Spain Hydrogen Market Size, Share, By Sales Channel (Direct Sale and Indirect Sale), By End-Use (Refining, Ammonia, Chemical, Fuel, and Others), Spain Hydrogen Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsSpain Hydrogen Market Insights Forecasts to 2035

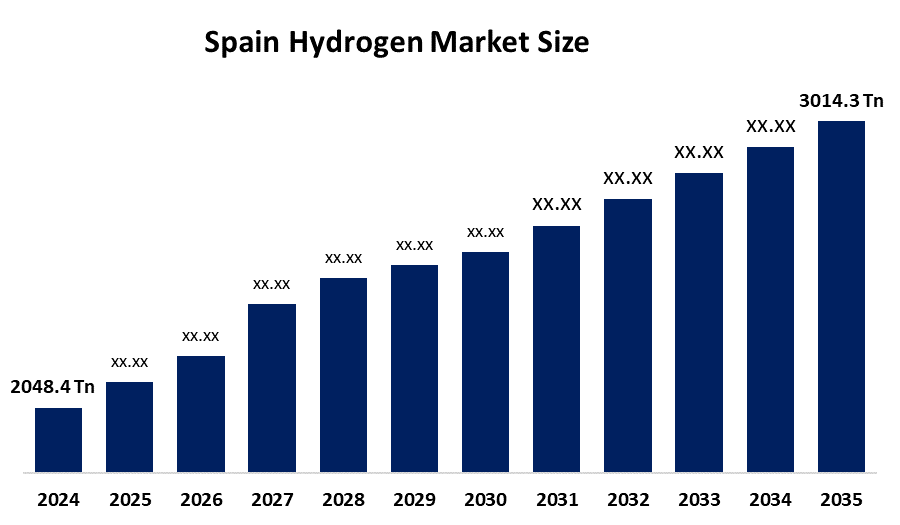

- Spain Hydrogen Market Size 2024: 2048.4 thousand tonnes

- Spain Hydrogen Market Size 2035: 3014.3 thousand tonnes

- Spain Hydrogen Market CAGR 2024: 3.57%

- Spain Hydrogen Market Segments: Sales Channel and End-Use

Get more details on this report -

The Spanish hydrogen market includes all activities that involve producing, distributing, and using hydrogen across various sectors that require decarbonisation, in line with both national and EU clean energy targets.

Nordex Electrolysers launched its NX2500 electrolyser, which operates at 2.5 MW, and the company built this product entirely in Spain, thus establishing Navarra as a hub for green hydrogen technology while enhancing domestic hydrogen technology capabilities.

The government has established auction-as-a-service AaaS systems together with national financial support to expedite project progress during periods when European Union funding sources are restricted. The funding package includes €126 million for Spain's first national hydrogen auction, together with a €415 million allocation to support domestic green hydrogen initiatives through the European Hydrogen Bank's AaaS system and an additional €50 million for industrial decarbonization auctions.

Spain's vast renewable energy resources, combined with its favourable government policies and European Union funding support, create multiple pathways for green hydrogen development, which will enable industrial decarbonization and provide solutions for mobility, energy storage and export markets by the year 2030.

Market Dynamics of the Spain Hydrogen Market:

The Spain hydrogen market is driven by the combination of renewable energy resources and government decarbonization policies, EU funding and incentives, increasing hydrogen from industrial and transportation sectors and the development of new electrolyzer and storage technologies. The market expansion receives a boost from increasing green hydrogen export activities and their integration into national energy transition planning.

The Spain hydrogen market is restrained by the high capital expenditures and insufficient large-scale facilities and electrolyzer and storage technologies, and renewable energy resources need continuous availability.

The future of Spain hydrogen market is bright and promising, with the major green hydrogen production and technological progress and export capacity by 2030 through its strong renewable energy resources, supportive government policies, EU funding and rising industrial decarbonization demands, transportation needs and energy storage requirements.

Spain Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 2048.4 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.57% |

| 2035 Value Projection: | 3014.3 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Sales Type, By End Use |

| Companies covered:: | Berdrola, Repsol, Enagas (Including Enagas Renovable), Moeve (Formerly Cepsa), Naturgy, Edp Renewables (Edpr), BP Spain, Endesa (Enel Green Power), Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The Spain hydrogen market share is classified into sales channels and end-use.

By Sales Channel:

The Spain hydrogen market is divided by sales channel type into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It requires massive volumes of hydrogen to remove impurities (desulfurization) and crack heavy hydrocarbons into cleaner-burning fuels like gasoline and diesel to meet strict environmental regulations.

By End-Use:

The Spain hydrogen market is divided by end-use into refining, ammonia, chemical, fuel, and others. Among these, the refining segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because industrial users (refineries and chemical plants) require high-volume, consistent supplies, typically managed through long-term contracts and dedicated on-site generation or pipeline delivery for cost-efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Spain hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Spain Hydrogen Market:

- Berdrola

- Repsol

- Enagas (Including Enagas Renovable)

- Moeve (Formerly Cepsa)

- Naturgy

- Edp Renewables (Edpr)

- BP Spain

- Endesa (Enel Green Power)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Spain, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Spain hydrogen market based on the below-mentioned segments:

Spain Hydrogen Market, By Sales Channel

- Direct Sale

- Indirect Sale

Spain Hydrogen Market, By End-Use

- Refining

- Ammonia

- Chemical

- Fuel

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Spain hydrogen market size?A: Spain Hydrogen Market is expected to grow from 2048.4 thousand tonnes in 2024 to 3014.3 thousand tonnes by 2035, growing at a CAGR of 3.57% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the combination of renewable energy resources and government decarbonization policies, EU funding and incentives, increasing hydrogen from industrial and transportation sectors and the development of new electrolyzer and storage technologies. The market expansion receives a boost from increasing green hydrogen export activities and their integration into national energy transition planning.

-

Q: What factors restrain the Spain hydrogen market?A: Constraints include the high capital expenditures and insufficient large-scale facilities and electrolyzer and storage technologies, and renewable energy resources need continuous availability.

-

Q: How is the market segmented by sales channel?A: The market is segmented into direct sales and indirect sales.

-

Q: Who are the key players in the Spain hydrogen market?A: Key companies include Berdrola, Repsol, Enagas (Including Enagas Renovable), Moeve (Formerly Cepsa), Naturgy, Edp Renewables (Edpr), BP Spain, Endesa (Enel Green Power) and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?