Global Styrene Butadiene Rubber Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Emulsion SBR (E-SBR) and Solution SBR (S-SBR)), By Application (Tires, Footwear, Gaskets and Hoses, Adhesives and Sealants, Conveyor Belts, and Electric), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Styrene Butadiene Rubber Market Insights Forecasts To 2035

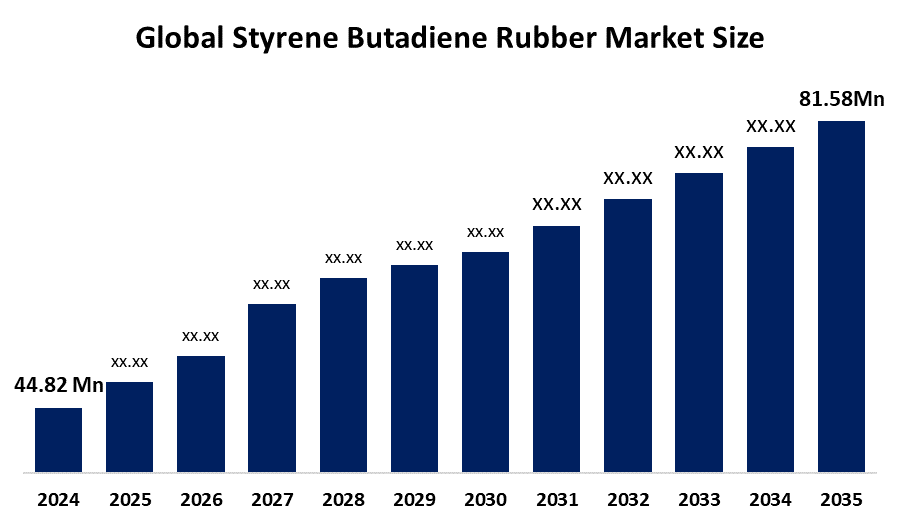

- The Global Styrene Butadiene Rubber Market Size Was Estimated At USD 44.82 Billion In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 5.6% From 2025 To 2035

- The Worldwide Styrene Butadiene Rubber Market Size Is Expected To Reach USD 81.58 Billion By 2035

- North America Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Styrene Butadiene Rubber Market Size was Worth around USD 44.82 Billion in 2024 and is Predicted to Grow to around USD 81.58 Billion By 2035 with a Compound Annual Growth Rate (CAGR) Of 5.6% From 2025 To 2035. The key factor in the growth of the global market for styrene butadiene rubber (SBR) is the growing requirement in the automotive market, electric vehicles included, for high-performance tires with fuel efficiency properties.

Market Overview

The Worldwide Styrene Butadiene Rubber (SBR) Market Size Refers To The Production And Application Of Styrene Butadiene Rubber, Which Falls Under The Category Of Synthetic Rubber Because It Possesses Excellent Resistance To Abrasion, Strength, And Economic Viability. The major application areas of SBR include tire production, which accounts for the major use segment, along with footware, adhesives, sealants, conveyor belts, hoses, and construction materials. The market growth is driven mainly by increasing automotive production, replacement tire demand, infrastructure, and industrial activity across the world. Growing urbanization and the rise in the mobility of people in emerging nations also contribute to its growth.

There Are Opportunities In Advanced, Solution-Polymerised SBR For High-Performance And Fuel-Efficient Tyres Due To Very Strict Emission And Fuel Efficiency Regulations. Innovation in sustainable and bio-based rubber solutions also opens up new growth avenues. Major players participating in the global SBR market are LANXESS, Arlanxeo, Kumho Petrochemical, Trinseo, Sinopec, Lotte Chemical, JSR Corporation, and Goodyear Chemical, where their aim is capacity enhancement, new product developments, and business collaborations. In January 2025, India ushered in faster expansion of domestic synthetic rubber production, including SBR, as a result of industrial and automobile policies that favor domestic production. The move is geared at making their supply chains more robust against imports, especially for the automotive industry.

Report Coverage

This Research Report Categorizes The Styrene Butadiene Rubber Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the styrene butadiene rubber market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the styrene butadiene rubber market.

Global Styrene Butadiene Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 44.82 Billion |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.6% |

| 2023 Value Projection: | USD 81.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application |

| Companies covered:: | ARLANXEO, Sinopec, LG Chem, Kumho Petrochemical, LANXESS, JSR Corporation, Lotte Chemical, Sibur, Trinseo, Versalis SpA, Asahi Kasei Corp, Synthos SA, ENEOS Corporation, Sumitomo Chemical Asia Pte Ltd, and Others,Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Global Styrene Butadiene Rubber Market Size Is Fueled By Increasing Demand From The Automobile And Tire Industries Due To Its Application As SBR, Which Exhibits Excellent Abrasion Resistance And Cost-Effectiveness When Compared With Other Rubber Materials. The use of SBR has also been on the rise due to increased urbanization and car production, especially from developing countries, as this has driven the tire market, thereby adding impetus to the SBR market. On the other hand, the increased use of SBR due to industrial applications such as footwear, adhesives, and construction materials has also positively driven the market.

Restraining Factors

The Styrene Butadiene Rubber Market Size Across The Globe Is Challenged By Volatile Raw Material Prices, Especially For Styrene And Butadiene, As A Result Of Which The Costs Of Production Are Affected. The challenges further include environmental issues, strict government regulations on the production of synthetic rubbers

Market Segmentation

The styrene butadiene rubber market share is classified into product type and application.

- The solution SBR (S-SBR) segment dominated the market in 2024, approximately 58% and is projected to grow at a substantial CAGR during the forecast period.

Based On The Product Type, The Styrene Butadiene Rubber Market Size Is Divided Into Emulsion SBR (E-SBR) And Solution SBR (S-SBR). Among these, the solution SBR (S-SBR) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The solution (S-SBR) category is increasing as a result of increasing government pressure on tire marking and energy efficiency, particularly from Europe and Asian regions. S-SBR provides better rolling resistance, durability, and wet traction. Suppliers of tires are increasing purchases, along with rising production capacities among chemical players, which is not going to let the market lack. As energy-efficient tires are given priority by the car industry, S-SBR is expected to maintain leadership.

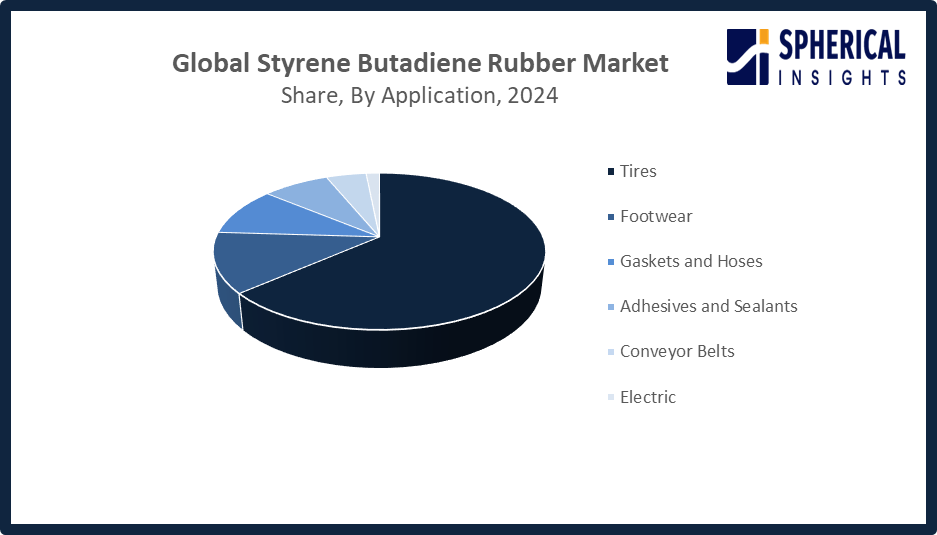

- The tires segment accounted for the highest market revenue in 2024, approximately 64% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The Application, The Styrene Butadiene Rubber Market Size Is Divided Into Tires, Footwear, Gaskets And Hoses, Adhesives And Sealants, Conveyor Belts, And Electric. Among these, the tires segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance in tire production, particularly tread and sidewall rubber, comes from the advantages provided by SBR, such as its strength, traction, abrasion resistance, heat stability, and economic viability. An increased number of passenger and lighter vehicles being sold in emerging countries boosts tire production, thereby leading to the consumption of SBR. Fuel efficiency standards, safety considerations, and the need to have environment-friendly tires made from premium SBR grades such as S-SBR make the tire industry the key growth driver for the SBR market.

Get more details on this report -

Regional Segment Analysis of the Styrene Butadiene Rubber Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the styrene butadiene rubber market over the predicted timeframe.

Get more details on this report -

Asia Pacific Is Anticipated To Hold The Largest Share Of The Styrene Butadiene Rubber Market Size Over The Predicted Timeframe. Asia Pacific will have the 34% market share in the global market for SBR. This is due to the fast-developing industries in the Asia Pacific, along with increasing automotive sales in the region. China has had the largest market share in the world’s tire production and the largest market share in the production of SBR. India has contributed to the market share of global SBR with increasing vehicle sales in the country, along with the Make in India campaign and EV incentives, pushing the market for high-performance SBR. In August 2025, China imposed anti-dumping duties of 13.8–40.5% on halogenated butyl rubber from Canada and Japan. India had maintained its duty on imports of SBR from the EU, South Korea, and Thailand.

North America Is Expected To Grow At A Rapid CAGR In The Styrene Butadiene Rubber Market Size During The Forecast Period. North America is anticipated to have a 22% share of the SBR market due to increasing demand from the automotive and tire segments, rising production of substitute tires, and stringent fuel efficiency and safety standards. The United States, being the leading SBR market, fuels this growth with advancements in high-performance tires and synthetic rubber development. Canada and Mexico offer growth through industrial uses and auto supply chains. In November 2024, the U.S. Congress eliminated an EPA rule on tire emissions, effective in 2025, relieving the industry burden on tire manufacturers, which also helps SBR production indirectly.

The Market Size For SBR In Europe Is Gradually Increasing Owing To The Increasing Need For Environmental Protection, Fuel Efficiency, And The Demand For Superior Quality Tire Performance. The German market is driven because of the country’s highly developed automotive and tire production industry, whereas the French, Italian, and UK markets are driven by the increasing use of the material in various industries and the development of environmentally friendly and eco-compatible tires. In July 2025, the EURIC and ETRMA called on the EC to establish EU End-of-Waste criteria for the rubber derived from End-of-Life Tyres.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The Styrene Butadiene Rubber Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ARLANXEO

- Sinopec

- LG Chem

- Kumho Petrochemical

- LANXESS

- JSR Corporation

- Lotte Chemical

- Sibur

- Trinseo

- Versalis SpA

- Asahi Kasei Corp

- Synthos SA

- ENEOS Corporation

- Sumitomo Chemical Asia Pte Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Eneos Materials Corporation announced a 10,000-tonne capacity increase at its Yokkaichi Plant to meet rising demand for SSBR used in high-performance tires. The expansion, completed by December 2027, supports next-generation, fuel-efficient, high-grip, and durable tires amid growing vehicle electrification trends.

- In September 2025, Sinopec started building a green, high-end rubber facility in Tianjin, China, following foundational design approval. The USD 344.65 million project will produce 100 kilotonnes/year each of SSBR and nickel-based butadiene rubber, supporting sustainable, advanced rubber material supply for domestic and global markets.

- In November 2022, Asahi Kasei began selling Tufdene S-SBR and Asadene BR produced via the mass-balance method at its Singapore and Kawasaki facilities. The sales follow the ISCC PLUS certification obtained in October 2022, highlighting the company’s commitment to sustainable synthetic rubber production.

- In August 2021, Agylix Corporation and Kumho Petrochemical announced a partnership to recover styrene monomer from post-use polystyrene waste for SSBR production. The collaboration includes developing a new chemical recycling plant in South Korea to support sustainable tire manufacturing and circular economy initiatives.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the styrene butadiene rubber market based on the below-mentioned segments:

Global Styrene Butadiene Rubber Market, By Product Type

- Emulsion SBR (E-SBR)

- Solution SBR (S-SBR)

Global Styrene Butadiene Rubber Market, By Application

- Tires

- Footwear

- Gaskets and Hoses

- Adhesives and Sealants

- Conveyor Belts

- Electric

Global Styrene Butadiene Rubber Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the styrene butadiene rubber market over the forecast period?The global styrene butadiene rubber market is projected to expand at a CAGR of 5.6% during the forecast period.

-

2. What is the styrene butadiene rubber market?The styrene butadiene rubber (SBR) market refers to the global trade and production of synthetic rubber used in tires, industrial applications, and consumer goods.

-

3. What is the market size of the styrene butadiene rubber market?The global styrene butadiene rubber market size is expected to grow from USD 44.82 billion in 2024 to USD 81.58 billion by 2035, at a CAGR of 5.6% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the styrene butadiene rubber market?Asia Pacific is anticipated to hold the largest share of the styrene butadiene rubber market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global styrene butadiene rubber market?ARLANXEO, Sinopec, LG Chem, Kumho Petrochemical, LANXESS, JSR Corporation, Lotte Chemical, Sibur, Trinseo, Versalis SpA, and Others.

-

6. What factors are driving the growth of the styrene butadiene rubber market?The SBR market is driven by rising automotive and tire demand, infrastructure development, government regulations on fuel efficiency and safety, growing industrial applications, and increasing adoption of high-performance, eco-friendly rubber products.

-

7. What are the market trends in the styrene butadiene rubber market?The SBR market shows a shift toward sustainable, high‑performance rubber, rising eco‑friendly grades, advanced tire formulations, and recycled/bio‑based materials due to regulations and automotive demand.

-

8. What are the main challenges restricting wider adoption of the styrene butadiene rubber market?The main challenges restricting the wider adoption of the styrene butadiene rubber (SBR) market are volatile raw material prices, stringent environmental regulations and sustainability concerns, competition from alternative materials, and certain performance limitations in specific applications.

Need help to buy this report?