Global Steel Plate Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Carbon Steel Plates, Stainless Steel Plates, Alloy Steel Plates, Tool Steel Plates, and Others), By Application (Construction, Automotive, Shipbuilding, Oil & Gas, Industrial Machinery, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Steel Plate Market Insights Forecasts to 2035

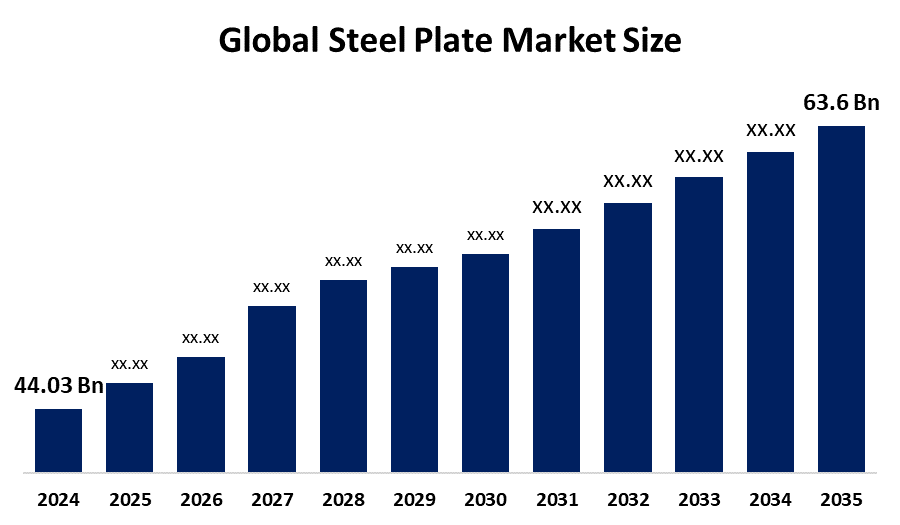

- The Global Steel Plate Market Size Was Estimated at USD 44.03 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.4% from 2025 to 2035

- The Worldwide Steel Plate Market Size is Expected to Reach USD 63.6 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Steel Plate Market Size was worth around USD 44.03 Billion in 2024 and is predicted to grow to around USD 63.6 Billion by 2035 with a compound annual growth rate (CAGR) of 3.4% from 2025 to 2035. The demand for steel plates is stimulated by growing demand from construction, shipbuilding, automobile, and heavy machinery sectors. Expansion of infrastructure, urban development, and rising investments in renewable energy projects further support demand. Advances in technology in the steel manufacturing process also improve quality, driving greater use and market growth.

Global Steel Plate Market Forecast and Revenue Outlook

- 2024 Market Size: USD 44.03 Billion

- 2035 Projected Market Size: USD 63.6 Billion

- CAGR (2025-2035): 3.4%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The steel plate market refers to the firm involved in producing and selling steel flat-rolled sheets that are typically more than 6mm in thickness. Steel plates are the principal commodities used by various industries such as construction, shipbuilding, automobiles, oil and gas, heavy machinery, and the military due to the fact that they are tough, durable, and versatile. The plates are used in structural components, pressure vessels, bridges, offshore structures, and tankage. The market is driven by emerging infrastructure, industrialization, and increasing demand for high-strength materials in manufacturing and building sectors. Government spending in public infrastructure, particularly in emerging economies, and urbanization are also driving market growth.

The demand is on the rise in the market with the rise in renewable energy projects, such as windmills, and demand for high-performance light metals in the automobile and air industries. The key players in the industry are ArcelorMittal, Nippon Steel Corporation, POSCO, JFE Steel, Tata Steel, and SSAB. These players heavily invest in R&D along with clean production technologies. India's Directorate General of Trade Remedies, in March 2025, has suggested a 12% provisional safeguard duty for 200 days on non-alloy and alloy steel flat products imports, including hot-rolled plates, coils, and sheets, in order to protect the domestic industry from low-cost imports.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the steel plate market during the forecast period.

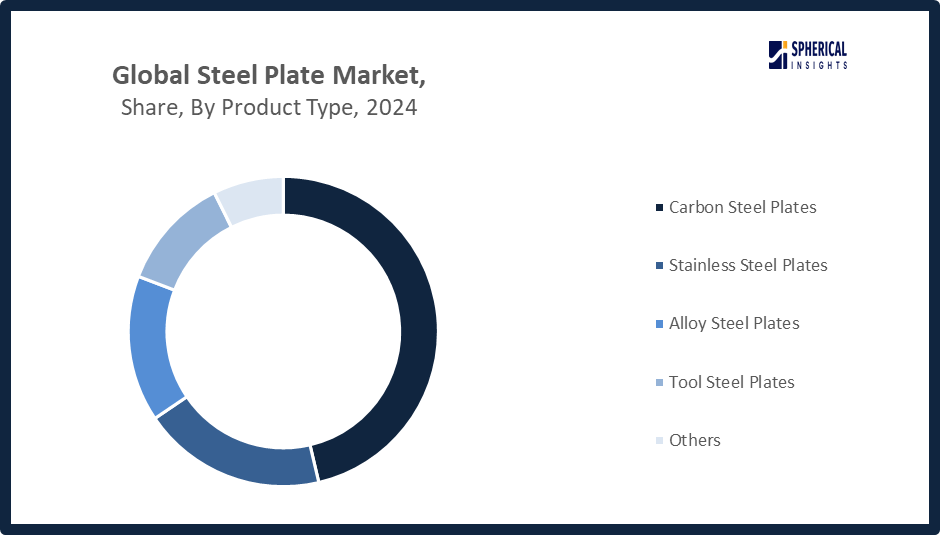

- In terms of product type, the carbon steel plates segment is projected to lead the steel plate market throughout the forecast period

- In terms of application, the construction segment captured the largest portion of the market

Steel Plate Market Trends

- Increasing use in shipbuilding and automotive industries fuels market growth.

- Rising infrastructure development drives demand for steel plates globally.

- Advances in steel manufacturing technologies enhance product quality and efficiency.

- Growing adoption of eco-friendly steel supports sustainability trends.

- Expansion of renewable energy projects boosts steel plate consumption.

Report Coverage

This research report categorizes the steel plate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the steel plate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the steel plate market.

Global Steel Plate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 44.03 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.4% |

| 2035 Value Projection: | USD 63.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product Type, By Application, By Region |

| Companies covered:: | Nucor Corporation, POSCO Holdings, ArcelorMittal, JSW Steel Ltd., Nippon Steel Corporation, Tata Steel, Baowu Steel Group, JFE Steel Corporation, EVRAZ, HBIS Group, Thyssenkrupp AG, Jianlong Group, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving factors

Key drivers for the steel plate industry are infrastructure development, renewable energy schemes, heavy machinery production, and shipbuilding. Infrastructure development demands huge quantities of steel plates to build buildings, bridges, and road networks, thereby pushing demand. Renewable energy schemes, such as windmills and solar parks, utilize steel plates for long-lasting structures. Heavy machinery production depends on steel plates for strength and longevity. The shipbuilding sector requires steel plates to build ships, enabling international trade and defense, and stimulating market growth.

Restraining Factor

Relevant hindering factors for the steel plate market are high raw material and energy prices, worldwide overcapacity, and geopolitical trade tensions. Higher raw material and energy prices raise production costs, constraining steel plate market growth. World overcapacity results in excess supply, lowering prices and profitability. Geopolitical trade tensions trigger tariffs and restraints, distorting supply chains and inducing market uncertainty, inhibiting investment and growth.

Market Segmentation

The global steel plate market is divided into product type and application.

Global Steel Plate Market, By Product Type:

- The carbon steel plates segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product type, the global steel plate market is segmented into carbon steel plates, stainless steel plates, alloy steel plates, tool steel plates, and others. Among these, the carbon steel plates segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Carbon steel plates dominate the market with an approximate market share of 46%, due to their versatility, economic affordability, and wide usage. Used extensively in construction, industrial machinery, and automotive industries, they exhibit good mechanical properties and can be easily fabricated. Increasing infrastructure growth and industrialization globally are anticipated to continue to drive strong demand for carbon steel plates.

Get more details on this report -

The stainless steel plates segment in the steel plate market is expected to grow at the fastest CAGR over the forecast period. Stainless steel plates, with an approximate market share of 19%, which are prized for durability and resistance to corrosion, find extensive application in the shipbuilding, chemical, and food industries. Increased environmental regulations, as well as pressure for sustainable materials, combined with advancements in alloys, are stimulating higher usage and growth in the market for stainless steel plates.

Global Steel Plates Market, By application:

- The construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global steel plate market is segmented into construction, automotive, shipbuilding, oil & gas, industrial machinery, and others. Among these, the construction segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Construction is the leading application segment, holding an approximate market share of 43%, driven by continued infrastructure expansion, especially across emerging markets. Steel plates find application in buildings, bridges, highways, and other structures owing to their durability and supporting capabilities. Increased investment in smart city projects and urban renewal also fuels higher demand for steel plates in construction, supporting growth in the market.

The oil & gas segment in the steel plate market is expected to grow at the fastest CAGR over the forecast period. Steel plates play a significant role in oil & gas applications, accounting for an approximate market share 15%, for pipelines, storage tanks, and offshore platforms. Increased energy demand, deep-water exploration, and new drilling technologies propel the demand for high-strength, corrosion-resistant steel plates in the growing infrastructure of the industry.

Regional Segment Analysis of the Global Steel Plate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Steel Plate Market Trends

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global steel plate market over the forecast period.

Asia Pacific is projected to account for approximately 54% of the world's steel plate market during the forecast period due to strong industrialization, urbanization, and widespread infrastructure development in China, India, and Southeast Asia. The increasing construction, automotive, and shipbuilding industries in the region contribute significantly to demand. Moreover, rising government investments in smart city programs and renewable energy projects also accelerate steel plate consumption. Increased manufacturing activities and increasing oil & gas exploration further boost the market growth in the region.

India Steel Plate Market Trends

India's steel plate market trends are fueled by high-speed infrastructure development, increasing automotive and construction industry growth, government efforts supporting domestic steel production, rising investments in oil & gas, and developing demand for sturdy, budget-friendly materials in various industries.

In July 2025, India proposed mandating green-rated steel use in central government projects from FY28. The draft policy, covering procurements over Rs 1 crore, was prepared by the Ministry of Steel, according to The Economic Times.

China Steel Plate Market Trends

China's steel plate market trends are propelled by large infrastructure programs, robust manufacturing expansion, growing automobile and shipbuilding sectors, government incentives for steel production, and rising investment in energy and urban development programs.

Japan Steel Plate Market Trends

Trends in Japan's market for steel plates are led by innovative manufacturing technology, robust automotive and shipbuilding sectors, a focus on advanced and specialty steel products, government promotion of sustainable infrastructure, and continued investments in energy, construction, and industrial machinery industries.

North America Steel Plate Market Trends

North America is expected to grow at the fastest CAGR in the steel plate market during the forecast period. North America held around 17% of the steel plate market over the forecast period, owing to rising infrastructure expenditures and a wave of modernization initiatives in the United States as well as Canada. Growth in the oil & gas industry in the region, mainly shale gas exploration and pipeline development, fuels demand for high-strength steel plates. Also, technological developments in manufacturing and a high emphasis on green and sustainable building improve the use of steel plates. Government policies supporting local steel manufacturing and increased demand from the automotive and machinery industries further help sustain North America's high market development rate.

U.S. Steel Plate Market Trends

The trends in the U.S. steel plate market are fueled by strong infrastructure spending, rising oil & gas exploration, technological development in manufacturing, higher automotive and construction sector demand, and domestic steel production and sustainability-promoting government policies.

Europe Steel Plate Market Trends

Europe's steel plate market expansion is spurred on by growing infrastructure spending, expanding automotive and shipbuilding sectors, and increased emphasis on renewable energy projects. Draconian environmental regulations promote the application of high-quality, sustainable steel products. Further driving market growth throughout the region are government efforts to spur industrial modernization and digitalization, and growing demand for long-lasting materials in construction and manufacturing.

Germany Steel Plate Market Trends

Germany's trends in steel plate markets are fueled by robust automotive and manufacturing industries, high investments in infrastructure and renewable energy, technology growth, and government incentives toward environmentally friendly steel production and industrial development.

France Steel Plate Market Trends

France's trends in steel plate markets are fueled by expanding infrastructure development, improving demand in the automotive and aerospace industries, government policies for green energy initiatives, and technological innovation in steel production that facilitates sustainable and performance-intensive steel products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global steel plate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Steel Plate Market Include

- Nucor Corporation

- POSCO Holdings

- ArcelorMittal

- JSW Steel Ltd.

- Nippon Steel Corporation

- Tata Steel

- Baowu Steel Group

- JFE Steel Corporation

- EVRAZ

- HBIS Group

- Thyssenkrupp AG

- Jianlong Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In June 2025, Tata Steel launched an expanded version of DigECA, its B2MSME e-commerce platform, now accessible to MSMEs classified as Emerging Corporate Accounts. The platform enables direct transactions, offering convenience and access to top-quality products and services tailored to MSME needs.

- In August 2024, ArcelorMittal launched HyMatch, a new steel solution for hydrogen pipeline construction. Designed for high-pressure hydrogen transport, it supports energy transition goals and offers reduced Scope 3 emissions through XCarb steel certificates and advanced R&D innovations.

- In August 2024, Global Steel Philippines Inc. began producing steel plates at its Iligan mill with a 20,000-ton monthly capacity. Targeting Southeast Asian markets, the company is exploring regional mining investments but has yet to finalize joint ventures, as Indian investors cautiously monitor market conditions and resource availability.

- In July 2023, ArcelorMittal became the first in Europe to produce low-carbon steel plates up to 18 tonnes, using XCarb recycled slabs made with nearly 100% scrap and renewable electricity via electric arc furnace.

- In January 2023, Nucor Corp. launched Elcyon, a heavy-gauge steel plate for offshore wind energy, produced using thermo-mechanical rolling at its new $1.7 billion facility in Kentucky.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the steel plate market based on the following segments:

Global Steel Plate Market, By Product Type

- Carbon Steel Plates

- Stainless Steel Plates

- Alloy Steel Plates

- Tool Steel Plates

- Others

Global Steel Plate Market, By Application

- Construction

- Automotive

- Shipbuilding

- Oil & Gas

- Industrial Machinery

- Others

Global Steel Plate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the steel plate market over the forecast period?The global steel plate market is projected to expand at a CAGR of 3.4% during the forecast period.

-

2. What is the steel plate market?The steel plate market refers to the global industry encompassing the production, sale, and trade of flat steel products with thicknesses greater than 3mm, used in construction, shipbuilding, automotive, and energy.

-

3. What is the market size of the steel plate market?The global steel plate market size is expected to grow from USD 44.03 billion in 2024 to USD 63.6 billion by 2035, at a CAGR 3.4% of during the forecast period 2025-2035.

-

4. Which region holds the largest share of the steel plate market?Asia Pacific is anticipated to hold the largest share of the steel plate market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global steel plate market?The major players operating in the steel plate market are Nucor Corporation, POSCO Holdings, ArcelorMittal, JSW Steel Ltd., Nippon Steel Corporation, Tata Steel, Baowu Steel Group, JFE Steel Corporation, EVRAZ, HBIS Group, Thyssenkrupp AG, Jianlong Group, and Others.

-

6. What are the market trends in the steel plate market?Steel plate market trends include growing infrastructure, renewable energy projects, automotive demand, technological advancements, and increased focus on sustainability.

-

7. What factors are driving the growth of the steel plate market?The steel plate market is growing due to increased demand from infrastructure development and the construction of residential, commercial, and industrial buildings, particularly in emerging economies.

-

8. What are the main challenges restricting the wider adoption of the steel plate market?The primary challenges restricting the wider adoption of the steel plate market are structural overcapacity, high costs influenced by raw material volatility and regulations, and intense global competition.

Need help to buy this report?