Global Stem Cell Concentration System Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Autologous Stem Cell Concentration Systems and Allogeneic Stem Cell Concentration Systems), By Application (Orthopedics, Cardiology, Neurology, Dermatology, and Dental), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Stem Cell Concentration System Market Insights Forecasts To 2035

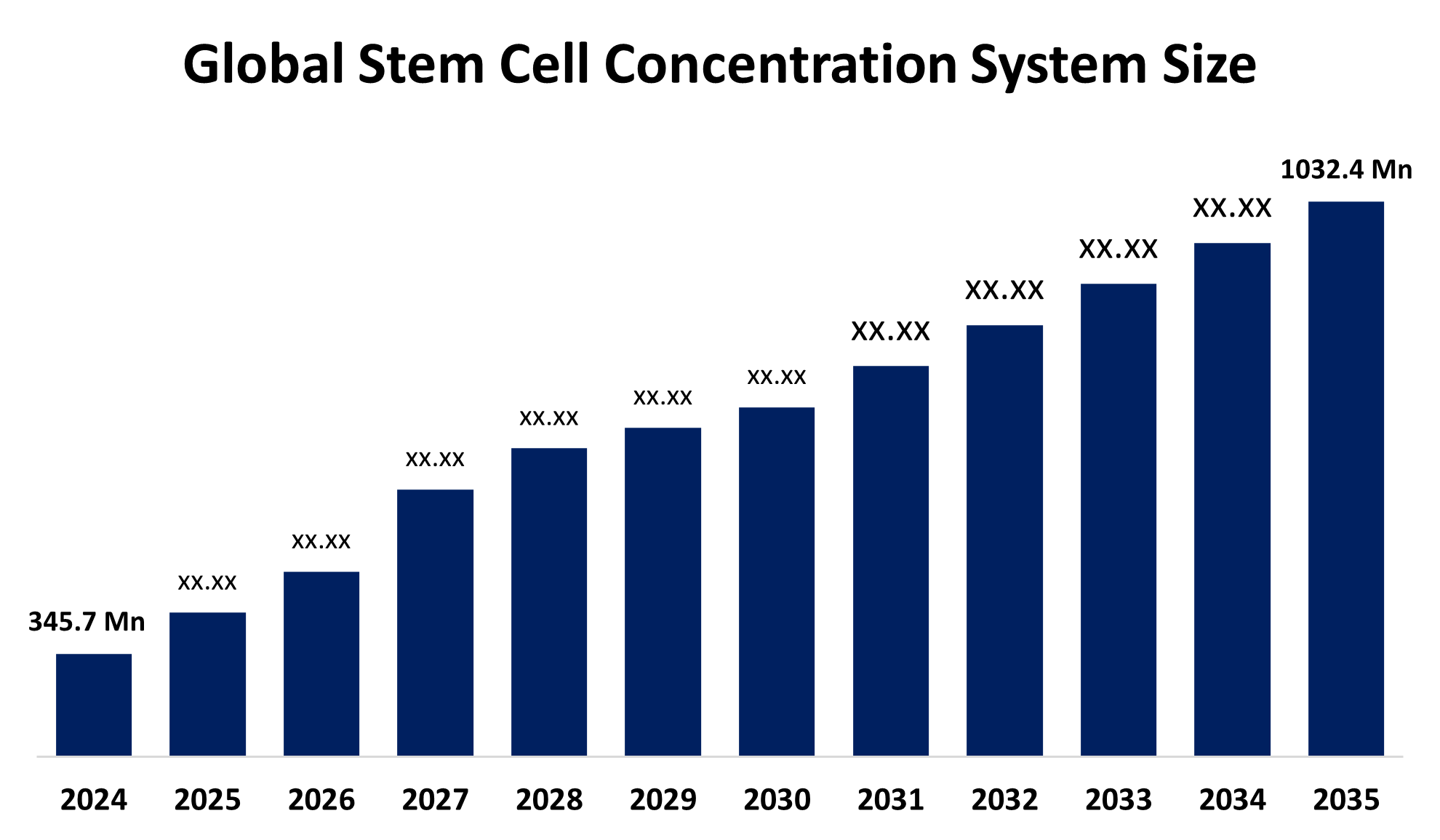

- The Global Stem Cell Concentration System Market Size Was Estimated at USD 345.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.46% from 2025 to 2035

- The Worldwide Stem Cell Concentration System Market Size is Expected to Reach USD 1032.4 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Stem Cell Concentration System Market Size was worth around USD 345.7 Million in 2024 and is Predicted to grow to around USD 1032.4 Million by 2035 with a compound annual growth rate (CAGR) of 10.46% from 2025 to 2035. Growing digitization, environmental consciousness, performance optimization, expanding applications in healthcare, automotive, electronics, packaging, and construction, as well as growing industrial and consumer usage, are the factors propelling the market for stem cell concentration systems.

Market Overview

The global stem cell concentration system market refers to the industry that focuses on technology and systems for isolating, concentrating, and processing stem cells for use in healthcare, regenerative medicine, research, and other industries. The market for stem cell concentration systems is expanding because of recent developments in tissue engineering and stem cell therapies, as scientists and medical professionals place a greater emphasis on using regenerative medicine to treat a range of illnesses. The market is expanding as a result of growing demand for stem cell banking and heightened research into the manufacturing, storage, and characterisation of stem cells. Reproducibility, sterility, and operational efficiency are improved in clinical and laboratory settings by technological advancements in automated systems for enriching stem cell populations. The use of these systems in treatment regimens is being accelerated by collaborative efforts between bioengineers and clinical researchers. Global interest has increased as stem cells are acknowledged as a promising source for regenerative therapies that can replace or repair damaged tissues and organs. Government programs, strong funding, partnerships, and intensive R&D all contribute to market expansion. To boost the entire market trajectory and advance manufacturing procedures for regenerative medicine goods, the CiRA Foundation and CGT Catapult, for instance, began a partnership effort in May 2020 to characterise induced pluripotent stem cells.

Report Coverage

This research report categorizes the stem cell concentration system market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the stem cell concentration system market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the stem cell concentration system market.

Global Stem Cell Concentration System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 345.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.46% |

| 2035 Value Projection: | USD 1032.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | STEMCELL Technologies, Zimmer Biomet, Isto Biologics, Celling Biosciences, Arthrex, EmCyte Corporation, Harvest Technologies, Argos Technologies, Inc., Terumo Corporation, Thermo Fisher Scientific, Becton, Dickinson & Company (BD), Miltenyi Biotec GmbH, GE Healthcare, Cervos Medical, InGeneron, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

There are important factors propelling the market for stem cell concentration systems. Ongoing technological innovation continues to enhance system performance, effectiveness, and responsiveness to specific applications. Its use is advancing beyond healthcare, as it proves valuable in numerous industries through cross-industry adoption. Urbanization and the development of infrastructure are propelling the uptake of viable, automated solutions in contemporary operations and smart cities. Complementary to this approach, modern society is embracing eco and efficient processing in response to an increasing focus on sustainability and ESG commitments, resulting in an overall expansion of market growth and significance to regenerative medicine and beyond.

Restraining Factors

There are various obstacles facing the market for stem cell concentration systems. Affordability is restricted by high production costs resulting from advanced materials, R&D, and processing. Product rollouts are delayed, and compliance costs are increased by a complicated regulatory environment. The availability of raw materials is impacted by supply chain disruptions caused by international crises. High-tech stem cell concentration technologies' effective deployment, scalability, and wider adoption are further hampered by a technical skills gap brought on by a shortage of qualified specialists.

Market Segmentation

The stem cell concentration system market share is classified into product type and application.

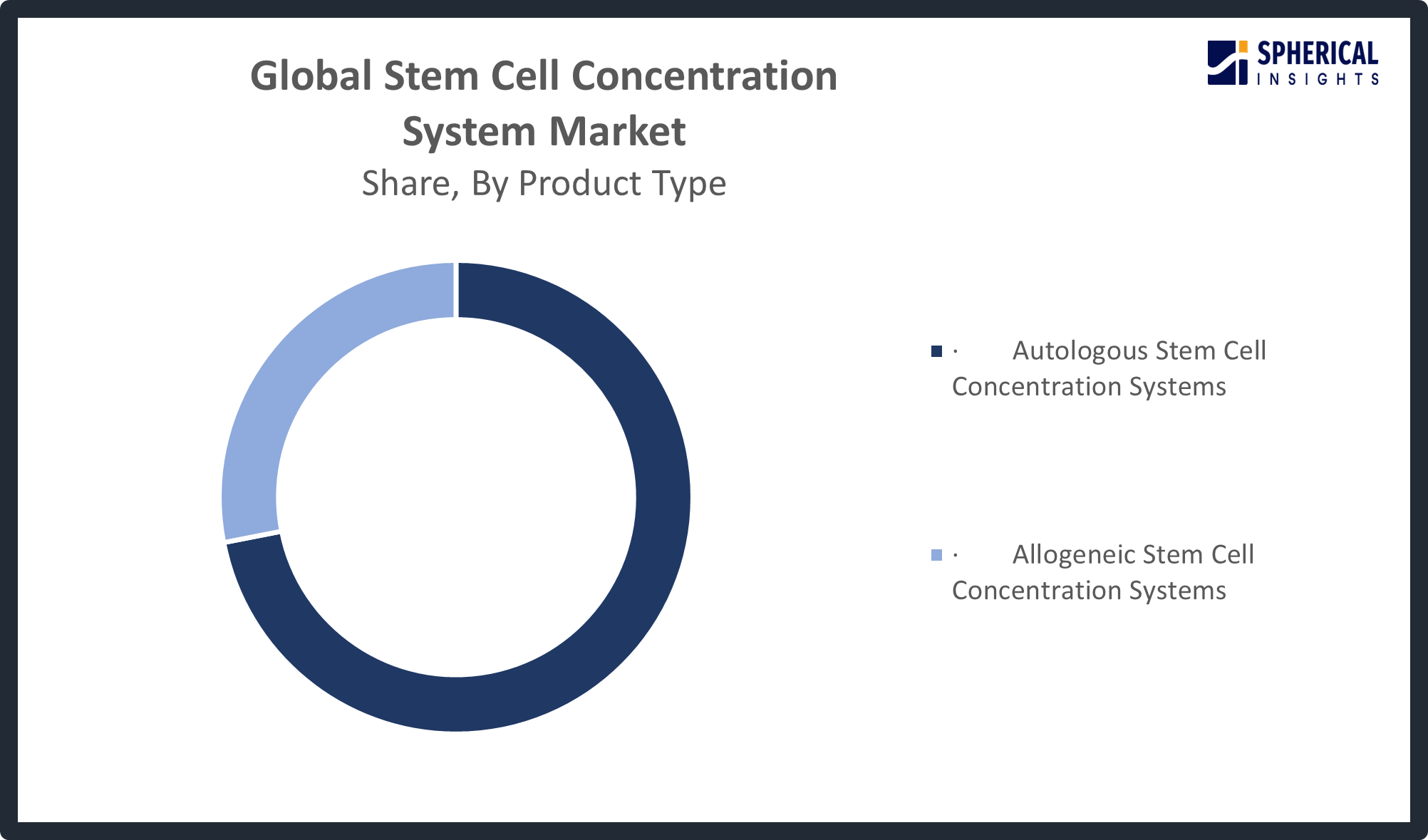

- The autologous stem cell concentration systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the stem cell concentration system market is divided into autologous stem cell concentration systems and allogeneic stem cell concentration systems. Among these, the autologous stem cell concentration systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Its extensive clinical use and decreased immunological rejection risk, in contrast to allogeneic substitutes. These technologies are the go-to option in regenerative medicine because they guarantee increased patient safety. Expanding applications in wound healing, cardiovascular therapy, orthopedics, and other therapeutic fields enhanced the segment's market revenue and further solidified its leadership.

Get more details on this report -

- The orthopedics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the stem cell concentration system market is divided into orthopedics, cardiology, neurology, dermatology, and dental. Among these, the orthopedics segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Driven by an increase in the number of cases of arthritis, sports injuries, and musculoskeletal problems. Demand has increased due to the use of regenerative therapies for joint restoration, fracture healing, and cartilage regeneration. The dominance of orthopaedics in this sector is further reinforced by expanding clinical research and favourable patient outcomes.

Regional Segment Analysis of the Stem Cell Concentration System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Stem Cell Concentration System market over the predicted timeframe.

North America is anticipated to hold the largest share of the stem cell concentration system market over the predicted timeframe. The industry is growing due to favourable regulatory frameworks, rising incidence of chronic diseases, and technological advancements. Additionally, significant financing from public and private institutions supports research and development efforts, encouraging innovation in stem cell therapy. The Board of the California Institute for Regenerative Medicine (CIRM) approved funds for projects about its Clinical and Translation programs, for example. Growing investments in healthcare infrastructure and the rising need for regenerative medicine solutions are two more factors propelling the market rise. When taken as a whole, these elements put North America at the forefront of the global stem cell therapy market, with room to develop.

Asia Pacific is expected to grow at a rapid CAGR in the stem cell concentration system market during the forecast period. Researchers from the Indian Institute of Science (IISc) made significant discoveries regarding gene expression during the reprogramming of adult cells into induced pluripotent stem cells (iPSCs). These discoveries contribute to knowledge about stem cell reprogramming and could enhance the application of regenerative medicine. As countries in this region collaborate to develop medical science and support innovation, the market is expected to expand and introduce ground-breaking solutions to healthcare. The market is expected to grow rapidly due to the rising prevalence of diseases such as cancer, diabetes, and neurological conditions. Additionally, government support to promote stem cell research contributes to the growth of this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the stem cell concentration system market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- STEMCELL Technologies

- Zimmer Biomet

- Isto Biologics

- Celling Biosciences

- Arthrex

- EmCyte Corporation

- Harvest Technologies

- Argos Technologies, Inc.

- Terumo Corporation

- Thermo Fisher Scientific

- Becton, Dickinson & Company (BD)

- Miltenyi Biotec GmbH

- GE Healthcare

- Cervos Medical

- InGeneron

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Novo Nordisk and Evotec formed a strategic partnership to develop stem cell-based treatments with an emphasis on cardiovascular and diabetes conditions. Through the cooperation, Evotec's beta-cell implant program, QR-Beta, will be used to improve clinical and commercial manufacturing capabilities.

- In March 2024, to maintain long-term financial stability and facilitate the continued commercialisation of Omisirge, Gamida Cell Ltd. obtained a Restructuring Support Agreement with Highbridge Capital Management, its primary lender. In Israel, a voluntary method will be used to carry out the restructuring.

- In January 2024, to produce research-grade and Good Manufacturing Practice (GMP) mesenchymal stem cells (MSCs), Cellcolabs AB, a spin-off from the Karolinska Institute, has partnered with REPROCELL Inc., Japan's first induced pluripotent stem cell (iPSC) firm. The goal of this partnership is to provide premium MSCs and MSC-derived products produced by Cellcolabs for use in clinical and research settings throughout the world. Furthermore, Cellcolabs has obtained the exclusive right of distribution in Japan.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the stem cell concentration system market based on the below-mentioned segments:

Global Stem Cell Concentration System Market, By Product Type

- Autologous Stem Cell Concentration Systems

- Allogeneic Stem Cell Concentration Systems

Global Stem Cell Concentration System Market, By Application

- Orthopedics

- Cardiology

- Neurology

- Dermatology

- Dental

Global Stem Cell Concentration System Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Stem Cell Concentration System market over the forecast period?The global Stem Cell Concentration System market is projected to expand at a CAGR of 10.46% during the forecast period.

-

2. What is the market size of the Stem Cell Concentration System market?The global Stem Cell Concentration System market size is expected to grow from USD 345.7 Million in 2024 to USD 1032.4 Million by 2035, at a CAGR of 10.46% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Stem Cell Concentration System market?North America is anticipated to hold the largest share of the Stem Cell Concentration System market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Stem Cell Concentration System market?STEMCELL Technologies, Zimmer Biomet, Isto Biologics, Celling Biosciences, Arthrex, EmCyte Corporation, Harvest Technologies, Argos Technologies, Inc., Terumo Corporation, and Thermo Fisher Scientific.

-

5. What factors are driving the growth of the Stem Cell Concentration System market?The market for stem cell concentration systems is being driven by technological advancements that improve efficiency and reproducibility, growing adoption in orthopaedics and regenerative medicine, increasing demand for automated cell processing, increasing funding and collaborations, and expanding applications across the global biotechnology, research, and healthcare sectors.

-

6. What are the market trends in the Stem Cell Concentration System market?AI-driven automation, growing regenerative medicine applications, cross-industry adoption, a focus on sustainable processes, and an increase in investments and collaborations are some of the major trends in the stem cell concentration system market that are propelling innovation, efficiency, and wider market penetration on a global scale.

-

7. What are the main challenges restricting wider adoption of the Stem Cell Concentration System market?High production costs, intricate regulatory requirements, a shortage of qualified professionals, supply chain interruptions, and the requirement for sophisticated infrastructure are the primary obstacles preventing the market for stem cell concentration systems from being widely adopted. These factors collectively impede scalability and market penetration.

Need help to buy this report?