Global Soybean Oil Market Size, Share, and COVID-19 Impact Analysis, By Application (Cooking & Frying, Margarine & Shortening, Salad Dressings & Mayonnaise, Bakery Products, and Non-Food Applications), By End-Use Industry (Food, Biofuel, Animal Feed, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Soybean Oil Market Size Insights Forecasts to 2035

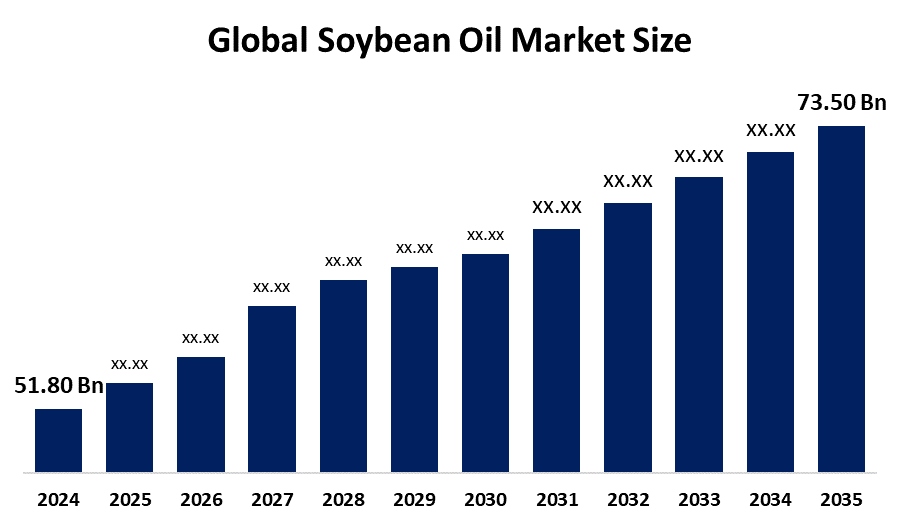

- The Global Soybean Oil Market Size Was Estimated at USD 51.80 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.23% from 2025 to 2035

- The Worldwide Soybean Oil Market Size is Expected to Reach USD 73.50 Billion by 2035

- Middle East & Africa is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Soybean Oil Market Size was worth around USD 51.80 Billion in 2024 and is predicted to Grow to around USD 73.50 Billion by 2035 with a compound annual growth rate (CAGR) of 3.23% from 2025 and 2035. The market for soybean oil has a number of opportunities to grow due to upsurging sustainable agriculture practices, along with an increasing health awareness.

Market Overview

The global industry of soybean oil refers to the production, processing, and trading of soybean oil, widely used in food and industrial applications, and even in the pharmaceuticals and cosmetics industry. Soybean oil is one of the most widely consumed cooking oils and the second most consumed vegetable oil extracted from soybean (glycine max) legumes. The processed soybean oil is also used as a base for printing inks (soy ink) and oil paints. The presence of high-value protein in soybeans and extensive use in food, feed, and industrial applications are responsible for driving the demand for soybean oil.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding partnerships for promoting sustainability. For instance, in April 2025, Verity Holdings LLC, a subsidiary of Gevo, announced a strategic partnership with Minnesota Soybean Processors (MnSP) to implement its proprietary track-and-trace software solution for enhancing the verification of sustainable agricultural practices.

Report Coverage

This research report categorizes the soybean oil market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the soybean oil market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the soybean oil market.

Global Soybean Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 51.80 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.23% |

| 2035 Value Projection: | USD 73.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 184 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End-Use Industry and COVID-19 Impact Analysis |

| Companies covered:: | Cargill Incorporated, Bunge Limited, Wilmar International Ltd, Richardson International Limited, CHS Inc., The Scoular Company, Archer-Daniels-Midland Company,, Apical Group, Granol S/A, COFCO Group, SD Guthrie Berhad, AG Processing Inc., MWC Oil, CJ Cheiljedang Corporation, Nordic Soya Oy, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased use of soybean oil in the production of biodiesel is primarily driving the market. For instance, according to the Food and Agriculture Organization (FAO), about 70% of biodiesel in the world is produced from vegetable oils, and soybean oil is the second most widely used vegetable oil in the biodiesel industry. Further, its use in food products like shortenings, margarines, and salad dressings due to the presence of bioactive compounds like essential fatty acids and antioxidants is enhancing the market demand. In addition, the development of soybean cultivators with high-oleic acid content and low palmitic acid content for enhancing nutritional and functional properties contributes to propelling the market demand for soybean oil.

Restraining Factors

The soybean oil market is restricted by the availability of alternative oils like palm oil, olive oil, rapseed oil, sunflower oil, and canola oil, with increased awareness of healthy oils like olive oil. Further, fluctuating crop yields and changing climatic conditions are impacting the soybean oil market.

Market Segmentation

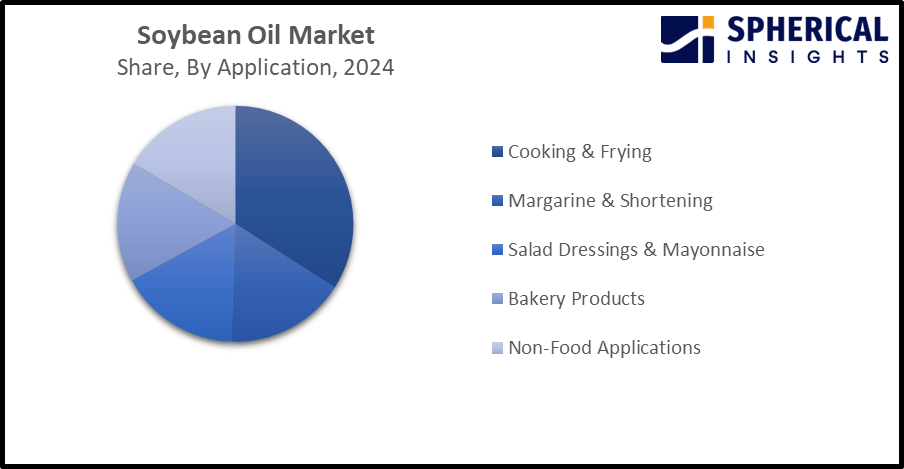

The soybean oil market share is classified into application and end-use industry.

- The cooking & frying segment dominated the market with a significant share of about 31.6% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the application, the soybean oil market is divided into cooking & frying, margarine & shortening, salad dressings & mayonnaise, bakery products, and non-food applications. Among these, the cooking & frying segment dominated the market with a significant share of about 31.6% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Soybean oil is most commonly used in cooking and frying due to various reasons, its stability at high temperatures, enable natural flavour shine, omega-3-fatty acids & vit E content, affordability & accessibility, and long shelf life. The surging trend towards dining out due to consumers’ increasing disposable income in countries like India, Indonesia, and China, is contributing to driving the market demand in the cooking & frying segment.

Get more details on this report -

- The food segment accounted for a major share of about 60.5% share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use industry, the soybean oil market is divided into food, biofuel, animal feed, and others. Among these, the food segment accounted for a major share of about 60.5% share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the food industry, soybean oil is the main ingredient among other vegetable oils, used as a cooking oil and as salad dressings. It was estimated that in the United States, soybean oil products account for approximately 80% of the 18 billion lb of edible oils used every year. An increasing investment in developing innovative products by the food manufacturers and processors, with the surging trend towards vitamin fortified, organic, non-GMO oils, is driving the market in the food segment.

Regional Segment Analysis of the Soybean Oil Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the soybean oil market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of 41.5% of the soybean oil market over the predicted timeframe. The market ecosystem in Asia Pacific is strong, due to the industry’s increased emphasis on expanding renewable fuel production and application in bio-based industrial products. The demand for soybean oil has been driven by the region's large & growing population, along with an increasing disposable income and urbanization. China is leading the soybean oil market in the Asia Pacific region, accounting 64-65% of total soybean oil consumption in the Asia Pacific region and 79% regional production volume.

Middle East & Africa is expected to grow at a rapid CAGR of 5.52% in the soybean oil market during the forecast period. The Middle East & Africa area has a thriving market for soybean oil due to the growing foodservice industry and Western dietary influences, which drives the inclination towards soybean oil. Furthermore, the increasing initiatives to promote collaborative platforms are supporting market growth. For instance, in August 2025, East Africa launched a regional project to boost soybean production and cut imports. Saudi Arabia is leading the Middle East and Africa soybean market, driven by increased import and export of soybean oil. For instance, in 2023, Saudi Arabia exported $83.3M and imported $20M of soybean oil, making it the 21st largest exporter and 65th largest importer of soybean oil in the world.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the soybean oil market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Incorporated

- Bunge Limited

- Wilmar International Ltd

- Richardson International Limited

- CHS Inc.

- The Scoular Company

- Archer-Daniels-Midland Company,

- Apical Group

- Granol S/A

- COFCO Group

- SD Guthrie Berhad

- AG Processing Inc.

- MWC Oil

- CJ Cheiljedang Corporation

- Nordic Soya Oy

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Olam Agri, a leading agribusiness in food, feed, and fibre, entered a strategic partnership with IDH and Arzikin Noma, a Nigerian agricultural development firm driving innovation and partnership in rural farming communities, to strengthen soybean production in Kwara State.

- In July 2025, the Federal Government launched the National Soybean Production Policy and Strategy to achieve food sovereignty, economic diversification, as well as harness the opportunities linked to the soybean value chain.

- In April 2024, an Ontario-based company developed a technology to produce soy protein for the plant-based food and ingredients sector. New Protein Global’s proprietary and trademarked extraction process, BioPur, uses a 100 per cent bio-based solvent to press oil from soybeans, replacing a widely used compound called hexane.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the soybean oil market based on the below-mentioned segments:

Global Soybean Oil Market, By Application

- Cooking & Frying

- Margarine & Shortening

- Salad Dressings & Mayonnaise

- Bakery Products

- Non-Food Applications

Global Soybean Oil Market, By End-Use Industry

- Food

- Biofuel

- Animal Feed

- Others

Global Soybean Oil Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the soybean oil market?The global soybean oil market size is expected to grow from USD 51.80 Billion in 2024 to USD 73.50 Billion by 2035, at a CAGR of 3.23% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the soybean oil market?Asia Pacific is anticipated to hold the largest share of the soybean oil market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Soybean Oil Market from 2024 to 2035?The market is expected to grow at a CAGR of around 3.23% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Soybean Oil Market?Key players include Cargill Incorporated, Bunge Limited, Wilmar International Ltd, Richardson International Limited, CHS Inc., The Scoular Company, Archer-Daniels-Midland Company, Apical Group, Granol S/A, COFCO Group, SD Guthrie Berhad, AG Processing Inc., MWC Oil, CJ Cheiljedang Corporation, and Nordic Soya Oy.

-

5. Can you provide company profiles for the leading soybean oil manufacturers?Yes. For example, Bunge Limited is a premier agribusiness solutions provider, and world leader in grain origination, storage, and distribution, oilseed processing and refining, offering a broad portfolio of plant-based oils, fats, and proteins.

-

6. What are the main drivers of growth in the soybean oil market?The application of soybean oil in biodiesel and the food product industry are major market growth drivers of the soybean oil market.

-

7. What challenges are limiting the soybean oil market?Availability of alternate oils and changing climatic conditions remain key restraints in the soybean oil market.

Need help to buy this report?