Global Soy Protein Isolate Market Size, Share, and COVID-19 Impact Analysis, Product Type (Dry and Liquid), By Application (Functional Foods, Bakery and Confectionery, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Soy Protein Isolate Market Size Insights Forecasts to 2035

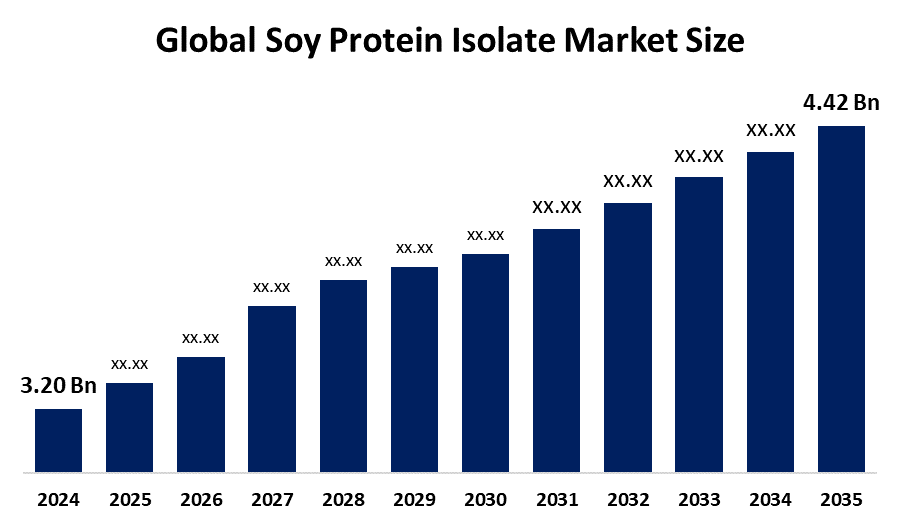

- The Global Soy Protein Isolate Market Size Was Estimated at USD 3.20 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.98 % from 2025 to 2035

- The Worldwide Soy Protein Isolate Market Size is Expected to Reach USD 4.42 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Soy Protein Isolate Market Size was valued at around USD 3.20 Billion in 2024 and is predicted to Grow to around USD 4.42 Billion by 2035 with a compound annual growth rate (CAGR) of 2.98 % from 2025 to 2035. The soy protein isolate market provides prospects driven by increased demand for plant-based nutrition, expanding food and beverages applications, health-conscious customers, and sustainable, inexpensive protein alternatives worldwide.

Market Overview

The production, trade, and consumption of soy protein isolate (SPI), a highly refined, high-purity plant-based protein obtained from defatted soybeans through procedures that eliminate fats, carbohydrates, and other non-protein components, resulting in a minimum 90% protein content on a moisture-free basis, are all included in the soy protein isolate market. Driven by its emulsifying, gelling, and nutritional qualities similar to animal proteins, this complete protein, which contains all essential amino acids, serves as a flexible ingredient in food and drinks, animal feed, and health products. According to Burcon NutraScience launched a patented next-generation SPI, while ADM launched its drive toward 100% deforestation-free soy, and companies launched innovative functional protein blends globally across the global soy protein isolate market. The affordability of soy compared to animal-based proteins, growing consumer awareness of functional health, and SPI's capacity to satisfy clean-label and high-protein formulation requirements are important factors driving demand. The market for soy protein isolate (SPI) is expanding due to a number of factors, including changing dietary habits, technical improvements, and rising consumer awareness.

Report Coverage

This research report categorizes the soy protein isolate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the soy protein isolate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the soy protein isolate market.

Global Soy Protein Isolate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.20 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.98% |

| 2035 Value Projection: | USD 4.42 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Archer Daniels Midland, Batory Foods, Cargill, CHS Inc., Crown Soya Protein Group, DuPont de Nemours, Farbest, Food Chem International, Fuji Oil Holdings, Kerry Group, Nutra Food Ingredients, Osage Food Products, The Scoular Company, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

SPI’s functional properties, including solubility, emulsification, and gelation, enable its extensive application in beverages, meat analogs, dairy substitutes, bakery products, and nutritional supplements, further supporting the soy protein isolate market expansion. The increasing shift towards plant-based diets is significantly driving the demand for soy protein isolate, particularly in the production of plant-based meat and dairy alternatives. Additionally, increasing global prevalence of lifestyle-related disorders, such as obesity and cardiovascular diseases, has intensified the shift toward protein-rich and low-fat diets, promoting SPI adoption.

Restraining Factors

The soy protein isolate market confronts restrictions from high production costs, unattractive beany tastes, allergen concerns, poor consumer knowledge in certain regions, and competition from alternative plant and animal proteins, which can impede general adoption and market expansion.

Market Segmentation

The soy protein isolate market share is classified into product type and application.

- The dry segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the soy protein isolate market is divided into dry and liquid. Among these, the dry segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dry SPI enables better handling, transportation, and inclusion into many formulations, including bakery items, beverages, meat replacements, and nutritional supplements. It is more suitable for industrial and consumer food items due to its high solubility, emulsification, and water-binding qualities.

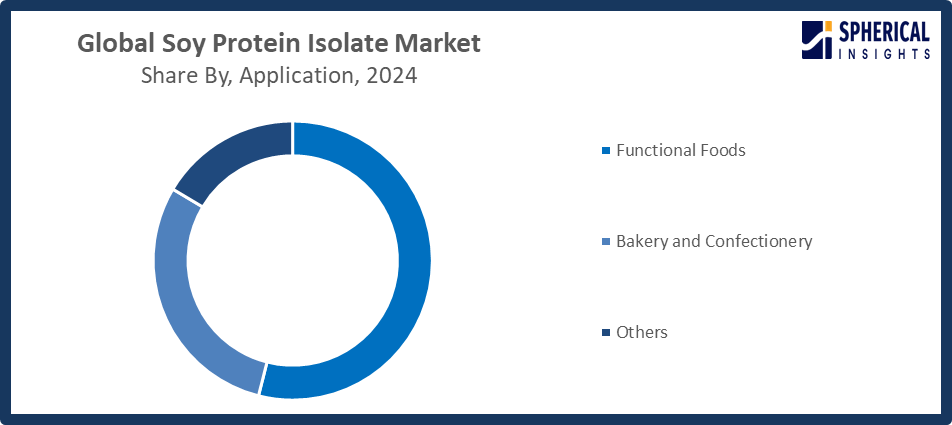

- The functional foods segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the soy protein isolate market is divided into functional foods, bakery and confectionery, and others. Among these, the functional foods segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The high protein content, low fat content, and cholesterol-lowering qualities make soy protein isolates frequently used in functional food items, such as protein-fortified beverages, meal replacements, and nutritional supplements. Demand in this market is driven by growing awareness of weight control, muscular growth, and cardiovascular health.

Get more details on this report -

Regional Segment Analysis of the Soy Protein Isolate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the soy protein isolate market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the soy protein isolate market over the predicted timeframe. The North America region has an agricultural infrastructure system that enables farmers to plant organic oats throughout their entire region. Due to the high demand for functional foods, sports nutrition products, and meat substitutes that include soy protein isolate, the United States, in particular, makes a significant contribution to regional supremacy. Two elements support North America's market dominance: industry-wide investment for plant-based protein research and development initiatives and regulatory frameworks that encourage product development. According to recent analyses (2024–2025), North America accounted for roughly 31–44% of worldwide sales due to consumer movements toward sustainable and health-conscious diets.

Asia Pacific is expected to grow at a rapid CAGR in the soy protein isolate market during the forecast period. The growth of regional markets is supported by improved retail access, the growth of e-commerce, and the increased presence of global food and beverage companies. The Indian Mid-Day Meal Scheme and similar programs in China and Southeast Asia use low-cost, high-quality soy plant proteins to treat malnutrition while they provide school meals to millions of students because these proteins cover their nutritional needs by offering budget-friendly shelf-stable supplements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the soy protein isolate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland

- Batory Foods

- Cargill

- CHS Inc.

- Crown Soya Protein Group

- DuPont de Nemours

- Farbest

- Food Chem International

- Fuji Oil Holdings

- Kerry Group

- Nutra Food Ingredients

- Osage Food Products

- The Scoular Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2026, Ghodawat Consumer Limited (GCL) launched soy protein isolate under its STAR brand, entering the plant-based protein market and catering to consumers seeking affordable, high-protein solutions for fitness and family nutrition.

- In March 2025, Protealis launched three new soybean varieties, including PRO Denali, expanding its portfolio and supporting the production of high-quality soy protein isolate for commercial growth across northern-central Europe.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the soy protein isolate market based on the below-mentioned segments:

Global Soy Protein Isolate Market, By Product Type

- Dry

- Liquid

Global Soy Protein Isolate Market, By Application

- Functional Foods

- Bakery and Confectionery

- Others

Global Soy Protein Isolate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the soy protein isolate market over the forecast period?The global soy protein isolate market is projected to expand at a CAGR of 2.98% during the forecast period.

-

2. What is the market size of the soy protein isolate market?The global Soy Protein Isolate market size is expected to grow from USD 3.20 billion in 2024 to USD 4.42 billion by 2035, at a CAGR of 2.98 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the soy protein isolate market?North America is anticipated to hold the largest share of the soy protein isolate market over the predicted timeframe.

-

4. Who are the top companies operating in the global soy protein isolate market?Archer Daniels Midland, Batory Foods, Cargill, CHS Inc., Crown Soya Protein Group, DuPont de Nemours, Farbest, Food Chem International, Fuji Oil Holdings, Kerry Group, Nutra Food Ingredients, Osage Food Products, The Scoular Company, and Others.

-

5. What factors are driving the growth of the soy protein isolate market?Rising health consciousness, increasing demand for plant-based diets, expanding functional foods and sports nutrition sectors, technological breakthroughs in protein extraction, and developing applications in meat alternatives and dairy substitutes fuel market expansion.

-

6. What are the market trends in the soy protein isolate market?Innovation in protein textures and flavors, clean-label and non-GMO formulations, fortified meals, growing usage of soy protein isolates in drinks and snacks, and the growing popularity of vegan and vegetarian goods are some trends.

-

7. What are the main challenges restricting the wider adoption of the soy protein isolate market?The wider use of soy protein isolates is restricted by high production costs, allergen concerns, low consumer awareness in some areas, restrictions on flavor and texture, and competition from other plant-based proteins.

Need help to buy this report?