Global Spiral Tubing Services Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Well Intervention, Well Cleaning, Logging & Perforation, Stimulation Services, Drilling Support, and Others), By Tubing Type (Spiral-Welded High Strength Tubing, Corrosion-Resistant Alloy (CRA), Spiral Tubing, and Custom-Diameter Spiral Tubing), By Application (Onshore and Offshore), By Well Type (Vertical Wells and Horizontal & Deviated Wells), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Energy & PowerGlobal Spiral Tubing Services Market Size, Insights Forecasts to 2035

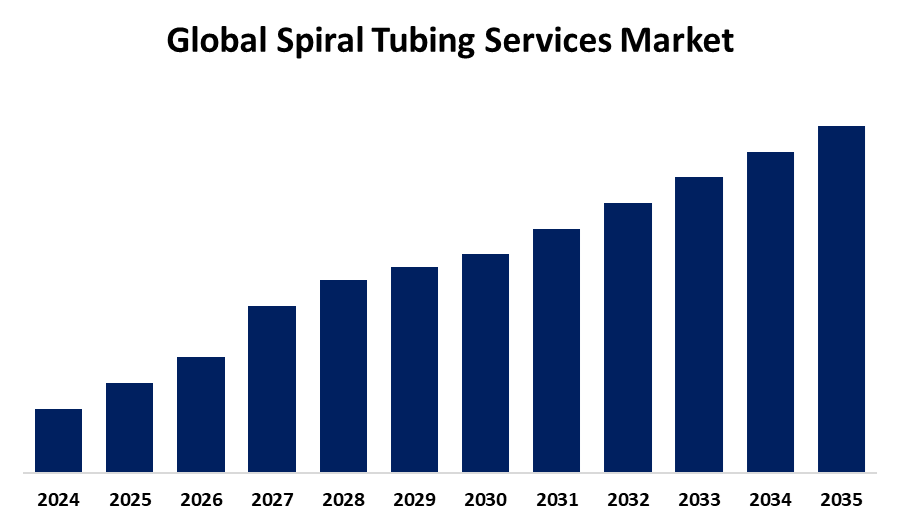

- The Market Size is Expected to Grow at a CAGR of around 5.3% from 2025 to 2035

- North America is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Spiral Tubing Services Market Size is Expected to Hold a Significant Share By 2035, with a Compound Annual Growth Rate (CAGR) of 5.3% from 2025 and 2035. The growing need for long-lasting and effective tubing solutions in sectors like telecommunications, energy, and construction creates the opportunity for spiral tubing services in the market.

Market Overview

The industry that manufactures, supplies, and uses spiral tubing in a variety of industries, including telecommunications, energy, automotive, and construction, is known as the spiral tubing services market. Spiral tubing services are crucial for fluid transportation, structural reinforcement, and protective casing due to their strength, flexibility, and adaptability. Technological developments, growing industrial applications, and expanding infrastructure development are the main factors of the spiral tubing services market. Technological developments, growing demand for robust and lightweight materials, innovations driven by sustainability, growing applications in the energy and infrastructure sectors, and rising investments in automation and customized manufacturing solutions are some of the trends driving the spiral tubing services market.

Government programs that encourage eco-friendly production methods and investments in intelligent infrastructure projects foster an environment that is conducive to market growth. Growing industrialization and infrastructure development in several industries, including as telecommunications, energy, and construction, are the main factors driving the spiral tubing services market. Market expansion has been greatly supported by the growing need for robust structural elements, effective fluid conveyance systems, and protective casing solutions.

Report Coverage

This research report categorizes the spiral tubing services market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the spiral tubing services market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the spiral tubing services market.

Global Spiral Tubing Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Service Type, By Tubing Type, By Application, By Well Type, By Region. |

| Companies covered:: | Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International plc, NOV Inc. (National Oilwell Varco), Altus Intervention, Superior Energy Services, Inc, Archer Limited, Trican Well Service Ltd, Tenaris S.A., Forum Energy Technologies, Sandvik AB, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising industrialization, the expansion of infrastructure, technological developments, the need for long-lasting solutions, regulatory assistance, specialized applications, and the growing energy and automotive industries are all factors driving the spiral tubing services market. Businesses can strengthen their market by implementing competitive pricing tactics, smart partnerships, and improved distribution networks. Technological developments, regulatory backing, industrial diversification, and infrastructure investments all work together to support the market for spiral tubing services' steady expansion, guaranteeing ongoing innovation and industry competitiveness.

Restraining Factors

The market for spiral tubing services is restricted by factors including expensive raw materials, erratic demand, strict regulations, and intricate production procedures. Disruptions to the supply chain, environmental issues, and competition from substitute materials further restrict growth, which has an impact on market expansion and profitability.

Market Segmentation

The spiral tubing services market share is classified into service type, tubing type, application, and well type.

- The well intervention segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the service type, the spiral tubing services market is divided into well intervention, well cleaning, logging & perforation, stimulation services, drilling support, and others. Among these, the well intervention segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Well intervention plays a vital role in maintaining and increasing well output, especially in established oil and gas fields. To prolong the productive life of wells, operators are depending more and more on well intervention services for tasks like re-perforation, stimulation, zonal isolation, and scale removal.

- The spiral-welded high strength tubing segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the tubing type, the spiral tubing services market is divided into spiral-welded high strength tubing, corrosion-resistant alloy (CRA) spiral tubing, and custom-diameter spiral tubing. Among these, the spiral-welded high strength tubing segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The extensive use of spiral-welded high-strength tubing in vital sectors, including water supply, construction, and oil and gas is responsible for its popularity. These tubes' natural strength and resilience make them perfect for moving gases and liquids under harsh conditions and at high pressures.

- The onshore segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the spiral tubing services market is divided into onshore and offshore. Among these, the onshore segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In general, onshore settings have less environmental and logistical obstacles than offshore ones, which simplifies and lowers the cost of operations.

- The horizontal & deviated wells segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the well type, the spiral tubing services market is divided into vertical wells and horizontal & deviated wells. Among these, the horizontal & deviated wells segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing use of horizontal drilling methods in oil and gas extraction is driving the market for horizontal and deviated wells. In unconventional resources like shale and tight gas deposits, horizontal wells provide better production rates and increased reservoir contact.

Regional Segment Analysis of the Spiral Tubing Services Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the spiral tubing services market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the spiral tubing services market over the predicted timeframe. Rapid industrialization, substantial infrastructural development, and rising demand in several important sectors are the main drivers of the Asia Pacific region. China, India, and Japan are anticipated to make major contributions because of their growing manufacturing capacities and technical developments. The existence of major industry players, favorable government regulations, and growing investments all contribute to the market's expansion. The region's leadership in this field is cemented by its robust economic position and changing industry landscape.

North America is expected to grow at a rapid CAGR in the spiral tubing services market during the forecast period. Growing oil and gas exploration and production activities are fueling the growth of the North American region and raising demand for well intervention operations, which use coiled tubing services. The strong oil and gas sector in North America, especially the growth of shale exploration and production, is the main driver of the continent. North America's rapid market growth trajectory is further supported by the existence of top service providers and advantageous legislative support.

The Middle East and Africa are predicted to hold a significant share of the spiral tubing services market throughout the estimated period. The main factors contributing to the Middle East and Africa region are the region's substantial oil and gas deposits as well as ongoing investments in production, exploration, and pipeline infrastructure. The need for spiral tube solutions is also being driven by continued industrial development, urbanization, and government-led infrastructure initiatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the spiral tubing services market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

- Weatherford International plc

- NOV Inc. (National Oilwell Varco)

- Altus Intervention

- Superior Energy Services, Inc

- Archer Limited

- Trican Well Service Ltd

- Tenaris S.A.

- Forum Energy Technologies

- Sandvik AB

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the spiral tubing services market based on the below-mentioned segments:

Global Spiral Tubing Services Market, By Service Type

- Well Intervention

- Well Cleaning

- Logging & Perforation

- Stimulation Services

- Drilling Support

- Others

Global Spiral Tubing Services Market, By Tubing Type

- Spiral-Welded High Strength Tubing

- Corrosion-Resistant Alloy (CRA) Spiral Tubing

- Custom-Diameter Spiral Tubing

Global Spiral Tubing Services Market, By Application

- Onshore

- Offshore

Global Spiral Tubing Services Market, By Well Type

- Vertical Wells

- Horizontal & Deviated Wells

Global Spiral Tubing Services Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the spiral tubing services market over the forecast period?The global spiral tubing services market is projected to expand at a CAGR of 5.3% during the forecast period.

-

2. What is the market size of the spiral tubing services market?The Global Spiral Tubing Services Market Size is expected to hold a significant share by 2035, at a CAGR of 5.3% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the spiral tubing services market?Asia Pacific is anticipated to hold the largest share of the spiral tubing services market over the predicted timeframe.

Need help to buy this report?