Global SPC Flooring Market Size, Share, and COVID-19 Impact Analysis, By Type (SPC Tiles and SPC Planks), By Application (Residential, Commercial, and Industrial), By Thickness (Standard Thickness and Enhanced/Heavy-Duty Thickness) By Distribution Channel (Online and Offline) By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal SPC Flooring Market Insights Forecasts To 2035

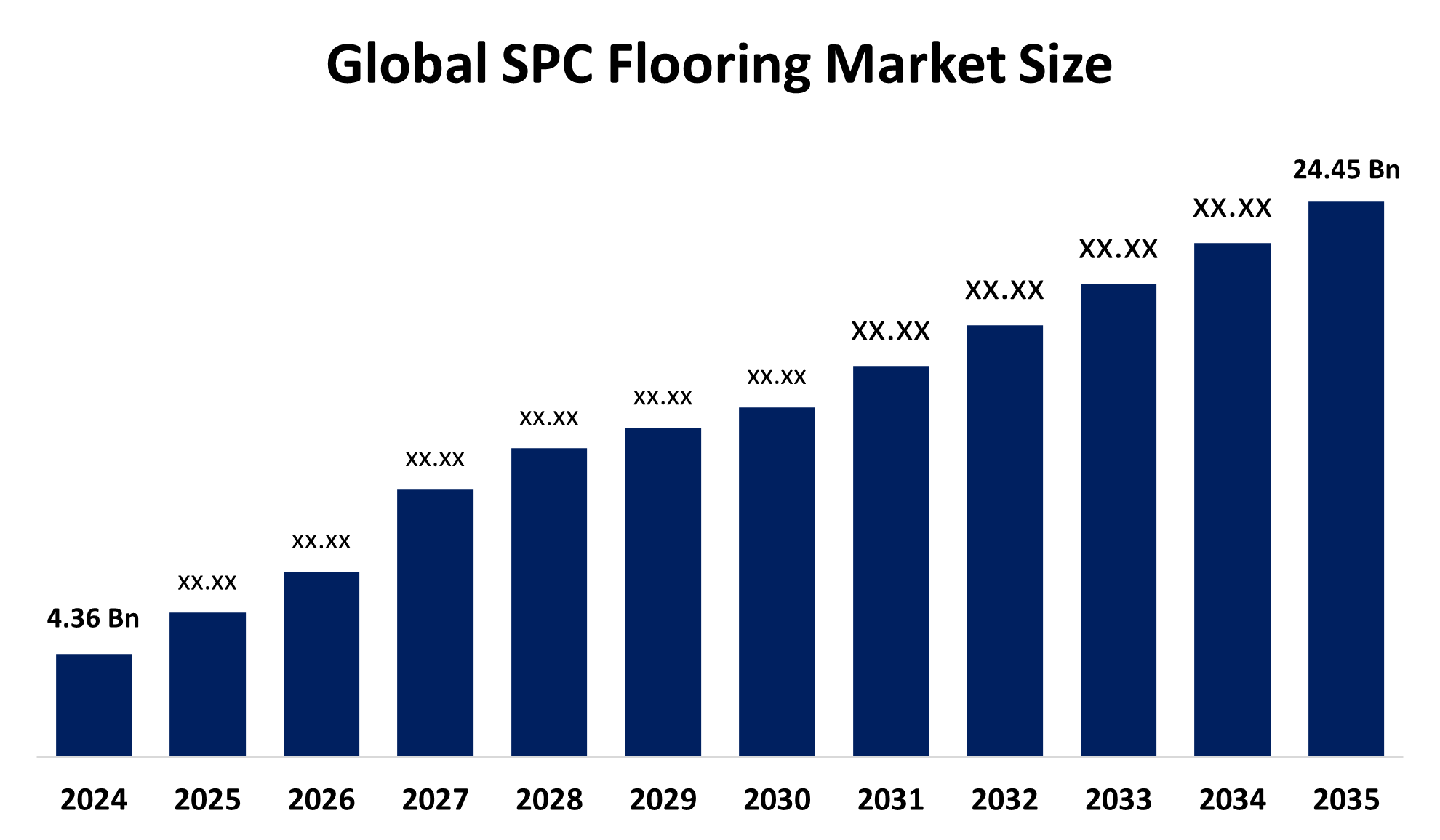

- The Global SPC Flooring Market Size Was Estimated at USD 4.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.97% from 2025 to 2035

- The Worldwide SPC Flooring Market Size is Expected to Reach USD 24.45 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global SPC Flooring Market Size was valued at approximately USD 4.36 Billion in 2024 and is Projected To Grow from USD 5.10 Billion in 2025 to around USD 24.45 Billion by 2035, with a compound annual growth rate (CAGR) of 16.97% from 2025 to 2035. The demand for SPC flooring is increasing as a result of rising consumer interest in low-maintenance, waterproof, and resilient flooring; increasing residential and commercial construction; increased urbanization and consumer desire for environmentally friendly, affordable, and attractive alternatives to traditional materials.

Global SPC Flooring Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.36 Billion

- 2035 Projected Market Size: USD 24.45 Billion

- CAGR (2025-2035): 16.97%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The SPC flooring market refers to the industry for stone plastic composite flooring, a hard, long-lasting, waterproof substance composed of stabilisers and limestone that is extensively utilised in commercial, industrial, and residential settings due to its strength, adaptability, and low maintenance requirements. The demand for long-lasting, reasonably priced, and environmentally friendly flooring options, as well as an increase in building activity and disposable money, are driving the global market for stone plastic composite (SPC) flooring. Superior stiffness, stability, waterproofing, fire and stain resistance, anti-slip qualities, and low emissions of volatile organic compounds are all provided by SPC, which is made of polyvinyl chloride and limestone. It is well-liked in both residential and commercial settings due to its multi-layered design, which improves durability, scratch resistance, and design versatility. Demand for SPC as a cleaner flooring material is rising as a result of tighter CARB and US EPA formaldehyde emission standards, among other government regulations. SPC is starting to replace traditional wood in outdoor applications where weathering and rotting resistance are necessary, including decking, fencing, doors, and windows. The potential of SPC can be even greater with its use in remodelling, which helps to reinforce walls, beams, and slabs. Although SPC is generally regarded as noisier and rougher underfoot than wood plastic composite, it is attractive in commercial outdoor applications because of its low cost and durability.

Key Market Insights

- North America is expected to account for the largest share in the SPC Flooring Market during the forecast period.

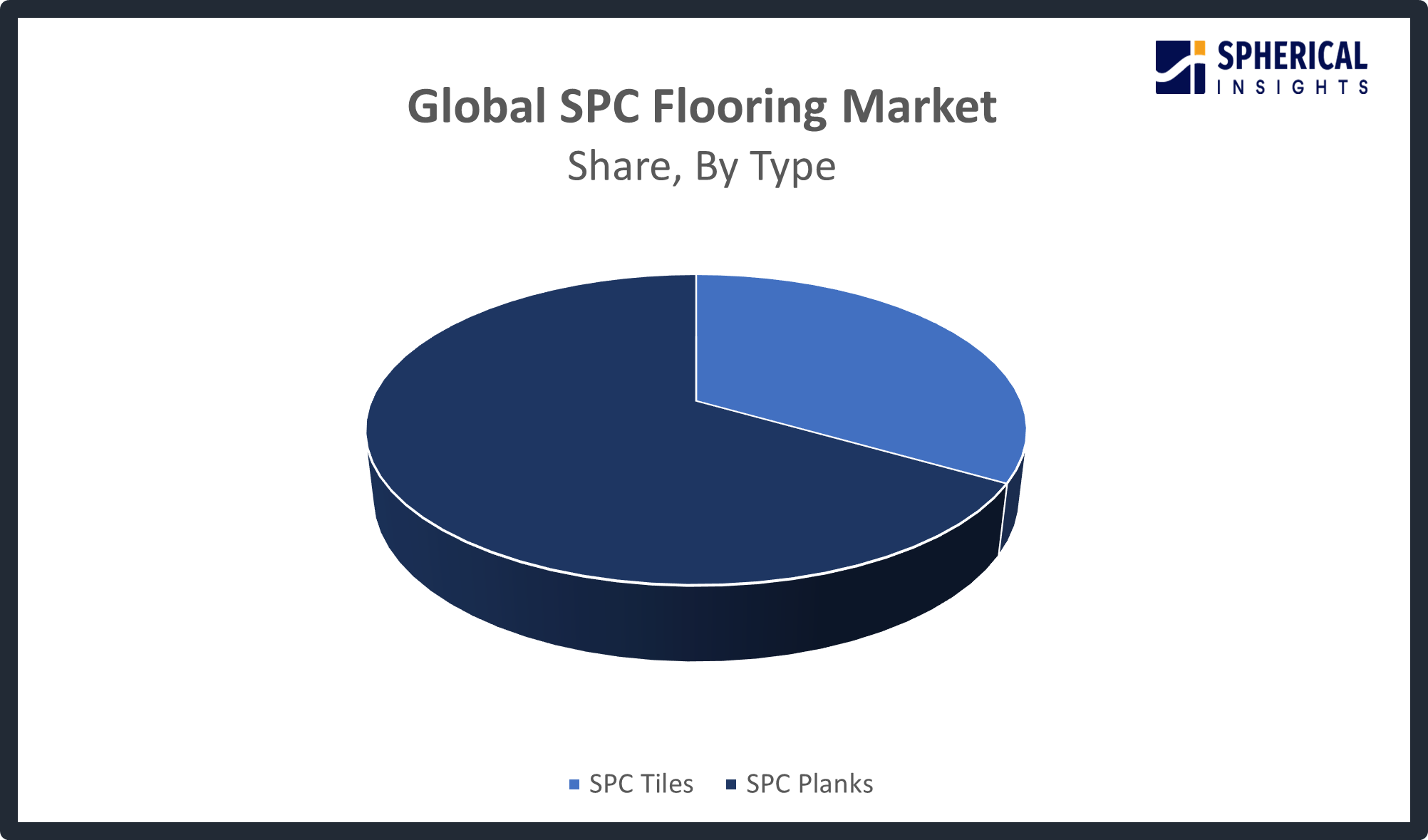

- In terms of type, the SPC planks segment is projected to lead the SPC Flooring Market throughout the forecast period

- In terms of application, the commercial segment captured the largest portion of the market

- By thickness, the standard thickness segment held the largest market share.

- In terms of distribution channel, the offline sector accounted for the majority share of the market.

SPC Flooring Market Trends

- Growing demand for formaldehyde-free and environmentally friendly flooring options.

- SPC flooring is becoming more and more popular in commercial areas with heavy usage.

- Low-maintenance and waterproof flooring is becoming more and more popular.

- Digital printing innovations increase the adaptability of designs.

- Market growth is boosted by the expansion of remodelling and renovation projects.

Report Coverage

This research report categorizes the SPC flooring market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the SPC flooring market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the SPC flooring market.

Global SPC Flooring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 4.36 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.97% |

| 2035 Value Projection: | USD 24.45 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 217 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Thickness, By Distribution Channel, By Region |

| Companies covered:: | Shaw Industries Group Inc., Mohawk Industries Inc., Mannington Mills, Inc., Armstrong Flooring Inc., Tarkett S.A., Beauflor, Gerflor, Karndean Designflooring, Congoleum, Novalis Innovative Flooring, and Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving factors

The SPC flooring market is growing largely because of its minimal maintenance, resistance to water, and durability, making it suitable for both commercial and residential environments. The use of recycled content, environmentally friendly materials, and recyclability meets consumers' increasing demand for sustainable flooring. In addition, the continued growth of the construction and remodelling industries is promoting adoption because SPC flooring offers long-lasting beauty, cost savings, and ease of installation. The SPC flooring is increasingly being adopted as an improvement to traditional flooring in offices, retail spaces, restrooms, and kitchens.

Restraining Factor

The high initial cost of SPC flooring is a barrier to its market expansion in emerging markets where consumers are price-sensitive. In certain areas, expansion is impeded by regulatory obstacles arising from environmental concerns around vinyl-based compounds. Other restrictions include noise problems, consumer ignorance, and the possibility of accidents because of how hard it is underfoot. Although features like water resistance and durability are beneficial, taken together, they limit broader adoption and reduce the market's growth overall, especially in residential applications as opposed to commercial ones.

Market Segmentation

The Global SPC Flooring market is divided into type, application,

Global SPC Flooring Market, By Type:

- The SPC planks segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on type, the global SPC flooring market is segmented into SPC tiles and SPC planks. Among these, the SPC planks segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The product has exceptional qualities, such as its ease of installation, water resistance, and longevity. Because of their great adaptability, SPC planks can be used in a variety of residential and commercial contexts. The product's popularity was further aided by its visual appeal, which replicated the appearance of natural stone or wood. The building industry's growing need for affordable, low-maintenance flooring options is another factor contributing to the segment's rise.

Get more details on this report -

The SPC tiles segment in the SPC flooring market is expected to grow at the fastest CAGR over the forecast period. The product's special qualities, namely its strong resistance to deterioration, make it a great option for places with lots of traffic. Customers looking to customise their rooms are drawn to SPC tiles because of their great degree of design freedom, which permits a broad range of patterns and designs. Since these items are simple to install and replace, the growing popularity of do-it-yourself home renovation projects is anticipated to propel the market. Furthermore, because SPC tiles are recyclable and have a minimal environmental impact, demand for them is expected to rise as more people become aware of sustainable and eco-friendly building materials.

Global SPC Flooring Market, By Application:

- The commercial segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global SPC flooring market is segmented into residential and commercial. Among these, the commercial segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The requirement for highly durable, waterproof, and low-care flooring has resulted in the SPC flooring market being driven by the commercial sector. SPC flooring is a perfect fit for high-traffic areas where aesthetic and functionality must work together, such as offices, retailers, restaurants, and public buildings. It’s the best choice to resist extreme use while keeping aesthetics over the long term due to its rigid construction and durability against stains, scratches, and moisture. It is now the product of choice for commercial applications around the world, due to its cost-effectiveness and long-lasting.

The residential segment in the SPC flooring market is expected to grow at the fastest CAGR over the forecast period. There is a growing need for low-maintenance, long-lasting, and waterproof flooring in houses. Adoption in living spaces, baths, kitchens, and remodelling projects is also fuelled by urbanisation, rising disposable incomes, and more awareness of eco-friendly and sustainable materials.

Global SPC Flooring Market, By Thickness:

- The standard thickness segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on thickness, the global SPC flooring market is segmented into standard thickness and enhanced/heavy-duty thickness. Among these, the standard thickness segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. It has cost-effectiveness, ease of installation, and extensive use in both residential and commercial environments. Customers and businesses favour it because of its strength, water resistance, and aesthetic adaptability. The segment is anticipated to rise significantly as a result of these reasons, as well as an increase in building and remodelling activities.

The enhanced/heavy-duty thickness segment in the SPC flooring market is expected to grow at the fastest CAGR over the forecast period. The increasing need for impact-resistant and highly durable flooring in high-traffic scenario applications, such as commercial, industrial, and institutional. It is well-suited for use in office environments, retail spaces, and public buildings because of its superior load-bearing performance, scratch resistance, and superior durability. The global consumption of the market is further aided by greater new construction and renovations, along with awareness of more costly and durable flooring.

Global SPC Flooring Market, By Distribution Channel:

- The offline segment accounted for the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on distribution channel, the global SPC flooring market is segmented into online and offline. Among these, the offline segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The custom of buyers inspecting things in person before making a purchase. Customers may touch, feel, and compare various flooring options through offline channels, including home improvement stores and speciality flooring dealers. It is projected that this tactile experience, along with the professional guidance and instant accessibility provided by these physical locations, will drive the market.

The online segment in the SPC flooring market is expected to grow at the fastest CAGR over the forecast period. The increasing use of smartphones and the internet is a huge change in purchasing behaviour. Online platforms offer a wider variety of SPC Flooring products, low costs, and the comfort of shopping from home. The market is expected to be further driven by the rise of virtual home improvement platforms, which feature services including virtual room visualization. These services help consumers make informed buying decisions since they can "install" different flooring products into a 3-dimensional (3D) view of their space.

Regional Segment Analysis of the Global SPC Flooring Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America SPC Flooring Market Trends

North America is expected to hold the largest share in 2024 for the global SPC Flooring market over the forecast period.

Get more details on this report -

North America is expected to grow at the largest CAGR in the SPC flooring market during the forecast period. The stone plastic composite (SPC) flooring market in North America is supported by the strong building industry and the increasing demand for long-lasting, engineered and cheap flooring products. The US has the largest share in the regional market because it has a large population, high disposable income, and urbanisation trends. The growth of building activity, especially within the residential and commercial building sectors, is the main driver of growth in the SPC flooring market in North America.

U.S. SPC Flooring Market Trends

Increasing construction and renovation activities are contributing to the request for durable, low-maintenance, and sustainable flooring options, which contributes to the growth of the U.S. SPC flooring market. LEED-certified buildings in the U.S. and Canada have diverted waste from entering landfills, illustrating the importance of sustainable building practices. The affordability, water resistant qualities, and recyclability of SPC flooring contribute to its eligibility for green building standards. Its aesthetic variety and simple installation are also contributing factors to its growing appeal and preference in commercial, institutional, and residential projects throughout the U.S.

Asia Pacific SPC Flooring Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the SPC flooring market during the forecast period. Fast urbanisation and a boom in development are driving the fastest growth in the Asia Pacific SPC flooring industry. Growing awareness of environmentally friendly and sustainable building materials and the booming construction industries in China and India are important factors. Green building is encouraged by government programs; Japan's Ministry of Land, Infrastructure, Transport, and Tourism has reported a notable rise in green building certifications. The area's emphasis on long-lasting, low-maintenance, and eco-friendly flooring options is hastening the use of SPC flooring in commercial, industrial, and residential buildings.

Europe SPC Flooring Market Trends

The increasing demand for low-maintenance, sustainable, and eco-friendly flooring options is driving up the European SPC flooring industry. Due to an increase in the number of building and renovation projects started, along with environmental regulations banning formaldehyde and VOC emissions, the adoption has quickened. SPC flooring is popular with clients and commercial projects because it is durable, water-resistant, and looks good. Further, the market growth for residential and commercial projects is fueled by new developments in digital printing and design flexibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global SPC flooring market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The SPC Flooring Market Include

- Shaw Industries Group Inc.

- Mohawk Industries Inc.

- Mannington Mills, Inc.

- Armstrong Flooring Inc.

- Tarkett S.A.

- Beauflor

- Gerflor

- Karndean Designflooring

- Congoleum

- Novalis Innovative Flooring

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In February 2025, A new range of SPC flooring products was introduced by Shaw Industries Group, Inc. This new line, which appeals to both residential and commercial customers, is made with improved durability and installation ease. Because of their exceptional moisture resistance, Shaw's new SPC materials can be used in a wide range of settings, including high-humidity spaces like kitchens and bathrooms.

- In October 2024, to meet growing demand, Shaw announced a $90 million investment in its Ringgold, Georgia, facility in April 2025. This expansion aims to double the plant's resilient flooring production capacity by 2026, reflecting the company's strategic focus on increasing manufacturing capabilities.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the SPC flooring market based on the following segments:

Global SPC Flooring Market, By Type

- SPC Tiles

- SPC Planks

Global SPC Flooring Market, By Application

- Residential

- Commercial

- Industrial

Global SPC Flooring Market, By Thickness

- Standard Thickness

- Enhanced/Heavy-Duty Thickness

Global SPC Flooring Market, By Distribution Channel

- Online

- Offline

Global SPC Flooring Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the SPC Flooring market over the forecast period?The global SPC Flooring market is projected to expand at a CAGR of 16.97% during the forecast period.

-

2. What is the market size of the SPC Flooring market?The global SPC Flooring market size is expected to grow from USD 4.36 billion in 2024 to USD 24.45 billion by 2035, at a CAGR 16.97% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the SPC Flooring market?North America is anticipated to hold the largest share of the SPC Flooring market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global SPC Flooring market?Shaw Industries Group Inc., Mohawk Industries Inc., Mannington Mills, Inc., Armstrong Flooring Inc., Tarkett S.A., Beauflor, Gerflor, Karndean Designflooring, Congoleum, and Novalis Innovative Flooring, and Others.

-

5. What factors are driving the growth of the SPC Flooring market?Rising construction and renovation projects, the need for long-lasting, water-resistant, and low-maintenance flooring, urbanisation, the desire for eco-friendly materials, and technological developments in installation and design are all factors propelling the SPC flooring market and increasing adoption in both the residential and commercial sectors.

-

6. What are the market trends in the SPC Flooring market?Improved durability for high-traffic areas, eco-friendly and low-VOC materials, a variety of wood and stone textures for aesthetics, sophisticated digital printing and embossing technologies, and robust regional growth in North America and Asia-Pacific due to an increase in building and remodelling projects are some of the major trends in the SPC flooring market.

-

7. What are the main challenges restricting wider adoption of the SPC Flooring market?The widespread use of SPC flooring is limited due to its high cost, hardness that can be uncomfortable and noisy to walk on, low awareness, and concern with vinyl-based products that creates regulatory roadblocks to growth in certain areas.

Need help to buy this report?