Global Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market Size, Share, and COVID-19 Impact Analysis, By Types (Chemosynthesis Drug and Biological), By Application (Oncology, Anti-Diabetic, Cardiovascular, Musculoskeletal, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market Size Insights Forecasts to 2035

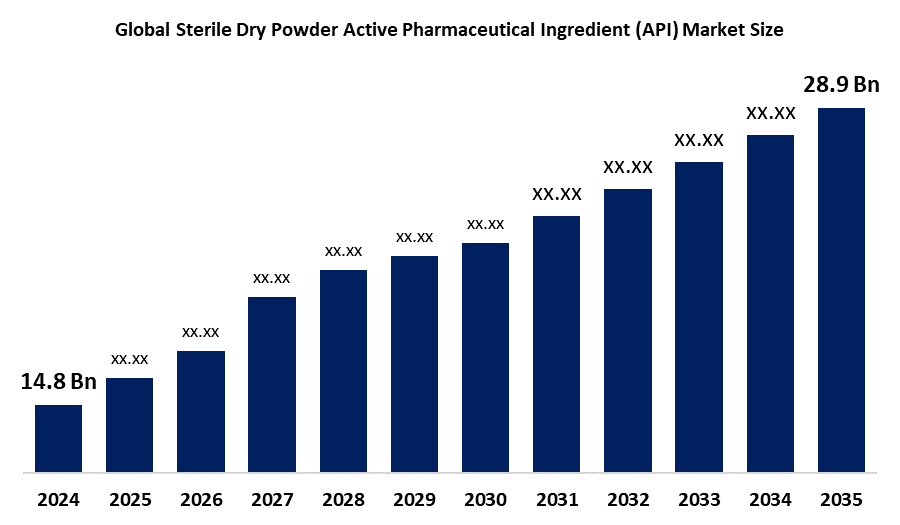

- The Global Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market Size Was Estimated at USD 14.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.27% from 2025 to 2035

- The Worldwide Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market Size is Expected to Reach USD 28.9 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market Size was worth around USD 14.8 Billion in 2024 and is predicted to Grow to around USD 28.9 Billion by 2035 with a compound annual growth rate (CAGR) of 6.27% from 2025 and 2035. The market for sterile dry powder active pharmaceutical ingredient (API) has a number of opportunities to grow because they are perfect for biologics or inhalable therapy, provide better stability, and make storage and transportation easier. Additionally, they satisfy strict safety and sterility regulations and are becoming more and more essential for contemporary medications.

Market Overview

A sterile dry powder active pharmaceutical ingredient is a biologically active substance that has been finely ground and is meant to be used in pharmaceutical formulations. The sterile dry powder active pharmaceutical ingredient market is an important segment of the pharmaceutical industry that relates to the production and sales of sterile dry powders utilized for the formulation of drugs. Significant growth at the global level in the sterile APIs market is projected due to increased demand for high quality drugs and advancements in drug delivery systems. The U.S. Food and Drug Administration estimates the pharmaceutical marketplace is expected to be valued at approximately USD 1.5 trillion by 2023, demonstrating the importance of sterile APIs in promoting therapeutic effectiveness and patient safety. In terms of sterile dry powder API products utilized in the manufacturing of various pharmaceuticals, the sterile dry powder active pharmaceutical ingredient discrete market remains an important part of pharmaceuticals. Because of current increases in the demand for injectable products, the sterile drug active pharmaceutical ingredient market is expanding rapidly, due to increased global awareness of chronic disease states. According to a survey conducted by the U.S. Food and Drug Administration, projected sales of sterile injectable products are targeted to reach about USD 275 billion by 2025, demonstrating one of the leading growth segments of pharmaceutical active ingredient products.

India is aggressively working to implement laws that would lessen its reliance on imported APIs, especially those from China. A Rs.3,000 crore incentive plan has been put forth by the government to promote the construction of fermentation and API facilities in the nation. Cabinet clearance of this project is anticipated shortly, since it is being prepared in conjunction with NITI Aayog. In order to lessen dependency on imports, the program intends to assist businesses that invest about Rs.500 crore in the establishment of new production facilities, with an emphasis on producing 38 essential medications.

Report Coverage

This research report categorizes the sterile dry powder active pharmaceutical ingredient (API) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sterile dry powder active pharmaceutical ingredient (API) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sterile dry powder active pharmaceutical ingredient (API) market.

Global Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.27% |

| 2035 Value Projection: | USD 28.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Types, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Lonza Group, Roquette Freres, Teva Pharmaceutical Industries Ltd., Novartis AG, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., AstraZeneca plc, Boehringer Ingelheim International GmbH, Hikma Pharmaceuticals PLC, Dr. Reddy’s Laboratories, Sandoz International GmbH, Aurobindo Pharma Limited, Corden Pharma GmbH, Sun Pharmaceutical Industries Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sterile dry powder active pharmaceutical ingredient (API) market is driven by the increasing incidence of chronic diseases, such as diabetes, cancer, and cardiovascular diseases, a large portion of which require effective treatment. According to the World Health Organization, chronic diseases are responsible for 71% of deaths globally, signifying the urgent need for new therapeutic pharmaceutical agents. Moreover, the increasing demand for biologics and biosimilars, which often require sterile dry powders for their formulation, is driving market development. The stability and ease of use of dry powders also add to their worth to pharmaceutical manufacturers. Another important aspect of the sterile dry powder API market is the sterilization process, which ensures the removal of all viable microbial organisms from the API. This step is important for maintaining the safety and efficacy of the product.

Restraining Factors

The sterile dry powder active pharmaceutical ingredient (API) market is restricted by factors the high costs associated with the development and manufacture of sterile APIs. The stringent regulatory criteria associated with health agencies, such as the FDA and EMA, complicate the manufacturing process and increase operational costs.

Market Segmentation

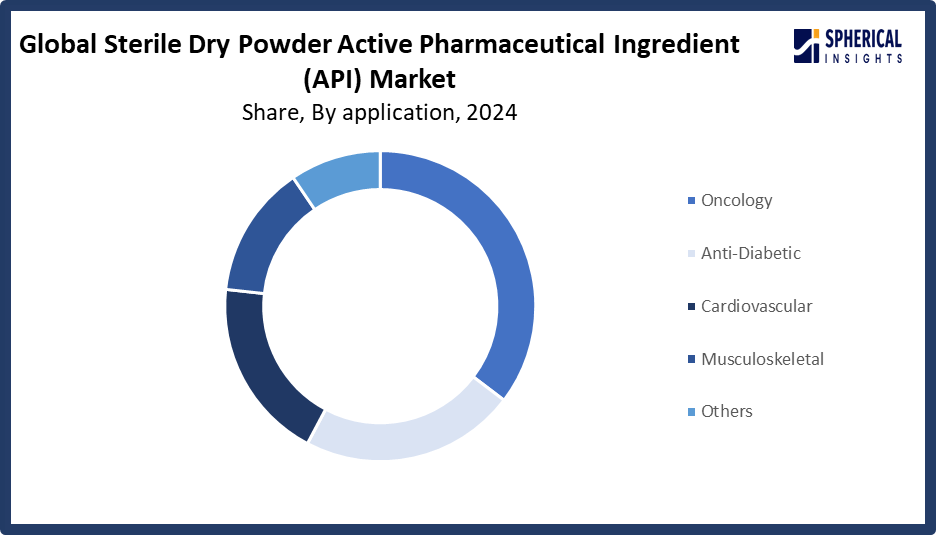

The sterile dry powder active pharmaceutical ingredient (API) market share is classified into types and applications.

- The chemosynthesis drug segment dominated the market in 2024, accounting for approximately 59.8% and is projected to grow at a substantial CAGR during the forecast period.

Based on the types, the sterile dry powder active pharmaceutical ingredient (API) market is divided into chemosynthesis drug and biological. Among these, the chemosynthesis drug segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because cancer treatments often involve high potency, sterile injectable or inhalable medications with rigorous requirements for purity, stability, and dosing. Sterile dry powder APIs offer significant advantages with their longer shelf life, decreased transportation costs, and less exposed risk during handling, making them valuable for chemotherapy, biologics, and monoclonals. The oncology field continues to move ahead of other treatment areas due to increasing global incidence of cancer, a large R&D pipeline, and strong regulatory support for sterile formulations.

- The oncology segment accounted for the largest share in 2024, accounting for approximately 35% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the sterile dry powder active pharmaceutical ingredient (API) market is divided into oncology, anti-diabetic, cardiovascular, musculoskeletal, and others. Among these, the oncology segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because, in comparison to biological APIs, chemically synthesized APIs usually require less specialized cold storage or handling, have more consistent purity and stability, are easier and less expensive to scale up, and are subject to fewer regulatory complications.

Get more details on this report -

Regional Segment Analysis of the Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 40% of the sterile dry powder active pharmaceutical ingredient (API) market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 40% of the sterile dry powder active pharmaceutical ingredient (API) market over the predicted timeframe. In the North American market, the industry is rising due to the presence of significant pharmaceutical corporations, sophisticated healthcare infrastructure, and strong regulatory frameworks allow the region to dominate the industry. Their market dominance is also influenced by the high incidence of chronic illnesses and a readiness to embrace cutting-edge treatments. Although they are rigorous, strict regulatory compliance standards also demonstrate a dedication to quality and safety, which influences market expansion.

The United States dominates the market for sterile dry powder active pharmaceutical ingredients. Due to its robust infrastructure, significant R&D expenditures, and favorable regulatory environment, the US pharmaceutical industry is positioned as a leader in API production and innovation. The efforts of the U.S. government to enhance domestic manufacturing capacity serve to further solidify its market supremacy.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 6.3% in the sterile dry powder active pharmaceutical ingredient (API) market during the forecast period. The Asia Pacific area has a thriving market for sterile dry powder active pharmaceutical ingredient (API) due to rising health care costs, high rates of chronic disease, and the growing population of CMOs offering lower cost sterile dry powder API production services. Nonetheless, there are challenges, including uneven legislative regimes and infrastructure challenges.

China has a large pharmaceutical manufacturing sector, significant government funding for the advancement of biotechnology, and rising local demand for high quality medical supplies. The country's position as a major player in the global API industry is further cemented by its dedication to improving its pharmaceutical infrastructure and regulatory requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sterile dry powder active pharmaceutical ingredient (API) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lonza Group

- Roquette Freres

- Teva Pharmaceutical Industries Ltd.

- Novartis AG

- Pfizer Inc.

- GlaxoSmithKline plc

- Sanofi S.A.

- AstraZeneca plc

- Boehringer Ingelheim International GmbH

- Hikma Pharmaceuticals PLC

- Dr. Reddy's Laboratories

- Sandoz International GmbH

- Aurobindo Pharma Limited

- Corden Pharma GmbH

- Sun Pharmaceutical Industries Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, 3P innovation launched a next generation dry powder inhaler filling technology that can fill inhalers with dry powder up to 5X faster than existing systems. It handles highly potent and dusty powders, better containment, lubricants, etc.

- In January 2025, Teva Pharmaceuticals International GmbH, a subsidiary of Teva Pharmaceutical Industries Ltd., announced that it had entered into a strategic collaboration with Klinge Biopharma GmbH and Formycon AG for the semi exclusive commercialization of FYB203, Formycons biosimilar candidate to Eylea in Europe, excluding Italy, and in Israel.

- In November 2024, Adragos Pharma, a German CDMO, acquired Baccinex, a Swiss aseptic fill finish company with lyophilization expertise. This gives Adragos expanded sterile manufacturing, especially liquid and lyophilized vials, for both clinical trial supplies and small to medium commercial production. Baccinexs Jura facility is EU GMP and US FDA certified.

- In May 2024, GEA introduced the GEA Aseptics spray dryer at ACHEMA 2024 in Frankfurt, designed for pharmaceutical spray drying applications (antibiotics, vaccines, proteins, etc.). It allows aseptic spray drying, i.e., converting sterile solution to sterile powder in one step, with advanced cleaning, steam sterilization, sterile filters, etc.

- In December 2023, a US based, global pharmaceutical contract development and manufacturing organization announced that it would acquire the Lubrizol Particle Sciences Inc. business. The acquisition includes the drug product formulation technology behind the Particle Sciences Inc. business as well as the Bethlehem, PA, development and manufacturing site with approximately 65 employees.

- In August 2023, Sigachi Industries Limited, a renowned name in the excipient segment of the pharmaceutical industry, announced its strategic expansion into the API business with the successful acquisition of a majority stake (80%) of a state of the art API manufacturing company, Trimax Bio Sciences, located in Raichur, Karnataka.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the sterile dry powder active pharmaceutical ingredient (API) market based on the below-mentioned segments:

Global Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market, By Types

- Chemosynthesis Drug

- Biological

Global Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market, By Application

- Oncology

- Anti-Diabetic

- Cardiovascular

- Musculoskeletal

- Others

Global Sterile Dry Powder Active Pharmaceutical Ingredient (API) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the sterile dry powder active pharmaceutical ingredient (API) market over the forecast period?The global sterile dry powder active pharmaceutical ingredient (API) market is projected to expand at a CAGR of 6.27% during the forecast period.

-

2. What is the market size of the sterile dry powder active pharmaceutical ingredient (API) market?The global sterile dry powder active pharmaceutical ingredient (API) market size is expected to grow from USD 14.8 Billion in 2024 to USD 28.9 Billion by 2035, at a CAGR of 6.27% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the sterile dry powder active pharmaceutical ingredient (API) market?North America is anticipated to hold the largest share of the sterile dry powder active pharmaceutical ingredient (API) market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global sterile dry powder active pharmaceutical ingredient (API) market?Lonza Group, Roquette Freres, Teva Pharmaceutical Industries Ltd., Novartis AG, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., AstraZeneca plc, Boehringer Ingelheim International GmbH, Hikma Pharmaceuticals PLC, Dr. Reddy's Laboratories, Sandoz International GmbH, Aurobindo Pharma Limited, Corden Pharma GmbH, Sun Pharmaceutical Industries Ltd, and Others.

-

5. What factors are driving the growth of the sterile dry powder active pharmaceutical ingredient (API) market?The sterile dry powder active pharmaceutical ingredient (API) market growth is driven by the growing prevalence of infectious and chronic diseases worldwide, which raises the need for sterile injectable and inhalable therapies. Manufacturing technology advancements, like as lyophilization, spray drying, aseptic fill finish, and single use systems, are increasing efficiency, decreasing the risk of contamination, and improving product stability.

-

6. What are market trends in the sterile dry powder active pharmaceutical ingredient (API) market?The sterile dry powder active pharmaceutical ingredient (API) market trends include rising demand for synthetic grafts, advancements in biocompatible materials, increasing minimally invasive procedures, and strategic partnerships for innovative product development and distribution.

-

7. What are the main challenges restricting wider adoption of the sterile dry powder active pharmaceutical ingredient (API) market?The sterile dry powder active pharmaceutical ingredient (API) market trends include extremely high manufacturing costs due to complicated, constantly changing regulatory requirements, cleanrooms, specialized equipment, and stringent GMP compliance. Scaling is further constrained by supply chain weaknesses, i.e, raw materials, logistics, and a lack of qualified workers.

Need help to buy this report?