Global Succinic Acid Plasticizer Derivatives Market Size, Share, and COVID-19 Impact Analysis, By Derivative Type (Dialkyl Succinate Plasticizers, Polymeric & Oligomeric Succinate Plasticizers, Bio-Based Succinate Esters, and Others), By Application (PVC & Flexible Vinyl, Bioplastics, Polyesters & Other Polymers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Succinic Acid Plasticizer Derivatives Market Size Insights Forecasts to 2035

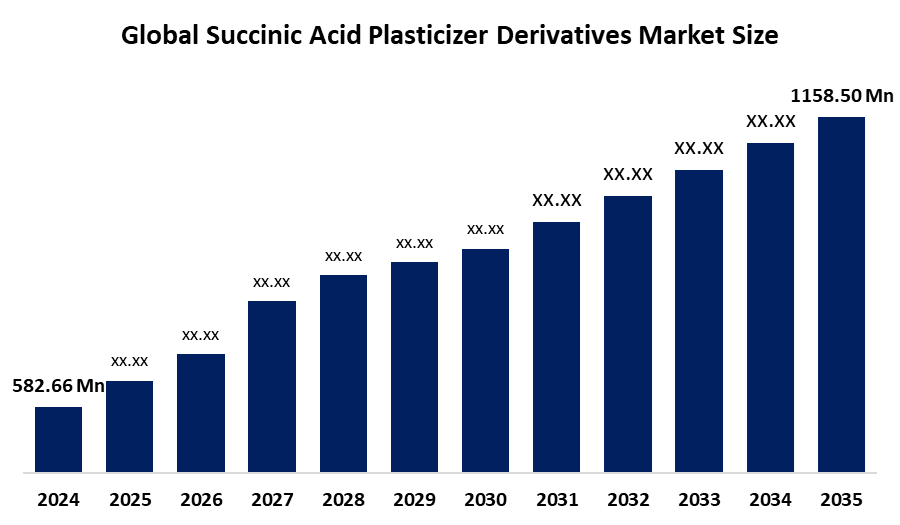

- The Global Succinic Acid Plasticizer Derivatives Market Size Was Estimated at USD 582.66 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.45 % from 2025 to 2035

- The Worldwide Succinic Acid Plasticizer Derivatives Market Size is Expected to Reach USD 1158.50 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Succinic Acid Plasticizer Derivatives Market Size was valued at around USD 582.66 Million in 2024 and is predicted to grow to around USD 1158.50 Million by 2035 with a compound annual growth rate (CAGR) of 6.45 % from 2025 to 2035. Opportunities in sustainable polymer production, bio-based substitutes, eco-friendly plasticizers, growing packaging applications, regulatory compliance, and rising demand in the consumer goods, construction, and automotive industries are all present in the succinic acid plasticizer derivatives market.

Market Overview

The production, trading, and use of ester-based compounds derived from succinic acid (butanedioic acid, C4H4O4), a frequently used dicarboxylic acid that can be produced from petrochemicals or through the bio-fermentation of renewable raw materials like glucose and agricultural waste, comprise the succinic acid plasticizer derivatives market. The market for derivatives, which includes dibutyl succinate and trimethylphenyl succinate, provides a range of non-phthalate plasticizers that enhance the elongation, flexibility, and thermal stability of the thermoplastic polymers (PVC, polyurethanes, and polyolefins) without changing their mechanical characteristics. The European Commission launched €500 million in funding for bio-chemicals, including succinic acid plasticizers, to phase out fossil-based additives by 2030, with pilot projects in Germany and France reporting 15% cost reductions via fermented feedstocks. Adoption of green and renewable products is further boosted by growing customer awareness and preference. Additionally, as manufacturers look for flexible, long-lasting, and high-performance polymer solutions, growing applications in a variety of industries, including packaging, automotive, construction, and medical devices, are driving market expansion.

Report Coverage

This research report categorizes the Succinic Acid Plasticizer Derivatives Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the succinic acid plasticizer derivatives market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the succinic acid plasticizer derivatives market.

Succinic Acid Plasticizer Derivatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 582.66 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.45% |

| 2035 Value Projection: | 1158.50 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Derivative Type, By Application |

| Companies covered:: | BASF SE, BioAmber, DSM-Firmenich, Evonik Industries AG, Lanxess AG, Mitsubishi Chemical Group, Novamont, Perstorp Group, Roquette Frères, UPC Technology Corporation, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing focus on sustainability and ecologically conscious production worldwide is the main driver of the succinic acid plasticizer derivatives market. Succinic acid derivatives are marketed as safer, non-toxic substitutes for the classical phthalate plasticizers. This switch is a direct result of the imposition of stricter regulations on phthalates owing to health and ecological issues. In addition, the increased production of bio-based succinic acid through microbial fermentation has created a cheap and eco-friendly supply chain, thus making it a customer-friendly product, which is likely to enhance the market's worldwide growth potential over a long period.

Restraining Factors

The market for succinic acid plasticizer derivatives is restricted by high production costs, limited large-scale availability, technical difficulties with polymer compatibility, slower adoption than dialkyl succinate plasticizers, and erratic raw material supply, all of which could prevent widespread commercialization.

Market Segmentation

The Succinic Acid Plasticizer Derivatives Market Size share is classified into derivative type and application.

- The dialkyl succinate plasticizers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the derivative type, the succinic acid plasticizer derivatives market is divided into dialkyl succinate plasticizers, polymeric & oligomeric succinate plasticizers, bio-based succinate esters, and others. Among these, the dialkyl succinate plasticizers segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market for dialkyl succinate plasticizers is a result of its extensive use in flexible PVC, bioplastics, and other polymer systems, where it improves processability, durability, and flexibility. Dialkyl succinate plasticizers also provide cost-effectiveness, proven commercial availability, and excellent compatibility with a wide variety of polymers, all of which contribute to their dominant position.

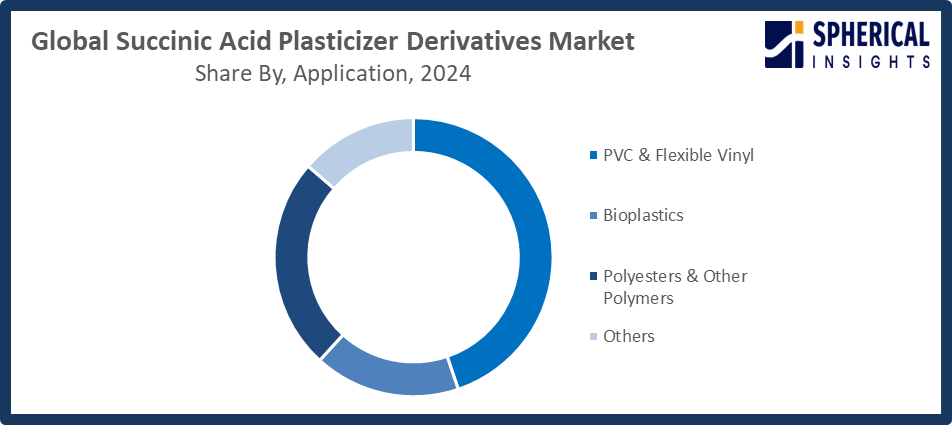

- The PVC & flexible vinyl segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the succinic acid plasticizer derivatives market is divided into PVC & flexible vinyl, bioplastics, polyesters & other polymers, and others. Among these, the PVC & flexible vinyl segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. PVC's strength, chemical resistance, and extended service life make it a popular choice for pipes, fittings, window profiles, flooring, and insulation in construction. Conversely, flexible vinyl is prized for its softness, flexibility, and ease of processing, making it perfect for uses including synthetic leather, cables, films, sheets, medical equipment, and shoes.

Get more details on this report -

Regional Segment Analysis of the Succinic Acid Plasticizer Derivatives Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Succinic Acid Plasticizer Derivatives Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the succinic acid plasticizer derivatives market over the predicted timeframe. Asia Pacific owes its standing in these markets to the region's strong manufacturing base, especially in the case of China, Japan, and India, which are the major production and consumption centers for polymer-based products. Plasticizers that are compatible with PVC and other polymers, are thermally stable, and are supplied at a competitive price, still remain the priority for Chinese manufacturers. In November 2025, with new certification requirements going into effect in Q1 2026, the Ministry of Environment announced increased tax incentives for the use of bio-succinic acid in consumer goods, forecasting a 15% decrease in plastic waste through derivatives integration.

North America is expected to grow at a rapid CAGR in the succinic acid plasticizer derivatives market during the forecast period. The integration of succinic acid derivatives into a variety of applications, such as packaging, automotive, construction, and medical devices, is made easier by the existence of robust polymer manufacturing and chemical processing industries in the United States and Canada. A combined CAD 200 million fund for cross-border biorefinery projects was announced by U.S. and Canadian officials in November 2025. The fund prioritizes succinic acid pathways to attain a 25% regional CAGR in bio-derivatives, with initial awards going to Ontario and Minnesota businesses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the succinic acid plasticizer derivatives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- BioAmber

- DSM-Firmenich

- Evonik Industries AG

- Lanxess AG

- Mitsubishi Chemical Group

- Novamont

- Perstorp Group

- Roquette Frères

- UPC Technology Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the succinic acid plasticizer derivatives market based on the below-mentioned segments:

Global Succinic Acid Plasticizer Derivatives Market Size, By Derivative Type

- Dialkyl Succinate Plasticizers

- Polymeric & Oligomeric Succinate Plasticizers

- Bio-Based Succinate Esters

- Others

Global Succinic Acid Plasticizer Derivatives Market Size, By Application

- PVC & Flexible Vinyl

- Bioplastics

- Polyesters & Other Polymers

- Others

Global Succinic Acid Plasticizer Derivatives Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Succinic Acid Plasticizer Derivatives Market Size over the forecast period?The global succinic acid plasticizer derivatives market is projected to expand at a CAGR of 6.45% during the forecast period.

-

2. What is the market size of the Succinic Acid Plasticizer Derivatives Market Size?The global succinic acid plasticizer derivatives market size is expected to grow from USD 582.66 million in 2024 to USD 1158.50 million by 2035, at a CAGR of 6.45 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Succinic Acid Plasticizer Derivatives Market Size?Asia Pacific is anticipated to hold the largest share of the succinic acid plasticizer derivatives market over the predicted timeframe.

-

4. Who are the top companies operating in the global Succinic Acid Plasticizer Derivatives Market Size?BASF SE, BioAmber (IP and legacy capacity via successors), DSM-Firmenich, Evonik Industries AG, Lanxess AG, Mitsubishi Chemical Group, Novamont, Perstorp Group, Roquette Frères, UPC Technology Corporation, and Others.

-

5. What factors are driving the growth of the Succinic Acid Plasticizer Derivatives Market Size?The market for succinic acid plasticizer derivatives is driven by a number of factors, including growing consumer and environmental awareness, phthalate regulations, technological breakthroughs, expanding polymer applications, and rising demand for bio-based, environmentally friendly plasticizers.

-

6. What are the market trends in the Succinic Acid Plasticizer Derivatives Market Size?Innovation in high-performance bio-based derivatives, integration into flexible PVC and specialty polymers, growing investments in green chemistry and circular economy projects, and the growing use of sustainable and renewable plasticizers are some of the major developments.

-

7. What are the main challenges restricting the wider adoption of the Succinic Acid Plasticizer Derivatives Market Size?High production costs, limited large-scale availability, compatibility problems with specific polymers, the industry's sluggish shift from dialkyl succinate plasticizers, and inconsistent raw material supply all hinder wider adoption.

Need help to buy this report?