Spain Phenol Market Size, Share, By End Use (Bisphenol A, Phenolic Resins, Caprolactam, Alkyl Phenyls, and Others), Spain Phenol Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsSpain Phenol Market Insights Forecasts to 2035

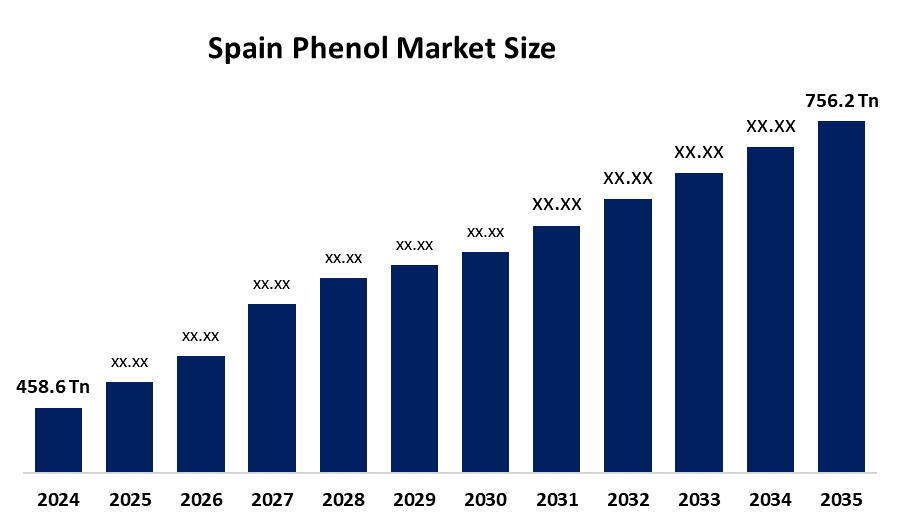

- Spain Phenol Market Size 2024: 458.6 thousand tonnes

- Spain Phenol Market Size 2035: 756.2 thousand tonnes

- Spain Phenol Market CAGR 2024: 4.65%

- Spain Phenol Market Segments: End-Use

Get more details on this report -

The Spain phenol market refers to the production, distribution, and consumption of phenol in Spain, which serves as the main raw material for producing resins and plastics, adhesives and laminates and pharmaceuticals and chemicals used in automotive, construction and industrial applications.

Spanish and European Union chemical firms are conducting experiments with bio-based phenol, while some companies develop or already market bio-phenol products that use biomass waste and meet sustainability certification requirements, which include supply agreements for major markets such as China.

The Spanish government provides financial assistance through Plan de Recuperation Transformation Resiliencies PRTR which receives most of its funding from EU Next Generation EU funds, to support projects that advance circular economy practices and industrial sustainability initiatives.

The Spain phenol market provides strong growth prospects through increasing demand for phenolic resins, construction expansion, automotive sector recovery, sustainable material development and the upcoming rise of domestic chemical production that industrial support policies will enable.

Market Dynamics of the Spain Phenol Market:

The Spain phenol market is driven by the construction industry, automotive sector and wood panel manufacturing sector, which show strong demand, which drives the rising use of phenolic resins and bisphenol-A and the development of infrastructure and the increasing demand for plastics and the government initiatives that support domestic chemical production and industrial development.

The Spain phenol market is restrained by the market facing multiple challenges because of its dependence on imported crude oil and its labor costs, the environmental protection measures and safety protocols and its restricted ability to produce phenol at domestic facilities when compared to worldwide production capacity.

The future of Spain phenol market is bright and promising, with the increasing need for phenolic resins, combined with the expanding construction industry and automotive sector, and the growing emphasis on sustainable chemical solutions and the government programs that back domestic chemical manufacturing, creating a positive environment for chemical production in the country.

Spain Phenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 458.6 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.65% |

| 2035 Value Projection: | 756.2 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Asset Type, By End Use |

| Companies covered:: | Cepsa (Compania Espanola de Petroleos, S.A.U.), INEOS Phenol, Repsol, Dow Chemical Spain, Shell Chemicals, Solvay, SABIC, Versalis, Borealis, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Spain phenol market share is classified into end-use.

By End-Use:

The Spain phenol market is divided by end-use into bisphenol A, phenolic resins, caprolactam, alkyl phenyls, and others. Among these, the bisphenol segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. BPA is extensively utilized in the manufacturing of epoxy resins and polycarbonate polymers, which are necessary for use in the construction, automotive, and electronics sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Spain phenol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Spain Phenol Market:

- Cepsa (Compania Espanola de Petroleos, S.A.U.)

- INEOS Phenol

- Repsol

- Dow Chemical Spain

- Shell Chemicals

- Solvay

- SABIC

- Versalis

- Borealis

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Spain, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Spain phenol market based on the below-mentioned segments:

Spain Phenol Market, By End Use

- Bisphenol A

- Phenolic Resins

- Caprolactam

- Alkyl Phenyls

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Spain phenol market size?A: Spain phenol market is expected to grow from 458.6 thousand tonnes in 2024 to 756.2 thousand tonnes by 2035, growing at a CAGR of 4.65% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the construction industry, automotive sector and wood panel manufacturing sector, which show strong demand, which drives the rising use of phenolic resins and bisphenol-A and the development of infrastructure and the increasing demand for plastics and the government initiatives that support domestic chemical production and industrial development.

-

Q: What factors restrain the Spain phenol market?A: Constraints include the market facing multiple challenges because of its dependence on imported crude oil and its labor costs, the environmental protection measures and safety protocols and its restricted ability to produce phenol at domestic facilities when compared to worldwide production capacity.

-

Q: How is the market segmented by end use?A: The market is segmented into bisphenol a, phenolic resins, caprolactam, alkyl phenyls, and others.

-

Q: Who are the key players in the Spain phenol market?A: Key companies include Cepsa, INEOS Phenol, Repsol, BASF, Dow Chemical Spain, Shell Chemicals, Solvay, SABIC, Versalis, Borealis, Mitsui Chemicals, and Kumho P&B Chemicals, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?