Global Styrene Acrylonitrile Market Size, Share, and COVID-19 Impact Analysis, By Type (Emulsion, Continuous mass Polymerization, and Suspension), By Application (Food Container, Kitchenware, Electronics Covers, Plastic Optical Fiber, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Styrene Acrylonitrile Market Size Insights Forecasts to 2035

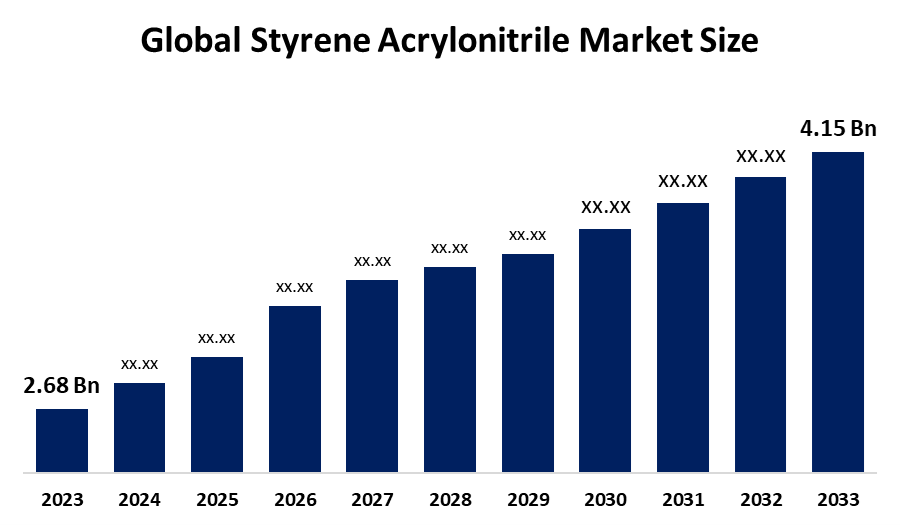

- The Global Styrene Acrylonitrile Market Size Was Estimated at USD 2.68 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.06 % from 2025 to 2035

- The Worldwide Styrene Acrylonitrile Market Size is Expected to Reach USD 4.15 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Styrene Acrylonitrile Market Size was valued at around USD 2.68 Billion in 2024 and is predicted to grow to around USD 4.15 Billion by 2035 with a compound annual growth rate (CAGR) of 4.06 % from 2025 to 2035. The growing need for long-lasting plastics, the expansion of the automotive and electronics sectors, the use of lightweight materials, improved chemical resistance, and growing consumer goods manufacturing applications all present opportunities for the Styrene Acrylonitrile Market Size.

Market Overview

The global industry that produces, distributes, and uses styrene-acrylonitrile copolymer, a stiff, clear thermoplastic resin made from roughly 70–80% styrene and 20–30% acrylonitrile monomers, is known as the styrene acrylonitrile (SAN) market. The copolymerization of acrylonitrile with styrene produces SAN, a polymer that combines the enhanced chemical resistance and thermal stability of acrylonitrile with the clarity and ease of processing of styrene. Suppliers of raw materials, producers of polymers, distributors, compounders, and end-user industries are all included in the Styrene Acrylonitrile Market Size. In January 2024, environmental approval was granted to Bhansali Engineering Polymers in India to increase SAN-related manufacturing to 25,000 TPA in addition to ABS. In September 2025, Supreme Petrochem Ltd. launched a related ABS line in Maharashtra at 70,000 TPA, which has SAN implications. The market for styrene acrylonitrile is expanding due to the healthcare industry's need for sterile and transparent packaging materials for medications and medical equipment.

Report Coverage

This research report categorizes the Styrene Acrylonitrile Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Styrene Acrylonitrile Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Styrene Acrylonitrile Market Size.

Styrene Acrylonitrile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.68 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.06% |

| 2035 Value Projection: | USD 4.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Asahi Kasei Corporation, BASF SE, Chevron Phillips Chemical Company LLC, Chi Mei Corporation, CNPC, INEOS Group, INEOS Styrolution, JSR Corporation, LG Chem, Ravago Group, SABIC, Styron LLC, Trinseo, Versalis S.p.A., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Styrene Acrylonitrile's superior mechanical qualities are driving its increasing use in automotive interiors, including instrument panels and trim pieces. The need for SAN-based materials in a variety of applications, such as windows, doors, and building panels, is increasing due to the global expansion of the construction sector. The market is growing, and the range of applications for SAN is increasing due to ongoing research and development activities to improve its qualities and investigate new uses. The market for styrene acrylonitrile is expanding due to the healthcare industry's need for sterile and transparent packaging materials for medications and medical equipment.

Restraining Factors

The market for styrene acrylonitrile is restricted by fluctuating raw material costs, regulatory and environmental constraints on plastic use, low impact resistance in comparison to alternatives, difficulties with recycling, and growing competition from engineering plastic substitutes.

Market Segmentation

The Styrene Acrylonitrile Market Size share is classified into type and application.

- The continuous mass polymerization segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the Styrene Acrylonitrile Market Size is divided into emulsion, continuous mass polymerization, and suspension. Among these, the continuous mass polymerization segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the market for styrene acrylonitrile (SAN), continuous mass polymerization refers to an uninterrupted, ongoing process of polymer synthesis. The market focuses on efficient procedures; continuous mass polymerization satisfies the need for SAN with enhanced properties in consumer products, electronics, and packaging applications.

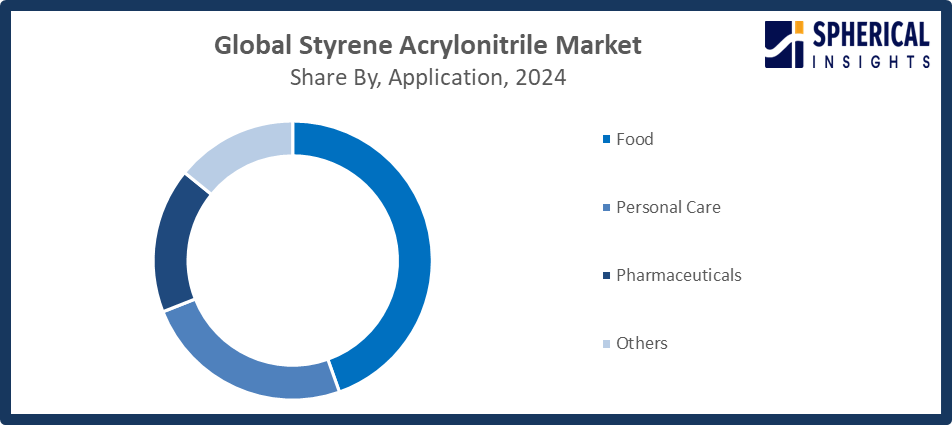

- The kitchenware segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Styrene Acrylonitrile Market Size is divided into food container, kitchenware, electronics covers, plastic optical fiber, and others. Among these, the kitchenware segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The manufacturing of different kitchen tools, containers, and accessories utilizing styrene acrylonitrile (SAN) is referred to as the kitchenware segment of the SAN market. Due to its long-lasting and aesthetically pleasant properties, SAN-based cookware is becoming more and more popular, satisfying consumer needs for aesthetically pleasing and useful kitchen products with improved resistance and lifespan.

Get more details on this report -

Regional Segment Analysis of the Styrene Acrylonitrile Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the Styrene Acrylonitrile Market Size over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the Styrene Acrylonitrile Market Size over the predicted timeframe. SAN is widely used in the region's well-established consumer goods, automotive, electrical and electronics, and healthcare sectors due to its dimensional stability, chemical resistance, and transparency. In European markets, SAN is preferred due to strict quality and environmental norms. The Green Deal from the European Commission and associated incentives for environmentally friendly materials, which promote recycling integration and styrenic copolymer innovation. Strict safety and quality regulations in European nations promote the use of dependable and high-performing polymer materials, which increases consumer demand.

North America is expected to grow at a rapid CAGR in the Styrene Acrylonitrile Market Size during the forecast period. The market for styrene acrylonitrile (SAN) is expected to increase significantly in North America due to the region's strong industrial infrastructure, advanced technology, and strong consumer demand for SAN-based goods. North America's dominant position in the market is further cemented by the adoption of SAN, which is driven by strict quality and safety regulations. Furthermore, the high uptake of contemporary processing technologies and the existence of sophisticated manufacturing infrastructure improve material quality and production efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Styrene Acrylonitrile Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi Kasei Corporation

- BASF SE

- Chevron Phillips Chemical Company LLC

- Chi Mei Corporation

- CNPC

- INEOS Group

- INEOS Styrolution

- JSR Corporation

- LG Chem

- Ravago Group

- SABIC

- Styron LLC

- Trinseo

- Versalis S.p.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Supreme Petrochem Ltd launched its first ABS production line at Amdoshi, Nagothane, Maharashtra, with a 70,000 tpa capacity, marking a significant expansion in India’s polymer manufacturing sector.

- In October 2023, SABIC and INEOS Styrolution launched a joint venture to establish the world’s largest SAN producer, with over 1 million tons annual capacity, headquartered in Riyadh, strengthening global market leadership.

- In July 2023, LG Chem and BASF SE launched a strategic partnership to advance SAN technology for the automotive sector, focusing on joint research, development, production, and innovation to meet evolving industry needs.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Styrene Acrylonitrile Market Size based on the below-mentioned segments:

Global Styrene Acrylonitrile Market Size, By Type

- Emulsion

- Continuous mass Polymerization

- Suspension

Global Styrene Acrylonitrile Market Size, By Application

- Food Container

- Kitchenware

- Electronics Covers

- Plastic Optical Fiber

- Others

Global Styrene Acrylonitrile Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Styrene Acrylonitrile Market Size over the forecast period?The global Styrene Acrylonitrile Market Size is projected to expand at a CAGR of 4.06% during the forecast period.

-

2. What is the market size of the Styrene Acrylonitrile Market Size?The global Styrene Acrylonitrile Market Size is expected to grow from USD 2.68 billion in 2024 to USD 4.15 billion by 2035, at a CAGR of 4.06 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Styrene Acrylonitrile Market Size?Europe is anticipated to hold the largest share of the Styrene Acrylonitrile Market Size over the predicted timeframe.

-

4. Who are the top companies operating in the global Styrene Acrylonitrile Market Size?Asahi Kasei Corporation, BASF SE, Chevron Phillips Chemical Company LLC, Chi Mei Corporation, CNPC, INEOS Group, INEOS Styrolution, JSR Corporation, LG Chem, Ravago Group, SABIC, Styron LLC, Trinseo, Versalis S.p.A., and Others.

-

5. What factors are driving the growth of the Styrene Acrylonitrile Market Size?Increasing demand for durable, lightweight, and chemically resistant plastics in automotive, electronics, consumer goods, and medical industries, coupled with technological advancements and industrial expansion, drives the Styrene Acrylonitrile Market Size growth.

-

6. What are the market trends in the Styrene Acrylonitrile Market Size?Rising adoption of high-performance plastics, focus on sustainability and recycling, use in automotive and electronics, technological innovations in polymer processing, and growing consumer demand for aesthetically appealing products characterize SAN market trends.

-

7. What are the main challenges restricting the wider adoption of the Styrene Acrylonitrile Market Size?Volatile raw material prices, limited impact resistance, environmental and regulatory restrictions, recycling difficulties, and competition from alternative engineering plastics hinder broader adoption of styrene acrylonitrile in various industries.

Need help to buy this report?