ltd., GIIAVA, Fismer Lecithin Corporation, Sun Nutrafoods, MITUSHI BIO PHARMA, Matrix Life Science Private Limited, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The potential advantage of sunflower seeds across various industries due to their emulsifying and stabilizing properties is expected to drive the market demand. For instance, sunflower lecithin creates emulsions in salad dressings, baked goods, and beverages in the food industry. Further, consumers’ increasing health and wellness driving need for sunflower lecithin in food, supplements, and personal care forms, which may propel the market growth. Additionally, sustainable agricultural practices that diversify their crops, enhance soil health, and potentially generate additional income are contributing to promoting the market of sunflower lecithin.

Restraining Factors

The Sunflower Lecithin Market Size is restricted by factors like uncertain weather conditions, global market dynamics, crop yield, and price volatility.

Market Segmentation

The Sunflower Lecithin Market Size share is classified into nature, form, and end use industry.

- The conventional segment dominated the market with the largest revenue share of over 82.7% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the nature, the Sunflower Lecithin Market Size is divided into organic and conventional. Among these, the conventional segment dominated the market with the largest revenue share of over 82.7% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Its cost-effectiveness, high production efficiency, and accessibility across large-scale industry are advantageous features of conventional sunflower lecithin, with the shared benefit of being non-GMO and allergen-free.

- The powder segment accounted for the dominant market share of about 52% in 2024 and is anticipated to grow at a significant CAGR of about 6.0% during the forecast period.

Based on the form, the Sunflower Lecithin Market Size is divided into liquid, powder, and others. Among these, the powder segment accounted for the dominant market share of about 52% in 2024 and is anticipated to grow at a significant CAGR of about 6.0% during the forecast period. Powdered lecithin is produced by subjecting lecithin liquid to an additional de-oiling process. Unlike its viscous liquid counterpart, powdered lecithin is easy to dose accurately, store, and incorporate into dry blends without clumping.

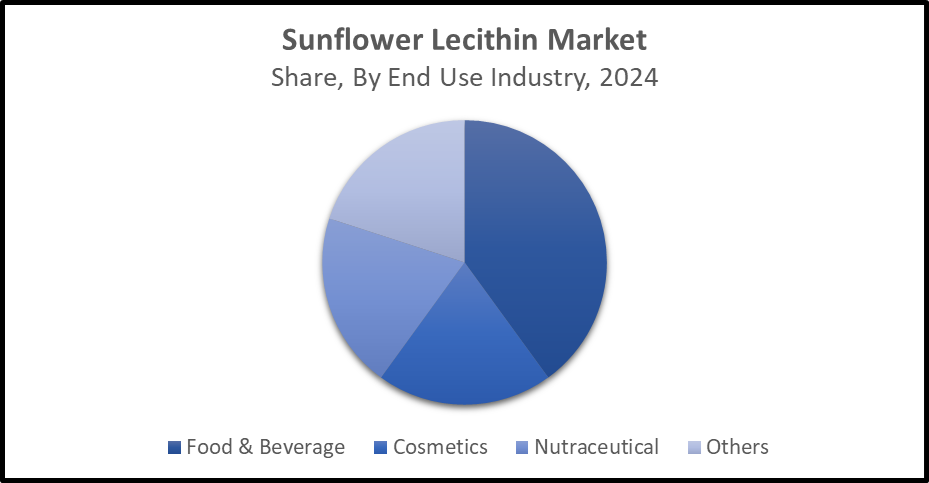

- The food & beverage segment dominated the market with over 40% share in 2024 and is anticipated to grow at a significant CAGR of about 6.0% during the forecast period.

Based on the end use industry, the Sunflower Lecithin Market Size is divided into food & beverage, cosmetics, nutraceutical, and others. Among these, the food & beverage segment dominated the market with over 40% share in 2024 and is anticipated to grow at a significant CAGR of about 6.0% during the forecast period. There is an increasing use of sunflower lecithin in food & beverage, including confectionery and bakery products. Out of which, half of the bakery launches with sunflower lecithin are sweet biscuits; gluten-free is the leading claim for bakery launches with sunflower lecithin.

Get more details on this report -

Regional Segment Analysis of the Sunflower Lecithin Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of about 34% in the Sunflower Lecithin Market Size over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 34% in the Sunflower Lecithin Market Size over the predicted timeframe. The market ecosystem in North America is strong, with increasing product approval. For instance, in April 2021, sunflower lecithin from Sterchemie was recognised as safe by the FDA for North American market. The demand for sunflower lecithin has been driven by the increased demand for sunflower lecithin in food, pharmaceutical, and cosmetics industries owing to lecithin’s multifunctional benefits, such as emulsification, and other health advantages. The United States is leading the North America Sunflower Lecithin Market Size with about 79% share, owing to the robust need from the food and pharmaceutical sectors, as well as the presence of extensive manufacturing facilities and distribution channels.

Asia Pacific is expected to grow at a rapid CAGR of about 8.0% in the Sunflower Lecithin Market Size during the forecast period. The Asia Pacific area has a thriving market for sunflower lecithin due to its rapid urbanization, rising disposable incomes, and expanding food, beverage, and nutraceutical industries. The need for natural emulsifiers is rising due to the region’s growing consumption of processed and functional foods, along with government programs promoting homegrown food production and nutritional enhancement, which are propelling the market growth. China accounted for the largest share in the Asia Pacific Sunflower Lecithin Market Size, owing to the country’s massive food processing sector, need for natural non-GMP ingredients, and expanding usage across bakery, dairy, and nutraceutical products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Sunflower Lecithin Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ciranda, Inc.

- Sonic Biochem

- Lecilite

- ConnOils LLC

- Process Agrochem Industries Pvt Ltd.

- GIIAVA

- Fismer Lecithin Corporation

- Sun Nutrafoods

- MITUSHI BIO PHARMA

- Matrix Life Science Private Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Lekithos launched its groundkeeping Sunflower Lecithin Granules, a product so innovative in its delivery method that it is redefining what consumers expect from their daily sunflower lecithin supplements.

- In May 2025, Austrade Inc. launched a non-GMO hydrolyzed sunflower lecithin powder for functional beverage manufacturers.

- In June 2021, Sternchemie launched SternPur S DH 50, a hydrolysed, de-oiled sunflower lecithin, aiming to meet current market demand for immune health, nutrition hacking and mood food.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Sunflower Lecithin Market Size based on the below-mentioned segments:

Global Sunflower Lecithin Market Size, By Nature

- Organic

- Conventional

Global Sunflower Lecithin Market Size, By Form

- Liquid

- Powder

- Others

Global Sunflower Lecithin Market Size, By End Use Industry

- Food & Beverage

- Cosmetics

- Nutraceutical

- Others

Global Sunflower Lecithin Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Sunflower Lecithin Market Size?The global Sunflower Lecithin Market Size is expected to grow from USD 537.1 Million in 2024 to USD 997.5 Million by 2035, at a CAGR of 5.79% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the Sunflower Lecithin Market Size?North America is anticipated to hold the largest share of the Sunflower Lecithin Market Size over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Sunflower Lecithin Market Size from 2024 to 2035?The market is expected to grow at a CAGR of around 5.79% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Sunflower Lecithin Market Size?Key players include Ciranda, Inc., Sonic Biochem, Lecilite, ConnOils LLC, Process Agrochem Industries Pvt Ltd., GIIAVA, Fismer Lecithin Corporation, Sun Nutrafoods, MITUSHI BIO PHARMA, and Matrix Life Science Private Limited.

-

5. Can you provide company profiles for the leading sunflower lecithin manufacturers?Yes. For example, Ciranda, Inc. is a US-based supplier of certified organic, non-GMO, and fair-trade food ingredients to brands and manufacturers in the natural products business. The employee-owned firm, founded in 1994 and headquartered in Hudson, Wisconsin, produces a wide range of products, including lecithins.

-

6. What are the main drivers of growth in the Sunflower Lecithin Market Size?Potential advantages of sunflower seeds, increasing health and wellness, and sustainable agricultural practices are major market growth drivers of the Sunflower Lecithin Market Size.

-

7. What challenges are limiting the Sunflower Lecithin Market Size?Uncertain weather conditions, global market dynamics, crop yield, and price volatility remain key restraints in the Sunflower Lecithin Market Size.

Need help to buy this report?