Global Subsea Power Cable Market Size, Share, and COVID-19 Impact Analysis, By Cable Type (Single-Core and Multi-Core), By Application (Wind Power Generation, Oil & Gas, and Remote Areas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Subsea Power Cable Market Insights Forecasts to 2035

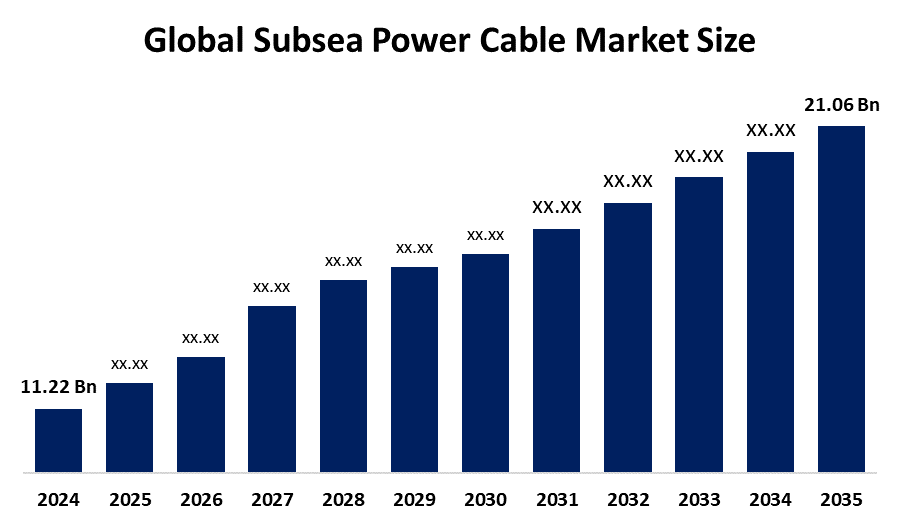

- The Global Subsea Power Cable Market Size Was Estimated at USD 11.22 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.5% from 2025 to 2035

- The Worldwide Subsea Power Cable Market Size is Expected to Reach USD 21.06 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global subsea power cable market size was worth around USD 11.22 billion in 2024 and is predicted to grow to around USD 21.06 billion by 2035 with a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035. The expansion of offshore renewable energy integration, cross-border grid interconnections, government-sponsored infrastructure projects, technological advancements in high-voltage transmission, and the growing demand for dependable, sustainable energy distribution worldwide present substantial opportunities for the subsea power cable market.

Market Overview

the design, production, installation, and maintenance of specialized electrical cables used to transmit high-voltage alternating current (HVAC) or direct current (HVDC) power across underwater environments. These cables play a critical role in connecting offshore renewable energy installations—such as wind farms—to onshore grids and enabling long-distance or intercontinental energy interconnections. Built with copper or aluminum conductors and protected by robust polymer sheaths, these insulated cables ensure safe, efficient, and low-loss power transmission while minimizing marine risks. Government initiatives are further strengthening the market landscape. The U.S. government’s 2025 regulatory streamlining efforts, Taiwan’s RISK initiative aimed at enhancing undersea infrastructure resilience, and Japan’s 50 billion fund to bolster subsea cable and digital energy networks all underscore growing global support for subsea infrastructure. Rising demand is being driven by the need for improved grid reliability, enhanced climate resilience, and the ongoing electrification of offshore oil and gas facilities.

Report Coverage

This research report categorizes the subsea power cable market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the subsea power cable market. Recent market developments and competitive strategies, such as expansion, Cable Type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the subsea power cable market.

Global Subsea Power Cable Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.22 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 6.5% |

| 024 – 2035 Value Projection: | USD 21.06 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Cable Type, By Application |

| Companies covered:: | ABB, Tratos, Prysmian, NKT A/S, Nexans, Hengtong, ZTT Group, KEI Industries, Universal Cables Ltd, LS Cable & System Ltd., Furukawa Electric Co., Ltd., Sumitomo Electric Industries, Ltd., And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The fast growth of offshore renewable energy, particularly offshore wind farms, is the main factor driving the subsea power cable market. The growing need for interconnectors between islands and across borders is a significant motivator. In order to trade renewable energy, improve energy security, and stabilize their grids, many countries are investing in underwater HVDC (high-voltage direct current) links. Another important factor is technological innovation: multi-core designs, better insulation materials, and advancements in HVDC cable technology improve transmission efficiency, lower losses, and enable longer-distance deployment. In addition to enhancing energy reliability, subsea cable projects drive the subsea power cable market by strengthening national power infrastructure against climate change-induced disruptions, ensuring a resilient and uninterrupted electricity supply.

Restraining Factors

High installation and maintenance costs, difficult underwater engineering problems, regulatory and environmental obstacles, a shortage of skilled labor, and possible risks from natural disasters and geopolitical tensions that affect the deployment of cross-border subsea infrastructure are some of the challenges facing the subsea power cable market.

Market Segmentation

The subsea power cable market share is classified into cable type and application.

- The single-core segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the cable type, the subsea power cable market is divided into single-core and multi-core. Among these, the single-core segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Long-distance subsea transmission and offshore wind farms require high voltage and extra high voltage transmission, which is best served by the single-core segment. Single-core cables are usually used to connect each turbine in a bundled form for export lines like HVAC or HVDC. Better heat dissipation is made possible by them, which is essential for high-capacity power transmission.

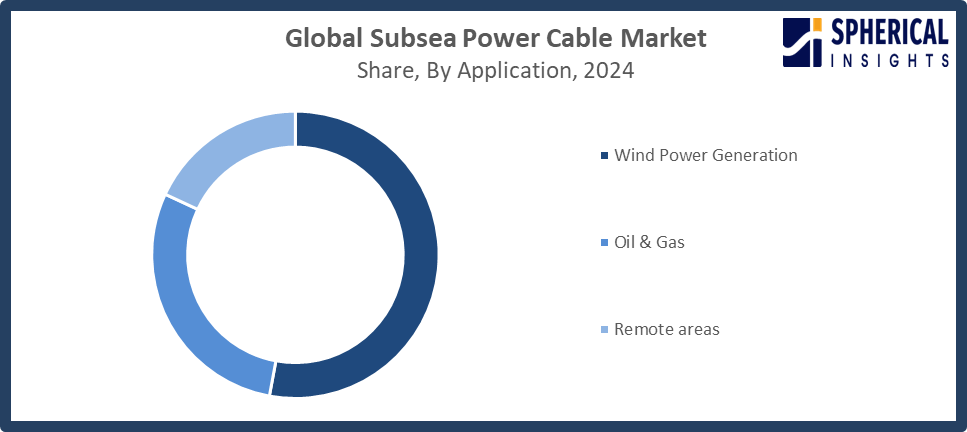

- The wind power generation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the subsea power cable market is divided into the wind power generation, oil & gas, and remote areas. Among these, the wind power generation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The global growth of offshore wind farms, which need dependable underwater cables to transfer electricity from turbines to shore, is driving the market for wind power generation is expanding quickly. In offshore wind projects, these cables are essential infrastructure for export transmission systems and inter-array connectivity.

Get more details on this report -

Regional Segment Analysis of the Subsea Power Cable Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the subsea power cable market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the subsea power cable market over the predicted timeframe. The fast growth of offshore renewable energy projects, especially offshore wind farms, in nations like China, Japan, and South Korea, is what propels the Asia Pacific region. The expansion of oil and gas activities in countries like Malaysia and Indonesia is met by subsea cables, which sustain offshore platforms and supply steady electricity for drilling and processing. China unveiled a tightly packed, deep-sea cable-cutting device that can cut the strongest undersea power or communication cables in the world. According to the government of India activate three cable systems by March 2025, Singapore commissions five projects, including the Bifrost link, and ASEAN unveils its Submarine Cable Framework, strengthening resilient regional networks.

North America is projected to register a rapid CAGR in the subsea power cable market during the forecast period. This growth is driven by the region’s advanced infrastructure, rising offshore renewable energy development, and increasing electricity demand. In the United States, the subsea power cable market is expanding due to strong renewable energy initiatives, including federal and state targets such as achieving 30 GW of offshore wind capacity by 2030, which encourages investment in subsea transmission systems and related infrastructure. Canada is also accelerating its subsea energy development. The September 2025 Offshore Wind Directive earmarks CAD 500 million for offshore wind and transmission projects, while the Federal Budget 2025 expands the Canada Infrastructure Bank’s mandate to CAD 45 billion, with a significant portion dedicated to renewable energy and subsea transmission projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the subsea power cable market, along with a comparative evaluation primarily based on their Cable Type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes Cable Type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- Tratos

- Prysmian

- NKT A/S

- Nexans

- Hengtong

- ZTT Group

- KEI Industries

- Universal Cables Ltd

- LS Cable & System Ltd.

- Furukawa Electric Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Meta has launched updates to its subsea cables in APAC, including the completed Bifrost system, enhancing connectivity, AI services, and global delivery of its products to billions across the region.

- In September 2025, SEACOM launched SEACOM 2.0, a cutting-edge subsea cable system enhancing connectivity across the Indian Ocean, Middle East, Mediterranean, and Europe, supporting Africa’s digital economy and growing AI, cloud, and data demands.

- In April 2025, LS Cable & System announced that its U.S. subsidiary, LS GreenLink, held a groundbreaking ceremony for the largest factory in the U.S., a USD 776.77 million investment marking the first major Korean local investment since Trump’s second term.

- In March 2025, Italy's Prysmian announced plans to leverage over USD 5 billion in U.S. purchases and AI-driven data center expansion, projecting a two-thirds core profit increase by 2028, despite previously halting U.S. offshore wind investments.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the subsea power cable market based on the below-mentioned segments:

Global Subsea Power Cable Market, By Cable Type

- Single-Core

- Multi-Core

Global Subsea Power Cable Market, By Application

- Wind Power Generation

- Oil & Gas

- Remote areas

Global Subsea Power Cable Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the subsea power cable market over the forecast period?The global subsea power cable market is projected to expand at a CAGR of 6.5% during the forecast period.

-

2. What is the market size of the subsea power cable market?The global subsea power cable market size is expected to grow from USD 11.22 billion in 2024 to USD 21.06 billion by 2035, at a CAGR of 6.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the subsea power cable market?Asia Pacific is anticipated to hold the largest share of the subsea power cable market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global subsea power cable market?ABB, Tratos, Prysmian, NKT A/S, Nexans, Hengtong, ZTT Group, KEI Industries, Universal Cables Ltd, LS Cable & System Ltd., Furukawa Electric Co., Ltd., Sumitomo Electric Industries, Ltd., and others.

-

5. What factors are driving the growth of the subsea power cable market?Growth in the subsea power cable market is driven by rising offshore renewable energy projects, cross-border grid interconnectors, government incentives, technological advancements, and increasing demand for reliable, sustainable electricity.

-

6. What are the market trends in the subsea power cable market?The growing market trends include deployment of high-voltage direct current (HVDC) systems, smart monitoring technologies, digital infrastructure integration, regional government-supported launches, and expansion of subsea networks for enhanced energy security.

-

7. What are the main challenges restricting wider adoption of the subsea power cable market?The market expansion is restricted by high installation and maintenance costs, complex underwater engineering, regulatory and environmental hurdles, a limited skilled workforce, natural disaster risks, and geopolitical uncertainties affecting subsea infrastructure.

Need help to buy this report?