Global Steel Shell Furnace Market Size, Share, and COVID-19 Impact Analysis, By Type (Below 1t Steel Shell Furnace, 1-30t Steel Shell Furnace, and Above 30t Steel Shell Furnace), By Application (Metallurgy, Mechanics, Building Material, and Automobile Manufacturing), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal Steel Shell Furnace Market Insights Forecasts to 2035

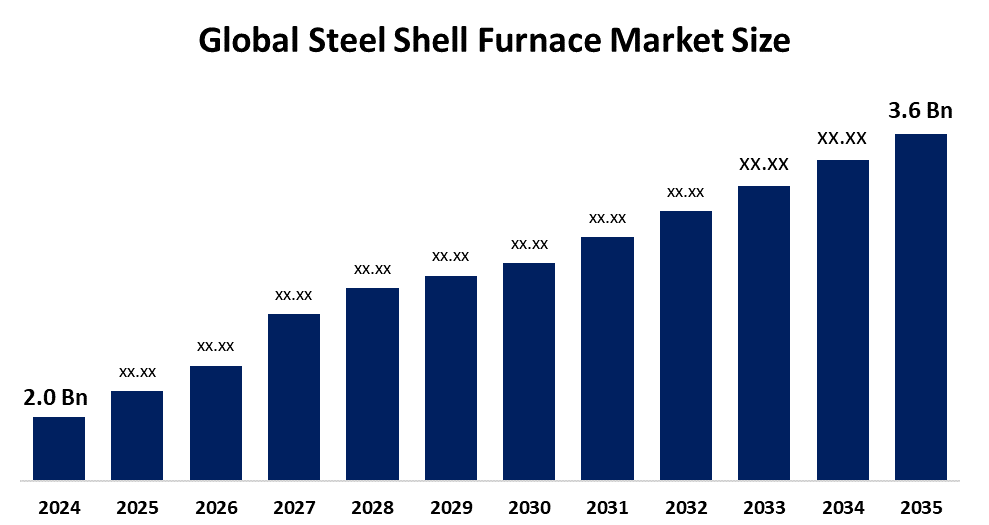

- The Global Steel Shell Furnace Market Size Was Estimated at USD 2.0 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.49% from 2025 to 2035

- The Worldwide Steel Shell Furnace Market Size is Expected to Reach USD 3.6 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global steel shell furnace market size was worth around USD 2.0 Billion in 2024 and is predicted to grow to around USD 3.6 Billion by 2035 with a compound annual growth rate (CAGR) of 5.49% from 2025 and 2035. The market for steel shell furnace has a number of opportunities to grow due to biocarbon use in electric arc furnace steelmaking, especially as a charge carbon material.

Market Overview

The global steel shell furnace industry focuses on the production and sale of steel shell melting furnaces, used to melt scrap steel and other metals. A steel shell furnace is a type of industrial furnace commonly used in the melting and smelting of various metals. The furnaces have an outer shell made of steel, typically made with a steel shell structure providing durability and resistance to extreme temperatures and thermal stress. Further, they are commonly used in heavy-duty applications like steel-making, casting, and forging where high temperature and heavy loads are required. For instance, in November 2024, SMS Group was chosen by SSAB, a Nordic and US-based steel company, for the construction of a new 190-ton Electric Arc Furnace (EAF).

Innovation and market expansion are anticipated as a result of the growing R&D expenditures of major players and expanding partnerships. The integration of carbon capture technologies in blast furnace-based steel making is driving a huge surge in the global steel shell furnace market. For instance, Primetals Technologies was entrusted with the task of repairing Blast Furnace No. 1 and 2 at the Visakhapatnam Steel Plant to enhance their production capacity.

Global Steel Shell Furnace Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.0 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.49% |

| 2035 Value Projection: | USD 3.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application, By Regional Analysis |

| Companies covered:: | Inductotherm, Induction Technology Corporation (ITC), APS Induction Technology, Cooldo, FOCO induction, Inductotherm India Private Limited, Luoyang Hongteng Induction, Luoyang shennai Power Equipment, SuperbMelt, Weifang Jinhuaxin Electric Furnace Manufacturing, Shandong Huaxin Electric Furnace, Abhay Induction Tech, Zhengzhou lanshuo electronics, Luoyang Dinghong Electric Technology, and Others |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Report Coverage

This research report categorizes the steel shell furnace market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the steel shell furnace market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the steel shell furnace market.

Driving Factors

The steel shell furnace market is primarily driven by its use in the metal industry for melting, refining, and heat treatment of steel, iron, copper, aluminium, and various alloys. Further, the increasing investment in infrastructure with the growing urbanization is contributing to propelling the market. For instance, as per the report of Stanford King Centre on Global Development, the world is rapidly urbanizing, with 70% global population expected to live in cities by 2050. Additionally, the evolution of automation of industrial furnaces, including the integration of the Internet of Things (IoT) and artificial intelligence (AI), is anticipated to promote market growth.

Restraining Factors

The steel shell furnace market is restricted by increased initial investment costs, raw material price volatility, competition with other melting methods, and strict safety regulations that lead to high manufacturing & operational costs.

Market Segmentation

The steel shell furnace market share is classified into type and application.

- The 1-30t steel shell furnace segment accounted for the largest market share of about 50% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the steel shell furnace market is divided into below 1t steel shell furnace, 1-30t steel shell furnace, and above 30t steel shell furnace. Among these, the 1-30t steel shell furnace segment accounted for the largest market share of about 50% in 2024 and is projected to grow at a substantial CAGR during the forecast period. The 30-ton induction furnace is a large piece of equipment that meets most melting needs and is mainly used for smelting steel. For instance, Shen Guang Electric furnace is a leading induction furnace that manufactures products used for smelting or heating steel.

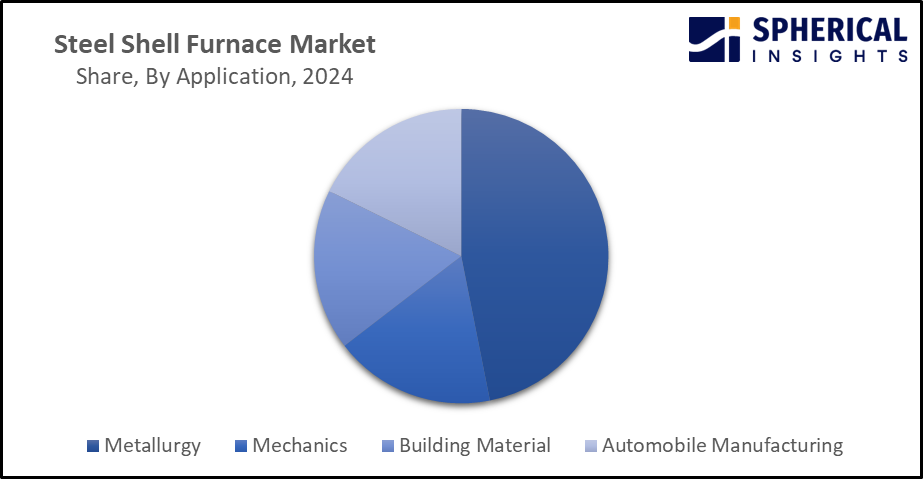

- The metallurgy segment accounted for the largest market share of about 45% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the steel shell furnace market is divided into metallurgy, mechanics, building material, and automobile manufacturing. Among these, the metallurgy segment accounted for the largest market share of about 45% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Furnaces used in metallurgical applications include steel production from ores and pre-reduced pelletized iron ores. For heavy-duty applications like steel making, casting, and forging, where high temperature and heavy loads are required, the furnace provides durability and resistance to thermal stability.

Get more details on this report -

Regional Segment Analysis of the Steel Shell Furnace Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the steel shell furnace market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the steel shell furnace market over the predicted timeframe. The market ecosystem in North America is strong, driven by decarbonization pathways and policy recommendations for the U.S. steel sector. For instance, as per the reports of Clean Air Task Force, approximately 70% of the steel produced in the U.S. is made by remelting metallics, primarily scrap, in electric arc furnaces. The market for steel shell furnace has been driven by the region's advanced manufacturing capabilities and the use of advanced technologies like electric arc furnaces and steel shell furnaces. The United States is leading the North America steel shell furnace market, driven by an increasing technological advancements in furnace design, enhancing energy efficiency and melting precision.

Asia Pacific is expected to grow at a rapid CAGR of about 6.41% in the steel shell furnace market during the forecast period. The Asia Pacific area has a thriving market for steel shell furnace due to the region’s rising need for steel in construction, automotive, and manufacturing sectors. An increasing study on the effect of furnace steel is anticipated to propel the market growth. For instance, in May 2019, China’s top steel manufacturer, China Baowu Steel Group, is conducting a feasibility study to move its blast furnaces from Xinjiang to Cambodia in late 2019. China is dominating the Asia Pacific steel shell furnace market during the forecast period, driven by increased investments in coal-based steel plants. For instance, China’s steel sector invests USD 100 billion in coal-based steel plants, despite low profitability, overcapacity and carbon commitments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the steel shell furnace market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Inductotherm

- Induction Technology Corporation (ITC)

- APS Induction Technology

- Cooldo

- FOCO induction

- Inductotherm India Private Limited

- Luoyang Hongteng Induction

- Luoyang shennai Power Equipment

- SuperbMelt

- Weifang Jinhuaxin Electric Furnace Manufacturing

- Shandong Huaxin Electric Furnace

- Abhay Induction Tech

- Zhengzhou lanshuo electronics

- Luoyang Dinghong Electric Technology

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Sinosteel Engineering & Technology Co., Ltd., and Tenova completed the performance test for Baosteel Zhanjiang Iron & Steel Co., Ltd.’s new hydrogen-based 1,000,000 tonnes/year Direct Reduction (DR) plant.

- In July 2022, ArcelorMittal and Tier 1 automotive supplier Gestamp successfully trialed the use of low-carbon emissions steel for use in car parts that would ultimately be used in the production of vehicles in Spain and throughout Europe.

- In December 2019, NLMK and Paul Wurth successfully accomplished a major Blast Furnace Reline. Within the frame of NLMK Group’s Strategy 2022, No. 6 Blast Furnace at NLMK’s main site in Lipetsk, Russia, has been completely rebuilt during a furnace outage stretching from May until October.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the steel shell furnace market based on the below-mentioned segments:

Global Steel Shell Furnace Market, By Type

- Below 1t Steel Shell Furnace

- 1-30t Steel Shell Furnace

- Above 30t Steel Shell Furnace

Global Steel Shell Furnace Market, By Application

- Metallurgy

- Mechanics

- Building Material

- Automobile Manufacturing

Global Steel Shell Furnace Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the steel shell furnace market?The global steel shell furnace market size is expected to grow from USD 2.0 Billion in 2024 to USD 3.6 Billion by 2035, at a CAGR of 5.49% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the steel shell furnace market?North America is anticipated to hold the largest share of the steel shell furnace market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Steel shell furnace Market from 2024 to 2035?The market is expected to grow at a CAGR of around 5.49% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Steel shell furnace Market?Key players include Inductotherm, Induction Technology Corporation (ITC), APS Induction Technology, Cooldo, FOCO induction, Inductotherm India Private Limited, Luoyang Hongteng Induction, Luoyang shennai Power Equipment, SuperbMelt, Weifang Jinhuaxin Electric Furnace Manufacturing, Shandong Huaxin Electric Furnace, Abhay Induction Tech, Zhengzhou lanshuo electronics, and Luoyang Dinghong Electric Technology.

-

5. Can you provide company profiles for the leading steel shell furnace manufacturers?Yes. For example, Inductotherm is the world’s leading manufacturer of induction metal melting systems for metal producers and has built more than 36,500 melting and heating systems for metal and metalcasting producers around the globe. Induction Technology Corporation (ITC) is an international company which specializes in the design and manufacturing of complete induction melting and heating systems.

-

6. What are the main drivers of growth in the steel shell furnace market?Increased use in the metal industry, investment in infrastructure with the growing urbanization, and automation of industrial furnaces are major market growth drivers of the steel shell furnace market.

-

7. What challenges are limiting the steel shell furnace market?Raw material price volatility, competition with other melting methods, and strict safety regulations remain key restraints in the steel shell furnace market.

Need help to buy this report?