Global Subpectoral Implants Market Size, Share, and COVID-19 Impact Analysis, By Product (Two-Stage Implant Reconstruction (Matrix (ADM)) and Direct-to-Implant Reconstruction), By End user (Hospitals, Cosmetology Clinics, Ambulatory Surgical Centers, and Medical Spas), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Subpectoral Implants Market Insights Forecasts to 2035

- The Market Size is Expected to Grow at a CAGR of around 8.1% from 2025 to 2035

- The Worldwide Subpectoral Implants Market Size is Expected to hold a significant share by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Subpectoral Implants Market Size is predicted to grow at a CAGR of 8.1% from 2025 and 2035. The market for subpectoral implants has a number of opportunities to grow due to increasing advancements in implant safety and technology, with the changing inclination towards implant-based breast reconstruction.

Market Overview

The global industry of subpectoral implants refers to a major segment of the global breast implant industry, primarily serving patients who want implants placed under the pectoral chest muscle during breast augmentation and reconstruction. Implant-based breast reconstruction is popularly used, particularly in the case of contralateral prophylactic mastectomy. Further, increasing advancements in terms of safety and technology, as well as in managing postoperative pain control, are expanding the application of subpectoral implants. Introduction of acellular dermal matrix is revolutionizing implant-based breast reconstruction that aids in minimal morbidity with maximum aesthetic outcomes. Furthermore, the combined use of subpectoral implantation of ICD and augmentation mammoplasty via auxiliary approach among young female patients with dilated cardiomyopathy and small breasts.

Innovation and market expansion are anticipated as a result of major players' growing innovations and use of advanced technologies. For instance, in December 2022, Integra LifeSciences plan to buy Surgical Innovation Associates for $50 million upfront in a bid to build a leading position in the changing breast reconstruction business. The use of advanced solutions, including ADMs, fat grafting, NSMs, enabling pre-pectoral breast reconstruction, is significantly affecting the market.

Report Coverage

This research report categorizes the subpectoral implants market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the subpectoral implants market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the subpectoral implants market.

Global Subpectoral Implants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product, By End user and By Region |

| Companies covered:: | Allergan (AbbVie), Mentor Worldwide, Establishment Labs S.A., Sientra, GC Aesthetics, POLYTECH Health & Aesthetics GmbH, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for subpectoral implants is driven by an increasing prevalence of breast cancer. For instance, as per the WHO report, in 2022, 2.3 million women were diagnosed with breast cancer, with an estimated 670,000 deaths globally, and it is the most common cancer in women in around 157 countries out of 185 countries worldwide. An increase in the number of implantation procedures, along with an increasing preference for enhancing aesthetic appeal among females, is anticipated to drive market demand. For instance, according to the International Society of Aesthetic Plastic Surgeons, in November 2018, 1,677,320 breast augmentations were performed at a global pace.

Restraining Factors

The subpectoral implants market is restricted by the emergence of alternative methods, including prepectoral reconstruction. The complications associated with subpectoral implants, like infection, bleeding, implant rupture, capsular contracture, and implant malposition, may hamper their adoption, thereby negatively affecting the market.

Market Segmentation

The subpectoral implants market share is classified into product and end user.

- The direct-to-implant reconstruction segment dominated the market with approximately 10-40% share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the subpectoral implants market is divided into two-stage implant reconstruction (matrix (ADM)) and direct-to-implant reconstruction. Among these, the direct-to-implant reconstruction segment dominated the market with approximately 10-40% share in 2024 and is projected to grow at a substantial CAGR during the forecast period. Direct to implant reconstruction provides one-stage, final implant insertion, bypassing the demand for serial tissue expansion. The successful preservation of the breast skin envelope and accurate implant size and placement enhance the success rate of breast reconstruction and patient satisfaction, which are responsible for driving the segmental market growth.

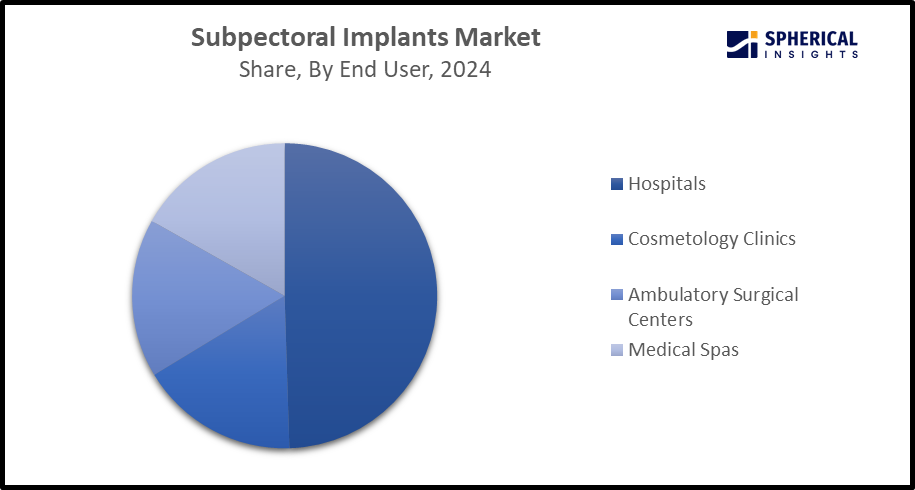

- The hospitals segment accounted for the largest revenue share of nearly 45-55% in 2024 and is anticipated to grow at a rapid CAGR during the forecast period.

Based on the end user, the subpectoral implants market is divided into hospitals, cosmetology clinics, ambulatory surgical centers, and medical spas. Among these, the hospitals segment accounted for the largest revenue share of nearly 45-55% in 2024 and is anticipated to grow at a rapid CAGR during the forecast period. With the presence of the latest technology and implant materials, hospitals focus on precision and safety for achieving optimal results that are tailored to each patient’s body and goals. Further, the presence of highly skilled surgeons for providing personalized care in the hospital setting aids in driving the subpectoral implants market.

Get more details on this report -

Regional Segment Analysis of the Subpectoral Implants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the subpectoral implants market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of nearly 40.0% in the subpectoral implants market over the predicted timeframe. The market ecosystem in North America is strong, due to increasing development of several breast augmentation techniques, including breast prosthesis and autologous fat injection. The market for subpectoral implants has been driven by the region's growing preference for enhancing aesthetic appeal among the female population, along with the growing prevalence of breast cancer. Due to their innovative subpectoral implants products and partnerships with other industry players, they have played a significant role in propelling the market's expansion. The U.S. is the dominant country in the North America subpectoral implants market with a major share of over 75-80%, due to increasing FDA approval of implants, along with an increase in medical tourism.

Asia Pacific is expected to grow at a rapid CAGR of 7.8% in the subpectoral implants market during the forecast period. The Asia Pacific area has a thriving market for subpectoral implants due to its strong focus on beauty standards and awareness regarding the significance of aesthetic appearance. Due to their governments actively supporting breast implants by offering free breast implants to the poor. For instance, in February 2018, a southern Indian state became possibly the first in the world to offer publicly funded breast implants. China is the leading country in the Asia Pacific subpectoral implants market, accounting for 32.3% share, owing to the increasing mastectomy rates with improved cancer survival and rising aesthetic awareness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the subpectoral implants market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allergan (AbbVie)

- Mentor Worldwide

- Establishment Labs S.A.

- Sientra

- GC Aesthetics

- POLYTECH Health & Aesthetics GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, BD (Becton, Dickinson and Company), a leading global medical technology company, announced the first patient treated in an Investigational Device Exemption (IDE) clinical trial intended to advance BD's efforts to achieve Premarket Approval (PMA) from the U.S. Food and Drug Administration (FDA) for the use of GalaFLEX LITE Scaffold in decreasing capsular contracture (CC) recurrence during breast revision surgery.

- In October 2024, Establishment Labs Holdings Inc., a global medical technology company dedicated to improving women’s health and wellness, principally in breast aesthetics and reconstruction, announced today that the first patients in the United States have successfully undergone breast augmentation with Motiva Implants.

- In August 2024, CollPlant Biotechnologies and Stratasys Ltd. announced the initiation of a pre-clinical study with 200cc commercial-sized regenerative implants printed on a Stratasys Origin 3D printer. The collaboration between CollPlant and Stratasys is focused on the development of a bioprinting solution for CollPlant’s breast implants, in addition to finding solutions to scale up the implant’s fabrication process.

- In January 2023, CollPlant, a regenerative and aesthetics medicine company developing innovative technologies and products for tissue regeneration and organ manufacturing, announced that it had completed a large animal study for its recombinant human collagen (rhCollagen)-based 3D bioprinted regenerative breast implants, addressing the $2.5 billion global breast implant market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the subpectoral implants market based on the below-mentioned segments:

Global Subpectoral Implants Market, By Product

- Two-Stage Implant Reconstruction (Matrix (ADM))

- Direct-to-Implant Reconstruction

Global Subpectoral Implants Market, By End user

- Hospitals

- Cosmetology Clinics

- Ambulatory Surgical Centers

- Medical Spas

Global Subpectoral Implants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region holds the largest share of the subpectoral implants market?North America is anticipated to hold the largest share of the subpectoral implants market over the predicted timeframe.

-

2. What is the forecasted CAGR of the Global Subpectoral Implants Market from 2024 to 2035?The market is expected to grow at a CAGR of around 8.1% during the period 2024–2035.

-

3. Who are the top companies operating in the Global Subpectoral Implants Market?Key players include Allergan (AbbVie), Mentor Worldwide, Establishment Labs S.A., Sientra, GC Aesthetics, and POLYTECH Health & Aesthetics GmbH.

-

4. Can you provide company profiles for the leading subpectoral implants manufacturers?Yes. For example, Establishment Labs S.A. is a global medical company focused on developing and manufacturing advanced silicone breast implants and related technologies, and is the most renowned product line, Motiva, representing a new generation of implants designed with safety, natural appearance, and innovation in mind.

-

5. What are the main drivers of growth in the subpectoral implants market?The growing prevalence of breast cancer and increasing preference for enhancing aesthetic appeal among females are major market growth drivers of the subpectoral implants market.

-

6. What challenges are limiting the subpectoral implants market?The emergence of alternative methods, including prepectoral reconstruction and the adverse effects of subpectoral implants, remains a key restraint in the subpectoral implants market.

Need help to buy this report?